Level 1 CFA® Exam:

Risk Modification

There are different ways of managing risk:

- risk prevention & avoidance,

- risk acceptance,

- risk transfer,

- risk shifting.

Risk Prevention & Avoidance

It is nearly impossible to completely prevent or avoid risk and the trade-off between the benefits of bearing risk and the costs of avoiding risk should be carefully considered. However, it is hard to correctly quantify both the possible gains and losses of risky activities and their assessment may be biased by subjective beliefs.

Self-Insurance

Forms: bearing the risk, establishing reserve funds to cover potential losses

Always make sure that the risk you are going to accept is in line with your risk tolerance.

Diversification

Diversification is a risk mitigation tactic. It is the most efficient when combined with other risk management tactics.

Risk transfer is about selling the risk to another party, mainly using an insurance policy.

The insured buys an insurance policy from the insurer.

The insurer can cover its risks thanks to:

- diversification / pooling of risks,

- deductible provision requiring that a small amount of loss is covered also by the insured.

Surety bond is a form of insurance that is used when there is a risk of non-performance by another party.

Fidelity bond is a variation of a surety bond. It is used to mitigate the losses resulting from employees’ dishonesty.

Risk shifting is about changing the distribution of risk outcomes.

The primary tools used for risk shifting are derivatives like forwards, futures, options, and swaps.

A derivative is a financial instrument whose value depends on the value of some underlying asset and which derives its performance by transforming the performance of the underlying asset.

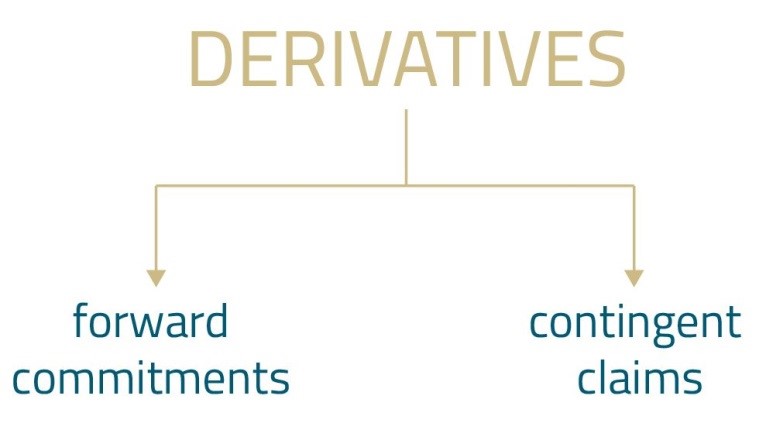

Forward commitments

A forward commitment is a legally binding agreement between two parties to perform certain actions in the future. The buyer of the contract agrees to purchase and the seller of the contract to sell an underlying asset at a specific time in the future at a price specified in the contract.

Examples of forward commitments: forwards, futures, swaps.

Contingent claims

A contingent claim is a claim that depends on a specific event that occurs in the future.

Because contingent claims are not symmetrical, as one party gets a right and the other gets an obligation, the party enjoying the right has to pay for it.

In a nutshell, at the time of entering into a transaction, contingent claims have a certain value, whereas forward commitments have no value, i.e. their value equals zero.

Examples of contingent claims: options.

Risk shifting in practice:

Example 1

If you have a long net position in a well-diversified portfolio of stocks and want to hedge against a decrease in stock prices, you can buy put options on an index. If stock prices drop, the loss on stocks will be covered by the gain on the long puts. Of course, there is a cost associated with this risk-shifting strategy. You’ll have to spend money on puts, which means that your overall potential gain will be lower compared to the situation when you do not buy these options. To sum up, by using long puts the distribution of risk outcomes changes (lower potential losses & lower potential gains compared to the no-hedge scenario).

Example 2

Your company has a net short exposure to call options on SP500 expiring next month. To hedge against an increase in the index value (that will result in a loss on short calls), you can for example buy futures on SP500. In such a case, the loss on short calls will be covered by the profit on long futures. However, as in Example 1, there is a cost associated with this strategy. If the index value decreases, you’ll incur a loss on long futures. To sum up, by using long futures the distribution of risk outcomes changes (lower potential losses & lower potential gains compared to the no-hedge scenario).

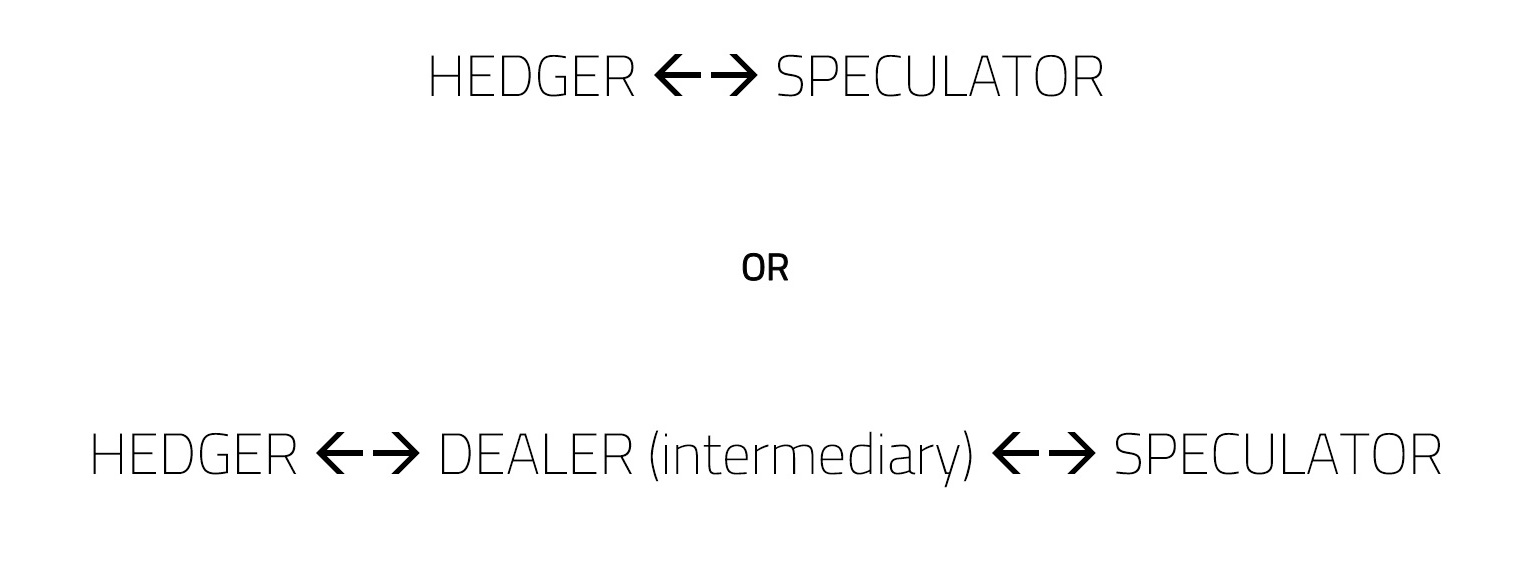

Risk shifting – parties involved

- There are different ways of managing risk: risk prevention & avoidance, risk acceptance, risk transfer, and risk shifting.

- Risk transfer is about selling the risk to another party, mainly using an insurance policy.

- Risk shifting is about changing the distribution of risk outcomes.

- The primary tools used for risk shifting are derivatives like forwards, futures, options, and swaps.

- A forward commitment is a legally binding agreement between two parties to perform certain actions in the future.

- A contingent claim is a claim that depends on a specific event that occurs in the future.