Master of Formulas

|

2 years 4 months ago |

CFA® Exam: Time Value of Money, AnnuityTVM problems in the level 1 CFA exam: ordinary annuity, annuity due, perpetuity? Annuity = a series of cash flows of the same value at equal intervals. |

|

2 years 4 months ago |

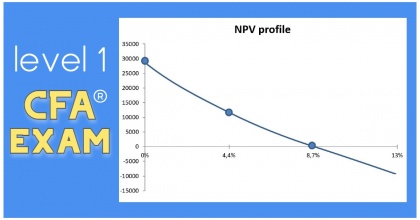

Level 1 CFA® Exam: NPV vs IRR. Which is Better? |

|

2 years 4 months ago |

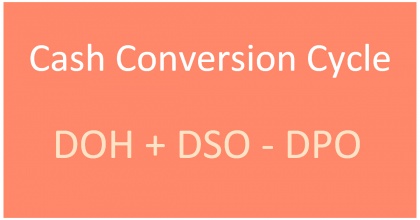

Cash Conversion Cycle CFA® Exam Cheat Sheet |

|

2 years 4 months ago |

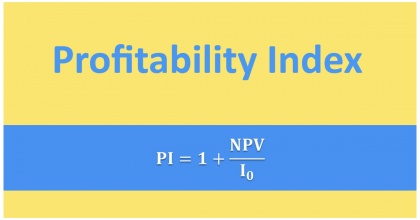

Profitability Index Level 1 CFA® Exam Cheat Sheet |

|

2 years 4 months ago |

Discounted Payback Period vs Payback Period: Pros & Cons |

|

2 years 4 months ago |

Money-Weighted vs Time-Weighted Return CFA® Exam Cheat Sheet |

|

2 years 4 months ago |

Level 1 CFA® Exam: Bayes' Formula Explained |

|

2 years 4 months ago |

Level 1 CFA® Exam: Geometric Mean Return |

|

2 years 4 months ago |

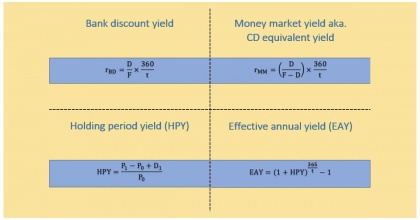

Money Market Yields CFA® Exam Cheat Sheet |

|

2 years 4 months ago |

Level 1 CFA® Exam: Measures of Location (Computing Percentile) |

|

2 years 4 months ago |

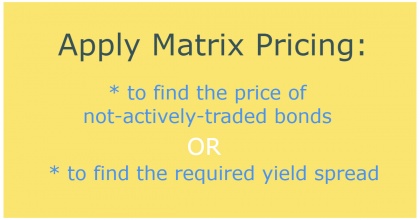

How to Use Matrix Pricing in Your Level 1 CFA® Exam? |

|

2 years 4 months ago |

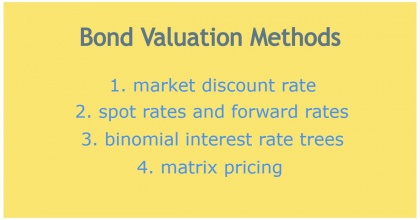

Level 1 CFA® Exam: 4 Methods of Bond Valuation |

|

2 years 4 months ago |

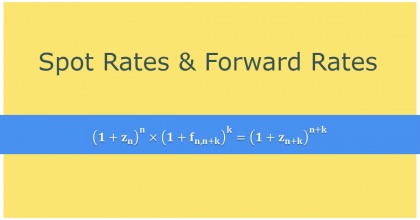

Using Spot Rates & Forward Rates In Your CFA® Exam |