Level 1 CFA® Exam:

Dividends

A dividend is paid to shareholders proportionally to the number of shares they own. Dividends are declared by a corporation’s board of directors and in some regions such as Europe or in China shareholders’ approval is required. The payment of dividends is discretionary, which means that companies are under no legal obligation to pay them.

There is a number of ways in which dividends are paid to shareholders. They include:

- cash dividends,

- stock dividends (aka. bonus issue of shares),

- stock splits (which are not dividends per se).

Cash dividends include:

- regular cash dividends,

- extra dividends,

- liquidating dividends.

Regular Cash Dividends

As you know many companies pay dividends on a regular schedule. In the US and Canada, dividends are paid quarterly, in Europe and Japan every six months, whereas in countries like China or Thailand once a year.

Companies that pay cash dividends aim to keep the dividends at the same level or increase them as time goes by. This is because the level of dividends is a vital factor – it indicates to investors that the company's shares are of high investment quality. Therefore, it is important not to reduce dividends when the company experiences temporary problems. If the dividend payment increases year by year, it is a signal to investors that the company's growth is stable and its prospects are promising.

Extra (Special) Dividends

Another type of cash dividend is special dividend. Special dividends are:

- dividends paid by companies that do not pay dividends on a regular schedule, or

- dividends that supplement regular cash dividends with an extra payment when the company's earnings are much higher than expected or when the company has a huge amount of excess cash.

Liquidating Dividend

A liquidating dividend is one paid to shareholders when the company goes out of business and the assets of the company, after all liabilities have been paid, are distributed to shareholders. This type of dividend can also be paid when the company sells a portion of its business for cash and the proceeds are distributed to shareholders or when the company pays a dividend that exceeds its accumulated retained earnings.

Apart from cash dividends, there are also stock dividends. What are they? Let's look at an example.

A company is to pay a 7% stock dividend. Jack Travis, a shareholder, owns 500 shares with a purchase price of USD 20 per share. The total cost of shares purchase is USD 10,000. What will change after the stock dividend payment?

(...)

From the point of view of the company, stock dividends do not reduce cash or assets and the equity also remains unchanged. Cash dividends do reduce cash (and assets), just as retained earnings, which are part of equity.

In other words, stock dividends, unlike cash dividends, do not decrease liquidity and solvency ratios. In terms of equity, only one aspect changes when it comes to stock dividends – retained earnings fall, while contributed capital grows. However, the decline in retained earnings is completely offset by the growth in contributed capital, so the company’s financial structure, and the debt-to-equity ratio, does not change.

A stock split, just as a stock dividend, has no economic effect on the company. If a company announces a two-for-one stock split, each shareholder will have twice as many shares after the split and their price will decline by half.

(...)

Reverse Stock Split

Since we've discussed stock splits, we should also mention reverse stock splits. As you can guess, a reverse split is the opposite of a split. When the shares are combined, their number declines and the price per share rises. It's important to note that a reverse stock split does not affect the market value of the company's equity. Just like in the stock split, the shareholders' wealth remains unchanged.

A reverse stock split is used most commonly when the stock price is very low. Its purpose is to increase the price to facilitate trading. Reverse stock splits are typical of companies in financial distress.

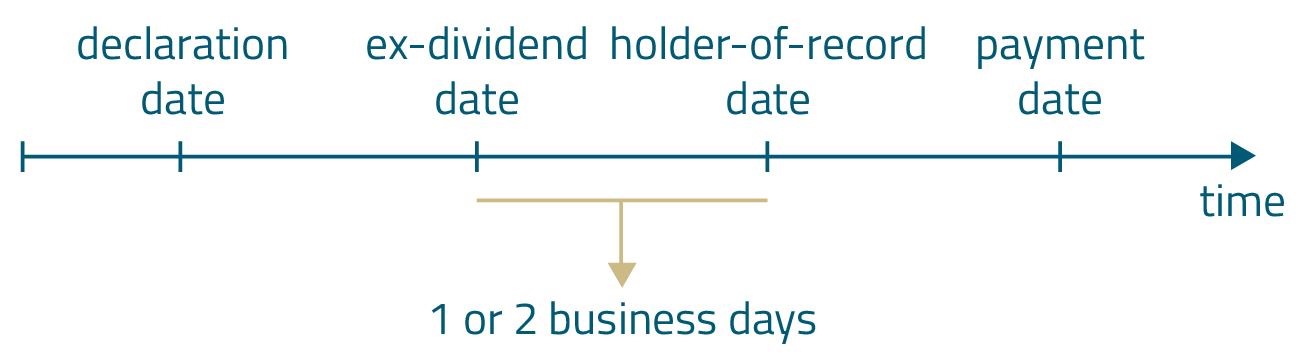

Payment chronology can differ across world markets, however, we can identify some significant dates. These are:

- the declaration date,

- the ex-dividend date,

- the holder-of-record date, and

- the payment date (payable date).

Declaration Date

The declaration date is the day that the company issues a statement declaring a dividend including such information as the ex-dividend date and the holder-of-record date. Irrespective of the type of dividend, its payment must be approved by the company's board of directors. In some European countries and also in China, the approval must be followed by shareholders' consent.

(...)

- A dividend is paid to shareholders proportionally to the number of shares they own. Dividend payment is discretionary.

- The 2 most common ways in which dividends are paid to shareholders include: cash dividends and stock dividends.

- Cash dividends include regular cash dividends, extra dividends, and liquidating dividends.

- A liquidating dividend is one paid to shareholders when the company goes out of business and the assets of the company, after all liabilities have been paid, are distributed to shareholders.

- If a company announces a two-for-one stock split, each shareholder will have twice as many shares after the split and their price will decline by half.

- Reverse stock splits are typical of companies in financial distress.

- The declaration date is the day that the company issues a statement declaring a dividend.

- The ex-dividend date is the first day when a share trades without the dividend.

- The holder-of-record date is usually one or two business days after the ex-dividend date.

- On payment date the dividend is transferred to shareholders.