|

Post date: Thursday, November 2, 2023 - 07:08

Level 1 CFA Exam: Learn about the Fixed Income topic and its many relations. Key terms: bond, price, interest rate, coupon rate, YTM, duration, etc.

|

|

Post date: Thursday, November 2, 2023 - 07:05

Learn how to apply matrix pricing in your level 1 CFA exam to compute the price of an illiquid bond or the required yield spread for a bond to be issued.

|

|

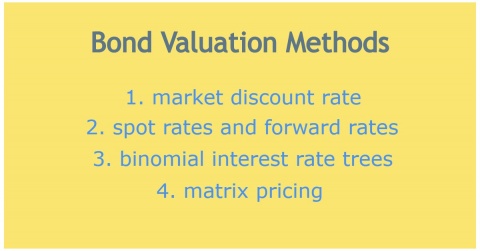

Post date: Thursday, November 2, 2023 - 07:01

[CFA exam] 4 bond valuation methods. To value a bond, use: market discount rate, spot rates & forward rates, binomial interest rate tree, matrix pricing.

|

|

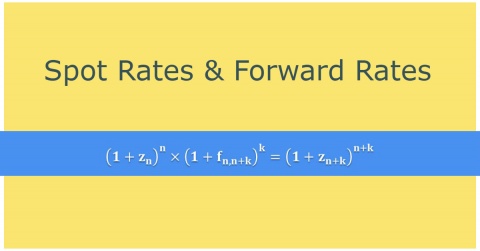

Post date: Thursday, November 2, 2023 - 06:55

In your level 1 CFA exam, you have to know different bond valuation methods. Learn how to use spot rates and forward rates to value bonds.

|

|

Post date: Wednesday, November 1, 2023 - 08:51

LEVEL 1 CFA EXAM REVIEW: Learn about different bond classifications to know in your level 1 CFA exam. The bond classifications are based on 5 criteria.

|

|

Post date: Wednesday, November 1, 2023 - 08:33

Level 1 CFA® Exam Revision: Companies use 2 methods to amortize bond discount or premium: (1) effective interest rate method or (2) straight-line method.

|

|

Post date: Wednesday, November 1, 2023 - 08:29

CFA EXAM, LEVEL 1: How to calculate the horizon yield in the most efficient and fastest way using TIBA II Plus Professional?

|

|

Post date: Tuesday, March 29, 2022 - 09:35

We asked former level 1 CFA exam candidates for some pieces of advice for current level 1 candidates. See the prep tips that some of the candidates shared.

|

- ‹‹

- 3 of 3