The 3 easiest level 1 CFA exam topics are:

Below you can see the details for the easiest 2024 level 1 CFA exam topics. There are some important changes for level 1 CFA exam topics in 2024, including new topic weights or a new number of learning modules. See all 2024 level 1 CFA exam topics here.

In fact, no simple Yes or No answer can be given to the question about the easiest level 1 CFA exam topics. However, we think that these 3 topics can be nominated in the 'easiest topic' category, especially if special conditions apply! If you meet these conditions, then the 3 topics tabulated below should be – if not the easiest – then certainly easier for you.

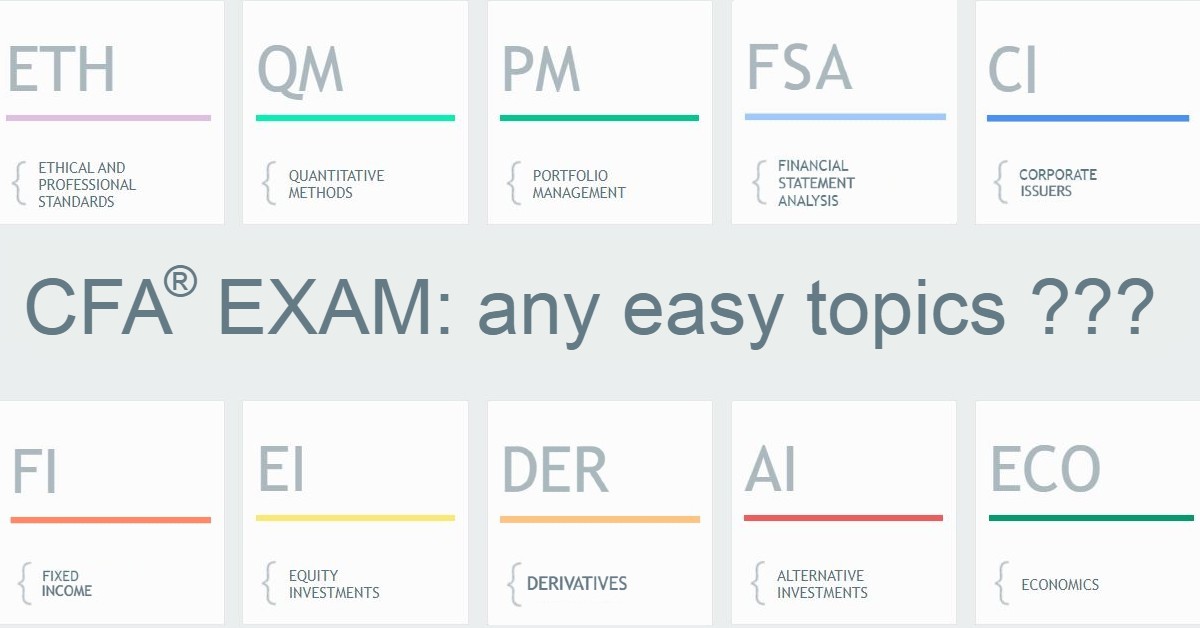

We begin our analysis of the easy level 1 CFA exam topics with a table.

Easiest Level 1 CFA Exam Topics

| Level 1 CFA Exam Topic | Short Description | 2024 Topic Weight | No. of Modules in 2024 |

No. of Formulas | Predicted No. of Questions |

|---|---|---|---|---|---|

| Portfolio Management | Portfolio: structure, risks & returns | 8-12% | 6 | around 30 | ca. 14 |

| Corporate Issuers* | Corporate governance & decision-making | 6-9% | 7 | around 30 | ca. 12 |

| Equity | Market, industry & company analysis | 11-14% | 8 | around 40 | ca. 20 |

* Before 2022, the CFA Program curriculum referred to Corporate Issuers as Corporate Finance.

A learning module is a new name for what used to be called reading. It's a change partially introduced to the level 1 CFA exam curriculum in 2023, mainly in nomenclature but not only. The idea is for the learning modules to form digestive lessons that can be studied over one sitting. In your 2024 syllabus, you'll find all of the level 1 topics divided into learning modules (LM).

The 3 topics have different exam weights. Equity gets the highest 11-14%, then there’s Portfolio Management with 8-12%, and Corporate Issuers with the quite low exam weight of 6-9%. As regards the number of modules to study or formulas to remember, the 3 topics are comparable. As far as the number of questions in the level 1 CFA exam goes, you can read more here.

How Qaunts & Portfolio Management Topics Interact

There’s a bond between Portfolio Management (PM) and Quantitative Methods (QM).

The rate of return or dispersion measures can serve as perfect illustrations of this inter-topic connection. The two concepts (and some more) are present in both Portfolio Management and Quantitative Methods. However, if you study QM first, PM gets so much easier.

CONDITION:

Study QM before PM to pave the way for the quantitative PM modules. All else is pure theory.

Here are the 6 learning modules you will find in your 2024 level 1 CFA exam syllabus for the Portfolio Management topic:

- PORTFOLIO RISK & RETURN I

- PORTFOLIO RISK & RETURN II

- PORTFOLIO MANAGEMENT - INTRODUCTION

- INVESTMENT POLICY STATEMENT

- BEHAVIORAL BIASES

- RISK MANAGEMENT

* There are 6 Portfolio Management modules altogether. However, 2 modules are placed just after Economics, and the remaining 4 are at the end of your level 1 CFA exam curriculum, before Ethics.

We explain some of the major PM stuff in our free presentation The Power of Portfolio Diversification in 8 Diagrams:

Portfolio Management:

Where Quantitative Skills Matter

There are 2 things every portfolio manager must be able to do:

- 1. Select 'the best' portfolios out of a larger set of investments, where 'the best' means with the best risk-return trade-off.

- 2. Choose from 'the best' portfolios those that are suitable for the client because they are compliant with the client’s investment profile.

The learning modules on risk and return (part I and part II) are full of formulas and concepts that help you develop these analytical skills. You will learn:

- 1. how to calculate the portfolio’s risk and return,

- 2. that – on account of the risk-return trade-off – some portfolios are better than others and so we call them efficient portfolios (note: if we’d like to invest in risky portfolios only, we’d look for them on the efficient frontier),

- 3. that it’s better to invest in a portfolio consisting of an efficient portfolio and a risk-free asset rather than in the risky portfolios lying on the efficient frontier (to meet the risk-return trade-off),

- 4. how to use the utility theory to select the optimal investor portfolio,

- 5. how to analyze risks and returns for different portfolios a lot easier thanks to the CAPM model.

So, to be able to grasp the real meaning of portfolio management (not only as a topic but also as a skill), you will surely need to understand what the expected rate of return, standard deviation, and correlation coefficient are and how they work. Without these QM concepts, there’s no portfolio management.

That is why you'll get Portfolio Management scheduled after Quantitative Methods if you choose Soleadea Topic Sequence while creating your study plan. We recommend to our users what we believe to be the optimal level 1 topic sequence but you can also easily adjust it to your needs.

WHY THE SEQUENCE IS OPTIMAL

- Where possible, topics are coupled based on the comparability of concepts, e.g. QM+PM (rate of return, standard deviation, covariance, etc.), FSA+CI (financing ratios).

- More challenging topics are coupled with more easy ones allowing you to take a sort of a break meanwhile, so PM after complicated but still important QM, CI after long and detailed FSA, or quite intuitive EI after more theoretical FI.

- The most important topics – like FSA or QM – are scheduled upfront to ensure they are thoroughly studied.

- The shortest topics – i.e. Derivatives and Alternatives – are scheduled more to the end. You can study them over a week if need be. Plus, DER should be easier to take in after you get familiar with the concept of options presented in FI.

- Economics is scheduled next to last because if you're really needy for time that's the topic you can skim through (especially if you have some previous educational background in this area).

Find 220+ LVL 1 STUDY LESSONS INSIDE!

Corporate Issuers Borrows from Other Topics

Wouldn't you say that borrowing can make life easier?

Let’s say you need a specific amount of money asap but you just don’t have it. Which solution is the easier one: borrow the money or make the money? Definitely, it’s a loan that helps you satisfy your need here and now. Especially if it’s a friend that you’re borrowing from ;).

It seems that the whole CI topic builds on this 'friendly borrowing' rule.

It borrows a lot:

- from Quantitative Methods (QM) TVM,

- from Portfolio Management (PM) beta & CAPM model,

- from Financial Statement Analysis (FSA) financial ratios.

Get friendly with the 'lending' topics first and you can get done with Corporate Issuers quickly.

That’s right!

By studying all the 3 topics (QM, PM, FSA) before you start reading Corporate Issuers, you can facilitate the understanding of this topic excessively.

CONDITION:

Study QM, PM & FSA before Corporate Issuers to speed up its intake. Apart from a couple of more complex bits, CI theory is quite intuitive & easy to handle.

Using our CFA Exam Study Planner and the Soleadea Optimal Topic Sequence, that’s exactly what you'll get! The first 4 topics are scheduled as follows: Quantitative Methods, Portfolio Management, FSA, and Corporate Issuers .

Corporate Issuers: No Troubles?

Owing to the borrowed concepts, quite intuitive CI issues, and relatively easy formulas, Corporate Issuers may actually prove to be the easiest level 1 topic.

Here are the 7 learning modules you will find in your 2024 level 1 CFA exam syllabus for the Corporate Issuers topic:

- CORPORATE STRUCTURES & OWNERSHIP

- INVESTORS & OTHER STAKEHOLDERS

- CORPORATE GOVERNANCE

- WORKING CAPITAL

- CAPITAL INVESTMENTS

- CAPITAL STRUCTURE

- BUSINESS MODELS

Equity:

Can Level 1 Topic Get Any Simpler?

Many CFA exam candidates invest in stocks. If you’re an investor yourself and follow companies listed on the stock exchange, you will find the Equity Investments topic quite basic in many aspects (though equity is not only stocks).

CONDITION:

Interest in stocks & listed companies gives you a head start. Besides, Equity Investments is mainly theory and it learns smoothly.

The topic is mostly theoretical, which means you need to hire your memory skills to get the job done (even if you never made any investments, no big deal you can still ace the topic if your memory’s good).

Here are the 8 learning modules you will find in your 2024 level 1 CFA exam syllabus for the Equity topic:

- MARKET ORGANIZATION

- MARKET INDICES

- MARKET EFFICIENCY

- EQUITY SECURITIES - INTRODUCTION

- COMPANY ANALYSIS - INTRODUCTION

- INDUSTRY & COMPANY ANALYSIS

- COMPANY ANALYSIS - FORECASTING

- EQUITY SECURITIES - VALUATION

On Market Efficiency (& Not Only)

There are 3 forms of market efficiency: weak, semi-strong, and strong. Each next form includes the previous one as shown below:

Weak form efficient market when all past information about prices and volumes are included in the price of an asset.

Semi-strong form efficient market when all past information about prices and volumes as well as all publicly available information is included in the price of an asset.

Strong form efficient market when all past information about prices and volumes as well as all publicly available and confidential information is included in the price of an asset.

What follows is that:

for a weak form efficient market technical analysis should yield no abnormal returns,

for a semi-strong form efficient market both technical and fundamental analysis should yield no abnormal returns.

Not only markets can be efficient!

Also, topics can be analyzed with respect to their efficiency. On the efficiency of CFA exam topics, we write in one of our posts on study planning. Before you go, also take a minute to think about how efficient is your exam prep. If you wish it was more productive, use our CFA Exam Study Planner that puts you in charge, motivates you to work, holds you accountable, and makes you study:

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1/level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Read Also: