Level 1 CFA® Exam:

Financial Reporting Standards

The role of financial reporting is to provide reliable, fair, and true information about a company’s performance and its financial position.

This information can be then analyzed by different market participants (e.g. analysts, investors, customers, management, etc.) and used to make/help make some economic decisions.

In other words, the purpose of financial reporting is to give information about:

- the company’s performance (income, expenses),

- the company’s financial situation (assets, equity, liabilities),

- changes in the company’s financial situation and performance.

Must-Know Abbreviations

- IASB = International Accounting Standards Board

- FASB = Financial Accounting Standards Board

- SEC = Securities Exchange Commission

- IOSCO = International Organization of Securities Commissions

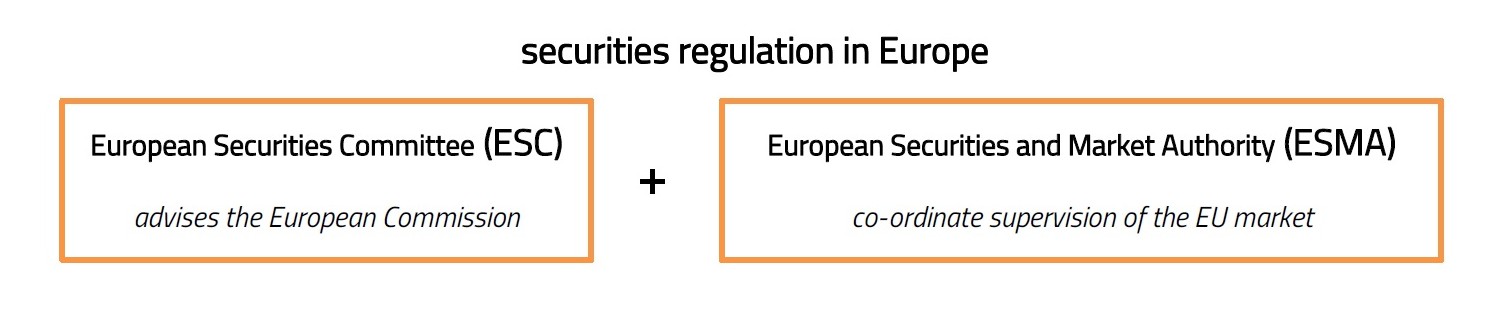

- ESC = European Securities Committee

- ESMA = European Securities and Market Authority

- IFRS = International Financial Reporting Standards

- IAS = International Accounting Standards

| Standard-Setting Bodies | Regulatory Authorities | |

|---|---|---|

| examples | IASB, FASB | SEC in the USA, Accounting and Regulatory Authority in Singapore, etc. |

| form | private sector, self-regulated organizations | created by authorities in a given country |

| role | set the standards | enforce the standards |

| power | their standards can be overruled by specific standards required in a given country | can set the standards that overrule the standards created by private sector organizations like IASB or FASB |

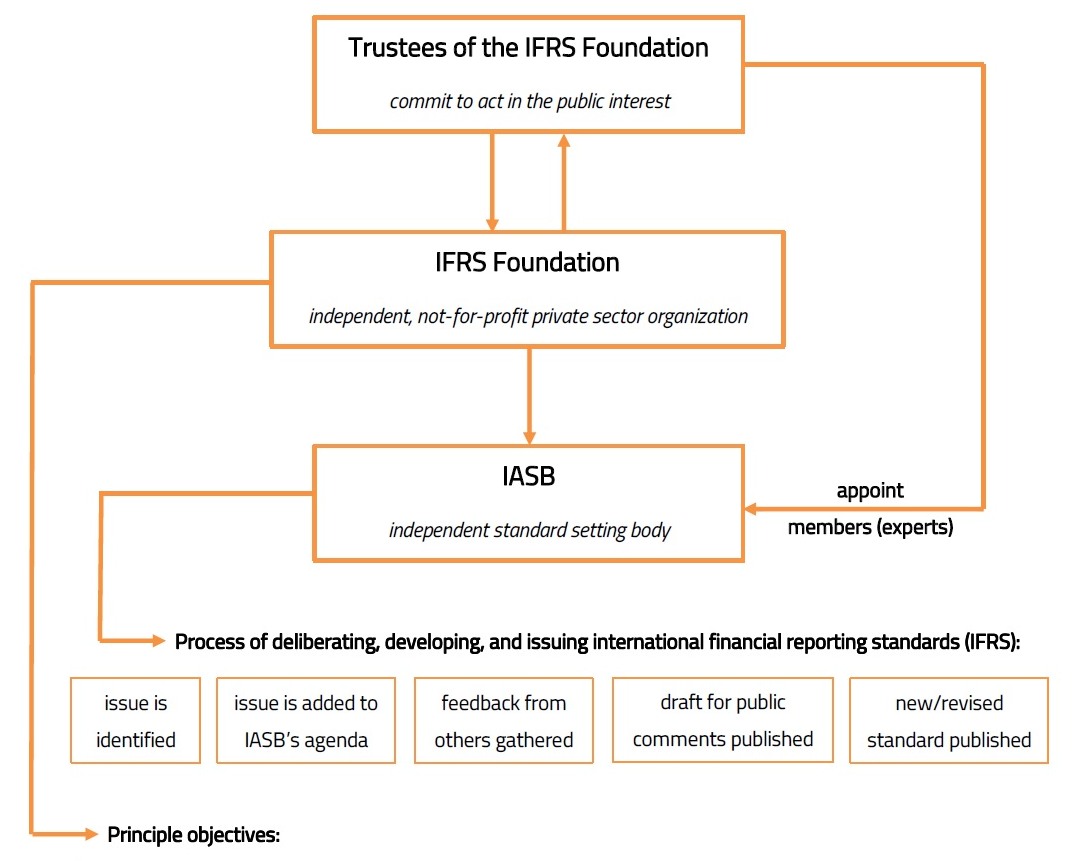

International Accounting Standards Board (IASB)

- to develop, in the public interest, a single set of high-quality, understandable, enforceable, and globally accepted financial reporting standards based upon clearly articulated principles. These standards should require the information presented in financial statements and other financial reports to be high quality, transparent, and comparable. Aim: to help investors, other participants in the world’s capital markets, and other users of financial information make economic decisions.

- to promote the use and rigorous application of those standards.,

- while fulfilling the above objectives, to take account of the needs of various entities in diverse economic settings.

- to promote and facilitate the adoption of International Financial Reporting Standards (IFRSs), being the standards and interpretations issued by the IASB, through the convergence of national accounting standards and IFRSs.

source: https://www.iasplus.com/en/resources/ifrsf/governance/ifrsf

Financial Accounting Standards Board (FASB)

Both the structure and process of deliberating, developing, and issuing financial reporting standards are very similar to the IASB’s structure and process.

The FASB establishes the so-called U.S. GAAP, which stands for the United States Generally Accepted Accounting Standards.

International Organization of Securities Commissions (IOSCO)

IOSCO:

- is not a regulatory authority per se

- gathers securities commissions from around the world

Core objectives of IOSCO:

- protecting investors,

- reducing systematic risk,

- ensuring markets are fair, efficient, and transparent.

Securities Exchange Commission (SEC)

In the USA, the regulatory authority, i.e. the SEC, also retains the power to set the financial reporting standards.

It’s worth noticing that the SEC rarely overrides standards set by the FASB but often states opinions and guidance about accounting-related disclosures, etc.

The key pieces of legislation in the USA:

- Securities Act of 1933 (specifies required information that investors must receive; prohibits misrepresentation; demands the initial registration of all public issuance of securities),

- Securities Exchange Act of 1934 (creates the SEC and makes it the authority regulating the securities market in the USA),

- Sarbanes-Oxley Act of 2002 (focuses on the independence of auditors; requires the company to report on its internal control over financial reporting; strengthens corporate responsibility for financial reporting).

(...)

European Union Capital Markets

Each country in the European Union regulates its own capital market. However, some regulations are adopted at the European level, for example, consolidated financial statements of public companies in Europe are to be prepared according to IFRS.

(...)

Financial Reports Constraints

We have to balance:

- between the cost of providing and using the information and the benefit of providing the information (the cost should be lower than the benefit), and

- between the 4 enhancing qualitative characteristics of financial reports (for example improving timeliness can have a negative impact on verifiability, so there is a trade-off).

Core Elements of Financial Statements

Financial statements provide information about the company’s:

- assets,

- liabilities,

- equity,

- income,

- expenses,

- contributions by and distributions to owners,

- cash flows.

An asset is a resource controlled by the company as a result of past events and which is expected to bring future economic benefits to the company.

Liabilities are present obligations of the company arising from past events, the settlement of which is expected to result in an outflow from the company of resources embodying economic benefits.

Equity equals assets minus liabilities (it is the residual interest in the assets after covering liabilities).

Income is an increase in assets or decrease in liabilities resulting in an increase in equity not related to contributions from or cash outflows to equity holders.

Revenues are income received for the supply of goods or services in the ordinary course of business.

Other income includes both gains that may or may not occur in the ordinary course of business.

Expenses are decreases in assets or increases in liabilities resulting in a decrease in equity not related to contributions from or cash outflows to equity holders

Measurement of Financial Statements Elements

(...)

source: https://www.iasplus.com/en/standards/ias/ias1

According to IAS No. 1, Presentation of Financial Statements, “the required components of financial statements are:

- a statement of financial position (balance sheet) at the end of the period,

- a statement of profit or loss and other comprehensive income for the period (presented as a single statement, or by presenting the profit or loss section in a separate statement of profit or loss, immediately followed by a statement presenting comprehensive income beginning with profit or loss),

- a statement of changes in equity for the period,

- a statement of cash flows for the period,

- notes, comprising a summary of significant accounting policies and other explanatory notes,

- comparative information prescribed by the standard.”

General Features Underlying Preparation of Financial Statements

source: https://www.iasplus.com/en/standards/ias/ias1

fair presentation:

"The financial statements must 'present fairly' the financial position, financial performance, and cash flows of an entity. Fair presentation requires the faithful representation of the effects of transactions, other events, and conditions in accordance with the definitions and recognition criteria for assets, liabilities, income, and expenses set out in the Framework. The application of IFRSs, with additional disclosure when necessary, is presumed to result in financial statements that achieve a fair presentation."

(...)

Structure & Content of Financial Statements

source: https://www.iasplus.com/en/standards/ias/ias1

classified statement of financial position:

"An entity must normally present a classified statement of financial position, separating current and non-current assets and liabilities, unless presentation based on liquidity provides information that is reliable. In either case, if an asset (liability) category combines amounts that will be received (settled) after 12 months with assets (liabilities) that will be received (settled) within 12 months, note disclosure is required that separates the longer-term amounts from the 12-month amounts."

line items:

"The line items to be included on the face of the statement of financial position are:

- property, plant, and equipment

- investment property

- intangible assets

- financial assets

- investments accounted for using the equity method

- biological assets

- inventories

- trade and other receivables

- cash and cash equivalents

- assets held for sale

- trade and other payables

- provisions

- financial liabilities

- current tax liabilities and current tax assets, as defined in IAS 12

- deferred tax liabilities and deferred tax assets, as defined in IAS 12

- liabilities included in disposal groups

- non-controlling interests, presented within equity

- issued capital and reserves attributable to owners of the parent."

- IASB promotes and facilitates the adoption of International Financial Reporting Standards (IFRSs).

- The FASB establishes U.S. GAAP, which stands for the United States Generally Accepted Accounting Standards.

- In the USA, the regulatory authority, i.e. the SEC, retains the power to set the financial reporting standards.

- 2 fundamental qualitative characteristics of financial reports are relevance and faithful presentation.

- 4 enhancing qualitative characteristics of financial reports are comparability, verifiability, timeliness, and understandability.

- Financial statements provide information about the company’s: assets, liabilities, equity, income, expenses, contributions by and distributions to owners, and cash flows.

- General features underlying the preparation of financial statements include fair presentation, going concern, accrual basis, materiality and aggregation, no offsetting, frequency of reporting, comparative information, and consistency of presentation.