2026 Level 1 CFA® Exam Topic Weights

Level 1 CFA Exam Weightage in Ranges

Level 1 CFA exam topic weights are given in ranges. For the 2026 CFA exams, the weights are: QM (6-9%), ECO (6-9%), FSA (11-14%), CI (6-9%), EI (11-14%), FI (11-14%), DER (5-8%), AI (7-10%), PM (8-12%), and ETH (15-20%).

The fact that CFA exam topic weights are given in ranges impacts your level 1 exam greatly. It means you won't know how many questions to expect exactly for each topic. But we give you a hint

Level 3 and level 2 CFA exam topic weights are also given in ranges, though the values differ.

2026 Level 1 CFA Exam Weights

| CFA Exam Topics | 2026 Level 1 Weight (MIN-MAX) |

|---|---|

| Quantitative Methods (QM) | 6-9% |

| Economics (ECO) | 6-9% |

| Corporate Issuers (CI) | 6-9% |

| Financial Statement Analysis (FSA) | 11-14% |

| Equity Investments (EI) | 11-14% |

| Fixed Income (FI) | 11-14% |

| Derivatives (DER) | 5-8% |

| Alternative Investments (AI) | 7-10% |

| Portfolio Management (PM) | 8-12% |

| Ethics (ETH) | 15-20% |

In 2026, level 1 CFA exam weights are the same as in 2025. They haven't changed for any of the level 1 CFA exam topics.

There was a significant change in topic weightage in 2024. It was the first such a change since CFA exams moved to computer-based testing (CBT) back in 2021. To better illustrate how the weights altered across the topics between the years 2023 and 2024, we've prepared charts that show the level 1 CFA exam weights changes graphically.

No change in the level 1 topic weightage this year, though :)

Predicted Number of Questions in 2026 Level 1 CFA Exam

What you can see below in the 'Predicted no. of Questions' column is an example of how your level 1 exam questions may be distributed among the topics in your test. We also give you the minimum and the maximum number of questions for each topic. The values are derived from the weightage ranges given above.

| Level 1 Topic | MIN no. of Questions 2026 |

MAX no. of Questions 2026 |

Predicted no. of Questions 2026 |

Topic Group |

|---|---|---|---|---|

| Quantitative Methods | 11 | 16 | 16 | II |

| Economics | 11 | 16 | 16 | II |

| Corporate Issuers | 11 | 16 | 12 | III |

| Financial Statement Analysis | 20 | 25 | 25 | II |

| Equity Investments | 20 | 25 | 20 | IV |

| Fixed Income | 20 | 25 | 20 | IV |

| Derivatives | 9 | 14 | 11 | IV |

| Alternative Investments | 13 | 18 | 13 | IV |

| Portfolio Management | 15 | 21 | 14 | III |

| Ethics | 27 | 36 | 33 | I |

| SUM | 157 | 212 | 180 | - |

Since the CFA exams moved to computer-based testing (CBT), the level 1 CFA exam format includes a total of 180 multiple-choice questions, 90 in SESSION 1 and 90 in SESSION 2. The number of questions has been reduced from 2 x 120, i.e. 240 overall. Topics are now divided into 4 groups: (I) Ethics, (II) Investment Tools, (III) Corporate Issuers and Portfolio Management, and (IV) Investment Assets. In your exam, questions may be shuffled within a group. You can rehearse the new exam format using our CFA mock test

Our prediction about the number of level 1 questions is just an educated guess and the actual number of topic questions may differ when you take your exam. However, when all the CBT changes and the MIN and MAX weight ranges are considered, this is what you can expect in your level 1 CFA exam:

Level 1 CFA Exam Structure, 2 Sessions

L1 CFA EXAM, SESSION 1

- Group I, Ethics (33 questions)

- Group II, Investment Tools: Quantitative Methods + Economics + Financial Statement Analysis (16 + 16 + 25 questions)

- Group I + Group II = 90 multiple-choice (a-b-c) questions

- time: 135 min

- average time per question = 1.5 min

L1 CFA EXAM, SESSION 2

- Group III, Corporate Issuers + Portfolio Management (12 + 14 questions)

- Group IV, Investment Assets: Equity + Fixed Income + Derivatives + Alternative Investments (20 + 20 + 11 + 13 questions)

- Group III + Group IV = 90 multiple-choice (a-b-c) questions

- time: 135 min

- average time per question = 1.5 min

TOTAL NO. OF QUESTIONS = 2 x 90 = 180 multiple-choice questions

TOTAL TESTING TIME = 2 x 135 min = 4 hrs 30 min

Average Level 1 CFA Exam Topic Weights

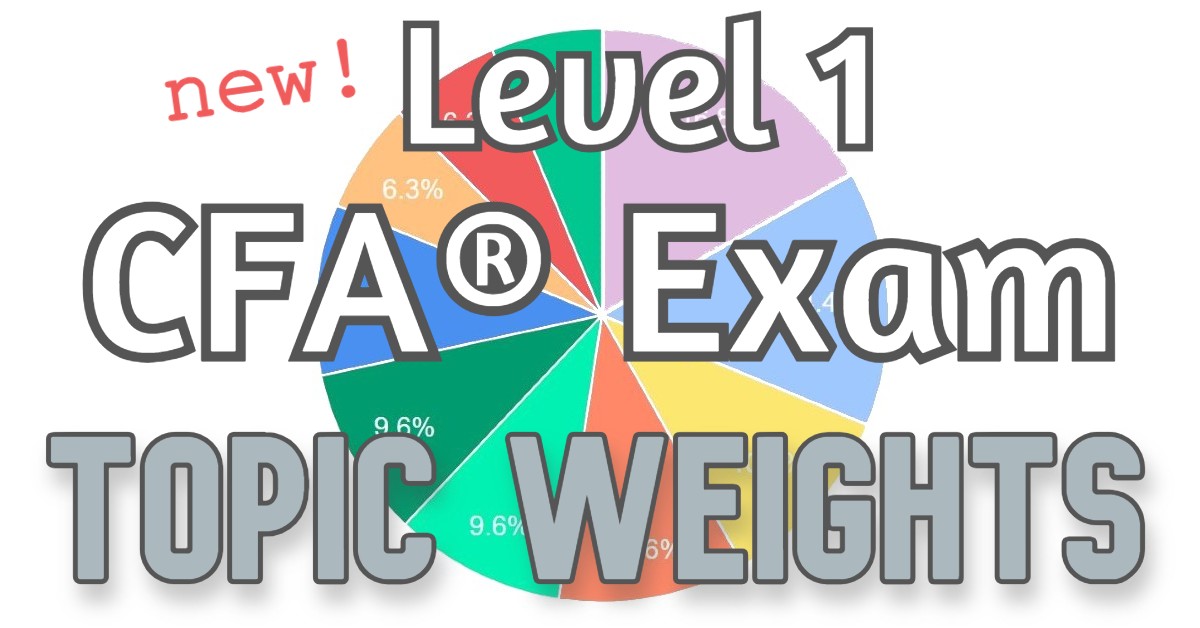

The average weights for level 1 CFA exam topics are averaged, i.e., presented as a single mean value for each topic. This criterion is just another estimation but it allows us to present CFA exam topic weights on a pie chart, which is so much more illustrative than the ranges shown in the tables above.

BTW, in the past, topic weights were given as single values and they were as follows: Ethics (15%), FSA (15%), EI (11%), FI (11%), QM (10%), ECO (10%), CI (10%), DER (6%), AI (6%), and PM (6%). It was back in 2020 when the level 1 CFA exam weightage was presented in ranges for the first time.

Here are the average level 1 topic weights for the 2026 CFA exams:

The pie chart below presents the 2026 level 1 topic weights as if they were single values – it uses the average exam weights, not ranges:

As you can see, the sum of all average topic weights is over 100%. That is why on the chart, you will see slightly lower values for the topics than the actual mean weights listed above. This only proves that the weights given in ranges yield no certain outcomes when it comes to the number of questions in your exam. You can even expect a various number of questions for topics with the same exam weights, which we showed in one of the tables above. For example, you can get 16 questions for Quants but 12 questions for Corporate Issuers even though both topics are in the same weight range in 2026.

Even though topic weights change, the difficulty of topics stays pretty much the same.

CFA Exam Topics Difficulty

The difficulty of topics is a subjective criterion. What is difficult for one candidate need not be difficult for another. When we define a topic as difficult, it means that the concepts it covers are usually said to be difficult.

Any easy topics in the level 1 CFA exam?

While making your level 1 study plan, you should definitely take topic difficulty into account. Factor it in if you consider a certain topic (or its part) to be difficult (or easy). If you have no idea, though, you can count on our help. Our CFA Exam Study Planner takes the topic difficulty and importance into account. The proposed topic sequence is called Soleadea Topic Sequence and we believe it to be optimal (but you can easily change it if you want):

- Soleadea Topic Sequence is: QM, PM, FSA, CI, FI, EI, DER, AI, ECO, ETH, and it's based on CFA exam topics length, difficulty, and importance,

- more challenging topics are coupled with easier ones allowing you to take a sort of break meanwhile,

- where possible, topics are coupled based on the similarity of concepts,

- we suggest that you study Ethics either at the beginning or at the end of your prep.

The time scheduled for each topic depends on its difficulty, the number of pages in the Curriculum, and the topic weights in your exam. While creating your personalized CFA exam study schedule, you can change the topic sequence according to your preferences:

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1/level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Read Also: