Level 1 CFA® Exam:

Spot Rates & Forward Rates

In the previous lesson, we discussed how to calculate the bond price using the market discount rate. In this lesson, we will learn how to compute the bond price using the so-called spot and forward rates.

Before we proceed to calculate the bond price, however, let us first explain what the spot and forward rates are.

Let’s begin with the spot rate.

The spot rate is defined as yield-to-maturity on a zero-coupon bond.

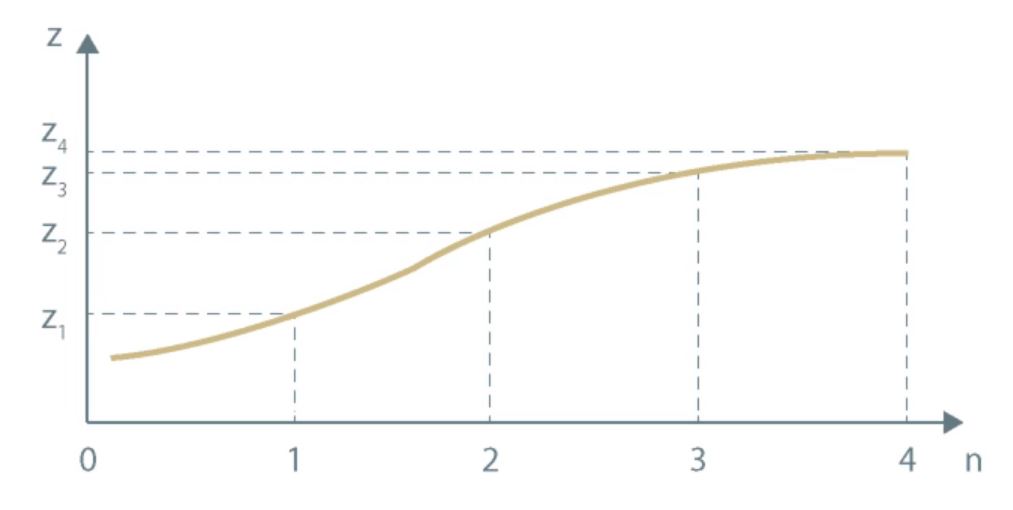

If we know more than one spot rate, we can plot a spot curve. Have a look at the graph below:

As you can see, the spot curve is a set of yields-to-maturity on zero-coupon bonds with different maturities.

Spot markets are markets for immediate delivery and forward markets are markets for future delivery.

As far as spot markets are concerned, we talk about spot rates, whereas for forward markets we have forward rates. Quite obviously, the former are interest rates on financial instruments traded in spot markets, while the latter are interest rates on financial instruments traded in forward markets.

So, the forward rate is defined as the rate on a financial instrument traded on the forward market.

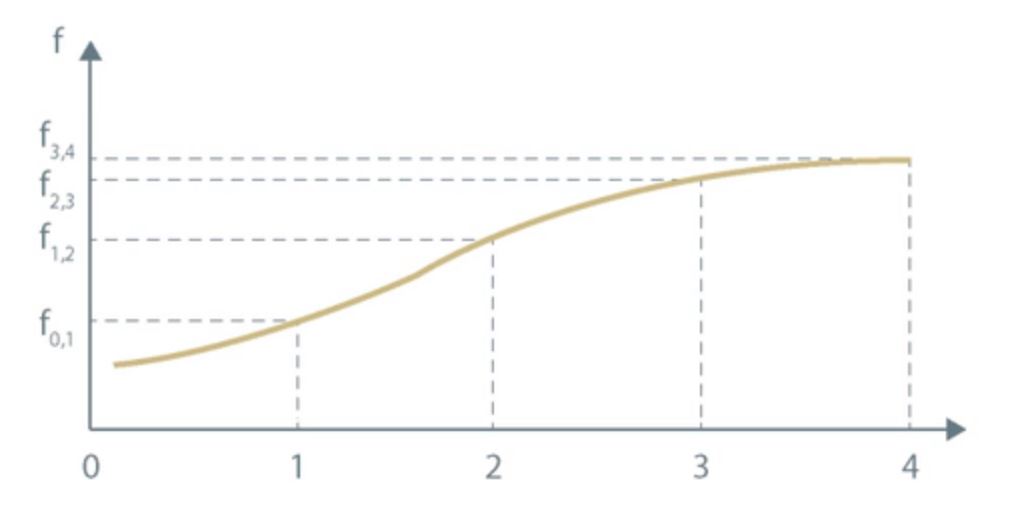

Just as we plotted the spot curve for spot rates, we can graph the so-called forward curve presenting different forward rates for different maturities.

Having defined the spot rate and spot curve, as well as the forward rate and forward curve, now we can analyze the relationship between the spot and forward rates and the so-called:

- implied forward rates, and

- implied spot rates.

If we know two different spot rates, we are able to compute the implied forward rate using the following formula:

This formula holds if we assume an annual bond basis. If we assume a semiannual bond basis, the formula should be modified. We will discuss the modification in our examples.

Because \(z_k\) is the same as \(f_{0,k}\) a similar formula can be used to compute the implied spot rate. In this case, we know forward rates and compute the implied spot rate.

Given the data in the table, compute the implied three-year forward yield four years into the future. Assume that yields-to-maturity on zero-coupon bonds are stated on an annual basis.

| Year | Spot Rate |

|---|---|

| 1 | 2% |

| 2 | 2.2% |

| 3 | 2.5% |

| 4 | 3% |

| 5 | 3.1% |

| 6 | 3.2% |

| 7 | 3.7% |

| 8 | 4.3% |

(...)

Given the data in the table, compute the implied three-year spot rate. Assume that yields are annualized for a periodicity of two.

| Forward Rate | |

|---|---|

| 0y1y | 2.8% |

| 1y1y | 3.2% |

| 2y1y | 3.4% |

| 3y1y | 3.8% |

| 4y1y | 4.4% |

(...)

Given zero-coupon bond prices presented in the table, compute the implied two-year into one-year rate.

| Bond's maturity | Bond's price |

|---|---|

| 1 year | 96.75 |

| 2 years | 93.35 |

| 3 years | 90.20 |

To makes things easier, let’s assume that the periodicity equals 1.

We will solve this problem using two methods:

(...)

First of all forward rates help us decide which of the bonds with different maturities is a better investment for us.

For example, assume that we have two bonds with different maturities and we wonder which of these bonds should be added to our portfolio. The first one matures in 9 years and the second – in 10 years. We know that the 9-year into 1-year implied forward rate equals 5%.

Now, if we believe that we will be able to reinvest the money for 1 year 9 years from now with the reinvestment rate greater than 5%, we should buy the 9-year bond. If, however, we assume that the 1-year reinvestment rate will be lower than 5%, we should add the 10-year bond to our portfolio.

Therefore, the implied forward rate can be perceived as the breakeven reinvestment rate.

Apart from what we’ve just said, forward rates help us exploit arbitrage opportunities if such opportunities arise. You can learn about arbitrage in one of our videos on Derivatives.

Moreover, forward rates are used to value derivative instruments, such as interest rate swaps or interest rates options.

Valuation of Bonds Using Spot Rates

Now, it’s time we talked about the valuation of bonds with the aid of spot rates.

In the case of bond valuation with the aid of spot rates, each of the bond’s cash flows will be discounted by a different spot rate applicable to the given cash flow. For example, for a 3-year bond, the first coupon payment will be discounted using spot rate \(z_1\), the second coupon payment will be discounted using spot rate \(z_2\), and the last coupon plus the par value of the bond will be discounted using spot rate \(z_3\).

Using the data from the table, compute the price of a 3-year bond with an annual coupon equal to 4%.

| Year | Spot Rate |

|---|---|

| 1 | 3.0% |

| 2 | 3.2% |

| 3 | 4.3% |

(...)

Using the data from the table, compute the yield-to-maturity on a 2-year bond with an annual coupon equal to 6%.

| Year | Spot Rate |

|---|---|

| 1 | 5.2% |

| 2 | 5.6% |

(...)

Valuation of Bonds Using Forward Rates

At the beginning of the lesson, we had a formula that related spot rates and forward rates. Because the relationship between these rates exists, then if we are able to compute the bond price using a series of spot rates, we are also able to compute the bond price using a series of forward rates.

The bond price equals the first coupon divided by (1 plus one-year forward rate) plus the second coupon divided by (1 plus one-year forward rate multiplied by 1 plus one-year into one-year rate), and so on until the bond’s last cash flow.

In the table, one-year forward rates are given:

| Forward Rate | |

|---|---|

| 0y1y | 4.8% |

| 1y1y | 5.2% |

| 2y1y | 5.4% |

| 3y1y | 5.8% |

| 4y1y | 6.4% |

What is the price of a four-year bond with an annual coupon equal to 8%?

We will compute the price of the bond using two methods, the longer one and the shorter one.

(...)

- The spot rate is the yield-to-maturity on a zero-coupon bond, whereas the forward rate is the rate on a financial instrument traded on the forward market.

- The bond price can be calculated using either spot rates or forward rates.

- We can calculate the implied forward rate from spot rates and vice versa. We can calculate the implied spot rate from forward rates.

- The implied forward rate can be perceived as the breakeven reinvestment rate.

- Forward rates help us exploit arbitrage opportunities if such opportunities arise and are used to value derivative instruments, such as interest rate swaps or interest rates options.