Level 1 CFA® Exam:

Portfolio Approach

This lesson is about a portfolio approach to investments and its advantages. We are also going to discuss main investment characteristics, namely the expected return and risk.

Every market participant, both individual and institutional, when managing its capital faces a dilemma over how to invest its money. As an investor, you have to know how to assess the risk and expected returns on an investment and you have to make a proper judgement of how to approach the investment. Should you look at each investment separately and analyse only the potential return on the investment and the risk of loss? Or should you take a comprehensive approach to the problem? This comprehensive approach is called a portfolio approach and is based on a collective evaluation of all assets included in an investment portfolio. So you don’t analyse individual assets in the portfolio separately, but you try to calculate the expected return and risk for the entire portfolio of assets.

Every investment involves some risk. There are different sources of risk involved in investing and the risk differs in its intensity. To reduce this risk, portfolio approach is used. One of the biggest advantages of the portfolio approach is portfolio diversification. When you diversify your portfolio, you select a number of assets to include in it.

You can easily see benefits of portfolio diversification when you imagine a completely non-diversified portfolio. So let’s say 10 years before retirement you decided to invest your lifetime savings in a single company’s shares. If the company goes bankrupt, you will most probably lose all the money you invested. If, however, you decided to invest only 10% of your savings in this particular company, you would lose only this 10%. The above example is not just a hypothetical assumption.

History has seen the collapse of many reputable top-brand companies. Some American examples include: Enron Corporation, North Telecom and ADC Telecommunications.

Investments in individual securities and portfolios are characterized by two things mainly: the expected return and risk. The biggest advantage of diversification is the ability to reduce the portfolio risk. However, because the concept of risk is subjective and ambiguous, it should be given a clear definition.

Defining Risk

Risk can be viewed either in a negative or in a neutral light.

If we perceive risk as a probability that a project will fail, we apply the negative approach to define risk. This negative concept of risk portrays risk as a threat. In finance, however, we usually view risk as an unknown outcome of a project. This risk neutral concept presents risk as failure to achieve a desired result, e.g. the expected rate of return on investment in a portfolio of assets. When talking about portfolio management we will use primarily the neutral concept of risk. The volatility of rates of return is most commonly used in the risk neutral concept and the most common measures of volatility are standard deviation and variance.

Portfolio Characteristics

Let us come back to the investment portfolio and its characteristics.

The expected return on a portfolio is the weighted average of the expected returns on individual assets included in the portfolio. The weights in this weighted average are the proportions of the assets in the portfolio.

When it comes to risk, however, it is not so clear.

Portfolio risk measured by means of the standard deviation is usually NOT equal to the weighted average of standard deviations of the individual assets included in the portfolio. This risk is usually lower because of the correlation between the assets.

Diversification Ratio

One important thing for determining the risk of portfolio is the so-called diversification ratio. This ratio shows the benefits of portfolio diversification and is expressed as a percentage. Let us imagine a number of possible investments in various assets. Each investment is characterized by the expected rate of return and risk measured by the standard deviation. The diversification ratio is defined as the ratio of the standard deviation of an equally weighted portfolio consisting of these assets to the standard deviation of a randomly selected asset.

(...)

Bear in mind that even the best diversification may not fully protect us against possible loss. The lower the correlation between the assets, the stronger the effect of diversification. However, history shows that in times of a market downturn, the correlation between assets becomes stronger and it is hard to find assets independent of each other. When markets are generally weak and declining, the effect of diversification is reduced and the possibility of loss is more dependent on the overall economic situation. Also note that the correlation between assets changes over time.

Risk-Return Trade-Off

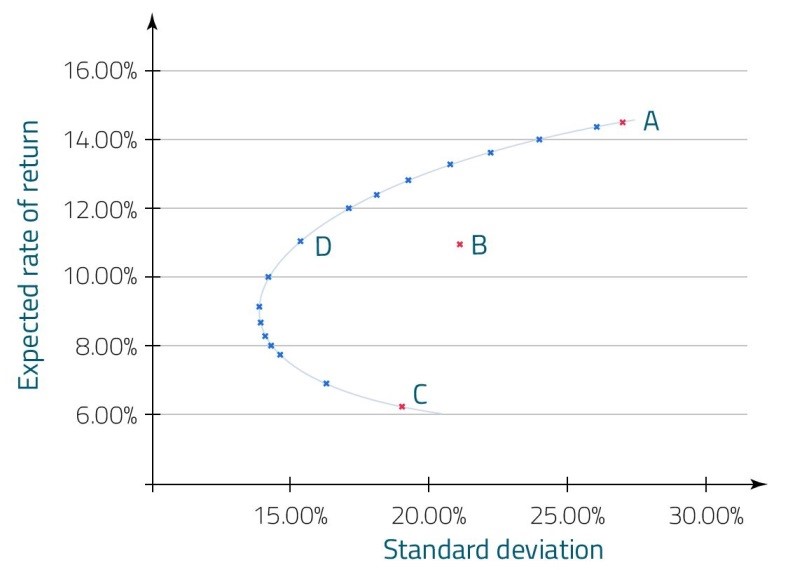

Both a portfolio and an individual asset are most commonly characterised by the expected return and risk. The risk-return trade-off is often used to present portfolios and individual assets. Let’s analyse a graph showing the benefits of the portfolio approach:

Certain assets are marked with red points: A, B and C. However, the blue points stand for portfolios that you can build if you combine assets A, B and C in the right proportions. The graph shows that if you select assets and their weights in the portfolio properly, you can get portfolios whose:

- expected rates of return are the same, and whose

- risk is lower in comparison to the investment in the individual assets A, B and C.

Let's look at Portfolio B. It has a standard deviation of 20% and an expected rate of return of 11%. It turns out that by selecting assets A, B and C in appropriate proportions, the rate of return of 11% can be achieved with the standard deviation equal to 16% (Portfolio D).

The portfolio approach has been intuitively used by investors for a long time. Investment diversification was formally defined by Harry Markovitz. In 1952 Markovitz published his article entitled ‘Portfolio Selection’ and this gave rise to modern portfolio theory later developed by Sharpe, Lintner and Treynor.

Modern portfolio theory (MPT) focuses on choosing the best investment depending on the expected rate of return and risk. The main conclusion investors may draw from the modern portfolio theory is that they should not focus on individual assets but on the correlation between them.

Markowitz observed that even diversified portfolios can have different levels of risk for a given level of profit. A rational investor should try to minimise this risk and this is possible thanks to portfolio diversification. Talking about modern portfolio theory we should also mention that the well-known and still used capital asset pricing model (CAPM), which is based on this theory.

- One of the biggest advantages of the portfolio approach is portfolio diversification.

- In finance, we usually view risk as an unknown outcome of a project.

- The expected return on a portfolio is the weighted average of the expected returns on individual assets included in the portfolio.

- Portfolio risk measured by means of the standard deviation is usually NOT equal to the weighted average of standard deviations of the individual assets included in the portfolio.

- The diversification ratio is defined as the ratio of the standard deviation of an equally weighted portfolio consisting of these assets to the standard deviation of a randomly selected asset.

- The lower the correlation between the assets, the stronger the effect of diversification.

- When markets are generally weak and declining, the effect of diversification is reduced.

- In 1952 Markovitz published his article entitled ‘Portfolio Selection’ and this gave rise to modern portfolio theory (MPT).

- A rational investor should try to minimise this risk and this is possible thanks to portfolio diversification.