Level 1 CFA® Exam:

Agency & Other Relationships

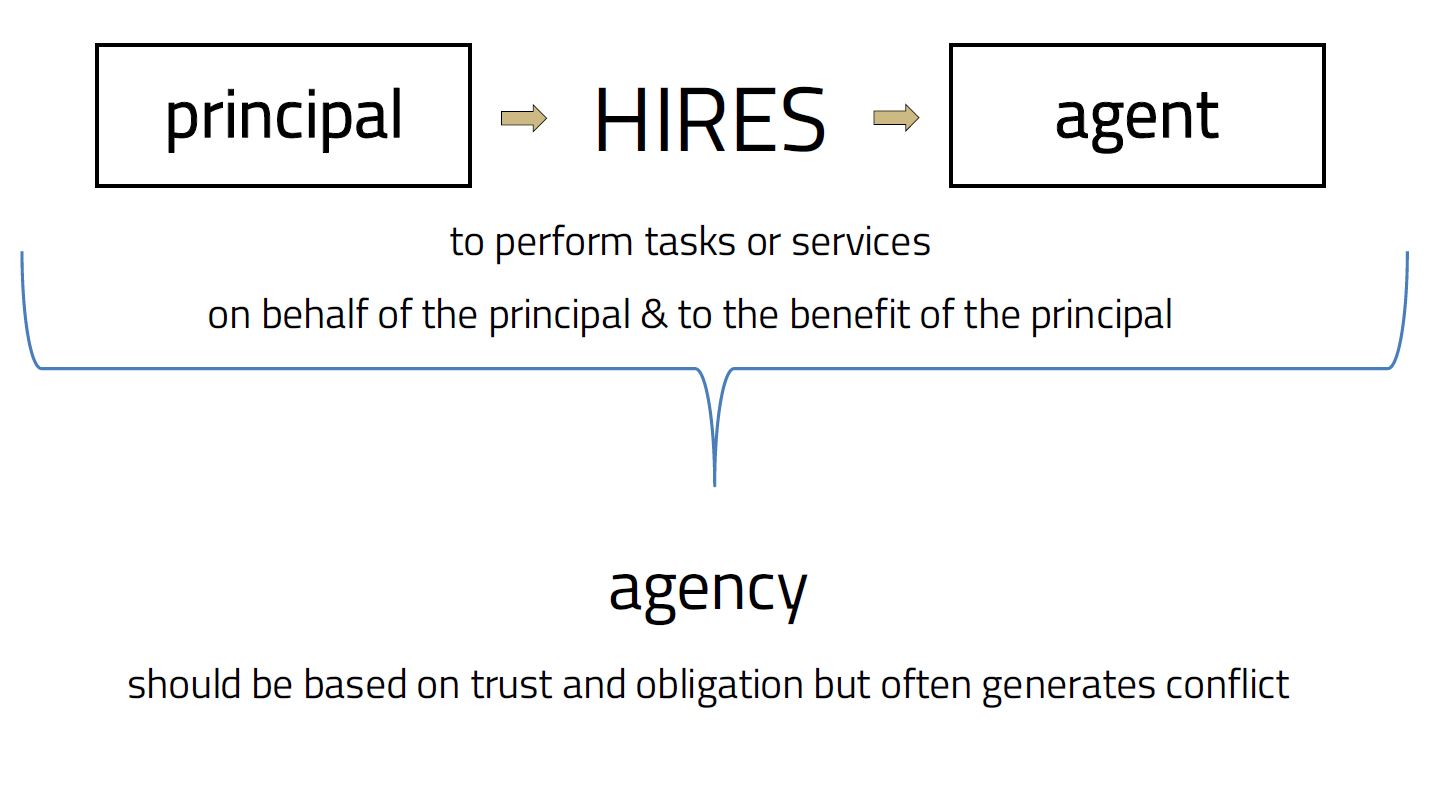

A principal-agent relationship (aka. agency) develops when a principal hires an agent to act in the best interest of the principal. In other words, a principal hires an agent to perform tasks or services on behalf of the principal and to the benefit of the principal. Although the agency relationship should be based on trust and obligation, it often generates conflict.

Shareholders-Managers/Directors Agency Relationship

The most basic and easiest to understand agency relationship is the one between the company’s shareholders and its managers and the board of directors. As mentioned in the previous lesson, the board of directors is hired by the shareholders to represent them and protect their interests. Then, the board hires the CEO and other executives to manage the company and maximize shareholder value.

In the relationship between the shareholders, the board of directors, and the management, the shareholders are the principal who elects directors (agent) who then hire managers (another agent) to act on behalf and to the benefit of the principal (i.e., the shareholders). Even though the board and managers are supposed to act in the best interest of the shareholders, potential shareholder-manager/director conflicts may arise.

Agency costs – costs that arise from the conflicts of interests between managers and shareholders (sometimes also bondholders). The better the company governance, the lower the agency costs.

As a rule, the agency theory assumes that directors and managers are the agents of the shareholders. However, there’s been quite a recent thought according to which directors and managers are the agents of the corporation, which is argued to be a separate “legal person” in some countries. Still, this new approach does not eliminate the conflicts of interest that may arise between shareholders and directors/managers.

Possible conflicts between the company and its stakeholders stem from the nature of the relationship.

Shareholders vs Managers/Directors

Shareholder-manager/director conflicts may arise owing to:

- information asymmetry,

- conflicting objectives,

- divergent risk tolerance.

Information asymmetry:

All companies experience information asymmetry to a certain degree. It means that the management has more information about the company, its performance, and prospects than other stakeholders, including shareholders. In other words, the distribution of information is not equal.

Some kinds of companies will have a higher level of asymmetric information. Such companies include for example high-tech companies due to the complexity of their products or companies whose financial reporting practices are not transparent.

If shareholders have unequal access to information, they find it difficult to assess the true performance of the agents hired to act in their best interest. Moreover – in the case of poor performance – it is more difficult to vote it out.

Conflicting objectives:

As said in the previous ESG lesson, management compensation may take on different forms and it may include – alongside base salary – bonuses or equity-based incentives. As a rule, this compensation is meant to motivate the managers to work hard in the shareholders’ best interest and maximize shareholder value.

However, if the remuneration is excessive, a conflict of interest may appear. Let’s call it entrenchment. As a result of entrenchment, both the managers and the directors want to keep their position. Thus, the managers avoid taking risks and directors refrain from speaking out against the management.

Another example of conflicting objectives is called empire building. It’s when the management strives for new acquisitions for growth’s sake, even though it does not increase shareholder value, just because its compensation is related to the size of the business.

Divergent risk tolerance:

When the management’s remuneration relies too much on the company’s stock and options, the managers may be willing to take too much risk to increase the stock value and – thus – their compensation.

When the management’s remuneration relies too little on the company’s stock and options, the managers may be more risk-averse to protect the long-term stability of the company. This may conflict with the shareholders’ desire for higher risks and higher profits.

Controlling vs Minority Shareholders

Corporate ownership structures:

- dispersed – there are many shareholders and none has the ability to control the company individually,

- concentrated – one or a group of shareholders has the ability to control the company individually, or

- hybrid of the two.

When an a group of shareholders has the ability to control the company individually, we call them controlling shareholders:

(...)

- A principal-agent relationship (aka. agency) develops when a principal hires an agent to act in the best interest of the principal.

- The most basic and easiest to understand agency relationship is the one between the company’s shareholders and its managers and the board of directors.

- Even though the board and managers are supposed to act in the best interest of the shareholders, potential shareholder-manager/director conflicts may arise.

- Agency costs are costs that arise from the conflicts of interest between managers, shareholders, and bondholders. The better the company governance, the lower the agency costs.

- Shareholder-manager/director conflicts may arise owing to information asymmetry, conflicting objectives, or divergent risk tolerance.

- Corporate ownership structures can be dispersed, concentrated, or a hybrid of the two.

- When an individual or a group of shareholders has the ability to control the company individually, we call them controlling shareholders.

- Conflicts of interest on the line between the majority (controlling) vs minority (non-controlling) shareholders may occur.

- Other relationships with a potential for a conflict of interest include the managers vs board and shareholders vs debtholders relationships.