CFA® Exam Review: Relations

|

Post date: Sunday, November 5, 2023 - 09:00

Intro to level 1 CFA exam time value of money (TVM): USD 100 is worth more today than in a year + formulas for present value (PV) and future value (FV).

|

|

Post date: Sunday, November 5, 2023 - 07:40

CFA Exam Quantitative Methods Summary: Watch our presentation on Quantitative Methods (TVM and stats) if you study or review for your level 1 CFA exam.

|

|

Post date: Sunday, November 5, 2023 - 07:37

CFA Exam Portfolio Management Summary: Watch our presentation on the level 1 Portfolio Management topic if you study or review for your level 1 CFA exam.

|

|

Post date: Saturday, November 4, 2023 - 09:05

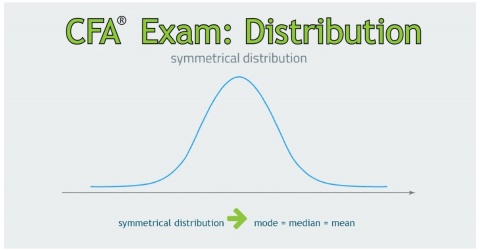

Level 1 CFA Exam Revision: Skewness is a measure of the asymmetry of a distribution. It tells us how observations are distributed around the mean.

|

|

Post date: Thursday, November 2, 2023 - 07:10

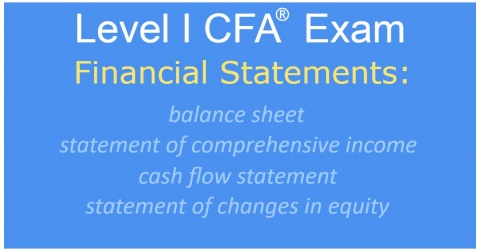

Level 1 CFA exam cheat sheets on the basics of the balance sheet, income statement, cash flow statement, and statement of changes in equity.

|

|

Post date: Thursday, November 2, 2023 - 07:10

Level 1 CFA Exam Revision: U.S. GAAP are more strict than IFRS with respect to classifying transactions into different cash flows. More details >>

|

|

Post date: Thursday, November 2, 2023 - 07:08

Level 1 CFA Exam: Learn about the Fixed Income topic and its many relations. Key terms: bond, price, interest rate, coupon rate, YTM, duration, etc.

|

|

Post date: Wednesday, November 1, 2023 - 08:33

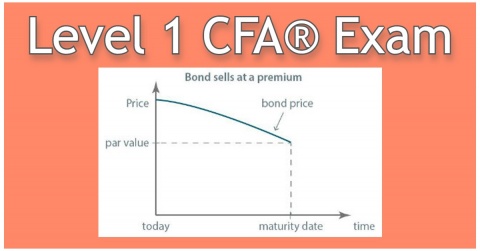

Level 1 CFA® Exam Revision: Companies use 2 methods to amortize bond discount or premium: (1) effective interest rate method or (2) straight-line method.

|