Level 1 CFA® Exam:

Forward Contracts

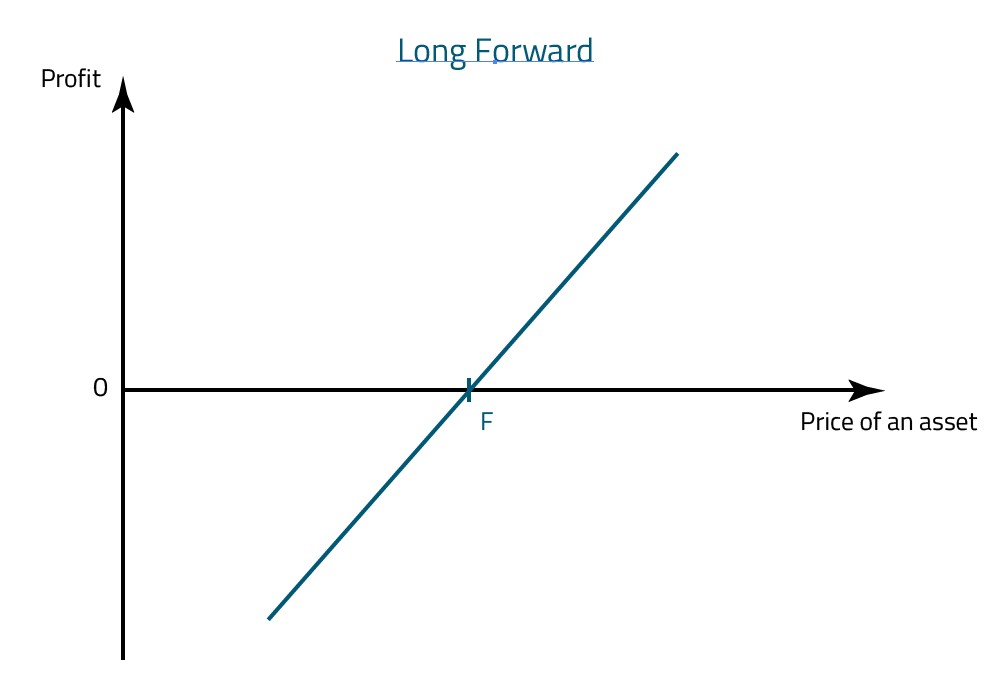

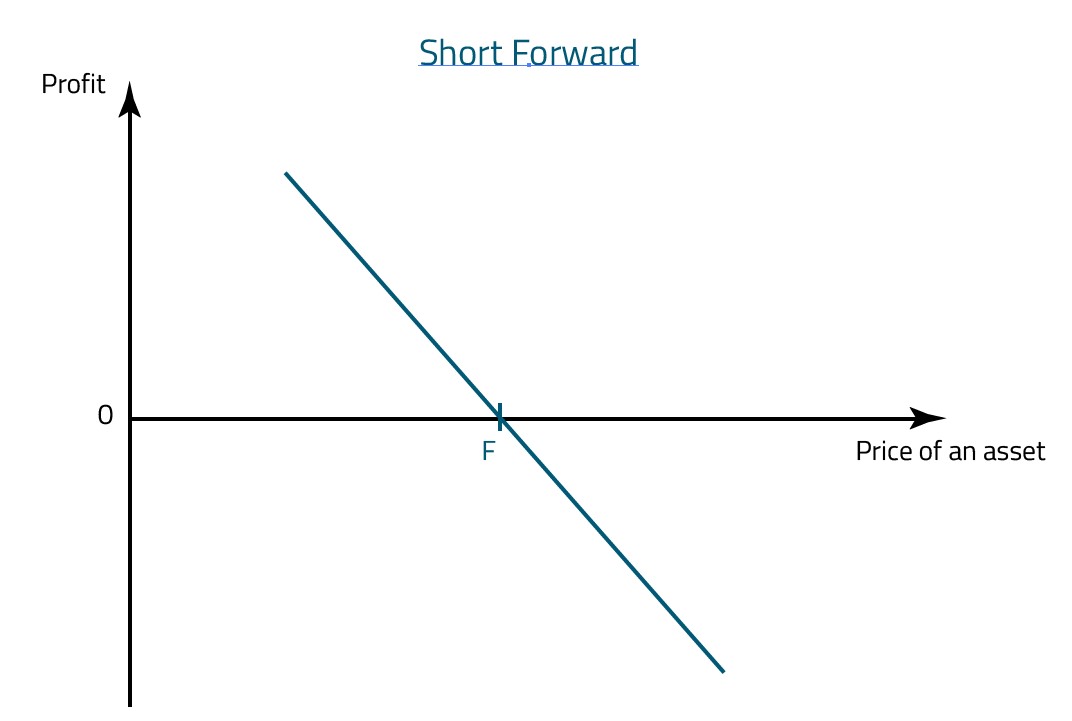

A forward contract is an agreement in which one party agrees to buy and the other party agrees to sell certain assets (e.g. stocks, commodities, currency, etc.) at a specified price at a specified time in the future. An investor who buys this contract takes a long position and the seller takes a short position. In the future the buyer, often called “the long”, will purchase the underlying asset from the seller, otherwise called “the short”. The long makes a profit when the price of the underlying asset goes up, and the short can be satisfied only with drops in the prices.

Risks

Because forward contracts are "tailor-made" and entered into by two parties without any intermediary, such as a stock exchange, both parties run the risk of default, as it is always possible that the other party will not be able to fulfill his or her obligation.

It should also be noted that in the case of forward contracts, there is generally no margin requirement and the parties do not make any deposits when entering into the contract, as is the case with futures.

As we have already mentioned, at expiration the contract can be settled:

- by cash (non-deliverable forwards [NFDs], cash-settled forwards, contracts for differences) or

- by delivery.

Settlement by delivery is when assets are delivered on the forward contract expiration date. We say that the contract is deliverable.

Cash settlement is when one party pays the difference between the current price of the underlying asset and the price that was agreed upon in the forward contract.

Settlement by Delivery

An investor, in order to hedge against the future increase in the price of wheat, enters into a forward contract on 10,000 bushels of this commodity at a price of USD 700 per 100 bushels. Both parties agree that the contract will be terminated in 90 days.

Note that whatever the price of wheat is in 90 days, the investor is obliged to purchase wheat from the seller at a price of USD 700 per 100 bushels. The seller, on the other hand, is obliged to sell this wheat to the investor at a price of USD 700.

This is an example of deliverable contract, where one party provides the other party with the contracted goods and so we say that in 90 days the contract will be settled and the asset delivered.

Cash Settlement

An investor, in order to hedge against the future increase in wheat price, enters into a forward contract on 10,000 bushels of this commodity at a price of USD 700 per 100 bushels. Both parties agree that the contract will be terminated in 90 days.

Scenario 1: The spot price of wheat in 90 days is USD 720 per 100 bushels.

Scenario 2: The spot price of wheat in 90 days is USD 690 per 100 bushels.

(...)

Investors don’t have to wait until the expiration date to terminate the contract. In order to terminate its position prior to expiration, the party has to enter into an opposite transaction. So, if we held a long position (in the original contract), we should now take a short position and the other way around – if we held a short position, we should take a long one now. The expiration date, position, and underlying asset of the opposite transaction should be the same as in the original contract.

Bear in mind that even if the party enters into an opposite transaction, it still has to fulfill its obligations arising from the original contract.

Example 3

An investor, in order to hedge against the future increase in wheat price, enters into a forward contract on 10,000 bushels of this commodity at a price of USD 700 per 100 bushels. Both parties agree that the contract will be terminated in 90 days. 30 days after the contract initiation date, the spot price of wheat amounts to USD 720. The seller (the short) concludes that wheat prices will continue to rise.

He obviously wants to avoid further expected losses and thus enters into an opposite transaction – he takes a long position in a forward contract with a price of USD 720 per 100 bushels and an expiration date in 60 days.

The position of the short in the original contract must now be viewed from two perspectives. On the one hand, he is obliged to sell 10,000 bushels of wheat at a price of USD 700 for 100 bushels but on the other hand, he is obliged to buy 10,000 bushels of wheat at a price of USD 720 per 100 bushels. Thus, 30 days after the contract initiation date, the level of losses is USD 2,000 (\(=\text{USD }20\times100\)) and it won’t change because if prices continue to rise, loss incurred as the short will be compensated by gains incurred as the long. If, however, prices begin to fall, short position gain will be reduced by long position loss.

Entering into an opposite transaction with another counterparty increases credit risk, as now we face the risk of default of both the long party, in the first contract, and the short party in the opposite transaction. There is, of course, a possibility to enter into an opposite transaction with the same counterparty, which eliminates the additional default risk. In this situation, the long party of the first contract would probably require that the difference between forward prices of the two contracts is immediately paid on the day of entering into the opposite transaction. Due to the fact that forward contracts are “tailored made”, it is also possible to renegotiate the contract.

- A forward contract is an agreement in which one party agrees to buy and the other party agrees to sell certain assets.

- At expiration the contract can be settled by cash or by delivery.

- Settlement by delivery is when assets are delivered on the forward contract expiration date.

- Cash settlement is when one party pays the difference between the current price of the underlying asset and the price that was agreed upon in the forward contract. The long receives payment if the spot price is higher than the forward contract price, while the short receives payment if the spot price is lower than the forward contract price.

- In order to terminate its position in forward contract prior to expiration, the party has to enter into an opposite transaction.

- Entering into an opposite transaction with another counterparty increases credit risk.