Income Taxes in Level 1 CFA Exam – Advanced

CFA Exam: Taxable and Accounting Profit, Tax Credit and Unused Tax Losses

star content check off when doneWelcome to the second lesson on income taxes. In this lesson, we will discuss:

- temporary and permanent differences between taxable and accounting profit,

- key exceptions,

- tax credit and unused tax losses,

- recognition and measurement of current and deferred tax,

- income tax presentation and disclosure,

- income taxes under IFRS and U.S. GAAP.

Let’s begin with the discussion on the temporary and permanent differences in taxes and how should companies treat them from an accounting perspective.

Temporary and Permanent Differences between Taxable and Accounting Profit

star content check off when doneIn the previous lesson, we noted that to recognize a deferred tax asset or liability, the difference between taxable and accounting profit needs to be temporary and driven by a discrepancy between the tax base of an asset or a liability and its carrying value. The premise assumes that those differences will reverse as time passes.

That approach to the recognition of deferred tax is called the balance sheet method both under IFRS and U.S. GAAP.

However, some differences will not reverse. They are called permanent differences. For such differences, companies are allowed to recognize neither a deferred tax asset nor a deferred tax liability. Permanent differences are mainly driven by:

- differences in the tax rules that do not allow to recognize, for tax purposes, certain income or expense items at all,

- tax credits that allow reducing taxes directly.

Leaving those aside for a moment, let’s focus on a more advanced analysis of temporary tax differences.

Temporary tax differences are split into two categories:

- taxable temporary differences, and

- deductible temporary differences.

Taxable Temporary Differences

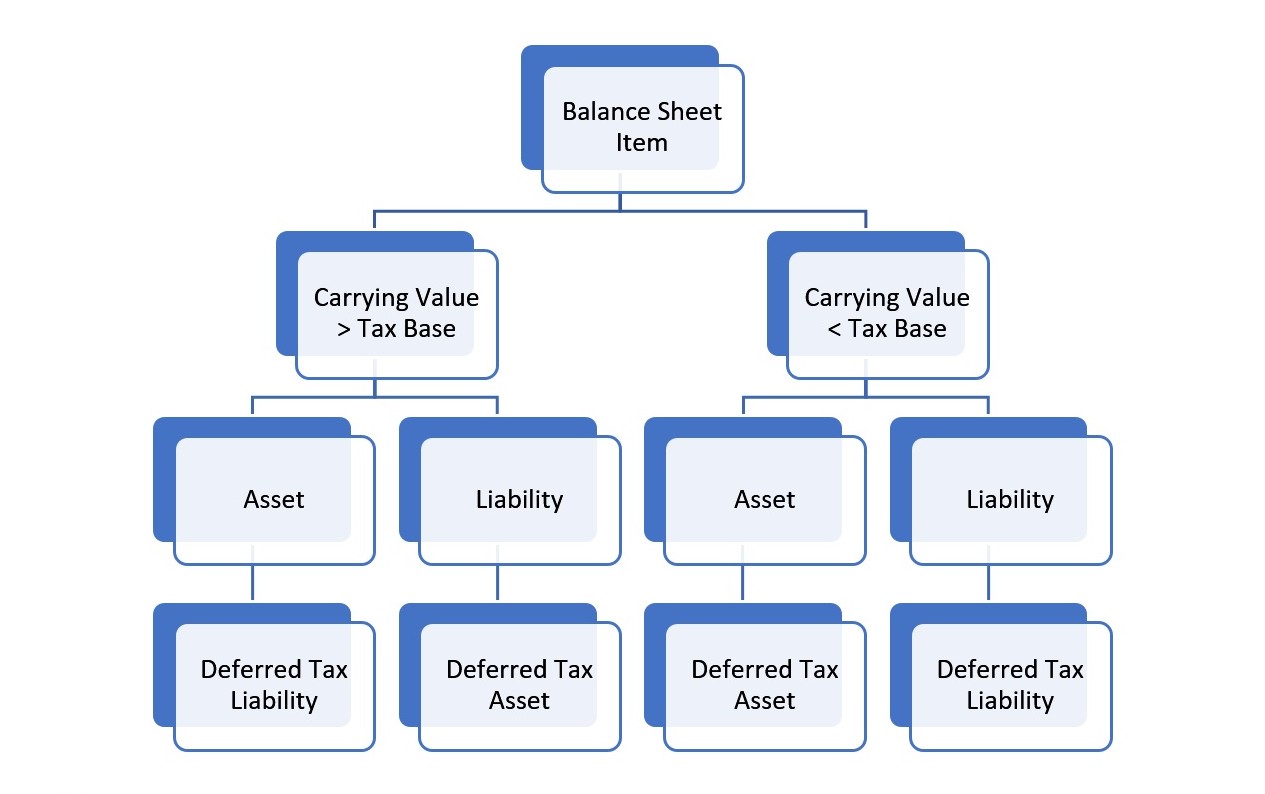

Taxable temporary differences lead to the creation of the deferred tax liability when the carrying amount of an asset is greater than the tax base and when the carrying amount of a liability is lower than its tax base. Taxable temporary differences lead to a taxable amount that will be recognized by the company in the future period.

One specific exception to those rules prescribed in the accounting standards touches on goodwill.

U.S. GAAPs and IFRS do not allow, in general, to recognize the deferred tax asset or liability arising as a result of the recognition of goodwill. In the case of U.S. GAAPs, it is narrowed down to the goodwill that is unamortizable, while for IFRS it is narrowed down to the goodwill recognized as part of a business combination at the moment when a transaction happens. We will provide more details on the topic further.

(...)

The topic might be quite difficult, so to help you with the understanding, here’s a summary of the decision-making process that is applied to the recognition of deferred tax assets and liabilities:

We have already highlighted that there are certain exceptions that we need to know and understand. We will provide more details now.

So far, we have mainly considered cases where tax differences were driven by mismatches in the carrying value and tax base of assets and liabilities that occurred as a result of the subsequent measurements of those assets and liabilities, e.g., different depreciation methods required for tax purposes and accounting purposes. Let’s now look at the situations where the differences occur at the initial recognition of an asset or liability.

Typical examples include donations and government grants received by the company.

If a grant or donation is given to the company to acquire an asset, according to the accounting rules, such a donation will be expensed in the current period and will decrease the balance sheet value of that asset. However, for tax purposes, such treatment is not allowed. This will result in a situation where the tax base is higher than the carrying value of an acquired asset. Very often such differences do not allow companies to create deferred tax assets or liabilities even though a tax difference occurs.

"IFRS states that deferred tax assets should not be recognized in cases that would arise from the initial recognition of an asset or liability in transactions that are not a business combination".

Let’s now talk a little bit about deferred tax assets and liabilities accompanying business combinations.

Goodwill:

We have already mentioned that the initial recognition of goodwill created as part of a business combination should not lead to the recognition of deferred tax assets and liabilities. However, IFRS allows the recognition of a deferred tax asset or liability as a result of subsequent (after a business combination) differences between the tax base and carrying value of the goodwill recognized. This will usually happen when goodwill is amortized or its portions are deductible for tax purposes.

Investments in subsidiaries, branches, associates, and interests in joint ventures:

Another key exception pertains to investments in subsidiaries, branches, associates, and interests in joint ventures. Such investments might lead to temporary differences in the consolidated versus the parent’s financial statement and will result in the creation of either deferred tax asset or deferred tax liability according to the following rules:

| Deferred tax liabilities can be recognized unless: | Deferred tax assets can only be recognized if: |

|---|---|

| * parent company can influence and control the timing of the tax difference reversal, | * the temporary difference will certainly reverse in the future, |

| * it is probable that the temporary difference will not reverse in the future. | * the company will generate sufficient taxable profits in the future so that the temporary difference can be used against that profit. |

When those peculiarities are explained, we should now turn our attention to unused tax losses and tax credits.

First, we define both unused tax losses (aka. tax losses carried forward) and tax credits:

Tax loss carry forward (unused tax loss) arises when a company recognizes a loss in a reporting period and is entitled to “use” this loss against the future taxable income.

Tax credit is simply an amount of money that the company is allowed to deduct from the tax payable to the tax authorities.

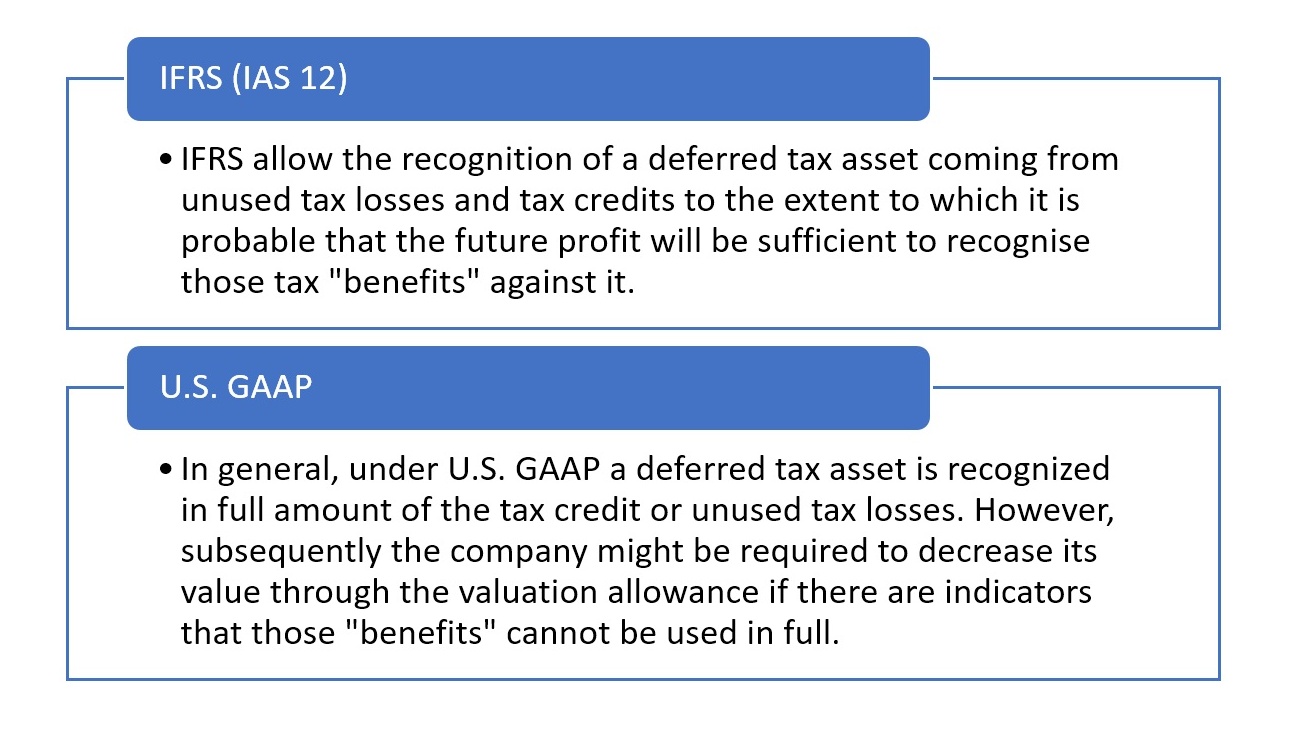

Depending on the accounting regime, the treatment of both unused tax loss and tax credit might differ:

Accounting standards provide the following guidelines to be used when assessing whether it is probable that unused tax losses and tax credits can be utilized:

(...)

The next one on the agenda is an important topic of the current and deferred tax recognition and measurement.

Firstly, let us remind the key rules that apply to both the current and deferred taxes:

- current taxes, in general, are measured at the tax rate applicable at the balance sheet date,

- deferred taxes should be measured using the tax rate that is expected to be in place when the recovery of the deferred tax is expected to happen,

- deferred tax assets and liabilities that are expected to settle at a future date are not discounted to the present value but should be adjusted for any tax changes that might happen until they are settled,

- deferred taxes and income taxes need to be reported in the income statement unless they are charged to equity or are a result of a business combination (we will explain which taxes might be charged to equity later in the lesson).

As previously noted, under U.S. GAAP companies are required to assess the value of deferred tax assets at the balance sheet date. If there are any indications that the deferred tax asset might not be recovered in full, companies are required to book the valuation allowance. If the company’s assessment in the subsequent periods leads to an opinion that the deferred tax asset can be recouped in full again, the valuation allowance should be resolved or decreased. Any such changes to the valuation allowance will result in the recognition of operating profit and increase the value of the deferred tax asset on the balance sheet.

Let’s now provide more details on the taxes that are charged directly to equity.

(...)

Next, let’s delve into how the taxes should be presented within the financial statements and what the required disclosures that companies need to make to ensure that users of the financial statements fully understand the nature of recognized current and deferred taxes are.

The best way to illustrate how companies present and disclose relevant income tax information is to provide an example. Before we dive into it, we point to some key elements that you need to be aware of:

- Companies should present the income tax expense information within the income statement. What’s more, they usually need to provide, within the notes to the financial statement, detailed information on how the company has arrived at the number, starting from the reported income before taxes and including the information on the statutory tax rate applied for the calculation.

- Disclosure should also include detailed information on any valuation allowances, changes in valuation allowances between reporting periods, tax credits, or foreign tax differentials.

- Notes should also include a detailed explanation of how the balance sheet value of the deferred tax asset or liability has been arrived at. Within the balance sheet, companies present the net of those two, so either deferred tax asset or liability will be presented. However, the notes should provide the details on both the deferred tax asset component and the deferred tax liability component with the indication of sources by balance sheet item (e.g., DTL that comes from the difference in the depreciation method used for property, plant & equipment). The final value needs to match the amount reported on the balance sheet.

The table below presents the tax-relevant extracts from the financial statements of the C&C company:

Balance sheet as of 2022:

| Assets | 2022 | 2021 |

| Deferred income tax assets | USD 2,129,000 | USD 2,460,000 |

| Liabilities | ||

| Deferred income tax liabilities | USD 2,821,000 | USD 1,833,000 |

Extract from the income statement for 2022:

| 2022 | 2021 | |

| Net Operating Revenues | USD 38,655,000 | USD 33,014,000 |

| COGS | USD 15,357,000 | USD 13,433,000 |

| Gross Profit | USD 23,298,000 | USD 19,581,000 |

| Selling and general expenses | USD 12,144,000 | USD 9,731,000 |

| Other operating expenses | USD 846,000 | USD 853,000 |

| Operating Income | USD 10,308,000 | USD 8,997,000 |

| Interest income | USD 276,000 | USD 370,000 |

| Interest expense | USD 1,597,000 | USD 1,437,000 |

| Equity income (net) | USD 1,438,000 | USD 978,000 |

| Other income (net) | USD 2,000,000 | USD 841,000 |

| Income Before Income Taxes | USD 12,425,000 | USD 9,749,000 |

| Income taxes | USD 2,621,675 | USD 1,979,047 |

| Net Income | USD 9,803,325 | USD 7,769,953 |

Notes to the financial statements – income tax expense:

| 2022 | 2021 | |

| Current taxes | USD 1,727,675 | USD 1,997,047 |

| Deferred taxes | USD 894,000 | USD (18,000) |

| Total | USD 2,621,675 | USD 1,979,047 |

Notes to the financial statements – reconciliation of the statutory federal tax and effective tax rate:

| 2022 | 2021 | |

| Statutory federal tax rate | 21% | 21% |

| State and local income taxes | 1.1% | 1.1% |

| Earnings in jurisdictions taxed at rates different from the statutory federal tax rate | 2.3% | 0.9% |

| Equity income/loss | (2.0%) | (1.4%) |

| Excess tax benefits on stock compensation | (0.5%) | (0.8%) |

| Other – net | (0.8%) | (0.5%) |

| Effective tax rate | 21.1% | 20.3% |

Additional commentary:

- State and local income taxes include USD 100 million (or a 1.0 percent impact on our effective tax rate) coming from the tax differences related to the tax base and carrying amount within property plant & equipment measurements due to specific tax laws in certain states, which will not revert in the future.

- Earnings in jurisdictions taxed at rates different from the statutory federal tax rate for 2022 include net tax charges of USD 375million (or a 3.0 percent impact on our effective tax rate) related to changes in tax laws in certain foreign jurisdictions, amounts required to be recorded for changes to our uncertain tax positions, including interest and penalties, in various international jurisdictions, as well as other discrete items.

- Other – net position for 2022 includes a tax benefit of USD 140 million (or a 1.5 percent impact on our effective tax rate) associated with the USD 834 million gain recorded upon the acquisition of the remaining ownership interest in one of the consolidated entities.

Notes to the financial statements – deferred taxes:

| 2022 | 2021 | |

| Deferred tax assets | ||

| Property, plant, and equipment | USD 532,250 | USD 615,000 |

| Trademarks and other intangible assets | USD 1,170,950 | USD 1,353,000 |

| Net operating/capital loss carry forward | USD 212,900 | USD 246,000 |

| Other liabilities | USD 319,350 | USD 369,000 |

| Gross total deferred tax assets | USD 2,235,450 | USD 2,583,000 |

| Valuation allowance | (USD 106,450) | (USD 123,000) |

| Total deferred tax assets | USD 2,129,000 | USD 2,460,000 |

| Deferred tax liabilities | ||

| Property, plant, and equipment | USD 705,250 | USD 458,250 |

| Trademarks and other intangible assets | USD 1,410,500 | USD 916,500 |

| Net operating/capital loss carry forward | USD 282,100 | USD 183,300 |

| Other liabilities | USD 423,150 | USD 274,950 |

| Total deferred tax liabilities | USD 2,821,000 | USD 1,833,000 |

| Net deferred tax assets / (liabilities) | (USD 692,000) | (USD 627,000) |

As we promised at the beginning of the lesson, let’s now solve some problems that will allow you to better understand the advanced concepts connected with income taxes:

The questions we will try to answer:

- What are the components of the tax payable in 2021 for the C&C company?

- Based on the information provided, what are the possible reasons that the effective tax rate differs from the statutory federal tax rate for 2022?

- Imagine that the statutory federal tax rate has changed to 25%. What would be the impact on the C&C company balance sheet for 2022?

(...)

In the two lessons on income taxes, we showed a couple of similarities and differences between the income tax treatment under IFRS and U.S. GAAP. We provide a holistic overview of those differences in the following section.

The table below summarizes the key similarities and differences between IFRS and U.S. GAAP concerning income tax accounting.

(...)

- Differences between the tax base and the carrying amount of assets and liabilities result in differences between the taxable profit and accounting profit. We divide them into temporary taxable differences and permanent taxable differences.

- Temporary differences are expected to reverse in time at some future date and the company expects that those differences will lead to future economic benefits. If that is the case, temporary differences will lead to the recognition of the deferred tax asset or liability.

- Permanent differences are not expected to be reversed in the future and they lead to the recognition of neither the deferred tax asset nor the deferred tax liability.

- When measuring the current taxes, companies should apply the current tax rate required by the tax authority. On the other hand, deferred taxes should be measured using the expected tax rate which will be applicable at the moment when temporary taxable differences are to reverse.

- Specifically for the deferred tax asset, companies are required to assess whether all or part of the deferred tax asset is to be recovered. If there are any indications that the benefit of the deferred tax asset might not be used in full, companies are required to either reduce the carrying amount of the deferred tax asset (under IFRS) or create a valuation allowance (under U.S. GAAP).

- IFRS and U.S. GAAP are generally aligned with regard to the treatment and recognition of the current tax payables and deferred taxes. However, some differences exist. Those differences are visible mainly in the treatment of the deferred tax asset within business combinations and in the recognition of goodwill.