Level 1 CFA® Exam:

Risk Associated with Bonds - Introduction

Level 1 CFA exam curriculum focuses on the interest rate risk but in this lesson, we’re also going to say a few words about other risks related to fixed income securities. In the next Module, we will also talk about credit risk.

When a layman thinks of bonds, he usually thinks of treasury bonds, which to a lesser or greater extent are perceived as risk-free financial instruments.

However, as a level 1 CFA candidate you should bear in mind that in addition to treasury bonds, there are many other debt instruments having different characteristics and being issued by different issuers. Risks associated with investing in such bonds are usually more complex and complicated than risks associated with investing in U.S. treasury bonds.

At the beginning of our discussion of bond risks, we should bear in mind the basic principle, which states that in an effective market the higher the risk, the higher the rate of return required by investors. What is more, the higher the required yield, the lower the bond price.

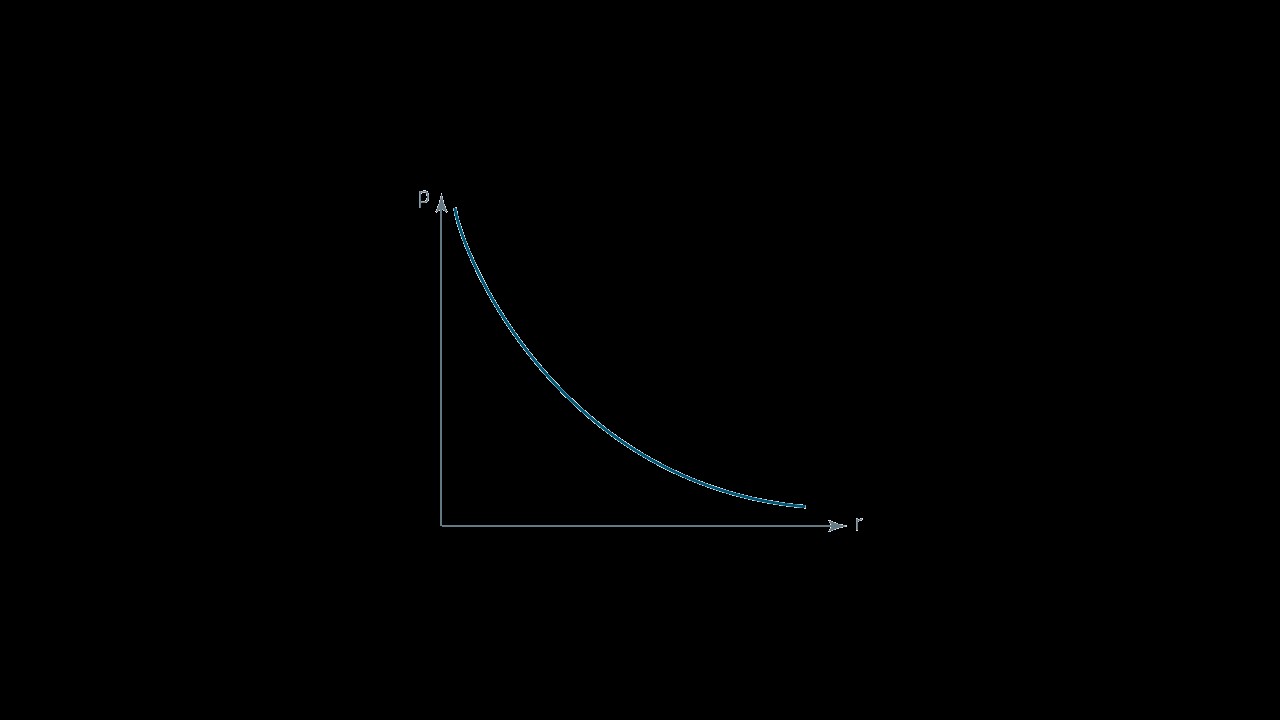

Have a look at the graph illustrating the relationship between the market discount rate and the bond price:

We can draw three conclusions from this graph:

- The relationship between the bond price and the market discount rate is inversed.

- If the required yield changes a bit, namely if it either increases or decreases a bit, the absolute value of the percentage change in the bond price will be the same for both the increase and decrease of the market discount rate.

- If the required yield changes a lot, the absolute value of the percentage change in the bond price will be lower if the market discount rate increases, than if the discount rate decreases.

The formula for the bond price to be used in your level 1 CFA exam:

As you can see, the value of the bond is equal to the present value of the expected future cash flows from the bond. The higher the market discount rate, the greater the values of the denominators and the lower the value of the bond and vice versa. If \(r\) is lower, the values of the denominators are also lower and the price of the bond is higher.

Let us now turn to risks associated with investing in bonds. Among other risks, we distinguish:

- interest rate risk,

- reinvestment risk,

- prepayment risk,

- credit risk,

- inflation risk,

- foreign exchange risk,

- liquidity risk, and

- volatility risk.

Interest Rate Risk

From the point of view of a level 1 CFA candidate, the interest rate risk is the most important type of risk.

As we mentioned a moment ago, the bond price changes in the opposite direction to changes in the required yield. So, if market discount rates are rising, the bond price falls.

Imagine that an investor sells a bond before its maturity date after the market discount rate increases. In such a situation, the investor may incur a loss because the price of the bond decreases and it is even possible that he sells the bond at a price lower than the purchase price.

The risk associated with a fall in bond prices due to an increase in interest rates is called the interest rate risk. This is the basic type of risk that investors can suffer from in a debt market.

Before we move on, let’s also say that if we have different bonds with the same maturity, a zero-coupon bond is characterized by the highest interest rate risk.

Another type of risk is the so-called reinvestment risk.

When we buy a bond, the realized rate of return depends on:

- coupons, and

- a possible difference between the price and the par value.

The realized rate of return depends also on the reinvestment rate. The additional income from reinvestment, sometimes called interest on coupons, depends on both the level of market rates in the future as well as the strategy applied by an investor to reinvest coupons.

When we talk about profit from investing in a bond, we often use the term yield-to-maturity. The YTM can be a good measure of the profit that an investor earns if she holds the bond until the maturity date. However, it is worth noticing that the yield to maturity has one serious drawback. It is calculated assuming that coupons are reinvested at an interest rate equal to the YTM.

Thus, if the investor doesn’t reinvest received coupons or she reinvests them at a lower rate than the YTM, then the realized rate of return will be lower than the YTM calculated at the time of purchasing the bond. If, however, the investor reinvests received coupons at an interest rate higher than the YTM, the realized rate of return will be higher than the YTM at the time of purchasing the bond.

The risk associated with the reinvestment of coupons and the reinvestment rate is called reinvestment risk.

John Clarke invests in a 5-year bond with both the YTM and the annual coupon rate equal to 4% and the price equal to par value. The yield curve is flat. Shortly after buying the bond, the yield curve moves down by 50 basis points.

What is the value of the realized rate of return if we assume that John will reinvest coupons at the current market discount rate?

(...)

John Clarke invests in a 5-year bond with both the YTM and the annual coupon rate equal to 4% and the price equal to par value. The yield curve is flat. Shortly after buying the bond, the yield curve moves up by 50 basis points.

What is the value of the realized rate of return if we assume that John will reinvest coupons at the current market discount rate?

(...)

So, this is how the reinvestment risk works in practice.

Note that the smaller the coupons of the bond, the lower the reinvestment risk. Zero-coupon bonds are not subject to the reinvestment risk because they have no coupons that could be reinvested.

Also, you should be able to distinguish between the interest rate risk and reinvestment risk. Interest rate risk refers to the situation when a rise in market discount rates causes a drop in bond prices, and – for obvious reasons – this is detrimental to bondholders.

Reinvestment risk refers to the situation when market discount rates fall and coupons must be reinvested at lower rates and this situation is also detrimental to bondholders.

We can generalize that the interest rate risk and reinvestment risk offset each other. An Asset/Liability Management strategy that uses the method of offsetting one risk against the other is called immunization.

(...)

Level 1 CFA Exam Takeaways: Risk Associated with Bonds – Introduction

star content check off when done- The higher the required yield, the lower the bond price.

- The risk associated with a fall in bond prices due to an increase in interest rates is called the interest rate risk.

- The risk associated with the reinvestment of coupons and the reinvestment rate is called reinvestment risk.

- The prepayment risk is associated with the possibility that the issuer will call the issue or partially repay it.

- The risk that the issuer will not be able to fulfill his obligations arising from issued bonds is called credit risk.

- Inflation risk arises when due to a decline in the purchasing power of money the real value of cash flows from the financial instrument decreases.

- The risk that changes in interest rate volatility will have a negative impact on the price of a bond is called volatility risk.