Level 1 CFA® Exam:

Business Cycles

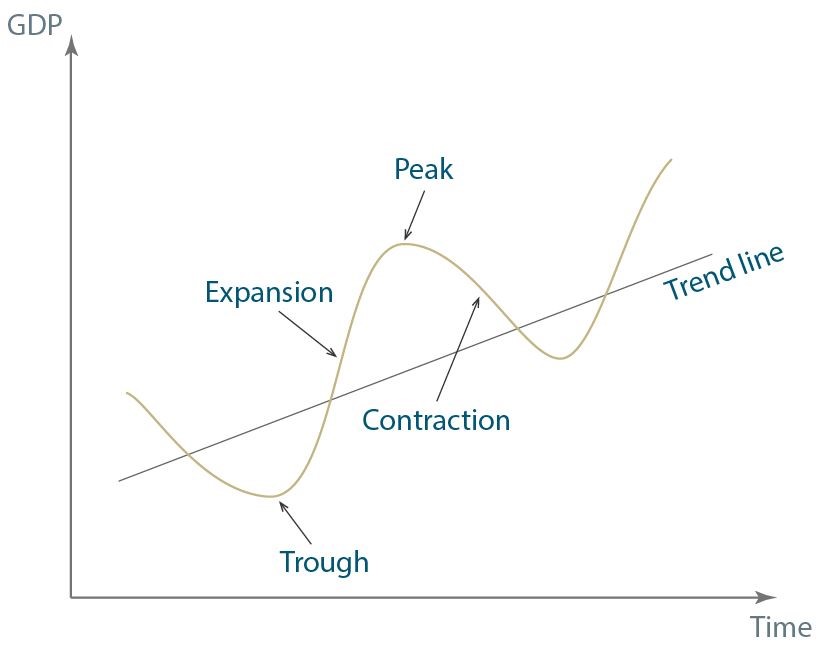

A business cycle is characterized by short-term deviations from the production trend and consists of 4 phases:

- contraction,

- trough,

- expansion, and

- peak.

Between the phases, there are cause and effect relationships, which means that the mechanisms and processes of one phase of the cycle determine the mechanisms and processes of the next phase. Business cycles are irregular – they differ in phase length and fluctuation amplitude.

Let’s discuss a full business cycle. Assume that we are starting at the peak. At this very point, both the production and spending are expanded too much and inflation is high. There is an excess of supply in comparison with the effective demand that comes as a result of uncontrolled investment processes. In consequence, the market can’t absorb everything that is produced and enter the contraction phase.

In the contraction phase, which can be called recession or even depression, production, investment, and employment are gradually reduced. People use fewer resources, investment is limited and real GDP falls. Also, inflation starts to fall.

This phase is followed by the trough, which is characterized by a relative economy stabilization at the lowest level. Those companies that survived harsh conditions and are still able to make a profit even with low prices stay in the market. In this phase, the strongest entrepreneurs who survived the crisis take advantage of unfavorable economic conditions and start restoring their capital, that is from this point they begin to increase employment and investment.

So, the expansion phase begins. The ratio of prices to production costs starts to improve, leading to increased profits. Funds accumulated in commercial banks seek commercial estuary, which results in lower interest rates. And, as we know, cheaper loans allow greater investments. In the beginning, inflation is still falling or remains constant, but as expansion is speeding up, inflation also starts to accelerate. Prices of equities and bonds are rising.

The recovery affects new areas of economic life more and more until it reaches a new phase of development, namely a peak. As we have said, the peak phase of the business cycle is when investments reach their highest levels and stop growing. Sooner or later, new tensions in the economy put an end to the expansion of investment and trigger mechanisms of transitional economic downturn. The contraction phase begins anew. And so the story continues.

You should know that the level of economic activity in the housing market is closely related to price trends, which in turn are derived from demographic changes, income changes, or investment demand in different phases of the business cycle.

What is more, external trade is also dependent on the phase of the business cycle. When GDP increases and a domestic currency appreciates, imports increase. But when revenues from abroad increase and a domestic currency depreciates, then exports increase.

There are 5 main schools of thought discussing the business cycle that you should know:

- Neoclassical school,

- Austrian school,

- Keynesian school,

- Monetarist school, and

- New Classical school.

Before we describe each school one by one, we have to say that all of these schools and their theories have their stronger and weaker points. Sometimes they seem to work well, but sometimes they don’t.

Interestingly, theories of the business cycle come as the answer to changes in the economic situation. And usually, over a given period of time, they tend to work satisfactorily and explain a given situation well. But as time passes by, the findings of a given theory are no longer sufficient to explain the economic reality that well and a new theory is created. Of course, new theories often build on the assumptions of the previous ones.

Some academics strongly support one or the other of the theories we enumerated above. However, we have to understand that it is hardly possible to create a theory that would well describe every economic situation in every country.

According to neoclassical economists, changes in the aggregate supply and demand are very quickly compensated by changes in interest rates and wages. The so-called Say’s law forms the basis of the neoclassical school. Say’s law says that supply creates demand and as a consequence, everything that is produced will be sold. So, business cycles are only temporary deviations from the general equilibrium. Technology may be recognized by neoclassical economists as one of the causes of the business cycle.

To sum up, if you are a neoclassical economist you assume that:

- business cycles are sporadic,

- business cycles may be caused by changes in technology,

- the economy tends to back to general equilibrium very fast without the help of the government because of Say’s law.

The Austrian school is somehow similar to the neoclassical school but additionally focuses on two issues that the neoclassical school is not interested in, namely:

- the role of money, and

- the role of the government.

(...)

The Keynesian school was started by John Maynard Keynes. Keynes argued that in certain situations the government should react to what’s happening in the market. Because it is often impossible to go back to equilibrium in the short run, during the recession the government should introduce the expansionary fiscal policy, that is it should increase government spending and cut taxes.

(...)

The most prominent economist supporting the Monetarist school was Milton Friedman. The Monetarist school is an answer to the Keynesian School. Monetarists indicate that often the timing of government interventions is wrong and that in the long run, the results of such interventions may be detrimental to the economy.

Monetarists argue that government policy should be transparent, consistent, and easy to foresee to market participants. In other words, government interventions can be not only inaccurate but also misleading to market participants. Where does the name Monetarist come from? It is derived from the stress that monetarists lay on the supply of money. They argue that money supply should increase at a stable and low rate.

According to monetarists, the business cycle is either a result of government interventions or exogenous shocks. So if you are a monetarist, you think that money supply should increase at a stable and low rate and that government interventions are not good for an economy.

The last group of theories we are going to discuss here is the New Classical school. Robert Lucas is one of the protoplasts of this school. Models of this school very often show that changes in the economy can be derived from the behavior of a single market participant.

(...)

- A business cycle is characterized by short-term deviations from the production trend and consists of 4 phases: contraction, trough, expansion, and peak.

- There are 5 main schools of thought discussing the business cycle: Neoclassical school, Austrian school, Keynesian school, Monetarist school, and New Classical school.

- The so-called Say’s law forms the basis of the neoclassical school. Say’s law says that supply creates demand and as a consequence, everything that is produced will be sold.

- According to the Austrian school, changes in the business cycles are the result of government economic interventions.

- According to Keynes, wages tend to be sticky and fall more slowly than the prices of goods.

- Monetarists argue that money supply should increase at a stable and low rate.

- According to monetarists, the business cycle is either a result of government interventions or exogenous shocks.

- New Classical school models very often show that changes in the economy can be derived from the behavior of a single market participant.

- If you belong to the New Classic school you treat business cycles as natural market responses to external shocks.