CFA® Exam Review: Master of Formulas

|

Post date: Sunday, November 5, 2023 - 08:55

TVM problems in the level 1 CFA exam: ordinary annuity, annuity due, perpetuity? Annuity = a series of cash flows of the same value at equal intervals.

|

|

Post date: Saturday, November 4, 2023 - 09:00

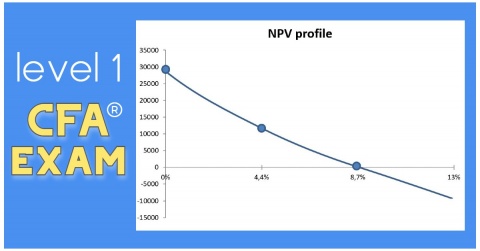

In the case of mutually exclusive projects, if the NPV and the IRR suggest two different investment projects, we should choose the project with a higher positive NPV.

|

|

Post date: Friday, November 3, 2023 - 09:08

CFA EXAM: The cash conversion cycle measures the time from paying suppliers for materials to collecting cash from the sale of goods produced from these materials.

|

|

Post date: Friday, November 3, 2023 - 08:55

CFA EXAM: Profitability index (PI) is the ratio of the present value of future cash inflows to the initial investment. If a project has a PI greater than 1, you should invest in the project.

|

|

Post date: Friday, November 3, 2023 - 08:45

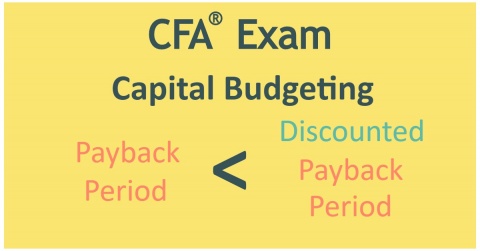

Both payback period (PP) and discounted payback period (DPP) measure the number of years necessary to recover funds invested in a project. In your level 1 CFA® exam, remember that DPP takes time value of money into account.

|

|

Post date: Thursday, November 2, 2023 - 10:37

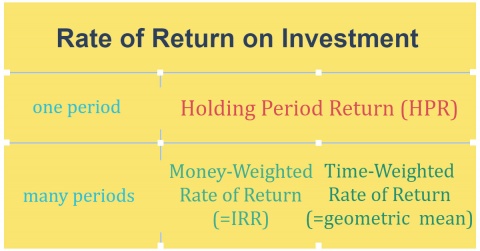

Learn how to compute rates of return on an investment in your level 1 CFA exam. There are 2 basic measures: the money-weighted rate of return and the time-weighted rate of return.

|

|

Post date: Thursday, November 2, 2023 - 08:55

Level 1 CFA Exam: Having trouble with Bayes' formula? Here's an alternative way of solving this kind of problems in your CFA exam. No formulas! Just logical thinking!

|

|

Post date: Thursday, November 2, 2023 - 08:45

If a company pays no dividends and you have to compute the geometric mean return over multiple periods, just divide the last price by the first price.

|

|

Post date: Thursday, November 2, 2023 - 07:22

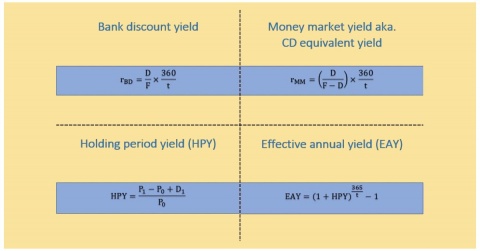

Level 1 CFA exam: Learn about various money market yields: bank discount yield, holding period yield, effective annual yield, money market yield.

|

|

Post date: Thursday, November 2, 2023 - 07:15

Level 1 CFA Exam Revision: Get a useful piece of advice related to measures of location, recall an important formula, and take a practical tip.

|

|

Post date: Thursday, November 2, 2023 - 07:05

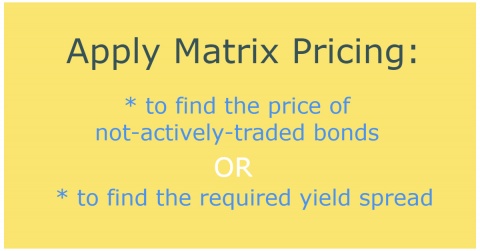

Learn how to apply matrix pricing in your level 1 CFA exam to compute the price of an illiquid bond or the required yield spread for a bond to be issued.

|

|

Post date: Thursday, November 2, 2023 - 07:01

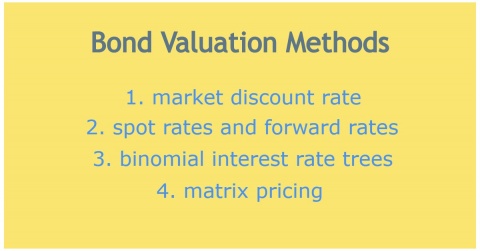

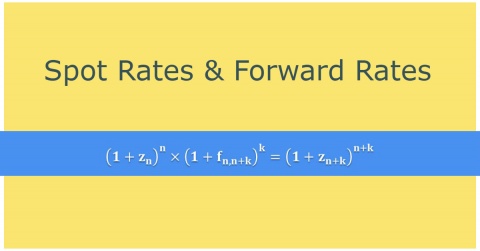

[CFA exam] 4 bond valuation methods. To value a bond, use: market discount rate, spot rates & forward rates, binomial interest rate tree, matrix pricing.

|

|

Post date: Thursday, November 2, 2023 - 06:55

In your level 1 CFA exam, you have to know different bond valuation methods. Learn how to use spot rates and forward rates to value bonds.

|