Level 1 CFA® Exam:

Efficient Frontier & Investor's Optimal Portfolio

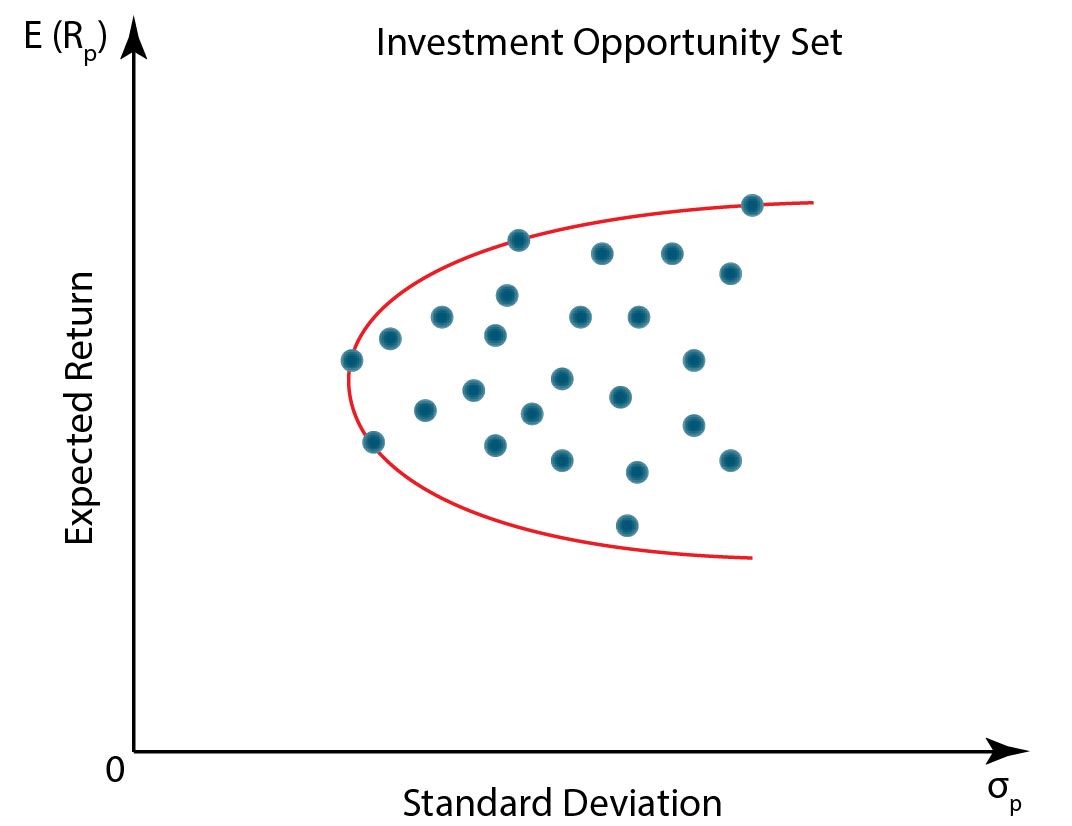

A set of all possible portfolios that you can create is called a feasible set or an opportunity set. These portfolios include all risky assets available to an investor. On the risk-return graph, the set of portfolios creates a figure. Have a look at this graph.

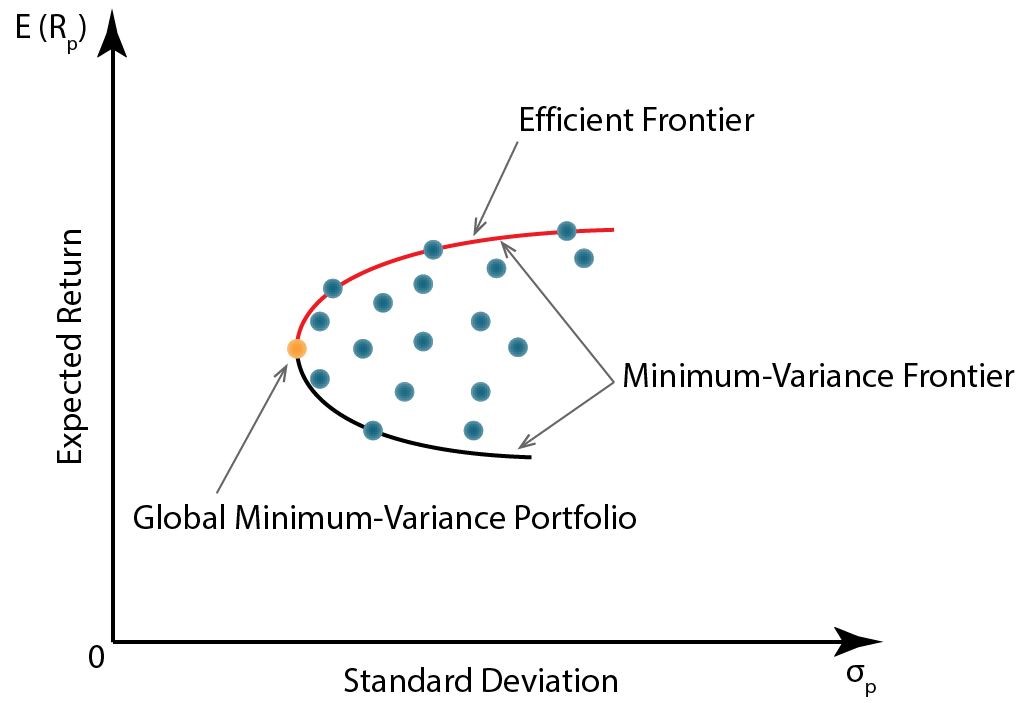

The set includes the interior and the edges of the figure. The edge that you can see on the graph is called the minimum-variance frontier. Please note that there are portfolios on this frontier that offer two different rates of return with the same level of risk. A rational investor will of course choose the portfolio which offers him a higher expected rate of return for the same level of risk.

A set of portfolios that a rational investor will choose is called the Markowitz efficient frontier, also known as an efficient set. A rational investor is characterized by risk aversion and will select only portfolios lying on the efficient frontier as they will provide the lowest risk for a given level of expected return or the highest expected return for a given level of risk.

An important point on the minimum-variance frontier is referred to as the global minimum-variance portfolio. This portfolio is characterized by the lowest risk of all possible portfolios that you can create. Moreover, it is the beginning of the efficient frontier.

Note that the efficient frontier is only a part of the minimum-variance frontier.

Henry Markowitz in his classic portfolio theory considered only risky instruments. James Tobin extended this theory. He asked the following questions: Why limit yourself only to risky assets? Couldn’t investment in risk-free assets be beneficial to the investor?

(...)

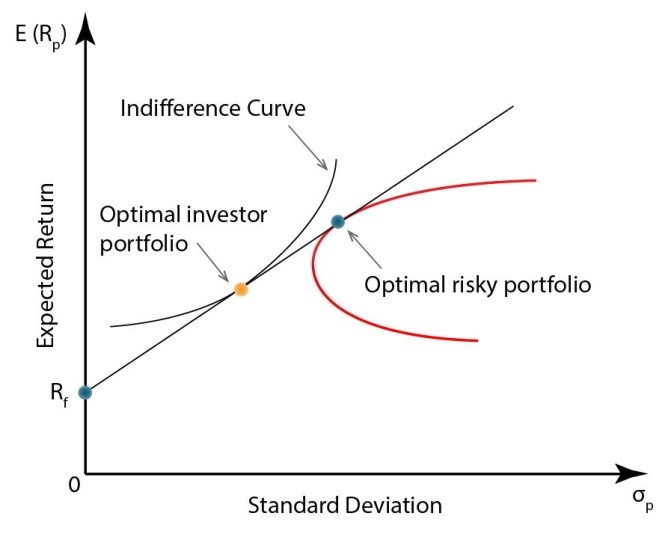

Each investor has a different risk tolerance. Investors with a low-risk tolerance will probably choose a portfolio in which risk-free assets predominate, while those with a higher risk tolerance will choose more risky portfolios, including those that are created out of borrowed money.

In a nutshell, portfolio selection depends on an investor’s personal preferences and the utility function. If we superimpose an investor's indifference curves on the capital allocation line, it will help us find the optimal investor portfolio. The highest indifference curve tangent to the capital allocation line indicates a portfolio that is available to an investor and provides him with the highest utility.

Level 1 CFA Exam Takeaways: Efficient Frontier & Investor's Optimal Portfolio

star content check off when done- A set of all possible portfolios that you can create is called a feasible set or an opportunity set.

- Markowitz efficient frontier is a frontier containing all efficient portfolios consisting only of risky assets.

- The efficient frontier is only a part of the minimum-variance frontier.

- A rational investor is characterized by risk aversion and will select only portfolios lying on the efficient frontier as they will provide the lowest risk for a given level of expected return or the highest expected return for a given level of risk.

- Global minimum-variance portfolio is the portfolio with the lowest possible risk, containing only risky assets.

- Optimal risky portfolio is a portfolio composed only of risky assets with the best ratio of expected return to risk.

- Capital allocation line (CAL) is a line connecting a risk-free asset with a portfolio consisting of risky assets. The capital allocation line connecting a risk-free asset with an optimal risky portfolio is where you can find the best portfolios available to investors.

- The two-fund separation theorem states that all investors regardless of risk preferences will aim at having a portfolio located on the capital allocation line that is tangent to the efficient frontier.

- Optimal investor’s portfolio is a portfolio lying on the capital allocation line combining a risk-free asset with an optimal risky portfolio. The decision about choosing this portfolio depends on the investor’s utility function.