CFA® Exam Review: Calculator Tricks

|

Post date: Tuesday, November 7, 2023 - 11:00

In level 1 CFA exam questions related to the IRR, when only the IRR needs to be computed, often the cost of capital is given to mislead the candidate.

|

|

Post date: Sunday, November 5, 2023 - 08:50

Time value of money (TVM) applied: how to use the approved CFA exam calculator and its CF and NPV worksheets to do TVM questions in your level 1 CFA exam.

|

|

Post date: Saturday, November 4, 2023 - 09:00

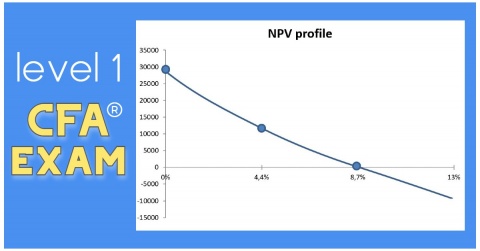

In the case of mutually exclusive projects, if the NPV and the IRR suggest two different investment projects, we should choose the project with a higher positive NPV.

|

|

Post date: Friday, November 3, 2023 - 08:45

Both payback period (PP) and discounted payback period (DPP) measure the number of years necessary to recover funds invested in a project. In your level 1 CFA® exam, remember that DPP takes time value of money into account.

|

|

Post date: Thursday, November 2, 2023 - 10:37

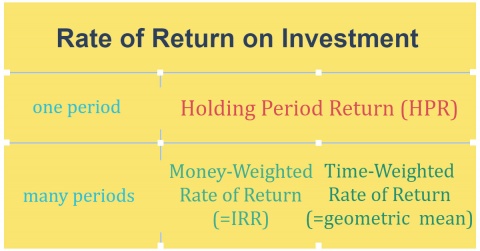

Learn how to compute rates of return on an investment in your level 1 CFA exam. There are 2 basic measures: the money-weighted rate of return and the time-weighted rate of return.

|

|

Post date: Thursday, November 2, 2023 - 08:50

Level 1 CFA Exam: Learn how to compute standard deviation using the DATA and STAT worksheets in your approved CFA exam calculator, TI BA Plus Pro.

|

|

Post date: Thursday, November 2, 2023 - 07:01

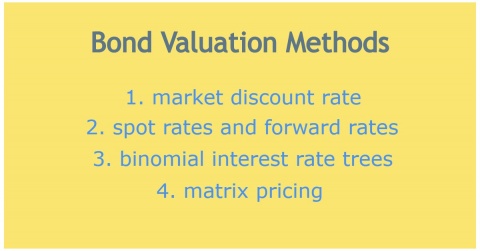

[CFA exam] 4 bond valuation methods. To value a bond, use: market discount rate, spot rates & forward rates, binomial interest rate tree, matrix pricing.

|

|

Post date: Wednesday, November 1, 2023 - 08:33

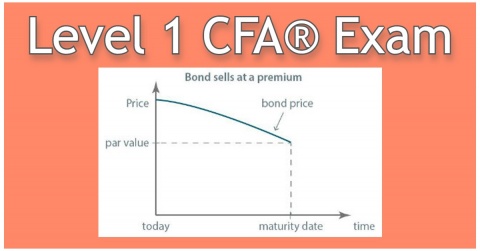

Level 1 CFA® Exam Revision: Companies use 2 methods to amortize bond discount or premium: (1) effective interest rate method or (2) straight-line method.

|

|

Post date: Wednesday, November 1, 2023 - 08:29

CFA EXAM, LEVEL 1: How to calculate the horizon yield in the most efficient and fastest way using TIBA II Plus Professional?

|