The 3 most difficult level 1 CFA exam topics are:

Below you can see the details for the most difficult 2024 level 1 CFA exam topics. There are some important changes for level 1 CFA exam topics in 2024, including new topic weights or a new number of learning modules. See all 2024 level 1 CFA exam topics here.

CFA exam candidates who take their level 1 exam usually indicate FI, Derivatives, and FSA (or FRA)* to be the most difficult. We couldn’t agree more...

The 3 topics differ from each other in certain aspects, such as their exam weight or the number of modules in your level 1 syllabus. You can find all 10 topics analyzed here and the 3 most difficult topics are compared below for convenience:

Hardest Level 1 CFA Exam Topics

| Level 1 CFA Exam Topic | Short Description | 2024 Topic Weight | No. of Modules in 2024 |

No. of Formulas | Predicted No. of Questions |

|---|---|---|---|---|---|

| Fixed Income | Bond features, yields & markets | 11-14% | 19 | around 40 | ca. 20 |

| Financial Statement Analysis* | Financial statements + Accounting methods + Reporting standards | 11-14% | 12 | around 50 | ca. 25 |

| Derivatives | Forwards vs futures vs options vs swaps | 5-8% | 10 | around 30 | ca. 11 |

* Before 2022, the CFA Program curriculum referred to Financial Statement Analysis as Financial Reporting and Analysis (FRA for short).

A learning module is a new name for what used to be called reading. It's a change partially introduced to the level 1 CFA exam curriculum in 2023, mainly in nomenclature but not only. The idea is for the learning modules to form digestive lessons that can be studied over one sitting. In your 2024 syllabus, you'll find all of the level 1 topics divided into learning modules (LM).

Fixed Income with its exam weight of 11-14% and 19 learning modules looks rather dangerous. Financial Statement Analysis doesn't look less scary with its exam weight of 11-14%, 12 learning modules, and roughly 50 formulas. All this tested in as many as 20 to 25 out of 180 level 1 exam questions.

But how about Derivatives? The topic weight is only 5-8% and not that many questions are expected in the exam... Sure, there are 10 modules but they are rather short and you will need just around 10 hours to study the whole topic.

So, what's the clue?

Here's the first tricky thing you must understand about level 1 CFA exam topics: it’s not the length or weight in the exam that makes a topic difficult. It’s the substance, curriculum contents, what's written on the topic, and how it's written!

So, although difficulty is a subjective criterion, there is an objective reason why these 3 choices are probably correct for the majority of level 1 candidates: all 3 topics are strictly conceptual plus they contain many things you’ve probably never heard of before.

What it means is that there’s a lot to remember and this lot may be hard to understand!

Fixed Income:

Tough Theory, Tough Math, Tough Everything...

Have you ever invested in shares? Even if not, you surely know many companies listed on the stock exchange. That’s why equity investments feel quite concrete and intuitive. But debt securities are not something people deal with on a regular basis (especially if they live in a country where the bond market is not as well developed as in the US). Therefore, studying fixed-income securities is more abstract.

Here are the 19 learning modules you will find in your 2024 level 1 CFA exam syllabus for the Fixed Income topic:

- BONDS FEATURES

- TYPES OF FIXED-INCOME INSTRUMENTS

- FIXED-INCOME ISSUANCE & TRADING

- BOND MARKETS FOR CORPORATE ISSUERS

- BOND MARKETS FOR GOVERNMENT ISSUERS

- BOND VALUATION

- FIXED-RATE BONDS: YIELDS & YIELDS SPREADS

- FLOATING-RATE INSTRUMENTS: YIELDS & YIELDS SPREADS

- TERM STRUCTURE OF INTEREST RATES

- RISK ASSOCIATED WITH BONDS - INTRODUCTION

- YIELD-BASED BOND DURATION

- YIELD-BASED BOND CONVEXITY

- CURVE-BASED & EMPIRICAL FIXED-INCOME RISK MEASURES

- CREDIT RISK

- CREDIT ANALYSIS: GOVERNMENT ISSUERS

- CREDIT ANALYSIS: CORPORATE ISSUERS

- SECURITIZATION

- ASSET-BACKED SECURITIES

- MORTGAGE-BACKED SECURITIES

- Learning Modules 49-51: explain nomenclature and different types of fixed-income securities.

- Learning Modules 52-53: describe bond markets and basic mechanisms.

- Learning Module 54: deals with bond valuation.

- Learning Modules 55-56: talks about yields and yield spreads of fixed income instruments.

- Learning Modules 57-61: unveil the notions of fixed-income risk & return.

- Learning Modules 62-64: delineate credit risk and credit analysis.

- Learning Modules 65-67: introduce securatization, asset-backed securities (ABS), and mortgage-backed securities. If you’ve seen "Big Short" and enjoyed it, the stuff detailed in LM 66 gets more friendly

To Cheer You Up

When you get to know about fixed-income investments, you’ll make a better start at derivatives. Bonds can have an impact on derivative instruments and then there are also options – first mentioned in the Fixed Income topic and examined inside out in the Derivatives topic.

How Derivatives Constitute The Hardest Part

Is it possible that the hardest part of the level 1 CFA exam curriculum has been hidden in almost the shortest of the topics? Undoubtedly, that is true for many CFA candidates.

The definition of a derivative already points to the problem. You know a derivative only if you know its underlying asset.

"A derivative is a financial instrument whose value depends on the value of some underlying asset."

There is a number of different assets that may serve as underlying assets for derivatives, for example: stocks, stock indices, bonds, interest rates, exchange rates, commodities, or other derivative instruments. The change in the value of the underlying asset affects the value of the derivative instrument.

The derivatives you’ll learn about while preparing for your level 1 exam include: forwards, futures, options, and swaps.

Here are the 10 learning modules you will find in your 2024 level 1 CFA exam syllabus for the Derivatives topic:

- INTRO TO DERIVATIVES

- FORWARD COMMITMENTS VS CONTINGENT CLAIMS

- DERIVATIVES - BENEFITS & RISKS

- ARBITRAGE, REPLICATION, & COST OF CARRY

- FORWARD CONTRACTS - PRICING & VALUATION

- FUTURES CONTRACTS - PRICING & VALUATION

- SWAPS - PRICING & VALUATION

- OPTIONS - PRICING & VALUATION

- PUT-CALL PARITY

- BINOMIAL VALUATION MODEL

Options, or Contingent Claims

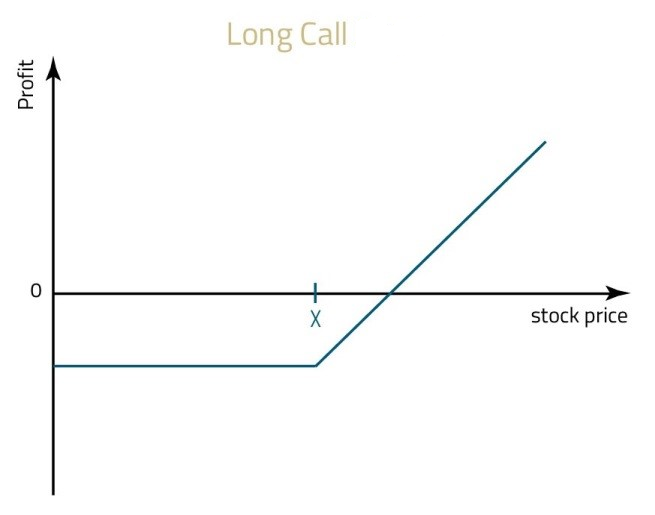

The most challenging task is probably to grasp the idea of how options work. There are various types of options, each with different characteristics. We say that options are contingent claims – the long will exercise the option and require that the short complete the transaction only if this transaction is profitable for the long party.

If we were to illustrate the profit from an option, it won’t be a straight line like for forwards or stocks. It makes option valuation extremely complicated. Luckily, option valuation models are left out of the level 1 CFA exam curriculum (apart from a short mention of the binomial option valuation) and you don’t need to worry about that until your level 2 exam.

Forward Commitments, i.e. Forwards, Futures & Swaps

The main goal with forward commitments is to get the difference between pricing and valuation.

If you take forwards:

Forward price is a fixed price for which the underlying will be purchased in the future.

Forward value – on the other hand – is determined for your position in the contract (that you entered some time ago) and it equals 0 (zero) at contract initiation and changes over time can be positive or negative depending on your position (long, short) and the price of the underlying.

Other DERivatives Concepts

Of course, getting to know different kinds of derivatives is not all. When you get familiar with forwards, futures, options, and swaps, it’s time to look into more enigmatic issues such as arbitrage, forward rate agreements (FRAs), put-call parity, or put-call-forward parity. You get it all explained in our premium videos.

Can It Really Be That Bad?

Yes, derivatives are much more puzzling than assets such as shares or even bonds. It’s because derivatives derive their value from underlying assets like shares or bonds.

However, if you feel that options – which are probably the hardest DER stuff – are not your story, you can always give up on them. It’s unlikely that your success in the exam should depend on this one decision. The topic has little weight in the level 1 exam and options are just part of it. You don’t need to study every issue to perfection if otherwise you spend your study time effectively.

Financial Statement Analysis: Both Difficult & Important

If you’ve had little or nothing to do with financial statements, FSA is going to give you a hard time. For the level 1 exam, it’s a lot of theory describing a vast range of accounting concepts.

Here are the 12 learning modules you will find in your 2024 level 1 CFA exam syllabus for the FSA topic:

- INTRO TO FINANCIAL STATEMENT ANALYSIS

- INCOME STATEMENT

- BALANCE SHEET

- CASH FLOW STATEMENT I

- CASH FLOW STATEMENT II

- INVENTORIES

- LONG-LIVED ASSETS

- LONG-TERM LIABILITIES & EQUITY

- INCOME TAXES

- FINANCIAL REPORTING QUALITY

- FINANCIAL STATEMENT ANALYSIS

- FINANCIAL STATEMENT MODELING

The first LM in an introduction to reporting standards and authorities associated with financial reporting and analysis.

The next 4 LMs are devoted to the main 3 financial statements, namely income statement, balance sheet, and cash flow statement (two parts described in two modules).

Then, there are 4 LMs elaborating on different financial statement items such inventories, long-lived assets, or income tax.

The last 3 LMs are about the quality of financial statements, their applications, and modeling.

Where Real Difficulty Lies

The greatest difficulty about the topic of Financial Statement Analysis is probably not the content itself but rather the abundance of the information.

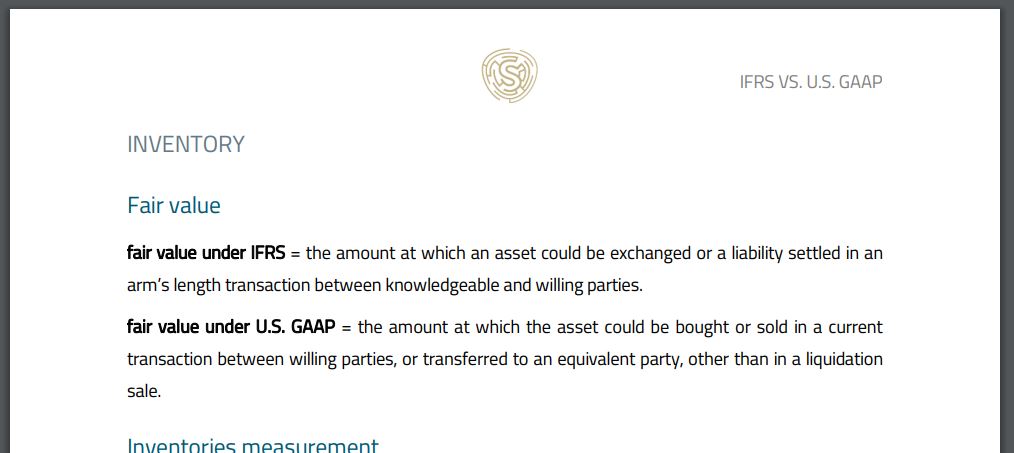

First of all, there are many differences and similarities to acquire. Take inventories. They are treated differently depending on whether they are reported under IFRS or U.S. GAAP. You can have it all cleared up with our IFRS vs U.S. GAAP e-book.

Moreover, there are plenty of ratios to take in.

That's when another difficulty arises, namely data irrelevance. Very often, FSA questions contain lots of data, some of which are totally insignificant for solving the problem. If you do not know exactly what elements you need to calculate the appropriate ratio, you won’t be able to cope with the exam question.

Excessive data also means more challenging analysis. You have to be able to interpret the data you see and judge its impact on the problem you’re dealing with.

Finally, questions about relations between different elements are extremely frequent. To give an example, let’s think of a lease and the cash flow from operations and how the former can affect the latter:

How can a change from a financing to an operating lease affect the company’s cash flow from operations?

To be able to approach this kind of problems, you need to understand what a given change means and whether it has any important influence. If yes, then you need to know what it is that the change affects and how it affects it.

Why FSA Is So Crucial

Is Financial Statement Analysis the hardest topic of the level 1 CFA exam?

It may be.

But it might be as well Fixed Income with its debt securities, Derivatives with its options, or any other topic as a matter of fact. It’s an individual matter.

If, however, it proves for you to be FSA – do not surrender but find a way to overcome the difficulty. It’s definitely worth it because it’s one of the most important topics in your level 1 exam. Think about it this way: no effort spared on FSA is lost. The better you cope with the topic now, the greater the chances of success in your level 1 exam. Plus, it will surely pay off when the challenges of the level 2 exam get real.

Find 220+ LVL 1 STUDY LESSONS INSIDE!

10 Level 1 CFA Exam Topics Ranked by Difficulty

Having said that Fixed Income, Derivatives, and FSA are the hardest level 1 CFA exam topics, it's time to rank all of the 10 level 1 topics by difficulty. Difficulty is a subjective criterion but this hard-to-easy topic hierarchy is meant as a guideline to help you approach CFA exam topics sensibly.

Hard-to-Easy Level 1 CFA Exam Topic Order

This is how our expert ranks the level 1 topics by difficulty but when deciding on your best CFA exam topic sequence, take also into consideration criteria such as your previous knowledge of the topics or the kind of a learner you are.

The sequence of topics is important here: the higher the position, the more difficult the topic (in our opinion). A topic is considered difficult if the concepts it covers are difficult, not if it takes much time to study the topic.

When you set up your CFA exam study schedule, you'll be able to choose topics difficulty. For the topics you mark as difficult, you'll have more study time allotted. And for the topics you consider easy – you'll get relatively less time. If you mark no topic as difficult or easy, we'll allot our recommended study times to your topics and weeks (topic length and difficulty already factored in as evaluated by our expert). To get exact study hours for your CFA exam modules and study weeks, please go for our PAID PLAN

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1/level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Read Also: