Level 1 CFA® Exam Fixed Income Relations

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

In this post, we cover the most important relations between variables from the Fixed Income level 1 CFA exam topic.

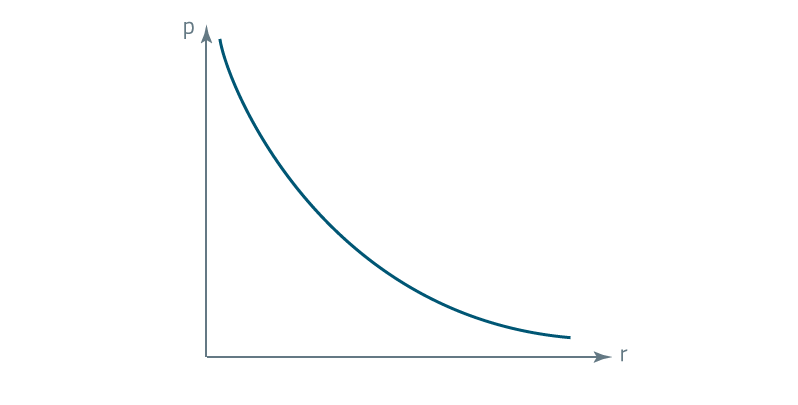

Inverse Relationship between Interest Rate and Bond Price

Let’s begin with some basics, namely the relationship between the market discount rate and the bond price.

Generally, there is an inverse relationship between interest rates and the price of a bond.

If:

interest rates go up the price of a bond goes down,

interest rates go down the price of the bond goes up.

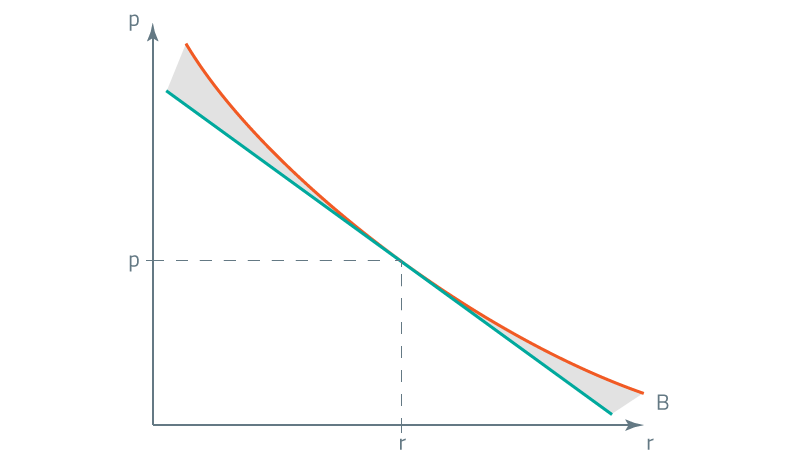

If:

the required yield changes only a bit (it either increases or decreases a bit) the absolute value of the percentage change in the bond price will be approximately the same for both increase and decrease of the market discount rate

the required yield changes a lot the absolute value of the percentage change in the bond price will be lower if the market discount rate increases than if the discount rate decreases

Coupon Rate vs YTM

coupon rate > YTM the bond sells at a premium (the bond price is higher than the par value)

coupon rate = YTM the bond sells at par (the bond price is equal to the par value)

coupon rate the bond sells at a discount (the bond price is lower than the par value)

coupons’ reinvestment rate investment's realized rate of return

coupons’ reinvestment rate > YTM investment's realized rate of return > YTM

Callable Bond vs Putable Bond

value of the callable bond = value of the bond without an embedded option - value of the call option

value of the putable bond = value of the bond without an embedded option + value of the put option

volatility of the market discount rate increases call option value increases callable bond value decreases

volatility of the market discount rate increases put option value increases putable bond value increases

Spot Curve vs Forward Curve

spot curve is upward sloping forward curve is above the spot curve

spot curve is downward sloping forward curve is under the spot curve

Reinvestment Risk vs Market Price Risk

the lower the coupon rate the lower the reinvestment risk

the lower the coupon rate the higher the market price risk

Bond's Price Change (Duration Only)

the greater the modified duration the greater the percentage bond price change

the lower the modified duration the lower the percentage bond price change

the greater the yield change (yield volatility) the greater the percentage bond price change

the lower the yield change (yield volatility) the lower the percentage bond price change

LAST UPDATE: 2 Nov 2023