Level 1 CFA Exam Is 4x a Year

The level 1 CFA exam takes place 4 times a year: in February, May, August, and November. It is delivered on computers. The CFA exam, level 1, tests you on 10 topics. It includes two 135-minute exam sessions, each with 90 multiple-choice questions.

The level 1 exam is the first of the 3 levels of the CFA exam – a prestigious financial certification introduced and held worldwide by CFA Institute. The whole CFA exam is quite costly and rather hard but rewarding.

| Key Facts about CFA Exam | |

|---|---|

| CFA EXAM | consists of 3 levels: level 1, level 2, level 3 |

| 2026 LEVEL 1 CFA EXAM WINDOWS | 2-8 Feb, 12-18 May, 18-24 Aug, 11-17 Nov |

| BASIC LEVEL 1 EXAM COST IN 2026 | USD 1140 for early birds or USD 1490 of the standard fee |

| RECOMMENDED STUDY HOURS | 300 study hours/exam level |

| LEVEL 1 EXAM PASS RATE | official: around 40% but we explain why in fact it's way lower! |

| LEVEL 1 CFA EXAM STUDY PLAN | 10 topics scheduled into 300 hours of study and review week by week! 3 basic game-changers: weekly control, maintained motivation, knowledge retention (see study guide). |

| YOUR GOAL | CFA® Charter – the global gold standard in finance |

Welcome to the LEVEL 1 CFA EXAM INFO CENTER – a place where you’ll find all the details about your level 1 exam. Read on and learn about:

- CFA Program Entrance Requirements

- Level 1 Exam Dates

- Level 1 CFA Exam in 2026

- How to Register for Level 1

- Registration Fees

- Registration Deadlines

- Scheduling & Rescheduling Deadlines

- Scholarships

- Level 1 Pass Rates

- Level 1 Topics, incl. Exam Weights

- Exam Day Details

- CFA Exam Study Guide for Level 1 Candidates

- Your Level 1 CFA Exam Study Plan

- Free Study Materials

- CFA Program Policies

- Level 1 Exam Results

First Things First: CFA Program Requirements

To be able to sit for your level 1 exam, you must meet CFA Program entrance requirements that include adequate education/work experience, knowledge of English, fee payments, place of residence + valid international passport, as well as professional conduct.

Here are 5 CFA Program requirements you need to satisfy before you can register for your level 1 CFA exam:

- EDUCATION: Have a bachelor’s (or equivalent) degree or be within 23 months (or less) of graduation (if you pass your level 1 exam, you must be within 11 months of graduation to sit for your level 2 CFA exam and you must earn your bachelor's degree (or equivalent) in time for your level 3 CFA exam).

OR

WORK EXPERIENCE (investment related or not): Have a combination of professional work experience and/or higher education totaling 4,000 hours acquired over a minimum of 3 sequential years (education and work cannot overlap; assume that a year of higher education is 1,000 hours). - KNOWLEDGE OF ENGLISH: The CFA exam is held in English + the CFA Program curriculum you get after registration is in English, so you should know English quite well to take the exam.

- CFA EXAM FEE PAYMENT: You can register for your level 1 exam only when you make due payments. If it’s your first registration ever – apart from the exam fee – you’ll also need to pay a one-time program enrollment fee (BUT: no more enrollment fee for 2026 CFA exams). Mind that after you register and pay for your exam, you'll be required to self-schedule your CFA exam appointment within your chosen exam window.

- PLACE OF RESIDENCE AND INTERNATIONAL PASSPORT: You need to live in a participating country (currently, most of the countries are in, while a few are excluded by the US OFAC policy) and have a valid international passport to register for your exam.

- PROFESSIONAL CONDUCT: As a candidate, you are obliged to follow the CFA Institute Code of Ethics and Standards of Professional Conduct and to confirm your commitment to the code and standards you need to submit – upon registering for your exam – a Professional Conduct Statement disclosing relevant reprimands, investigations, litigations, etc.

Chartered Financial Analyst® (CFA®) is a program developed and run by CFA Institute, an association of investment professionals originating in the USA and spreading all over the world. As a candidate and then a CFA charterholder, you can enhance your analytical skills, gain investment expertise, and improve your chances of career advancement. If there is one expression that can describe what you’re up for after signing up for the CFA exam, it’s disciplined self-study. As of 2021, CFA Institute introduced computer-based testing for level 1 exams. You'll find more about the CFA exam day and structure as you read on.

Nearest Level 1 CFA Exam Dates

* The dates indicate the exam window when you can self-schedule your level 1 exam. See how to schedule your CFA exam.

Level 1 CFA Exam in 2026

On 29 Apr 2025, the Feb 2026 exam registration opens:

- FEB 2026 level 1 CFA exam is from 2 to 8 Feb.

On 12 Aug 2025, the May 2026 CFA exam registration opens:

- MAY 2026 level 1 CFA exam is from 12 to 18 May.

On 11 Nov 2025, the Aug 2026 CFA exam registration opens:

- AUGUST 2026 level 1 exam is from 18 to 24 Aug.

On 11 Feb 2026, the Nov 2026 CFA exam registration opens:

- NOVEMBER 2026 level 1 exam is from 11 to 17 Nov.

The length of the CFA exam window and seating availability may vary for different test centers and geographic regions.

Can I Still Register?

| 2026 LEVEL 1 REGISTRATION | ||

|---|---|---|

| CFA EXAM | STARTS | ENDS |

| FEBRUARY 2026 | 29 Apr 2025 | 29 Oct 2025 |

| MAY 2026 | 12 Aug 2025 | 12 Feb 2026 |

| AUGUST 2026 | 11 Nov 2025 | 6 May 2026 |

| NOVEMBER 2026 | 11 Feb 2026 | 11 Aug 2026 |

How to Register for Level 1 CFA Exam?

Level 1 CFA exam registration starts with creating an account on the CFA Institute's website. Here's how to register for your level 1 CFA exam step by step:

- Create your CFA Institute account, which is necessary to apply for a scholarship (if you're eligible) and register for your CFA exam.

- If you’re eligible for a scholarship, apply for it before the scholarship application deadline and then wait for the official decision before you register for your level 1 exam.

- If you’re ineligible for a scholarship, register for your level 1 exam by paying the relevant CFA exam registration fees. As of 2026, there is no enrollment fee but the CFA exam registration fees go up in 2026!

- After you register, you need to self-schedule your CFA exam date within your chosen exam window. The scheduling deadline is always a bit longer than the registration deadline and the rescheduling deadline is even longer.

- Upon registration, you'll be asked to accept the Candidate Agreement.

- Also, the Professional Conduct Statement needs to be submitted.

Registering for the exam means you need to pay the fee. Before you register, however, check your CFA exam scholarship eligibility. If you apply, wait for your scholarship before you register for the exam or you’ll lose it. Mind the final registration deadline, though! Check right below.

CFA Exam Registration Costs

ALL CANDIDATES: Each time you register to take or retake your level 1 CFA exam (and later your level 2 and 3 exams), you'll have to pay a registration fee. There's an early-bird registration fee of USD 1140 and a standard registration fee of USD 1490. This is your basic CFA exam cost that depends on when you register for your exam.

NO enrollment fee as of the 2026 CFA exams.

In 2026 level 1 CFA exam registration fees go up, both early and standard. This is another rise in CFA exam registration fees over the last two years. Read on

Level 1 CFA Exam Registration Fees & Deadlines

2026 Level 1 CFA Exam

Registration Fees & Deadlines

HIGHER 2026 CFA EXAM FEES!

The 2026 level 1 CFA exam fees increased by USD 150 for early registration and by USD 200 for standard registration. The early-bird fee for the 2026 level 1 CFA exam is USD 1140 and the standard registration fee is as high as USD 1490. The enrollment fee of USD 350 no longer applies to the 2026 CFA exams, which means there are no additional registration costs but the registration fee.

| 2026 CFA EXAM | Early Registration Deadline | Standard Registration Deadline |

|---|---|---|

| Registration Fee | USD 1140 | USD 1490 |

| Feb 2026 | 7 July 2025 | 29 Oct 2025 |

| May 2026 | 14 Oct 2025 | 12 Feb 2026 |

| Aug 2026 | 21 Jan 2026 | 6 May 2026 |

| Nov 2026 | 15 Apr 2026 | 11 Aug 2026 |

The deadlines end at 11:59 p.m. ET.

Level 1 CFA Exam Scheduling & Rescheduling

Don't forget to schedule your level 1 CFA exam after you register. Best do it ASAP 'cos CFA exam scheduling is done on a first-come first-served basis. CFA exam scheduling is free of any additional charge.

Mind that if you don't schedule your exam, you won't be allowed to take it and you'll forfeit your registration fee.

If your scheduled CFA exam date happens to be inconvenient, you can reschedule your level 1 exam if you pay USD 250 (per each re-appointment).

2026 Level 1 CFA Exam

Scheduling & Rescheduling Deadlines

| 2026 Level 1 CFA Exam | Scheduling Deadline | Rescheduling Deadline |

|---|---|---|

| Feb 2026 | 5 Nov 2025 | 22 Jan 2026 |

| May 2026 | 18 Feb 2026 | 1 May 2026 |

| Aug 2026 | 13 May 2026 | 7 Aug 2026 |

| Nov 2026 | 18 Aug 2026 | 31 Oct 2026 |

The deadlines end at 11:59 p.m. ET.

There's NO scheduling fee.

RESCHEDULING FEE is USD 250 per each exam re-appointment within your registered exam window.

CFA Institute Scholarships

ACCESS SCHOLARSHIP

If awarded, the Access Scholarship guarantees the biggest CFA exam cost reduction. The new Access Scholarship reduces the exam registration fee to USD 400 (it used to be USD 300) and waives the enrollment fee (if applicable).

The CFA exam Access Scholarship application window for the 2026 CFA exams is open now. The deadline depends on when you want to take your CFA exam. Each exam window has its own Access Scholarship application window. CFA Institute will contact you 4-6 weeks after the application window ends to inform you whether the scholarship award decision is positive or negative.

ACCESS SCHOLARSHIP APPLICATION WINDOWS:

FEB 2026 CFA EXAM: 29 Apr – 19 May 2025

MAY 2026 CFA EXAM: 12 Aug – 1 Sept 2025

AUG 2026 CFA EXAM: 11 Nov – 1 Dec 2025

NOV 2026 CFA EXAM: 11 Feb – 3 March 2026

Access Scholarship is for all those who may find the CFA exam cost challenging. To apply you must NOT be registered for the exam yet and you need to meet all the CFA Program entrance requirements.

OTHER SCHOLARSHIPS

Other CFA Institute scholarships include Student Scholarship and Professor Scholarship. They reduce the CFA exam cost to USD 600 (it used to be USD 400).

Unfortunately, CFA Institute no longer supports women with a dedicated Women's Scholarship.

APPLICATION WINDOW for STUDENTS:

STARTS ON: 1 Sept 2025

ENDS ON: 31 July 2026

As a student, best ask your alma mater if you can apply for a Student Scholarship because your school needs to be enrolled in a special program for you to be able to apply.

NOT ELIGIBLE FOR A SCHOLARSHIP?

It’s not a rare thing that employers financially help their employees taking part in the CFA Program by reimbursing or paying for their CFA exams, either fully or partially. So, don’t hesitate to ask your employer for support.

How High Is Level 1 CFA Exam Pass Rate?

Until 2020, CFA exams were held twice a year, in June and December. Some former level 1 pass rates are given below:

| HISTORICAL LEVEL 1 PASS RATES | ||

|---|---|---|

| JUNE EXAMS | DECEMBER EXAMS | |

| postponed | 2020 | 49% |

| 41% | 2019 | 42% |

| 43% | 2018 | 45% |

| 43% | 2017 | 43% |

Since 2021, there's been computer-based testing (CBT) for CFA exams and the exams are now held more frequently. The pass rate for the first level 1 CBT CFA exam was similar to what we had seen in the past. Then, there was a series of astonishingly low CFA exam pass rates. However, the most recent level 1 CFA exam pass rate is again as high as it used to be:

| LEVEL 1 CFA EXAM PASS RATES, CBT | ||

|---|---|---|

| 2021 | February | 44% |

| May | 25% | |

| July | 22% | |

| August | 26% | |

| November | 27% | |

| 2022 | February | 36% |

| May | 38% | |

| August | 37% | |

| November | 36% | |

| 2023 | February | 38% |

| May | 39% | |

| August | 37% | |

| November | 35% | |

| 2024 | February | 44% |

| May | 46% | |

| August | 44% | |

| November | 43% | |

| 2025 | February | 45% |

| May | 45% | |

| August | 43% | |

| November | 43% | |

Many CFA candidates who register to take their level 1 exam don’t show up on the exam day. This means that the "real" pass rate for all registered level 1 candidates is lower, even by 10+ pp!. We explain why further on, so keep on reading .

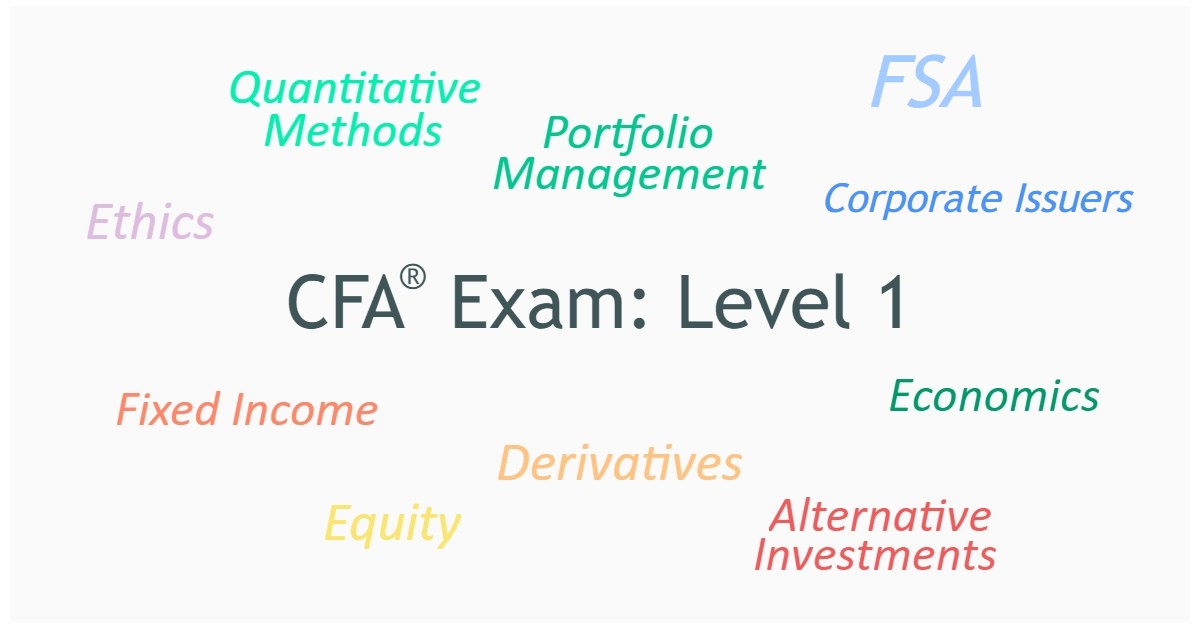

Level 1 Topics In a Nutshell

Level 1 candidates are tested in 10 topic areas, each with its defined exam topic weight given as a range. Here are all the 10 level 1 CFA exam topics ordered from the highest to the lowest exam weight (% of exam questions):

- Ethics: 15-20%

- Financial Statement Analysis: 11-14%

- Equity Investments: 11-14%

- Fixed Income: 11-14%

- Portfolio Management: 8-12%

- Alternative Investments: 7-10%

- Quantitative Methods: 6-9%

- Economics: 6-9%

- Corporate Issuers: 6-9%

- Derivatives: 5-8%

In 2024, level 1 CFA exam topic weights changed compared to 2023 weightage.

Here is the recommended Soleadea topic sequence. Where possible, we couple together topics that share similar ideas and concepts. However, if you need, you can easily customize this order when you use our study planner:

3 LEVEL 1 TOPIC CATEGORIZATIONS

While the most important level 1 topics are Ethics, Financial Statement Analysis, and Quantitative Methods, the hardest level 1 topic trio is Financial Statement Analysis, Fixed Income, and Derivatives. Also, 3 topics may be regarded as relatively easy level 1 subjects. However, the topic difficulty is always a subjective criterion.

| 3 most important L1 topics |

3 hardest L1 topics |

3 easiest L1 topics |

|---|---|---|

| Financial Statement Analysis | Fixed Income | Portfolio Management |

| Ethical and Professional Standards | Derivatives | Corporate Issuers |

| Quantitative Methods | Financial Statement Analysis | Equity Investments |

LEVEL 1 CFA EXAM CURRICULUM

Level 1 has 10 topics available to CFA candidates either in a digital form or as printed level 1 curriculum books. The topic's content is further divided into smaller portions, namely learning modules (readings). Overall, the level 1 curriculum is roughly 3000 pages long. That’s why candidates often look for more digestible CFA exam study materials like videos, tests, or e-books.

As a rule, the CFA exam curriculum slightly changes from year to year. The recent changes to the level 1 CFA exam curriculum include the transition to learning modules for all level 1 topics. But don't worry. A learning module is just another name for what used to be called reading. Learning modules are meant to be more like study lessons that you can do over one sitting. The 2026 curriculum changes are rather cosmetic.

To organize your long and tough exam prep, you'll want to have a study plan with deadlines for topics and – ideally – also for readings, best if arranged weekly. This way you get a controllable and manageable study plan you can systematically follow. We explain more below .

CFA Exam Day: What to Expect?

The level 1 CFA exam consists of two sessions taken on the same day with an optional break meanwhile. Each session includes 90 multiple-choice (a-b-c) questions. You'll have 1.5 minutes per question on average. There's no penalty for giving a wrong answer (so go ahead and guess even if you don’t know the answer). The level 1 CFA exam is in CBT format ever since 2021.

| CBT CFA Exam Day, Level 1 | |

|---|---|

| 30 minutes allotted to pledge, tutorial, and survey | |

| SESSION 1: 135 min | 90 multiple-choice questions |

| OPTIONAL BREAK: 30 min | |

| SESSION 2: 135 min | 90 multiple-choice questions |

| TOTAL TESTING TIME: ca. 4.5 hrs | |

| WHOLE EXAM DAY: MAX. 5.5 hrs | |

Also, we distinguish 3 types of level 1 questions: theory, computing, and reasoning questions.

- Theory questions mean you'll need to show your knowledge of different financial concepts and their definitions, as well as of various models, theorems, or principles.

- Computing questions will require competence in using your financial calculator and doing the math.

- Reasoning questions demand the ability to see relations between concepts, associate things, and think logically.

SESSION 1 of the level 1 CFA exam covers Ethics, Quantitative Methods, Economics, and Financial Statement Analysis.

SESSION 2 of the level 1 CFA exam covers Corporate Issuers, Portfolio Management, Equity, Fixed Income, Derivatives, and Alternative Investments.

On the exam day, you must bring your valid international passport and approved calculator (only different versions of TIBA II Plus or Hewlett Packard 12C are allowed). You will be provided with writing tools such as an erasable writing tablet.

Best Way to Prepare for Level 1 CFA Exam

Keeping in mind the 3000 pages of curriculum and the low level 1 pass rates, you’ll need a sure-fire study strategy for your CFA exam prep. Best if it’s based on these 3 pillars:

FULL

CONTROL

MAINTAINED

MOTIVATION

KNOWLEDGE

RETENTION

WHY?

ca. 300 hrs

& procrastination

up to 25%

no-shows

ca. 30%

of the "real" pass rate!

It is common knowledge that you need approximately 300 study hours to get prepared for your level 1 CFA exam. That’s a lot. Take 5 months of prep, for example. It gives you an average of 60 hours per month, i.e. around 15 study hours every week.

It is hard to control 300 hours or even 60 hours. But 15 hours a week? That you can control! So, break down those 300 hours into smaller study times you can easily control and manage from week to week of your exam prep.

Otherwise, procrastination may seriously endanger your CFA exam preparation. It is too easy to postpone, especially if the consequences are delayed into the future. Many people choose to overlook these consequences in favor of immediate gains such as a night with a movie instead of the curriculum. But, in the end, they end up with too many readings piled up and impossible to cover before their exam.

That is why you need to constantly maintain your motivation to study week by week. To better understand why it’s so important, consider this: as many as 25% of level 1 candidates do not show up for their exam because they feel they didn’t learn enough to take it. What it means is that the effective pass rate is lower than the average 40% If out of 100 candidates registered for the level 1 CFA exam, only 75 actually take it, then – with the pass rate of 40% – only 30 out of 75 exam-takers pass. SO, the "real" pass rate for all registered level 1 candidates is 30% instead of the level 1 average of 40%.

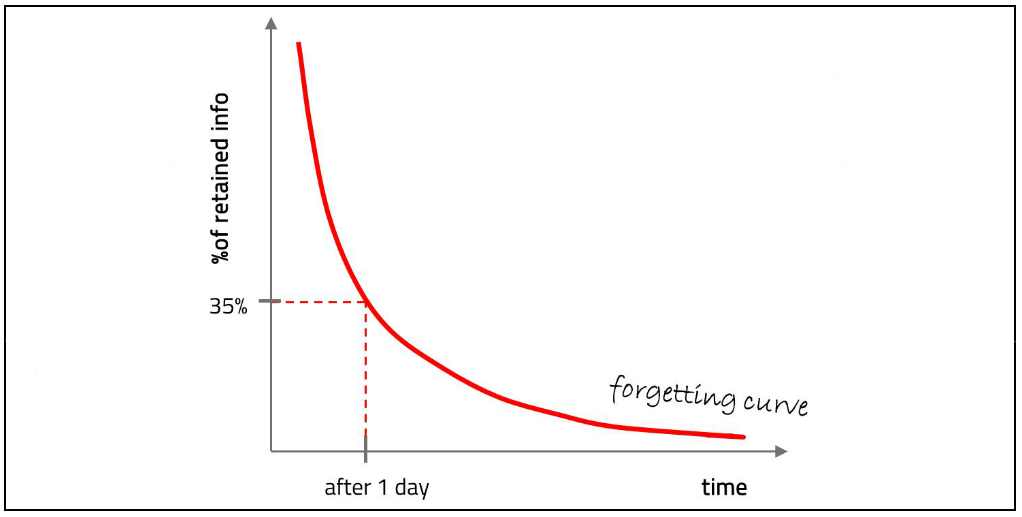

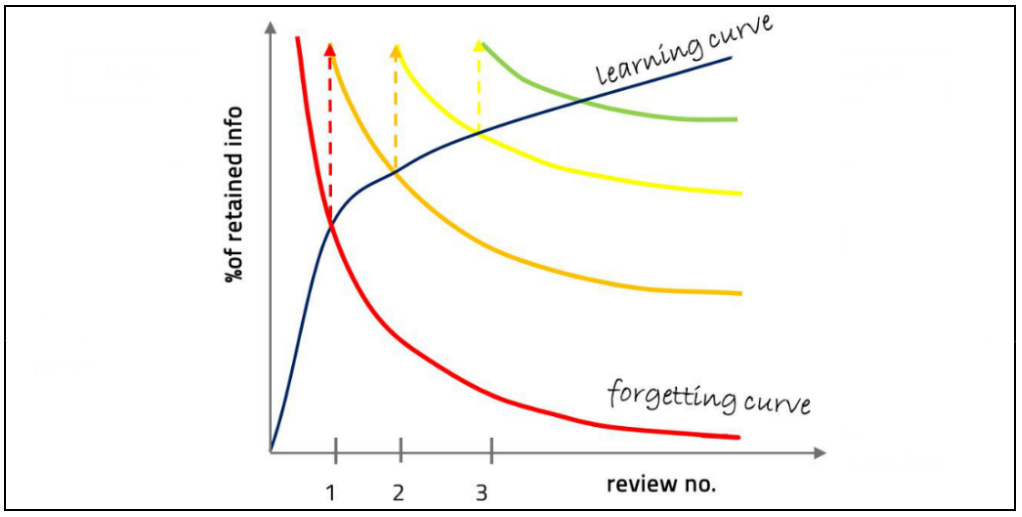

Procrastination and lack of motivation are also a problem when it comes to revision. The majority of candidates put off reviewing the study material until the last weeks before the exam, which is a huge mistake. It makes your forgetting curve even steeper (after one day only, we forget up to 65% of what we studied the previous day!) and leaves your learning curve totally unattended.

To be sure you’ll really learn all 10 topics just in time for your exam, it’s best you have your study plan scheduled weekly and revise regularly. Benchmark study times for weeks and readings and a proper review system in place make it easier to stay motivated and hold tight to the benchmarks and recommendations, and then to pass the exam. If you also feel this is the way to go, you can find all this and more inside our CFA Exam Study Planner.

Your Level 1 CFA Exam Study Plan

IT IS STILL ROUGHLY:

Get CFA Exam Study Schedule:

& see how to make the most of your study time!

Free CFA Exam Study Materials

If you're looking for some free CFA exam study materials to help you understand your CFA Program curriculum, here's a bunch of blog posts explaining some issues. Apart from theory, you'll also find there some exam-type questions. That’s how you should study: combine theory with practice!

- CORPORATE ISSUERS blog posts

- ETHICS blog posts

- QUANTITATIVE METHODS blog posts

- FIXED INCOME blog posts

- PORTFOLIO MANAGEMENT blog posts

- FINANCIAL STATEMENT ANALYSIS blog posts

- Level 1 MOCK EXAMS

Also, we've got some free videos for you. We suggest you use them twice. First – to get familiar with the most important concepts before you dive into your books. Then, after you study your level 1 curriculum – to revise & make sure you finally know everything there is to know for each topic:

What Calculator to Get and Other Policies

As a level 1 candidate, you need to know all CFA exam rules and regulations. There are many policies and failure to comply may result in your inability to take the exam, voiding your exam result, or even suspension from the CFA Program.

CFA Program policies include (but are not limited to):

- Calculator Policy

- Refund Policy

- Identification Policy

- Admission & Appointment Policy

- Personal Belongings Policy

- Deferral Policy

CFA Program policies are the same for all levels. In 2021, many new rules were introduced due to computer-based testing. Moreover, in 2023, some of the rules were made less strict with the COVID-19 pandemic in retreat. To help you get familiar with the key regulations, we've prepared:

Hope it helps!

When Will I Get My CFA Exam Results?

CFA Institute intends to release level 1 CFA exam results in 5-7 weeks after the exam window ends. In the past, CFA Institute had up to 60 days to announce level 1 scores but this changed due to computer-based testing.

Here's our most optimistic educated guess about when level 1 CFA exam results should be available:

FEB 26 LVL 1 EXAM

17 March* 2026

MAY 26 LVL 1 EXAM

23 June* 2026

AUG 26 LVL 1 EXAM

29 Sept* 2026

NOV 26 LVL 1 EXAM

12 Jan* 2027

* This educated guess is based on the information that CFA Institute intends to release level 1 CFA exam results in even 5 weeks after the close of the exam window + CFA exam results are usually announced on Tuesday or Thursday.

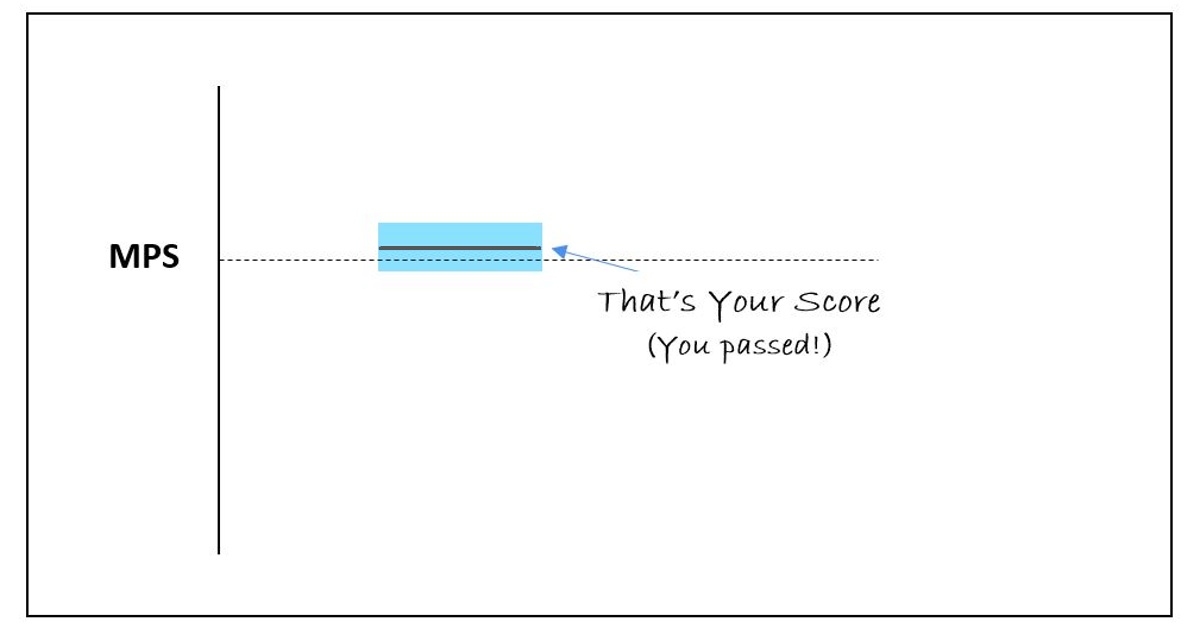

You’ll get your 'PASS' or 'DID NOT PASS' CFA exam result in your e-mail. After you log into your CFA Institute account, you'll be also able to see your CFA exam results report that states Your Score given as a scale score and the MPS given as a scale score (we explain more below).

Apart from your overall performance on the exam, your results report will also present your performance in different topics. The CFA exam results are presented visually using a thick gray line that illustrates how you scored both in the exam and for different topic areas. No exact scores (in %) are given, though.

Starting in February 2024, to get your level 1 CFA exam result you must complete at least one PSM. A PSM or Practical Skills Module takes 10-15 hours to complete. PSMs are separate from the main curriculum and can be completed anytime, but not later than after the exam and before the results release date. If you don't complete your PSM before your CFA exam results are released, your exam score will be voided and you will have to retake your exam.

Only after you receive your level 1 CFA exam result may you register for the next exam.

MPS, Ethics Adjustment, CFA Exam Grading

CFA Exam Passing Score: What is MPS?

Every CFA exam has its MPS individually set when it’s over. The minimum passing score (MPS) is the threshold value determining who passes and who fails the CFA exam. Both the actual MPS (in %) and individual candidate scores (in %) are never released. However, as of the 2025 CFA exams, CFA Institute has introduced the so-called scale scores and established the MPS at 1600 for the level 1 exam. Another scale score you'll get on your results report is Your Score, which is a PASS if it's equal to or higher than 1600.

What is Ethics adjustment?

The CFA Program aims to promote an ethical culture in the investment industry. That’s why the Ethics topic is said to be particularly important in the CFA exam and there’s the so-called ethics adjustment. Your Ethics result can help you pass or fail if you are a borderline candidate, i.e. if your total exam score borders the MPS. According to the Ethics adjustment:

- Good Ethics result for a borderline candidate means a Passed Exam.

- Poor Ethics result for a borderline candidate means a Failed Exam.

What is CFA exam grading like?

To pass, Your Score must equal or be higher than the MPS set for your exam or your Ethics result must be good enough to pull you through if you are on the border. You don’t need to pass all the topics. It is the overall exam score that counts!

Editor's Note: This post was first published in 2019 and has been regularly updated ever since.

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1/level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Read Also: