Level 1 CFA® Exam:

Supply - Advanced (Part 1)

Factors of production are resources that a company employs to manufacture goods. We distinguish 4 types of factors of production:

- capital,

- labor,

- materials, and

- land.

Note: Sometimes also technology is considered to be one of the factors of production, especially in economic growth models.

However, often only two factors of production are taken into account, that is labor and capital.

As far as revenues are concerned we distinguish:

- total revenue,

- average revenue, and

- marginal revenue.

Total revenue (TR) is a product of the per-unit price of the product offered by the company and the quantity of products sold.

Average revenue (AR) is total revenue divided by the quantity of items sold.

Marginal revenue (MR) is an increase in total revenue resulting from selling an additional unit of product.

The table presents the prices of a product given the quantity sold.

| Quantity Sold (Q) | Price per Each Unit Sold (P) |

|---|---|

| 0 | 50 |

| 1 | 50 |

| 2 | 47 |

| 3 | 43 |

Calculate the total revenue, average revenue, and marginal revenue for each price level.

(...)

Note that if prices are declining for greater amounts of quantity sold, then the marginal revenue is also declining and is lower than the average revenue and price. On the other hand, if the price remains constant, the marginal revenue also doesn’t change and is equal to the average revenue and price.

There are 2 types of costs:

- fixed costs, and

- variable costs.

Fixed cost is the cost that doesn’t have a direct relationship with the output. If the output changes, fixed cost remains at the same level. Variable cost, in turn, changes when the output changes. Rental contracts and administrative salaries are examples of fixed costs. Wages or raw materials are examples of variable costs.

The sum of total fixed cost and total variable cost is called total costs (TC).

As in the case of revenues, we can calculate average and marginal costs.

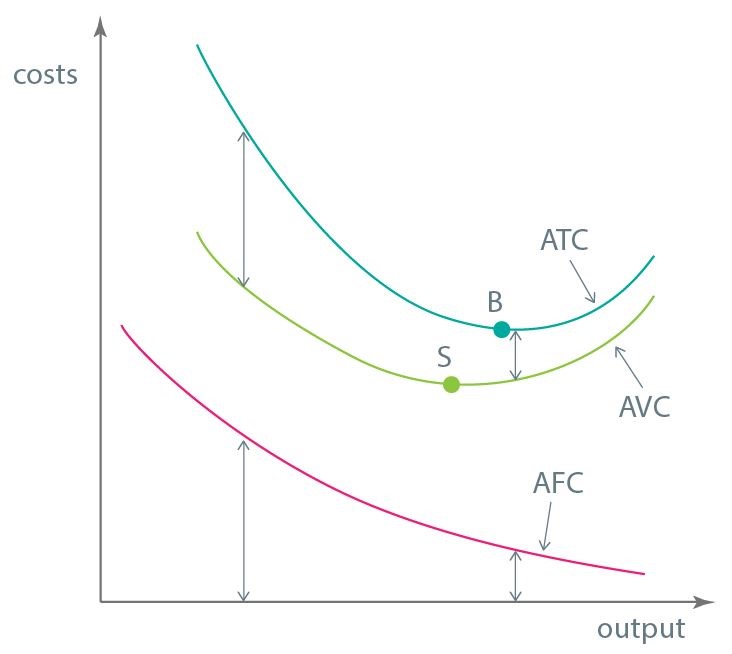

Average fixed cost (AFC) will decline if output increases because we divide a constant value that is fixed cost by increasing quantity.

Usually, the average variable cost (AVC) and average total cost (ATC) initially decline while output increases. However, after reaching a certain value of output, an increase in output leads to an increase in AVC and ATC.

Have a look at the graph presenting average costs in the short run. Initially, while output is increasing, both average variable cost and average fixed cost decrease. As a consequence average total cost also decreases. The average variable cost reaches its minimum at point S. From this point, the average variable cost starts to increase. However, the average total cost is decreasing because the average fixed cost is decreasing. Average total cost reaches its minimum at point B. From this point, an increase in average variable cost is greater than a decrease in average fixed cost, so as a result average total cost starts to increase.

Economies of Scale & Diseconomies of Scale

When talking about costs and companies in a long run, we can distinguish between:

- economies of scale, and

- diseconomies of scale.

Economies of scale occur when at a higher production volume average total cost decreases. In this case, the long-run average total cost curve is negatively sloped.

Diseconomies of scale occur when at a higher production volume average total cost increases. In the case of diseconomies of scale, the long-run average total cost curve is positively sloped.

Marginal Cost

Marginal cost (MC) determines the increase in the total costs as a result of another unit of output produced. As you can imagine, it initially declines but turns higher at greater production volumes.

(...)

Accounting profit is net income reported on the income statement. Accounting profit is defined as a difference between total revenue and explicit costs (aka. total accounting costs).

Economic profit takes into consideration not only explicit costs but also implicit opportunity costs. An example of implicit opportunity costs can be the cost of equity. Cost of equity is not included in accounting costs but is included in implicit opportunity costs.

Normal profit is the accounting profit a company must generate to cover implicit opportunity costs. So, accounting profit equals economic profit plus normal profit.

When accounting profit is greater than normal profit, economic profit is positive. In other words, accounting profit is greater than implicit costs.

When accounting profit is lower than normal profit, an accounting profit is less than implicit costs and economic profit is negative. In other words, the firm has an economic loss.

(...)

- Factors of production are resources that a company employs to manufacture goods.

- Marginal revenue is an increase in total revenue resulting from selling an additional unit of product.

- Fixed cost is the cost that doesn’t have a direct relationship with the output.

- Variable cost changes when the output changes.

- Economies of scale occur when at a higher production volume average total cost decreases.

- Diseconomies of scale occur when at a higher production volume average total cost increases.

- Marginal cost (MC) determines the increase in the total costs as a result of another unit of output produced.

- Accounting profit is defined as a difference between total revenue and explicit costs (aka. total accounting costs).

- Economic profit takes into consideration not only explicit costs but also implicit opportunity costs.

- Normal profit is the accounting profit a company must generate to cover implicit opportunity costs.