Fixed Income

|

7 months 5 days ago |

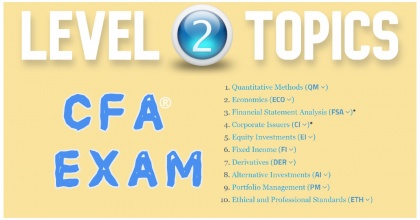

Free CFA® Exam Study Materials for Level 1 and Level 2Check our list of free CFA exam study materials, including level 1 and level 2 videos, level 1 and level 2 questions, and level 1 written content. |

|

2 years 4 months ago |

Level 1 CFA® Exam Fixed Income Relations |

|

2 years 4 months ago |

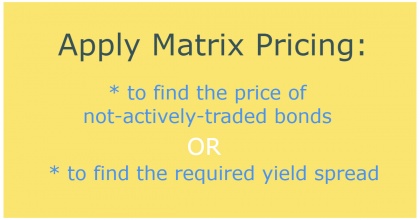

How to Use Matrix Pricing in Your Level 1 CFA® Exam? |

|

2 years 4 months ago |

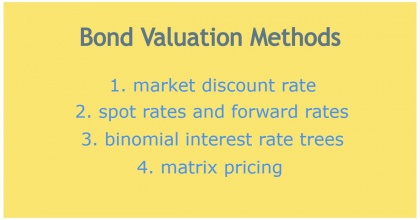

Level 1 CFA® Exam: 4 Methods of Bond Valuation |

|

2 years 4 months ago |

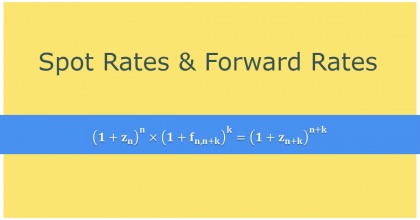

Using Spot Rates & Forward Rates In Your CFA® Exam |

|

2 years 4 months ago |

Bond Types Level 1 CFA® Exam Cheat Sheet |

|

2 years 4 months ago |

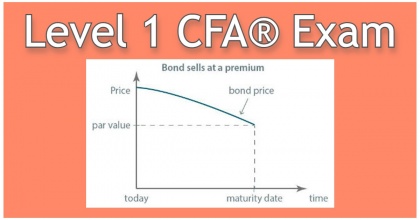

Level 1 CFA® Exam: Amortizing Bond Discount or Premium |

|

2 years 4 months ago |

CFA® Exam: Computing Horizon Yield Using IRR & MOD |