Level 1 CFA® Exam:

Systematic Risk vs Nonsystematic Risk

When analyzing a portfolio it is important to distinguish between systematic and nonsystematic risk. In the previous lessons, we emphasized the power of diversification and we showed you how to effectively reduce portfolio risk by choosing the least correlated assets. The lower the correlation between selected assets, the lower the portfolio risk.

Note, however, that diversification usually eliminates only a part of the total risk of a portfolio. This is because certain factors affect, let’s say, only one company in the portfolio, while others can affect the entire portfolio or even the whole market. The risk associated with factors affecting only one company in the portfolio can be effectively eliminated through diversification of the portfolio.

However, risk resulting from factors that affect the whole market cannot be eliminated through diversification. And this is how we introduced a division between systematic and nonsystematic risk.

Systematic Risk

Systematic risk (also called market risk or nondiversifiable risk) is inherent in the market. It cannot be avoided and it affects all assets in the market. Examples of factors that constitute systematic risk include inflation, economic cycles, politics, or natural disasters.

Nonsystematic Risk

Nonsystematic risk (sometimes also called unique risk, firm-specific risk, or diversifiable risk) is limited to a particular asset or asset classes, for example, concerning a particular industry. Investors can avoid nonsystematic risk through diversification. Examples of such risks include mining disasters, embargos, tariffs on certain goods, new fishing quotas, rising prices of certain raw materials or other materials, fires in factories, etc. All these factors are important for specific companies and assets, but they don’t affect the entire market.

The more assets are in the portfolio and the less they are correlated, the lower the nonsystematic risk is. The best-diversified portfolio is the market portfolio because it consists of all assets available in the market. Nonsystematic risk of the market portfolio equals zero.

We already know that a reasonable investor in exchange for a higher risk should demand a higher rate of return. He shouldn’t, however, want a higher rate of return for nonsystematic risk as it can be avoided through portfolio diversification.

If investors demanded higher rates of return for nonsystematic risk, they would like to have more and more of this kind of risk as it can be diversified away. Demand for nonsystematic risk would grow indefinitely, and at the same time, the expected return resulting from this risk would be approaching zero. Investors would take a very high risk with no compensation whatsoever. This is against the assumption that investors are rational, according to which the bigger the risk, the higher the compensation.

Coming back to diversification and a market portfolio. We talked about how difficult it is to find the true market portfolio. Does this mean that the benefits of diversification are difficult to achieve? No, they aren’t. Some studies show that a good diversification effect can be achieved by creating a portfolio that includes from 12 to 18 different assets. This way, we can use up to 90% of the diversification effect. Other studies talk about 20 to 30 assets in the portfolio. What is important for our discussion is that even with over a dozen different assets in the portfolio, the risk is much lower than the average risk of a single asset.

In practice, when diversifying a portfolio an investor should take into account not only the benefits but also the costs involved, such as transaction and analysis costs.

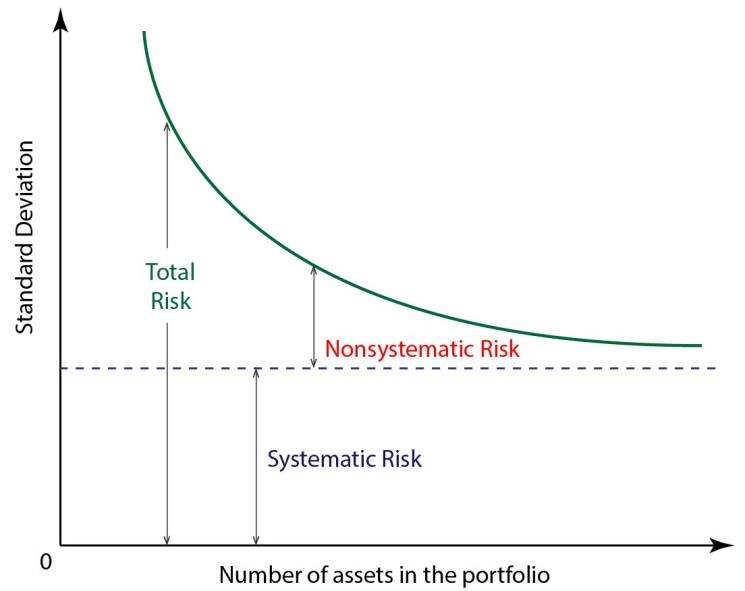

Let's look at a graph showing the relationship between total risk, nonsystematic risk, systematic risk, and the number of assets in the portfolio.

What does the graph tell us?

- The first important thing is that the total risk is equal to systematic risk plus nonsystematic risk.

- Secondly, the more assets you have in the portfolio, the lower its total risk becomes.

- Thirdly, with every asset added to the portfolio its total risk decreases more slowly. For a certain number of assets in the portfolio, the manager should consider whether the benefits associated with adding a new asset resulting from further diversification outweigh the costs of operation, analysis, and management, as well as transaction costs.

- The next point is that for a well-diversified portfolio nonsystematic risk is virtually equal to zero.

- Also, the graph shows that there is a certain level of risk that we cannot go below. This level of risk is determined by systematic risk. Even if you bought dozens of different assets for your portfolio, you can’t avoid the risk associated with the market, that is systematic risk. Such risk can only be eliminated through the use of derivatives.

- Systematic risk is inherent in the market and cannot be avoided and it affects all assets in the market.

- Nonsystematic risk is limited to a particular asset or asset classes.

- Investors can avoid nonsystematic risk through diversification.

- Nonsystematic risk of the market portfolio equals zero.

- In practice, when diversifying a portfolio an investor should take into account not only the benefits but also the costs involved, such as transaction and analysis costs.