Level 1 CFA® Exam:

Bonds Payable

Long-term debt is initially recognized in the balance sheet at the present value of the future cash flows.

The cost of bond issuance, for example, legal fees, commissions, and so on is differently recognized under IFRS and U.S. GAAP.

According to IFRS, the costs related to the issuance of a bond are included as part of bonds payable. For example, if the sales proceeds are equal to USD 100 million and the issue costs are equal to USD 2 million, then we debit cash for USD 98 million and the bond payable will be initially recognized at USD 98 million.

Under U.S. GAAP, the costs related to the issuance of a bond are not included as part of bonds payable but – instead – they are treated as a deferred asset amortized over the life of the bond.

For example, if the sales proceeds are equal to USD 100 million and the issuance costs are equal to USD 2 million, then the bond payable will be initially recognized at USD 100 million and we will debit cash and deferred charge for USD 98 million and USD 2 million, respectively.

So – assuming no issuance costs – when the company issues bonds, in the statement of financial position:

- the cash account increases and

- a liability (bonds payable) is recorded.

There is also a cash inflow in the financing section of the cash flow statement.

In the subsequent periods we can measure a long-term debt either at:

- amortized cost, or at

- fair value.

The majority of companies apply the former approach.

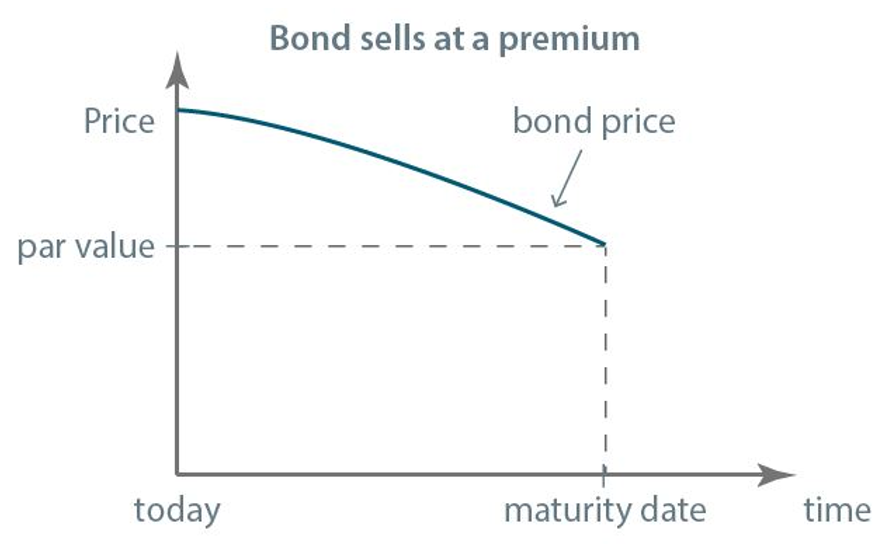

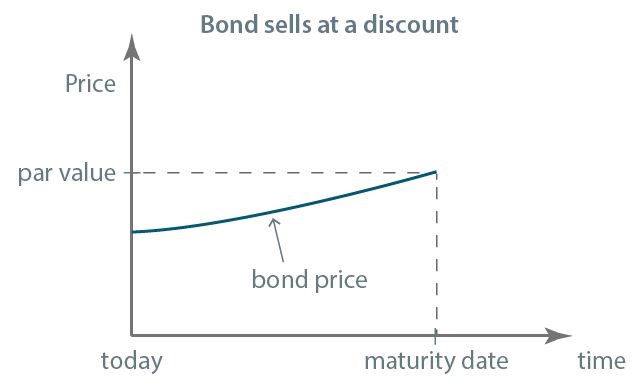

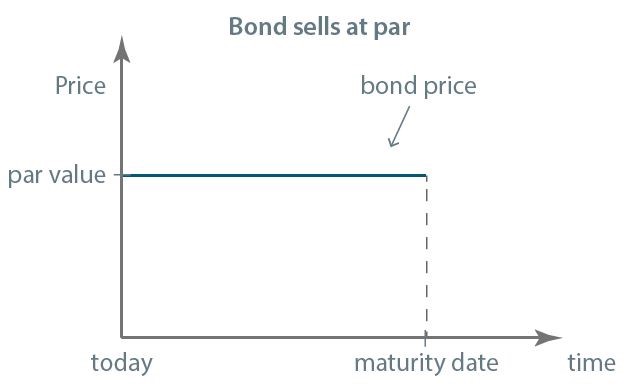

According to the amortized cost approach, a long-term debt is reported in a given period at the historical cost adjusted up or down by the amortization of a bond discount or premium, respectively. For discount bonds, in the consecutive periods, we will adjust the historical cost up until we reach the par value and for premium bonds, we will adjust the historical cost down until we reach the par value.

The other approach (fair value) is used mainly by financial companies and consists in measuring the bond in all periods at its fair value. If the market value of the bond goes up in a given period, then unrealized loss and bonds payable also go up. If the market value of the bond goes down, the bonds payable goes down and unrealized gain goes up.

If the company uses the amortized cost approach, it can use 2 methods to amortize the discount and the premium:

- the effective interest rate method, or

- the straight-line method.

The general rule for both methods is the same.

For discount bonds, in the consecutive years, we will adjust the historical cost up until we reach the bond’s par value and for premium bonds, we will adjust the historical cost down until we reach the par value.

However, the straight-line method assumes that in each period throughout the bond’s maturity the value of the adjustment is the same.

According to the effective interest rate method, the adjustment reflects the reality better. In other words, it reflects what the change in the bond price would be if we assumed that the market discount rate doesn’t change.

Below you can see how the bond price changes as time passes by and you can compare it to the bonds payable measured both under the effective interest rate and under the straight-line methods.

Note that we assume here that the market discount rate doesn’t change over time. If it changes, the part of the graph presenting the bond price will be different.

Also note that as far as the effective interest rate method and the straight-line method are concerned, the latter is allowed only under U.S. GAAP.

Now we will analyze how both these methods work in practice.

In the first example, we will take a look at a premium bond, whereas in the second – at a discount coupon bond.

Let’s begin with the premium bond.

On 1 January 2021 Robots, Inc. issued 4-year bonds with a total par value of USD 100 million and a coupon paid on an annual basis that amounts to 8% of the par value. The effective annual interest rate at the time of issuing the bonds was equal to 7%. What is the interest payment, interest expense, amortization of premium, and bond carrying amount in the first two years?

Solve the problem assuming:

- the effective interest rate method, and

- the straight-line method.

(...)

Now we can analyze the amortization for the discount coupon bond. This time, we will use the effective interest rate method only.

On 1 January 2013. Grain, Inc. issued 8-year bonds with a total par value of USD 100 million and a coupon paid on an annual basis that amounts to 5% of the par value. The effective annual interest rate at the time of issuing bonds was equal to 8%.

What was the interest payment, interest expense, amortization of premium, and bond carrying amount in the first year? And what was the value of the interest expense in 2019?

Use the effective interest rate method.

(...)

To sum up these two examples:

- For premium bonds, the interest payment is always higher than the interest expense. So, in all years the bonds payable is reduced by the difference between the interest payment and interest expense.

- For discount bonds, the interest payment is always lower than the interest expense. Thus, in all years the bonds payable is increased by the difference between the interest expense and interest payment.

Note that under the indirect method in the statement of cash flows a noncash expense is added in the operating section of the cash flow statement.

When the company decides to buy back its bonds at some point in time, then depending on whether the amount of money necessary to buy back bonds is greater or lower than their carrying amount, the company will incur a loss or gain, respectively.

- Long-term debt is initially recognized in the balance sheet at the present value of the future cash flows.

- According to IFRS, the costs related to the issuance of a bond are included as part of bonds payable.

- Under U.S. GAAP, the costs related to the issuance of a bond are not included as part of bonds payable but – instead – they are treated as a deferred asset amortized over the life of the bond.

- In the subsequent periods we can measure a long-term debt either at: amortized cost or at fair value.

- According to the amortized cost approach, a long-term debt is reported in a given period at the historical cost adjusted up or down by the amortization of a bond discount or premium, respectively.

- If the company uses the amortized cost approach, it can use 2 methods to amortize the discount and the premium: the effective interest rate method or the straight-line method.

- The effective interest rate method reflects what the change in the bond price would be if we assumed that the market discount rate doesn’t change.

- The straight-line method is allowed only under U.S. GAAP.

- The interest expense in a given period is equal to the effective interest rate at the time of issuing bonds multiplied by the carrying amount at the beginning of the period.

- For premium bonds the interest payment is always greater than the interest expense and the difference between them is the amortization of the premium.

- For premium bonds the carrying amount at the end of a given year is equal to the carrying amount at the beginning of the year less the amortization of the premium.

- For discount bonds the interest payment is lower than the interest expense and the difference between them is called the amortization of the discount.

- For discount bonds the carrying amount at the end of a given year is equal to the carrying amount at the beginning of the year plus the amortization of the discount.