Level 1 CFA® Exam:

Lenders vs Owners

The 2 main sources of financing for companies are:

- equity capital, and

- debt capital.

In return for the capital provided, debtholders receive interest and the return of capital in the future. On the other hand, holding equity gives voting rights and the right to a dividend but there is no legal obligation of returning the capital invested.

In the case of a liquidation event, debtholders have a prior legal claim over the claim of equity owners. However, equity owners have a residual claim to the company's net assets after all liabilities (including also the claims of other stakeholders such as employees, suppliers, and government) have been settled.

From the perspective of a company, interest paid to debtholders is tax deductible but dividends aren’t. So, for example, if the company’s earnings before interest and taxes (EBIT) is USD 10 million and the interest expense is USD 2 million, the company will pay taxes on USD 8 million of earnings before taxes (EBT).

The rate of return required by debtholders is lower than the rate of return required by equity owners because debtholders take lower risk than equity owners. This is because – as we said earlier – debtholders have a prior legal claim to the company’s cash flows and assets and equity owners only have a residual claim to the company’s net assets.

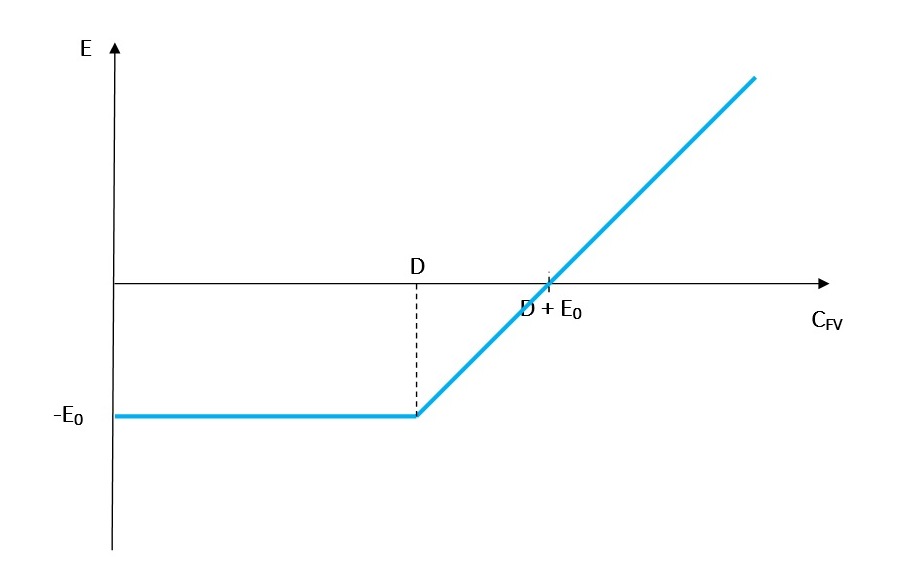

Risk profiles for equityholders and debtholders differ a lot. Both the value of profit from debt capital (\(D\)) and equity capital (\(E\)) depends directly on the future value of the company (\(C_{FV}\)).

Equityholders:

Where:

- \(E\) - profit of equityholders,

- \(-E_0\) - initial equity investment,

- \(D\) - outstanding debt,

- \(C_{FV}\) - future value of company,

For equityholders, the maximum profit is unlimited and the maximum loss is equal to the initial equity investment (\(-E_0\)). As long as the future value of the company is lower than the outstanding debt (\(D\)), the equityholders receive nothing because they have a residual claim to the company's net assets. When the future value of the company gets bigger than the value of outstanding debt, the equity value begins to increase. We reach the breakeven point when \(C_{FV}=D+E_0\).

If you are familiar with options, you’ll notice that the graph for equityholders resembles the profit graph for a long call option with the exercise price equal to the value of debt. If you don’t know what options are, don’t worry we discuss them in detail in Derivatives.

(...)

- The 2 main sources of financing for companies are equity capital and debt capital.

- In the case of a liquidation event, debtholders have a prior legal claim over the claim of equity owners.

- For equityholders, the maximum profit is unlimited and the maximum loss is equal to the initial equity investment.

- For debtholders, both the maximum profit and the maximum loss are limited. The maximum profit is equal to the value of interest. The maximum loss is equal to the value lent to the company.