Level 1 CFA® Exam:

Swaps & Credit Derivatives

When two parties enter into a swap they agree to exchange a series of cash flows at specified times in the future. So, at some point in the future one party, let’s call it Party A, will be obliged to pay an amount of money to the other party, which we will call Party B. At the same time Party B will be obliged to pay an amount of money to Party A (so they exchange the payments).

The parties may agree on a single exchange of payments (like in a forward contract) but usually they agree on a number of payments (a series of forward contracts, called a swap). Any payment date is referred to as a settlement date and any time frame between two settlement dates is called a settlement period. The date of the final payment is called termination date and time to maturity is referred to as the tenor of a swap.

Plain Vanilla Interest Rate Swap

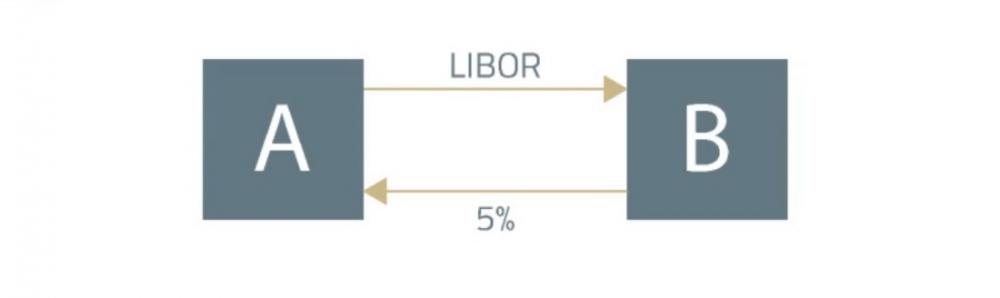

The most basic swap is an agreement between two parties to make a floating-rate payment in exchange for a fixed-rate payment.

So, for example, Party A agrees to pay LIBOR multiplied by the notional principal of the swap and Party B agrees to pay a fixed rate, say at the level of 5%, also multiplied by the notional principal of the swap. Now, which party will profit from this swap depends on whether LIBOR determined for a given settlement date will be greater or lower than 5%. If LIBOR is greater than 5%, Party B will make a profit. If LIBOR is less than 5%, the profit will be realized by Party A.

Payments made by the parties may be denominated in different currencies and they may depend not only on rates such as LIBOR or Euribor but also on different variables, say, returns on a stock index.

- Swaps are over-the-counter instruments and they are said to be “tailor-made”, which means they are suitable for the parties’ needs.

- Swaps are traded in unregulated markets.

- Both parties to a swap are subject to the risk of default by the counterparty.

- No initial payment is required, which means that the value of a swap equals zero at the time when the parties enter into the agreement. If you remember, this is also the case with forwards and futures. Among derivative instruments, only options require that the long pays the short an option premium at the very start.

- When the same currency is used for the payments of both parties, the payments are netted against each other, which means that only the net amount owed from one party to the other is paid.

- Mainly large institutions are participants of swap markets and private individuals usually do not engage in swaps.

Credit derivatives are used to hedge against credit risk. Examples of credit derivatives include:

- total return swap,

- credit spread option,

- credit-linked note (CLN), and

- credit default swap (CDS).

CDS

In the case of a CDS, there are usually 3 parties to be taken into account:

(...)

- When two parties enter into a swap they agree to exchange a series of cash flows at specified times in the future.

- The most basic swap is an agreement between two parties to make a floating-rate payment in exchange for a fixed-rate payment.

- A swap can be perceived as series of forwards contracts so it is “tailor-made”, trades in unregulated markets, and both parties to a swap are subject to the risk of default by the counterparty.

- Credit derivatives are used to hedge against credit risk.

- If the lender is afraid of the borrower not being able to fulfill the obligation to pay interest and principal, he may buy a credit default swap.