Level 1 CFA® Exam:

Securitization Process

Securitization is a process in which we take a pool of assets (aka. collateral) and issue fixed-income securities (aka. asset-backed securities) that are backed or collateralized by this pool of assets. Cash flows from the collateral are used to pay interest and repay the principal to investors that bought the asset-backed securities (aka. ABS).

Here are examples of assets used as collateral (aka. securitized assets):

- residential mortgage loans,

- commercial mortgage loans,

- auto loans,

- credit card receivables, etc.

Examples of fixed-income instruments created through securitization include:

- residential mortgage-backed securities (RMBS), e.g. mortgage pass-through securities, collateralized mortgage obligations (CMOs),

- commercial mortgage-backed securities (CMBS),

- non-mortgage asset-backed securities (non-mortgage ABS),

- collateralized debt obligations (CDOs).

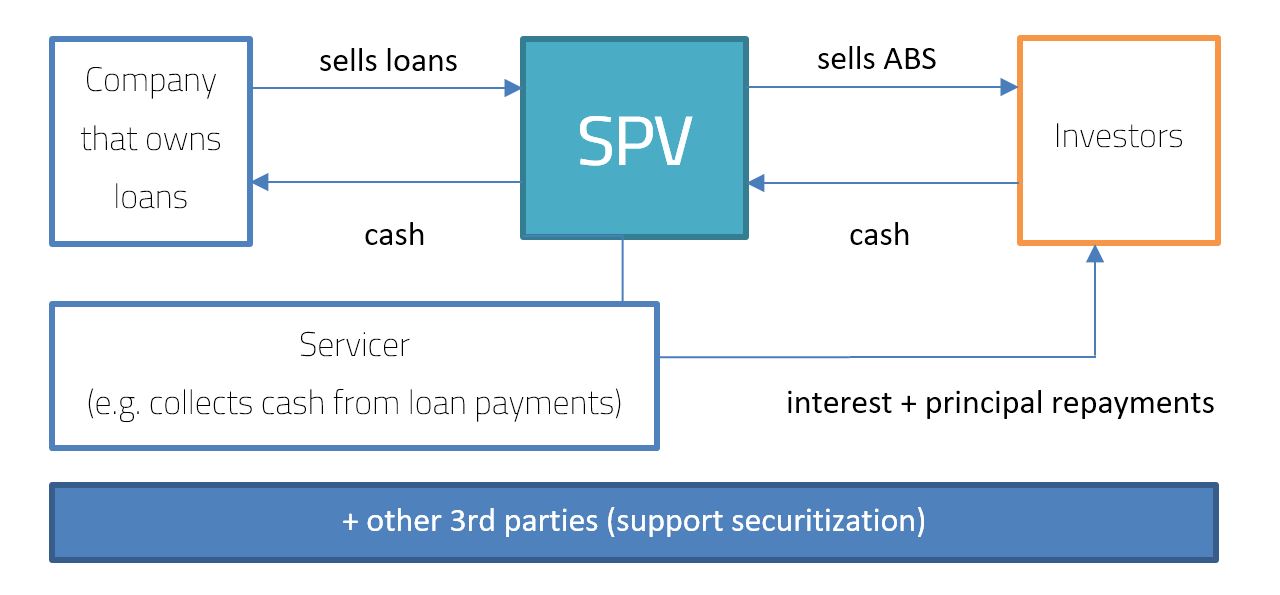

There are 4 groups of entities taking part in the securitization process:

- A financial institution or other company that owns loans (e.g. mortgages, receivables),

- A special purpose vehicle (SPV) that buys loans from the financial institution/other company and issues new securities backed by these loans.

- Third parties to securitization (lawyers, trustees, rating agencies, guarantors, etc. + the servicer if it’s different from the seller of the collateral) that support the securitization process and are responsible, e.g. preparing legal documents, collecting the loan payments, etc.

- Investors that buy securities meeting their appetite for risk and return issued by the SPV.

The benefits of securitization include:

(...)

The main risks associated with securitization include:

- prepayment risk,

- credit risk.

Because the monthly cash flow from a mortgage pass-through security depends also on not scheduled prepayments of the loans, investors don’t know what the future cash flows will be. We call this a prepayment risk.

Because of prepayment risk and credit risk, multiple class bond structures can be created:

(...)

- Securitization is a process in which we take collateral and issue fixed-income securities backed by this collateral.

- Examples of assets used as collateral: residential mortgage loans, commercial mortgage loans, auto loans, credit card receivables, etc.

- Examples of fixed-income instruments created through securitization: RMBS, e.g. mortgage pass-through securities or CMOs; CMBS; non-mortgage ABS; CDOs.

- The main risks associated with securitization include prepayment risk and credit risk.

- Because of prepayment risk and credit risk, multiple class bond structures can be created, e.g. time tranching and credit tranching.

- Creating different tranches doesn’t reduce the risks but allows the redistribution of the risks to different investors.