CFA Exam Results Released

The soonest NOV 2025 CFA exam results release date is 6 Jan* 2026, at least for level 1 candidates. Level 2 candidates need to wait at least until 13 Jan*, or a bit longer. Make sure to do your PSM module before then!

CFA Institute intends to release level 1 & level 2 CFA exam results 5-7 weeks after the close of the exam window. As a rule, level 3 candidates get their grading scores 6-8 weeks post-exam. This is the estimated time of results release but sometimes you may need to wait longer.

As soon as you receive your CFA exam results, you can register for your next exam (next level or retake). However, the choice is yours. You can take as much time as you need before you actually register for your next exam.

2026 study plans are available now!

CFA exam results have usually been released either on Tuesday or on Thursday. For some time, after the CFA exam was moved to computer-based testing (CBT), the usual pattern for releasing the results was: CFA exam date + 6-7 weeks for level 1 / 7-8 weeks for level 2 / 8-9 weeks for level 3 but it has improved now.

See the table below for our most optimistic educated guess about the NOV 2025 CFA exam result release date and some past dates and pass rates.

CFA Exam Results Dates & Pass Rates

* This is our educated & most optimistic guess (but the results may arrive later...).

| Your CFA Exam | Exam Date | Expected CFA Exam Results Date | Pass Rate |

|---|---|---|---|

| NOV 2025 Level 1 Exam | 12-18 Nov | 6 Jan 2026* | waiting |

| NOV 2025 Level 2 Exam | 19-23 Nov | 13 Jan 2026* | waiting |

| AUG 2025 Level 1 Exam | 20-26 Aug | 7 Oct 2025 | 43% |

| AUG 2025 Level 2 Exam | 27-31 Aug | 9 Oct 2025 | 44% |

| AUG 2025 Level 3 Exam | 15-19 Aug | 23 Oct 2025 | 50% |

| MAY 2025 Level 1 Exam | 14-20 May | 26 June 2025 | 45% |

| MAY 2025 Level 2 Exam | 21-25 May | 1 July 2025 | 54% |

| FEB 2025 Level 1 Exam | 17-23 Feb | 3 Apr 2025 | 45% |

| FEB 2025 Level 3 Exam | 13-16 Feb | 22 Apr 2025 | 49% |

| NOV 2024 Level 1 Exam | 13-19 Nov | 14 Jan 2025 | 43% |

| NOV 2024 Level 2 Exam | 20-24 Nov | 16 Jan 2025 | 39% |

| AUG 2024 Level 1 Exam | 20-26 Aug | 8 Oct 2024 | 44% |

| AUG 2024 Level 2 Exam | 27-31 Aug | 10 Oct 2024 | 47% |

| AUG 2024 Level 3 Exam | 16-19 Aug | 17 Oct 2024 | 48% |

| MAY 2024 Level 1 Exam | 15-21 May | 26 June 2024 | 46% |

| MAY 2024 Level 2 Exam | 22-26 May | 2 July 2024 | 59% |

| FEB 2024 Level 1 Exam | 19-25 Feb | 4 Apr 2024 | 44% |

| FEB 2024 Level 3 Exam | 15-18 Feb | 11 Apr 2024 | 49% |

| NOV 2023 Level 1 Exam | 11-17 Nov | 10 Jan 2024 | 35% |

| NOV 2023 Level 2 Exam | 18-22 Nov | 17 Jan 2024 | 44% |

| AUG 2023 Level 1 Exam | 22-28 Aug | 3 Oct 2023 | 37% |

| AUG 2023 Level 2 Exam | 29 Aug-2 Sept | 5 Oct 2023 | 44% |

| AUG 2023 Level 3 Exam | 29 Aug-5 Sept | 25 Oct 2023 | 47% |

| May 2023 Level 1 Exam | 16-22 May | 27 June 2023 | 39% |

| May 2023 Level 2 Exam | 23-27 May | 6 July 2023 | 52% |

| Feb 2023 Level 1 Exam | 14-20 Feb | 28 March 2023 | 38% |

| Feb 2023 Level 3 Exam | 21-23 Feb | 12 Apr 2023 | 48% |

| Nov 2022 Level 1 Exam | 15-21 Nov | 12 Jan 2023 | 36% |

| Nov 2022 Level 2 Exam | 22-26 Nov | 19 Jan 2023 | 44% |

| Aug 2022 Level 1 Exam | 23-29 Aug | 4 Oct 2022 | 37% |

| Aug 2022 Level 2 Exam | 30 Aug-3 Sept | 11 Oct 2022 | 40% |

| Aug 2022 Level 3 Exam | 30 Aug-6 Sept | 1 Nov 2022 | 48% |

| May 2022 Level 1 Exam | 17-23 May | 7 July 2022 | 38% |

| May 2022 Level 3 Exam | 24-26 May | 28 July 2022 | 49% |

| Feb 2022 Level 1 Exam | 15-21 Feb | 12 Apr 2022 | 36% |

| Feb 2022 Level 2 Exam | 22-26 Feb | 19 Apr 2022 | 44% |

| Nov 2021 Level 1 Exam | 16-22 Nov | 11 Jan 2022 | 27% |

| Nov 2021 Level 2 Exam | 26-30 Nov | 19 Jan 2022 | 46% |

| Nov 2021 Level 3 Exam | 23-25 Nov | 3 Feb 2022 | 43% |

| Aug 2021 Level 1 Exam | 13-30 Aug | 14 Oct 2021 | 26% |

| Aug 2021 Level 2 Exam | 31 Aug - 4 Sept | 21 Oct 2021 | 29% |

| Aug 2021 Level 3 Exam | 1-8 Sept | 2 Nov 2021 | 39% |

| July 2021 Level 1 Exam | 18-26 July | 14 Sept 2021 | 22% |

| May 2021 Level 1 Exam | 18-24 May | 27 July 2021 | 25% |

| May 2021 Level 2 Exam | 25 May - 1 June | 3 Aug 2021 | 40% |

| May 2021 Level 3 Exam | 25 May - 1 June | 10 Aug 2021 | 42% |

| Feb 2021 Level 1 Exam | 16 Feb-1 March | 13 Apr 2021 | 44% |

Before CFA exams moved to CBT, the average pass rate was around 43% for level 1, 46% for level 2, and over 50% for level 3. Now, the average CFA exam pass rates are 41%, 46%, and 51%, respectively. It's mainly due to the astonishingly low 2021 pass rates. Then, the pass rates started to grow and now they are usually as high as they used to be in the past.

In this post, you can also learn about:

- How You Know If You Passed CFA Exam

- CFA Exam Passing Score: What is the MPS?

- CFA Exam Level 1 MPS

- CFA Exam Level 2 MPS

- CFA Exam Level 3 MPS

- Benefits of MPS as a Scale Score

- CFA Exam Results Report

- Why Does It Take So Long to Get CFA Exams?

- *Grading Cases* |OUR EXAMPLES|

- What to Do if You FAIL Your CFA Exam?

- What to Do if You PASS Your CFA Exam?

How You Know If You Passed CFA Exam

First, you’ll get your PASS or DID NOT PASS score in your e-mail.

On the results day, you’ll get your CFA exam result e-mailed and the message from CFA Institute will say if you PASSED or DID NOT PASS and what was the pass rate. For level 1 and level 2, more detailed and visualized results are available after logging into your CFA Institute account, where you can find out more about your overall exam performance and topic performance.

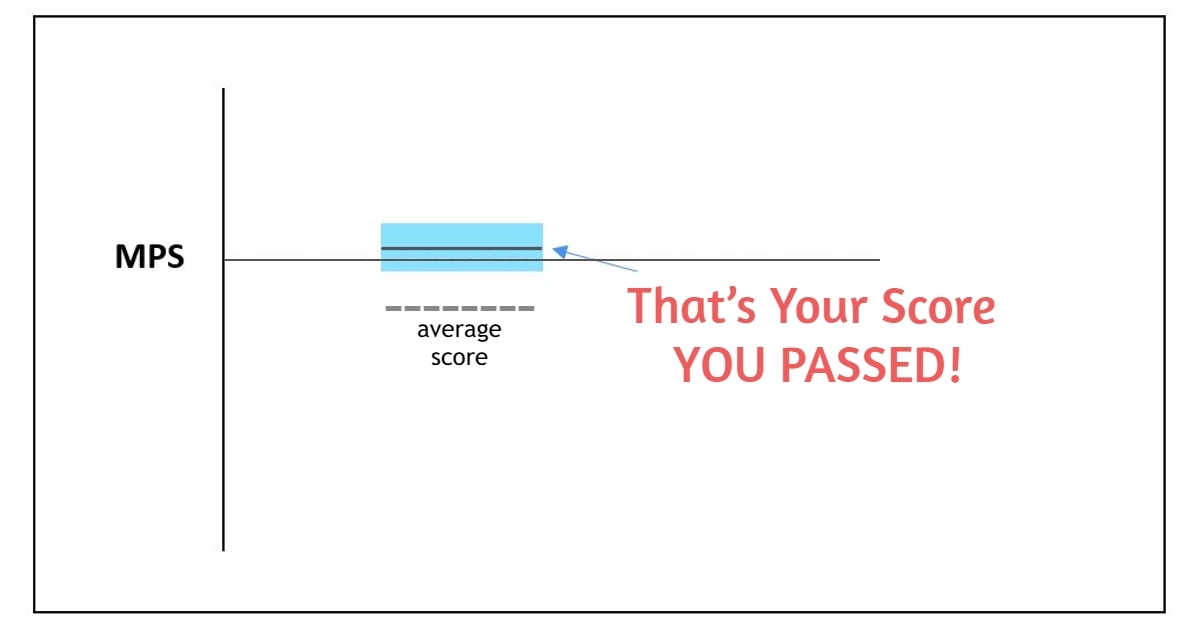

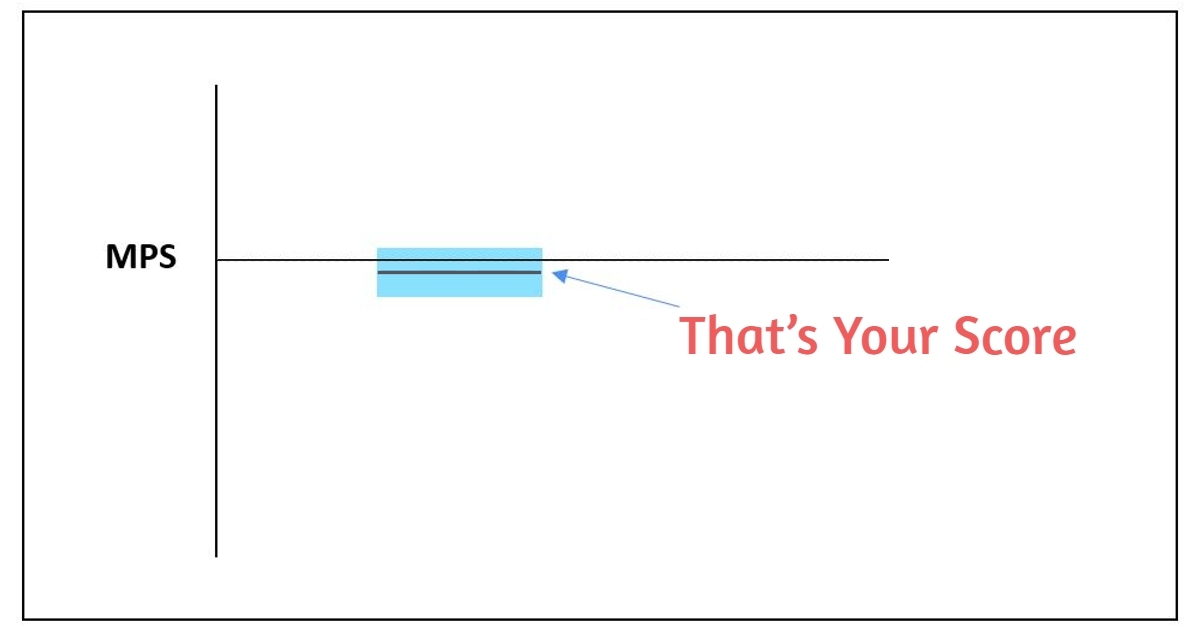

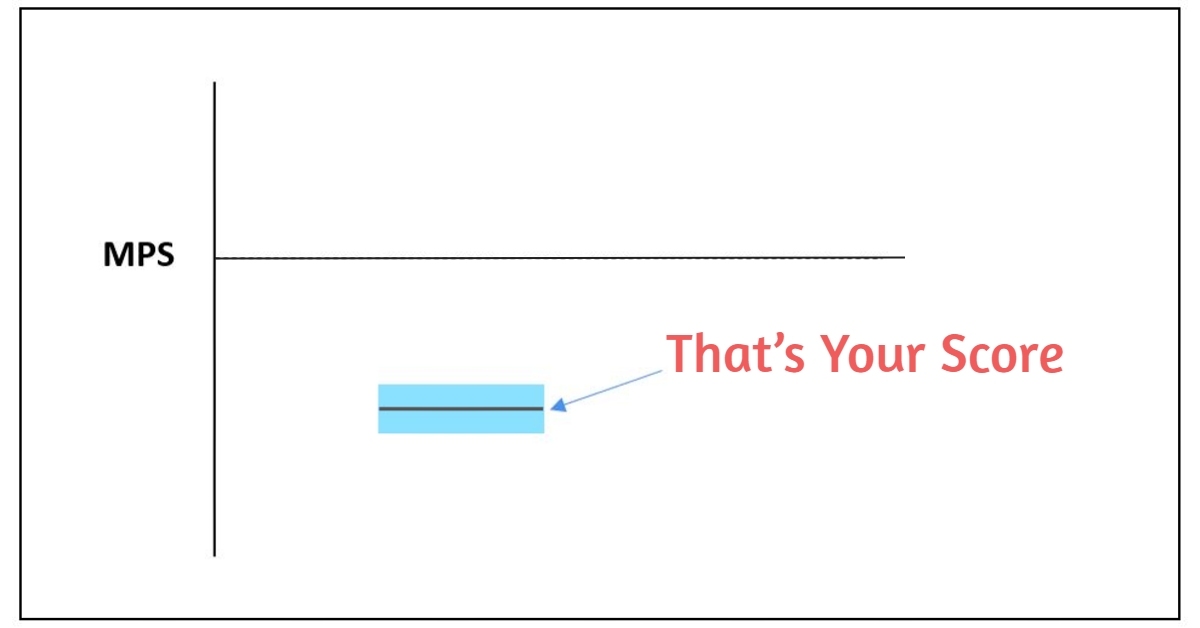

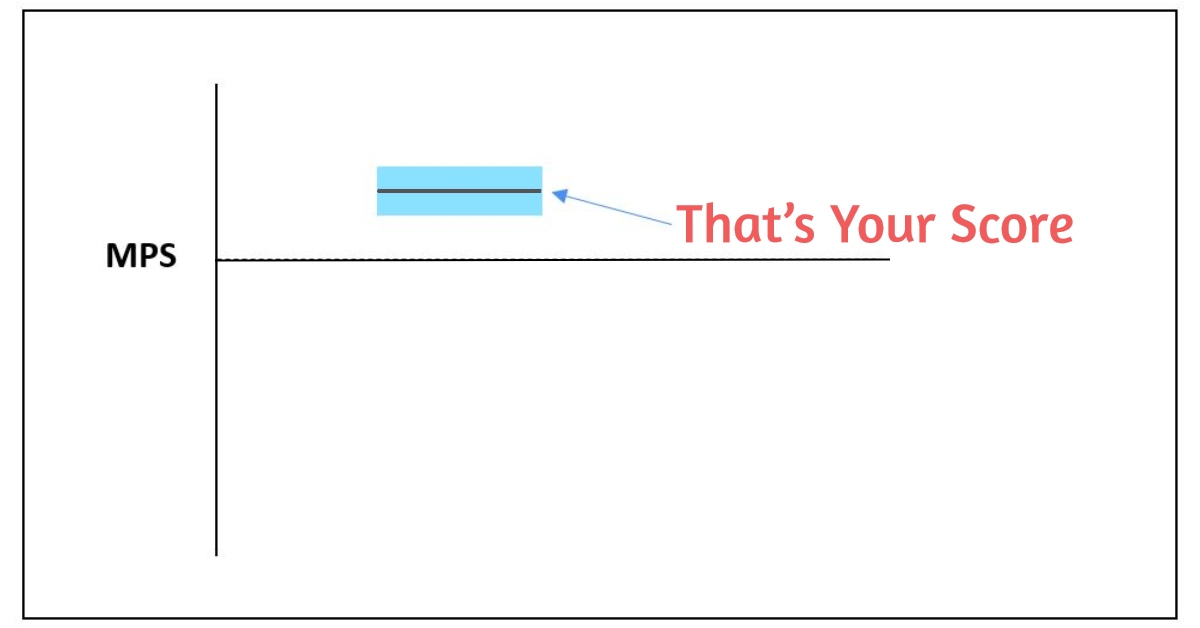

Your detailed CFA exam results feature the thick solid gray line. That’s your score!

If you pass your CFA exam, the thick gray line is at (overlaps) or above the thin gray MPS line (MPS stands for the Minimum Passing Score, which is a minimum score needed to pass your CFA exam). The thick gray line below the thin gray line means you did not succeed this time.

The results are usually sent after 9 AM ET and there are tons of messages to be sent that day, so it's good to be patient. Of course, you may try logging into your CFA Institute account to find out about your results, but this may require lots of luck on that day. As soon as you access your detailed exam scores, however, don’t forget to download them to your computer. The results are available for download only for around a year, so it's best to save them right away.

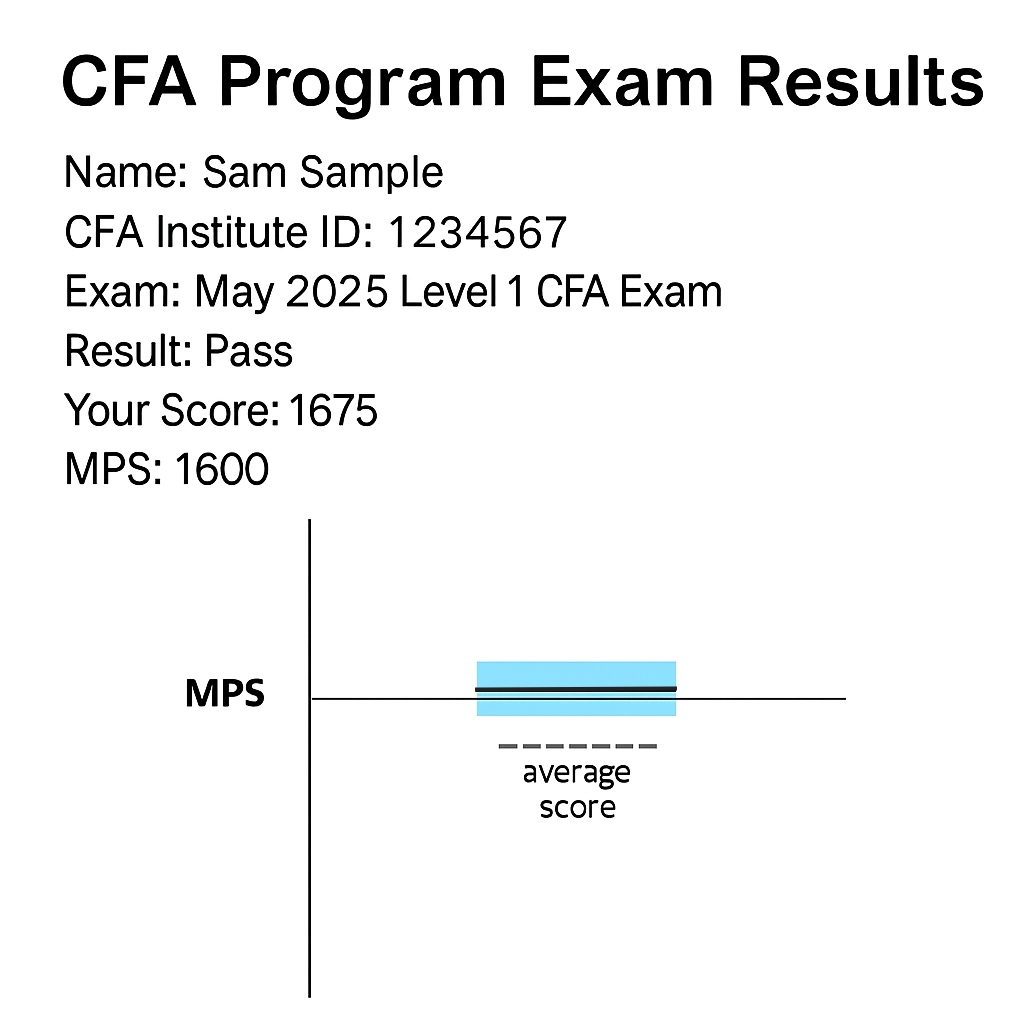

CFA Institute has introduced some changes to the presentation of the 2025 CFA exam results. The MPS for the level 1 exam has been set at 1600 and for level 2 and level 3 the MPS is now 2600 and 3600, respectively. Read on to learn more about the MPS that is now given as a scale score.

CFA Exam Passing Score: What is the MPS?

To pass your CFA exam, you have to meet the minimum passing score (MPS) set individually for each ended exam.

The MPS may vary across CFA exam windows but it probably never exceeds 70%. However, neither the MPS expressed as a percentage nor individual candidate scores are ever released.

Currently, both the MPS and Your Score are presented as scale scores on the CFA exam report, which doesn't change the fact that you will never know precisely how many questions you got right on the exam or what percentage level you reached exactly. All you can say is that:

- if you PASSED you met the MPS or you were close enough for the ethics adjustment to pull you through,

- if you FAILED you were below the MPS or the ethics adjustment worked to your disadvantage.

CFA Exam Level 1 MPS

A score of 1600 is the score needed to pass the level 1 CFA exam.

As of the 2025 CFA exams, CFA Institute presents the level 1 MPS as a scale score of 1600. It is a mathematically transformed raw score of the number of correct answers needed to pass your CFA exam reported on a standardized scale ranging from 1000 (minimum score) to 1900 (maximum score).

If your score is at or above 1600, you PASS your level 1 CFA exam. If your score is below 1600, you fail.

Of course, the exact number of correct answers needed to pass your CFA exam is not given and just like in the past the pass rate is most likely somewhere between 65% and 70%. It may be different for different exam windows because the CFA exam difficulty may slightly differ from version to version but in the end it's all balanced during the grading process to ensure the comparability of CFA exam results between various exam administrations.

CFA Exam Level 2 MPS

A score of 2600 is the score needed to pass the level 2 CFA exam.

For the 2025 CFA exams, CFA Institute presents the level 2 MPS as a scale score of 2600. It is a mathematically transformed raw score of the number of correct answers needed to pass your CFA exam reported on a standardized scale ranging from 2000 (minimum score) to 2900 (maximum score).

If your score is at or above 2600, you PASS your level 2 CFA exam. If your score is below 2600, you fail.

For the level 2 exam, the scale goes up to 2000-2900 to imply the progress in knowledge.

CFA Exam Level 3 MPS

A score of 3600 is the score needed to pass the level 3 CFA exam.

For the 2025 CFA exams, CFA Institute presents the level 3 MPS as a scale score of 3600. It is a mathematically transformed raw score of the number of correct answers needed to pass your CFA exam reported on a standardized scale ranging from 3000 (minimum score) to 3900 (maximum score).

If your score is at or above 3600, you PASS your level 3 CFA exam. If your score is below 3600, you fail.

For level 3, the scale ranges from 3000 to 3900. This another increase in the scale values ensures that all your CFA exam results for the three levels of the CFA Program fall on a continuous scale from 1000 to 3900.

Benefits of MPS as a Scale Score

Why is the CFA exam MPS now given as a scale score? There are many benefits of transforming the MPS into a scale score:

- it adds transparency because not only the MPS but also Your Score is given a numerical representation,

- starting from the Feb 2025 CFA exams, you can compare your scores among different exams,

- it helps you assess if you're improving in case of repeated failed exam attempts,

- when you compare Your Score to the MPS, it clearly shows whether you meet the specific standards of performance required,

- it shows how the difficulty from level to level increases.

CFA Exam Results Report

For level 1 and level 2, CFA Institute gives you a detailed 2-page CFA exam results report accessible after you log into your account. CFA exam results are presented visually for both your overall exam performance (page 1) and topic by topic performance (page 2).

On page 1 of your report, apart from the visualization of your exam score, you'll find stated from the top:

- your name,

- your CFA Institute ID,

- your CFA exam level and window,

- your result: Pass or Did Not Pass,

- your score given as a scale score, e.g., 1675 (Pass) or 1400 (Did Not Pass),

- minimum passing score (MPS) given as a scale score (1600 for level 1, 2600 for level 2, 3600 for level 3).

The 2 key things to look at when you view your CFA exam score presentation are:

thin solid gray line & thick solid gray line

The thin solid gray line is the MPS. The thick solid gray line is Your Score.

When it comes to your CFA exam score:

- thick gray ABOVE thin gray = you PASSED

- thick gray BELOW thin gray = you FAILED

No doubt, more visual means more attractive. However, one thing can be misleading. If your score is close enough to the MPS, your thick gray line may kind of overlap with the thin MPS line, which – unfortunately – will not always mean you passed :/ That’s why you need to pay close attention to what Your Score stated as a scale score above the illustration says. That's what counts. The visualization is only there to help you understand how close to the established standard of competence you are.

Blue Confidence Interval Shows True Ability!

Different favorable & unfavorable factors may influence your exam score. That's why you will find your thick gray line inside a light blue box (confidence interval). This is to show your true ability, which might be higher than the line (but on the exam day you had to face some unfavorable circumstances) or lower than the line (but in the exam you worked under favorable circumstances).

The fact that CFA Institute is trying to allow for additional factors is actually good! It can give you more insight into how well you were indeed prepared and how much of an improvement you need to make in case you need to retake your CFA exam.

What Is This Dashed Line?

There are no more 90th percentile or 10th percentile dashed lines. To show you how you did when compared to the rest of the candidates, one dashed line is now included.

This dashed line on your CFA exam report is for the sake of comparison and it indicates the average exam score counted for all the candidates that took the same exam you did.

CFA Institute emphasizes though that it is not so much how you did compared to the others but rather how you did compared to the MPS that really matters!

Detailed Topic Performance Report

For your topic performance presentation, similar rules are applied. On page 2 of your CFA exam results report, you’ll get an estimation of:

- your topic scores (thick gray line for every topic – no exact values given though), and

- your true topic ability (blue confidence interval for every topic – allowing for different favorable & unfavorable factors).

These estimations are all set against two lines, an MPS-like 70%-value thin gray line, which is considered to indicate 'topic mastery', and a 50%-value thin gray line placed a bit lower for reference. Your topic performance is presented using separate thick gray lines inside blue confidence intervals. If your topic scores are above the 70% line, you may be confident that you have mastered the topic. Also, note that the confidence intervals for topics vary in their width depending on the number of exam questions for a given topic.

Level 3 candidates no longer receive any visualization of their results. It's just the Pass/Did Not Pass message as of 2025.

Why Does It Take So Long to Get CFA Exams?

It takes a while to set the MPS, so it takes a while to deliver your CFA exam results. Before they sit down to set the MPS, various things happen that affect the long grading process.

For starters, it takes up to a few days before all the exam data are delivered to CFA Institute from all around the world. Then, the process of reviewing the exam experience begins, including the review of candidates' complaints about confusing questions. When all the exams are graded, they double-check that no errors occurred in the process. Plus, the level 3 essay questions are hand-graded, which extends the grading process even further. Also, those exams that fall right on the verge of passing are re-assessed to make sure no one's harmed. Only then is the MPS set.

The exact MPS value is set by the CFA Institute Board of Governors. The set MPS value falls within the valid range established using the modified Angoff method, which provides an empirical basis for the MPS settlement. Applying the method, a large and diverse group of CFA charterholders assesses both the exam difficulty and actual candidate performance before the MPS is finally determined. Statistical equating is used in the process to make sure that the MPS is comparable among different administrations of the exam.

So Much Info and You Still Feel Like You Know Nothing?

You’re right. CFA Institute is quite secretive about our exam results. It never reveals any exact percentage values, both for the MPS and for your exam scores. It's always just estimations presented visually or now also stated as scale scores. But since one scale score may mean different raw values for different exam windows, there’s still some information gap.

Let us, however, wrestle a bit and try to draw some conclusions from what we know.

CFA EXAM GRADING CASES

First, we need to set some common ground.

Let’s take the level 1 CFA exam, for example. There are 2 exam sessions, each including 90 exam questions. That makes it 180 questions for the whole level 1 exam. If we assume every question is worth 1 point, we end up with the maximum total score of 180 points. For an incorrect answer, no points are deducted.

Keeping in mind the common ground assumptions and facts about CFA exam results we gave above, we are able to analyze some grading-related issues and dispel some popular myths:

Q-1: Do I need 70% to pass my CFA exam?

You don’t need to score 70% in your CFA exam to pass it! What you need to do though is to meet the MPS set for your exam.

Generally, the MPS for CFA exams is most likely to be slightly below 70%. To prove this observation, let’s examine the following situation:

Assume the MPS of 75%. You are notified about your level 1 CFA exam result. In the topic performance information, you see you scored above 70% for every topic. Still, your exam score message says you DID NOT PASS. You feel confused: “How come I failed? All my topic scores are above the 70% threshold which according to CFA Institute is a reasonable signal of topic mastery”.

That is why the MPS can't exceed 70%. Otherwise, you could always end up confused about your exam results like in our example.

Here’s why.

To make the situation described above more clear-cut, we analyze it bit by bit.

From your topic performance information, you know you scored above 70% for each topic. So, your total score must have been above 70%. But since you know you failed, it must have been lower than the MPS (below 75% for our example). Perhaps you achieved 72% for each topic. You didn’t reach the MPS and that’s why you failed.

Even if our example is just a simplification, it shows well that for the MPS values above 70% there’s practically always a gap for those who may fail their exam despite having all their topic scores in the mastery range. Quite an undesirable situation for the candidates whose exam performance is on the verge of mastery, don’t you think?

CONCLUSION:

If the MPS is above 70%, the grading system fails to be transparent. Thus, it’s most likely that the MPS usually fluctuates between 65% and 70%, and sometimes it may equal 70%. Surprisingly, for 2021 level 1 CFA exams, the MPS probably exceeded 70%, which led to exceptionally low level 1 CFA exam pass rates :/

Q-2: Do I have to pass all the topics, to pass my CFA exam?

You don't have to pass all the topics, to pass your CFA exam.

Wait! But what does it actually mean to pass a topic? To score over 70%? Or to be above the MPS with your topic score?

What you need to do to pass your CFA exam is to meet or exceed the MPS. But it holds for your total exam score, not for separate topics. That’s the major principle!

Of course, if you score over 70% for every topic, it should ensure you pass the exam (see Question No. 1 above).

However, consider the following example:

You receive your level 1 CFA exam results. You did poorly in 2 topics and moderately fine in 5 (this time, we assumed the MPS of 69% = 1600):

* This is our assumption.

CFA Institute never gives you exact scores or discloses the MPS in %. Currently, the MPS for level 1 is presented as a scale score of 1600.

Does it mean the e-mail message says you DID NOT PASS?

No! The example illustrates how various scores for different topics still give you a PASS because you managed to meet the MPS of 69% set for your exam.

CONCLUSION:

Your total exam score is what counts! As a rule, to pass your CFA exam you must meet or exceed the minimum passing score set for your exam. The math is merciless, however. If you do badly in any of the topics, you have to excel at some other. In other words, every topic scored below the MPS has to be offset by another topic scored way above the MPS. This way, your total score can meet the MPS criterion and you pass.

Q-3: Can I do badly in Ethics? There’s an Ethics adjustment!

We’ve just said that the major principle behind passing the exam is meeting or exceeding the MPS.

So, even if you do badly on the Ethics questions but do great overall, you’ll pass your exam. Take a look at our example:

* This is our assumption.

CFA Institute never gives you exact scores or discloses the MPS in %. Currently, the MPS for level 1 is presented as a scale score of 1600.

For the level 1 CFA exam, the number of questions per topic may vary from exam to exam. That's because CFA exam topic weights are given in ranges.

We assume there'll be as many as 33 Ethics questions in your exam. You must have gotten only 11 questions right because you scored only 33% in Ethics. But wait a minute. Other scores are great! It’s impossible you failed your exam. Your total score exceeds 70% by far, so it also exceeds the MPS of 67% that we assumed in this example.

Be careful, though.

You may not manage to exceed the MPS much enough. If your final score borders the MPS, poor performance in Ethics will definitely contribute to your failure in the exam. That’s because of the Ethics adjustment explained in our post: Why Your Ethics Score Matters.

CONCLUSION:

You do not have to excel at Ethics to pass your exam. However, here are 3 reasons for which it is surely worth paying attention to Ethics:

- The significance of ethical conduct in the workplace is unquestionable. The better you know the CFA Institute Code of Ethics and Standards of Professional Conduct, the more sensitive you’ll be to possible violations and better equipped to handle various situations.

- You will be tested on Ethics at every level of your CFA exam and every time Ethics will be counted among the most important topics.

- Ethics adjustment is applied to borderline cases. A good grade for the Ethics questions may pull you through if your total exam score borders the MPS. But if your Ethics performance is weak and you're a borderline case, it may cause you to fail the exam.

Q-4: Does topic performance objectively indicate which topics definitely need improvement and which are fine?

It’s not all that easy.

The information about your performance in different topics is meant to identify your strengths and weaknesses. However, there’s no objective truth about it. To prove the point, we analyze two opposing situations:

SITUATION No. 1:

You scored poorly for Derivatives. Before the exam, you felt quite strong on the topic. What to trust? The numbers or your intuition?

Derivatives is a topic that has a relatively small number of questions on the level 1 exam. We assumed in the tables above that your level 1 exam included only around 11 questions for Derivatives. So, the exam sample for Derivatives was quite small relative to other topics. Notice that if you answered correctly just one more question, your Derivatives score would be higher by over 9 percentage points. That would shift you up quite a bit!

So, are Derivatives definitely your weak point or was it just bad luck?

Before we can answer this question, we need to consider another example:

SITUATION No. 2:

You scored poorly for Financial Statement Analysis (FSA). Weakness or misfortune?

This time the exam sample is bigger. The topic is quite extensive and your test was expected to contain as many as 25 FSA questions. Every correct answer improved your topic score by 4 percentage points.

CONCLUSION:

For some topics, there are too few questions on the exam to definitely categorize them as your weakness or strength. In such cases, it may be hard to decide whether you know the topic poorly or if it was just bad luck (or good luck for that matter because although you scored over 70%, you feel you still don’t know much about the topic). For topics with a bigger number of questions, exam results are more representative. It is more likely that they really indicate whether you need to improve the topic or if you managed to master it already. Note that it's also reflected in the width of the confidence interval presented in your topic performance report when you get your results. The topics with wider confidence intervals are the topics with fewer questions in the exam.

So, you have to be rational when drawing conclusions. To resolve doubtful situations in which your exam performance contrasts your intuition about a topic, an additional parameter may come in handy. Your CFA mock exam scores can serve as good indicators. If you usually scored rather low for Derivatives, and now your Derivatives score is also poor, you definitely need to improve this topic area. If, however, you scored high in all the mock exams you took, the low exam result for Derivatives may be just an accident. Still, it can’t harm you if you study even harder before your next exam.

What to Do if You FAIL Your CFA Exam?

And if You PASS?

After you receive your CFA exam results and let the news sink in, you’ll be surely asking yourself this one little question: OK, what now?

Here’s a list of 6 things you should do if you FAIL your CFA exam (but also if you PASS it):

- Look at your thick gray line showing your overall performance in the exam.

- Compare your CFA exam topic results.

- Analyze the exam prep you had before your exam.

- Write down all your conclusions.

- Start your next preparation at least 5-4 months before your next exam.

- Have your personalized CFA exam study plan and make sure you follow it.

Read on for the details. These depend on your personal exam experience.

I Failed My CFA Exam By a Hair's Breadth

1. Look at your thick gray line showing your overall performance in the exam:

So, you are close enough to the MPS line to get a bit angry that you didn’t make it? Bummer… Keep your spirits up, though. It means you did quite a good job overall. OK. There are things you’ll need to improve. But the chances are high that your next CFA exam will be a success.

Below we help you identify your weak points, tell you what to focus on to improve, and suggest the best way of studying for you.

2. Compare your CFA exam topic results:

Take your time and scrutinize your topic performance. How many thick gray topic lines were over or close to the 70%-line and how many – way below? Focus on the latter because they indicate which topics you definitely need to improve. However, while studying don’t get tempted to neglect the topics you did well at this time. What you need to do is regularly review the contents of these topics and study the bits you feel insecure about. Your next exam may test you on different areas of the topics than it did this time.

NOTE: The visual presentation of your topic performance is meant to help you draw some useful conclusions and aid you in preparing for your next CFA exam. Even if it’s far from ideal, it has some valuable information for you if you can give it the right meaning.

3. Analyze the exam prep you had before your exam:

Topics analysis is one thing. But then there’s also an issue of your attitude. There’s always something we can do better to succeed in the CFA exam. Think about what it is for you when it comes to the way you study. Perhaps you lost too much time not following your study plan but postponing your study hours? Or you had no study plan at all?!?! Maybe you practiced too little leaving tests till after you read all the topics? That’s a mistake. You should do exam-type questions systematically during your whole exam prep. Practice and theory should intertwine. Then, there’s also an issue of review. Few candidates do it regularly (perhaps that’s why the pass rates are so low…). In your case, spaced revision throughout the whole exam prep (not just a week or two before the exam) is especially important! Why? Because while you focus on the topics you need to improve, you also need to review the topics you did well at to make sure you lose no points here next time.

4. Write down all your conclusions:

Better plan? More practice? Spaced review? As soon as you know what to change about your exam preparation, write it down and pin the list in a visible place. It’s the best way to hold yourself accountable. As time passes, all your resolutions will start to fade. But then it’s all there – written down point by point. A sheer look at the list reminds you of what you want to do better this time.

5. Start your next preparation at least 5-4 months before your next exam:

It’s up to you to decide how many months of preparation you need. But we’d like to encourage you to make it at least 5-4 months. This is an average study period for CFA exam candidates. The shorter your exam prep is, the more intensive it needs to get. Otherwise, you risk ending up with a result like the one you got lately.

6. Have your personalized study plan and make sure you follow it:

You certainly need a good study plan. And we’re not saying it because we have this CFA exam study planner 4.0 for you. We’re saying it because there’s no other way you can successfully control your whole 300-hour exam prep. You need to take so much into consideration, now also your personal topics experience, practice needs, spaced review, or whatever it is you want to improve. When using our study planner, you can choose your topic sequence and the difficulty for all topics according to your topic performance in the previous exam. You can also control your progress week by week by summarizing your weekly study achievements. If you opt in for our paid program, you’ll get major motivational boosts (e.g. your Chance-to-Pass-ScoreTM) hand in hand with top study hints in the form of inbox messages to help you develop your study routine. Also, your review sessions will be properly scheduled in your study plan and some extra tools will be available for you to practice more.

I Failed My CFA Exam By a Lot...

1. Look at your thick gray line showing your overall performance in the exam:

If your thick score line is low enough for you to get scared you’ll never make it, then it's definitely not the way you imagined your CFA Program participation.

Here’s what you need to do >> You need to rethink your approach completely! Ask yourself why you WANT to become a CFA charterholder (and how much you WANT it?). Then >> Follow our CFA exam study guide and take this revolutionary road and experience revolutionary effects .

2. Compare your CFA exam topic results:

Not too many satisfactory scores, huh…? Generally, you’ll need to work hard on every topic before your next exam. Unless there’s a topic you did reasonably well at. Perhaps you often use this topic’s concepts at work? Or you simply studied this topic more thoroughly? If the latter is the case, try to build on this experience and think about what exactly made this one topic score different than others.

3. Analyze the exam prep you had before your exam:

Even though you feel devastated by your CFA exam score, you need to know one thing. Not all of your exam prep was a fiasco. There were some bad things and some good things about it. Now it’s time to face the truth and call it all by name. What did you do right? What did you do wrong? This is probably the biggest step for you. Unless you can draw some meaningful conclusions from your failed CFA exam, you won’t be able to carry on successfully.

4. Write down all your conclusions:

This is the only way to take your next exam prep seriously. Divide a sheet into two. Make the TO DO list and the NEVER TO DO list side by side. If you don’t make it, your next exam prep won’t be any different. But again: (i) out of control, (ii) poorly executed, and (iii) letting your goal get out of perspective.

5. Start your next preparation at least 5-4 months before your next exam:

5-4 months is an average study period for candidates. However, the shorter your exam prep is, the more intensive it needs to get. Bearing in mind how much work there’s in front of you, you should aim at the CFA exam prep that is long enough for you to succeed this time. 5 or 4 months may not be enough but we make even 8-month study plans available to our users.

6. Have your personalized CFA exam study plan and make sure you follow it:

Your next CFA exam prep needs to be revolutionary. That’s why you need a study plan that makes you work! Use this CFA exam study planner 4.0 to stay in control of your preparation. Personalize your study schedule so that it fits you. If it fits you well, it’ll be easier to follow. While customizing: (1) choose your start date and exam date; (2) change your topic sequence to your liking; (3) specify which topics are easy, moderate, or difficult to you; (4) plan your holiday weeks (especially if you’re opting for more than 5 months of preparation – some rest will do you good!); (5) sign in for motivational messages if you feel you lack motivation and a proper review system if you don’t know how to study efficiently. You’re on the right track. Just keep on going .

I Passed My CFA Exam! New Is Before Me...

1. Look at your thick gray line showing your overall performance in the exam:

Congrats on passing your CFA exam! The next level is waiting for you . A new exam means a new challenge and new rules. You’ll do best if you start your new preparation with the analysis of your recent achievement. Because the closer you are to the MPS line, the more you may want to improve your studying process.

Below we show how you can do better. And there are at least two reasons why you should aim at doing better. Firstly, each next CFA exam level is harder than the previous one. Secondly, it’s not just a cliché – it’s a fact supported by fairly low and fixed pass rates. Every year, only around 50% of the successful-in-previous-level candidates pass their NEXT CFA EXAM. (The third reason we can think of is your natural desire to grow, which we strongly advocate .)

2. Compare your CFA exam topic results:

Start your analysis by looking at your topic performance. First, look at your Ethics score. Remember you will be tested on the same Code and Standards at each level of your CFA exam. Your latest Ethics result can tell you a lot. If it’s highly satisfactory, it says you should keep on studying Ethics the way you did (also, to a certain extent, it may be a good benchmark for studying other topics). If your Ethics score is unsatisfactory, you know you need to be more serious about this topic now. Also, pay attention to the topics you scored the lowest. Are they your Achilles heel or was it just an accident? That’s important because topics often share some common concepts across exam levels. Identify all the topic areas common for your previous and next exam. Then, think about how well you know it and how much you’ll need to improve.

3. Analyze the exam prep you had before your exam:

You never err by asking yourself what you did right and what you did wrong. Your exam prep is no exception. This way you develop your skills and competencies and you grow as a student. Perhaps you’d like to be more organized and regular about your study hours? Or maybe you struggled with the motivation to study? Finally, you surely neglected spaced revision. Obviously, it was a mistake because it’s the best way to keep your learning curve up, not falling.

4. Write down all your conclusions:

Better organization? Maintained motivation? Study content revision? All this may be on your growth list. Your next CFA exam prep needs to be more advanced than the previous one because your next exam is going to be more advanced than the one you just passed. And we hope you’re not going to take it easy now just because you were successful once. Your next exam success is not coming cheap – you need to earn it!

5. Start your next preparation at least 5-4 months before your next exam:

If your previous exam prep was longer than that, feel free to stick to your way. All we’re saying is that the majority of CFA exam candidates do 5-4 months of prep. You need to choose what’s best for you and – since you already had quite a successful exam prep – you surely know it best. No matter the prep length – just make sure you approach your prep responsibly and productively!

6. Have your personalized CFA exam study plan and make sure you follow it:

A good study plan is a must for every successful exam preparation. We hope you agree. Here you can create your CFA exam study plan and personalize it according to your needs. It puts you in control of your whole exam prep. Week by week you see your progress as you study readings (aka. learning modules). With our paid plan, you also get to know how long to study each reading. These estimations can be particularly helpful since you have no experience in preparing for the next exam level. To keep your motivation strong (and to add some fun to studying), you’ll also get your Chance-to-Pass-ScoreTM estimated and illustrated. It grows when you’re doing fine, i.e., when you mark your readings green for done, summarize your study achievements week by week, or do your spaced revision sessions scheduled throughout your whole preparation. Good luck with your upcoming prep!

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1/level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Read Also: