Level 1 CFA® Exam:

Optimal Capital Structure, Static Trade-Off Theory, & Competing Stakeholder Interests

As we remember, the first model of Miller and Modigliani for an economy without taxes says that a company’s value is not affected by its capital structure, and therefore the WACC is constant. In the case of an unlevered company, a lower cost of debt is offset by an increase in the cost of equity.

In the case of an economy with taxes, tax savings contribute to the growth of a company’s value, and when debt increases, the WACC decreases. From this perspective, the best idea would be to finance a company only with debt. But it is not possible, among other things, because of the reasons we discussed in the previous lesson. Companies cannot use debt as the only source of finance as above a certain level of debt, the share of benefits that increase the value of the company is offset by the costs that reduce its value.

In the real economy, companies can be affected by the costs of financial distress, agency costs, and the theory of asymmetric information.

When considering all these factors, companies try to choose an optimal capital structure. Optimal meaning one for which the value of the company will be maximized. The static trade-off theory assumes that the value of a company may be increased by the existence of a tax shield, but as debt in the financial structure of the company increases, so do the costs of financial distress.

Under this theory, the formula for the value of a leveraged company looks like this:

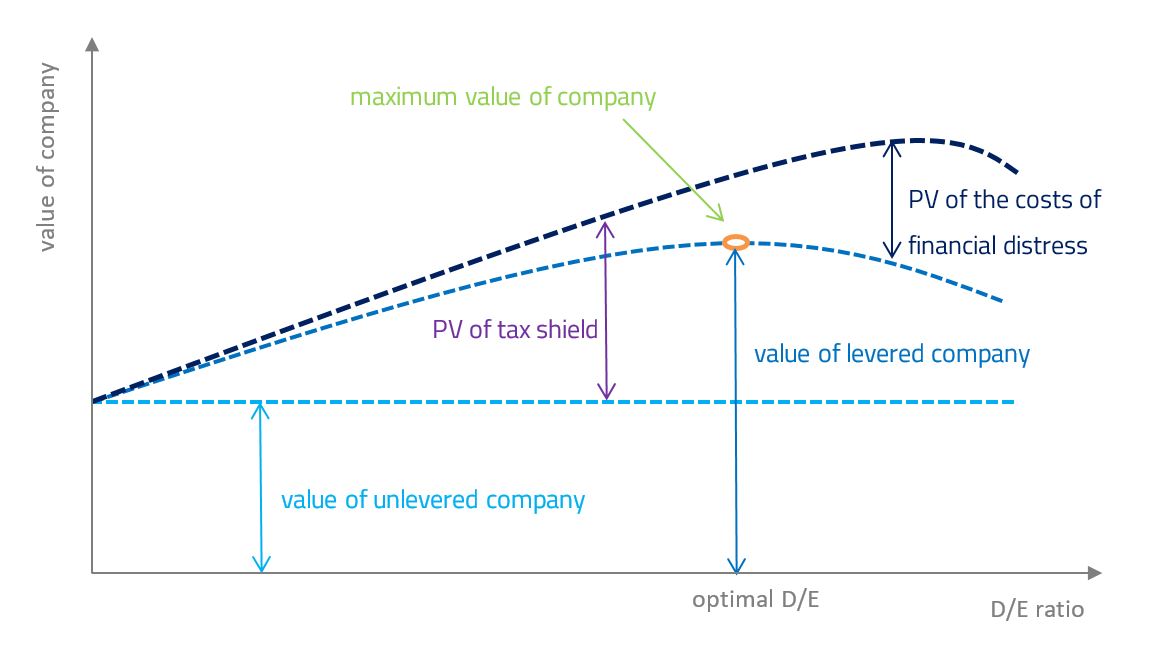

The static trade-off theory of capital structure is presented on the graph below:

Initially, the value of the levered company increases as the a tax shield is higher than the PV of the costs of financial distress. This happens up to the point where the company maximizes its value. This point determines the optimal capital structure, which can be written as the debt to equity ratio. To the right of the maximum value of the company, the PV of the costs is higher than a tax shield, so the company’s value goes down.

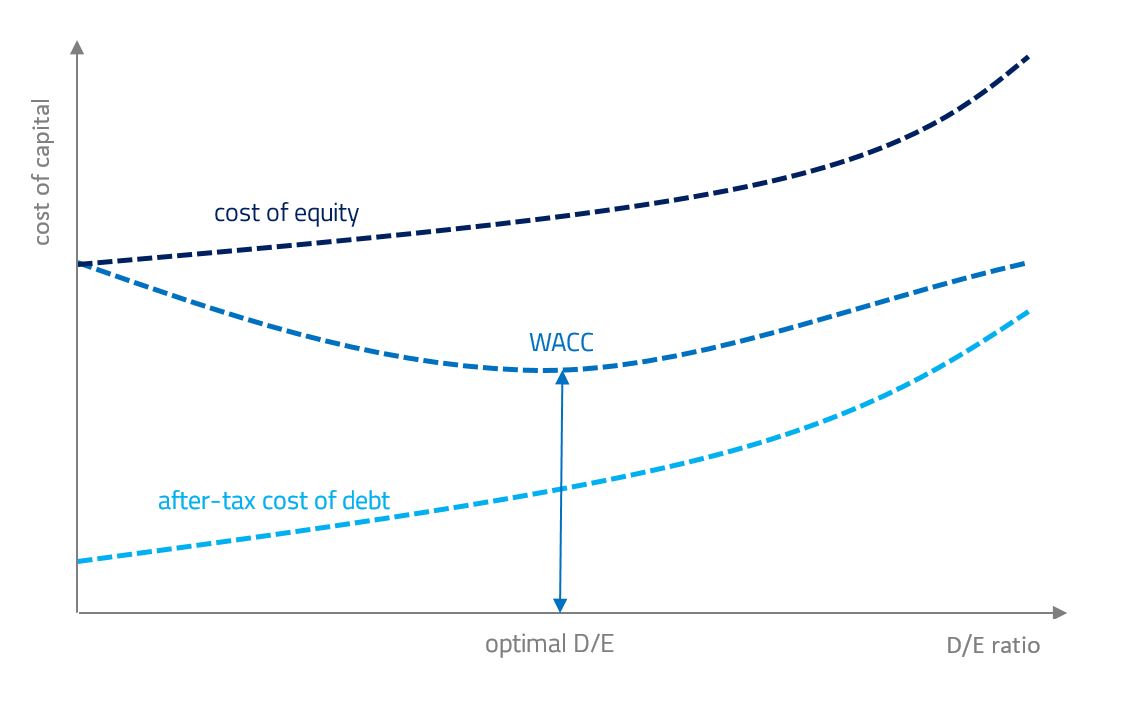

The next graph presents the weighted average cost of capital for the entire company:

Initially, the WACC decreases due to a low cost of borrowed capital. However, the higher the level of debt, the higher the leverage of the company and the higher the cost of debt. The WACC reaches its lowest level at the point of an optimal debt to equity ratio and at this point the value of the company is the highest. To the right of this point, increasing risk of debt financing causes the WACC to grow.

Let us remember that every company will have its own optimal debt to equity ratio, as it is dependent on a number of particular factors, including business risk, tax situation, and many others.

Most companies try to reach its target capital structure, which can be defined as a desirable proportion of equity to debt. The target capital structure determines the ways of acquiring additional capital. In the vast majority of cases, managers assume that their businesses have a certain optimal capital structure which they want to reach to maximize the company’s value. In fact, the capital structure is more likely to fluctuate around the target level. This happens for at least two reasons:

(...)

Let's assume that Company C is financed only with common stock and debt. We know that the market value of the company's debt is USD 5 million and the market value of equity is USD 7 million. Have a look at the capital structure of the other companies:

Company A: market value of debt = USD 10 million; market value of equity = USD 15 million

Company B: market value of debt = USD 13 million; market value of equity = USD 7 million

We also know that the target debt-to-equity ratio based on trend analysis is 0.6.

Let’s calculate the target capital structure in 3 ways:

- using current capital structure,

- using competitors’ capital structure, or

- using the capital structure based on the target debt-to-equity ratio of 0.6.

(...)

Principal stakeholders groups include:

- providers of capital,

- other stakeholders.

The group of capital providers can be divided into:

- equity shareholders – public (minority) shareholders & controlling shareholders (founders, private equity),

- preferred shareholders,

- debtholders – public debtholders, bank lenders, private lenders.

The other stakeholders include:

- customers,

- suppliers,

- employees,

- managers,

- directors,

- regulators, governments.

Examples of conflicts between different groups of stakeholders:

- debtholders prefer lower financial leverage (lower risk), whereas shareholders prefer higher financial leverage (higher potential return),

- controlling shareholders may have different goals and time horizon than minority shareholders,

- employees prefer to work for a company that is stable and doesn’t take a lot of risk in the long-run, whereas controlling shareholders can have a different plan for the company (e.g. increasing financial leverage),

- managers might be more interested in short-term growth and profitability (especially when their compensation is directly related to these metrics) or could prefer a riskier approach to the capital structure (e.g. if they hold management stock options), whereas shareholders prefer a long-term growth of their shares value.

Level 1 CFA Exam Takeaways: Optimal Capital Structure, Static Trade-Off Theory, & Competing Stakeholder Interests

star content check off when done- Optimal capital structure is when the value of the company is maximized.

- The static trade-off theory assumes that the value of a company may be increased by the existence of a tax shield, but as debt in the financial structure of the company increases, so do the costs of financial distress.

- Every company will have its own optimal debt to equity ratio, as it is dependent on a number of particular factors, including business risk, tax situation, and many others.

- We can calculate the target capital structure for a company in 3 ways: 1) using current capital structure, 2) using competitors’ capital structure, or 3) using the capital structure based on the target debt-to-equity ratio.

- Principal stakeholders groups include: providers of capital and other stakeholders.

- The group of capital providers can be divided into: equity shareholders, preferred shareholders, and debtholders.

- The other stakeholders include: customers, suppliers, employees, managers, directors, regulators, and governments.