Level 2 CFA® Exam Study Plan for MAY 2026 Candidates

CFA EXAM STUDY PLANNER available for ALL LEVELS

Optimal 4-Month Level 2 CFA Exam Study Plan

For all level 2 candidates who want to start their CFA exam prep in January 2026, here's our advice on the optimal 4-month level 2 CFA exam study plan and preparation.

Level 2 CFA Exam Study Schedule in 4 Months

START on 19 JAN 2026

1st Study Block: EI + CI + Topic Review

2nd Study Block: FI + DER + Topic Review

3rd Study Block: FSA + ECO + Topic Review

4th Study Block: QM + PM + Topic Review

5th Study Block: AI + ETH + Topic Review

FINAL REVIEW (27 Apr – 18 May)

END on 19-23 MAY 2026

Assumptions of Our Level 2 CFA Exam Study Plan

This sample 4-month level 2 CFA exam study plan:

- starts on 19 January 2026, i.e., 4 months before the MAY'26 level 2 CFA exam,

- is divided into 5 Study Blocks, each coupling two topics together,

- follows the topic order that starts with Equity and pairs the 15-10% and 10-5% topics together, but you can customize the topic sequence the way you like,

- has 3 weeks devoted to Final Review, when you should do as many mocks as possible,

- ends just before your CFA exam day.

The MAY 2026 level 2 exam window lasts from 19 to 23 May 2026. So, you can have from 3 to 4 weeks of – what we call – Final Review. Basically, that's when you should do as many mock exams as possible!

Level 2 CFA Exam Topic Deadlines Schedule

| Level 2 Topics | MAY 2026 Exam Deadlines |

|---|---|

| Equity Investments | 30 Jan |

| Corporate Issuers | 6 Feb |

| EI+CI Review | 7 Feb |

| Fixed Income | 17 Feb |

| Derivatives | 22 Feb |

| FI+DER Review | 25 Feb |

| EI+CI Review | 25 Feb |

| Financial Statement Analysis | 9 March |

| Economics | 15 March |

| FSA+ECO Review | 20 March |

| EI+CI+FI+DER Review | 20 March |

| Quantitative Methods | 29 March |

| Portfolio Management | 6 Apr |

| QM+PM Review | 12 Apr |

| EI+CI+FI+DER+FSA+ECO Review | 12 Apr |

| Alternative Investments | 18 Apr |

| Ethics | 25 Apr |

| AI+ETH Review | 26 Apr |

| Final Review | 18 May |

If you set up your personalized study plan,

the deadlines will get adjusted.

The time scheduled for each topic depends on its difficulty, the number of pages in the CFA Program Curriculum, and the number of questions devoted to the topic on the exam.

This is a sample 4-month level 2 CFA exam study plan. But you can have your own personalized study schedule, free but limited or unlimited available at pay-what-you-can prices:

CFA Exam: Level 2 is Different than Level 1

When you prepare for your level 2 CFA exam, you need to know how level 1 and level 2 exams differ. Here are the key differences between level 1 and level 2 CFA exams:

- exam format,

- contents of the exam & curriculum,

- topic weights.

1. Level 2 CFA Exam Format

The format of the level 2 CFA exam is different compared to the level 1 exam. No longer will you get a standard multiple-choice test. The level 2 exam consists of the so-called item sets (mini-cases). An item set includes a case statement called a vignette (it's like a short story description) followed by 4 multiple-choice questions to match the description. What stays the same is that for every multiple-choice question, 3 answers are provided and only one is correct.

Due to the item set exam format, it can be said that the level 2 CFA exam is more difficult than the level 1 exam. The good news is that you have more time per question on the exam.

Level 2 CFA candidates have approx. 3 minutes to cope with one multiple-choice question (it was 1.5 minutes in the level 1 exam) it's about 12 minutes per one item set (recall: one vignette supports 4 multiple-choice questions) you can expect 44 multiple-choice per exam session, i.e. 88 multiple-choice choice questions overall (find our prediction about the number of item sets in the level 2 exam).

FREE PRACTICE: sample level 2 CFA exam questions

2. Contents of the Exam & Level 2 Curriculum

Even though you will be tested in the same 10 topics you studied during your level 1 exam, you need to be prepared to apply your knowledge more deeply this time.

The problems you will have to solve when taking your level 2 CFA exam are highly detailed problems. Based on the opinions of those who took the exam, you can expect practically anything from your level 2 curriculum.

It means that you need to be more analytical while studying and pay more attention to detail.

3. Level 2 CFA Exam Topic Weights

In comparison with the level 1 exam, level 2 CFA exam topics have different weights. The topics with the highest weights are Equity, Financial Statement Analysis (aka. Financial Reporting & Analysis), Fixed Income, Ethics, and Portfolio Management: all with a topic weight of 10-15%. The other 5 topics, namely Derivatives, Corporate Issuers (aka. Corporate Finance), Quantitative Methods, Economics, and Alternative Investments are given a weight of 5-10%.

As you can see, all the topic weights for level 2 are given in ranges, which means that the exact number of questions per topic is hard to predict and may vary from exam to exam but we give our prediction in the blog post about CFA level 2 topic weightage).

In the past, Equity was the most important topic with a weight of 15-25%, which had to be taken into account when planning the CFA exam prep. Now, as many as 5 topics are given the same importance ranging from 10 to 15%. This means you should devote a similar effort to all these topics because you may expect a similar number of questions for these 5 topics. However, the Equity topic in your level 2 curriculum hasn't changed much, which makes it still quite lengthy and important.

Managing Level 2 CFA Exam Prep

Because of the crucial differences in both the format and the contents of the level 2 vs level 1 exam, you should arrange your level 2 exam preparation accordingly.

First of all, you have to solve as many mini-cases as possible to get thoroughly familiar with the form of the exam.

Secondly, to get acquainted with all the required study content, we recommend that you generally use your level 2 curriculum. To facilitate your studying process, however, you might want to use some complementary study materials like videos, tests, or a formulas app. They can help you to get the big picture, necessary practice, and lots of revision.

Thirdly, our advice is that you take the most important level 2 topics seriously. We particularly advise you to pay attention to Equity, Ethics, and Financial Statement Analysis while prepping for your level 2 exam. We think that you can expect the greatest number of questions on these topics. That's why we allowed for lots of Equity, Ethics, and FSA in our free CFA Exam Study Planner for level 2 candidates:

If you go for the paid version, you will also get access to 50 exam-type item sets, a mock, some videos, tests, and a Formulas App!

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with named study lessons inside, various level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

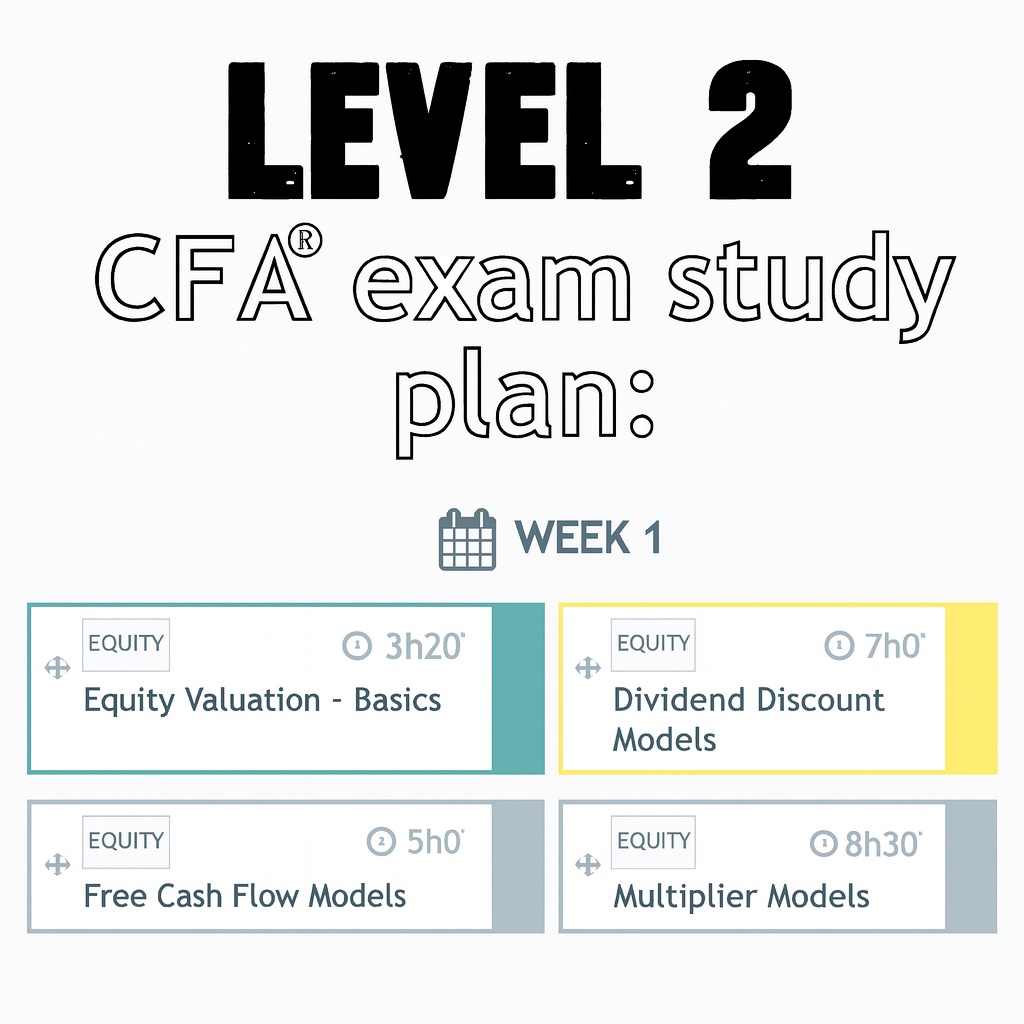

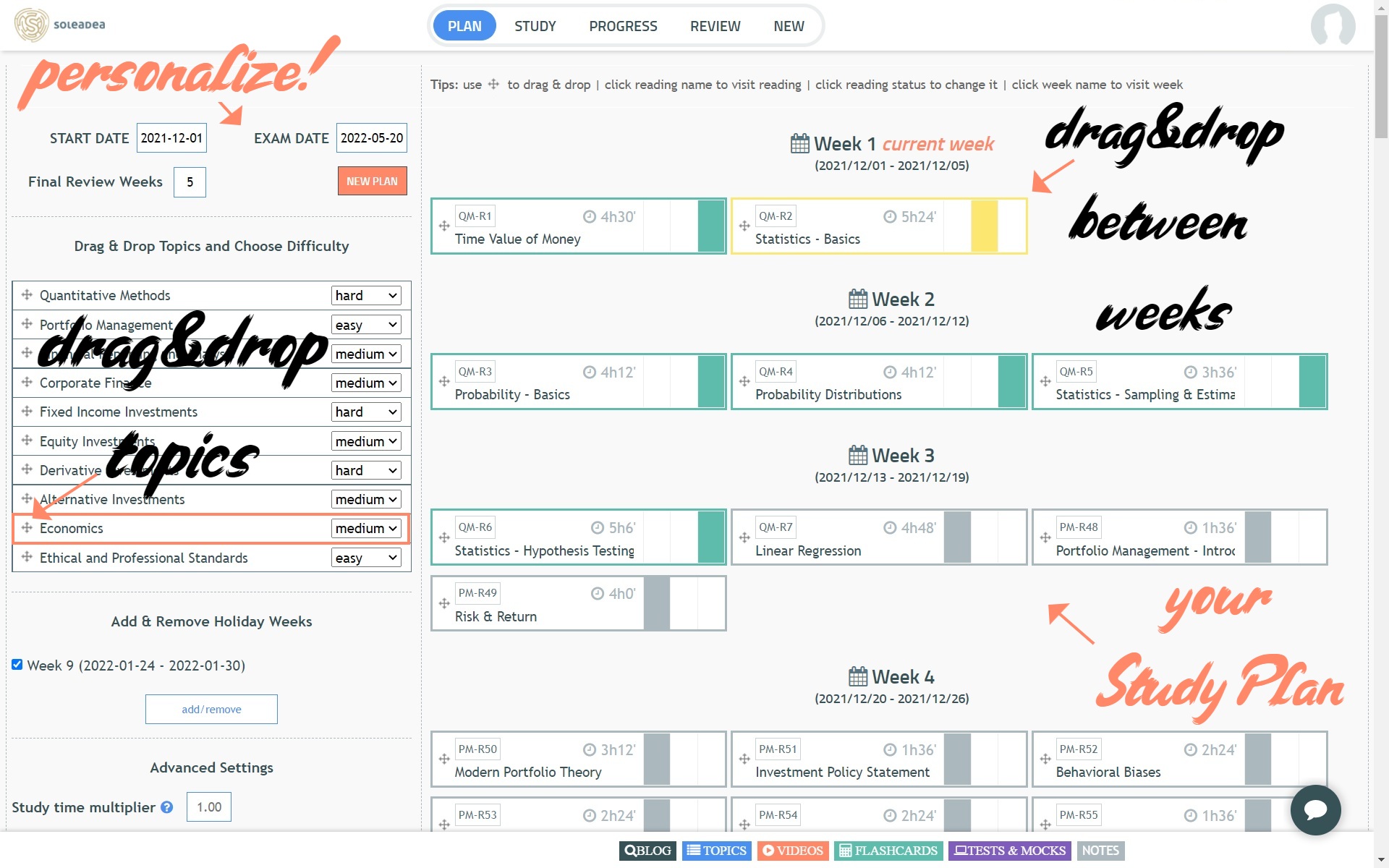

Here’s a sample CFA exam study schedule as displayed in our Study Planner:

PLAN VIEW of CFA EXAM STUDY PLANNER:

FIND your Study Plan in the PLAN tab View all the weeks of your CFA exam prep, see how much you’ve done and how much is still ahead of you, as well as customize your schedule using your Study Plan personalization options and the DRAG & DROP for both topics and study weeks.

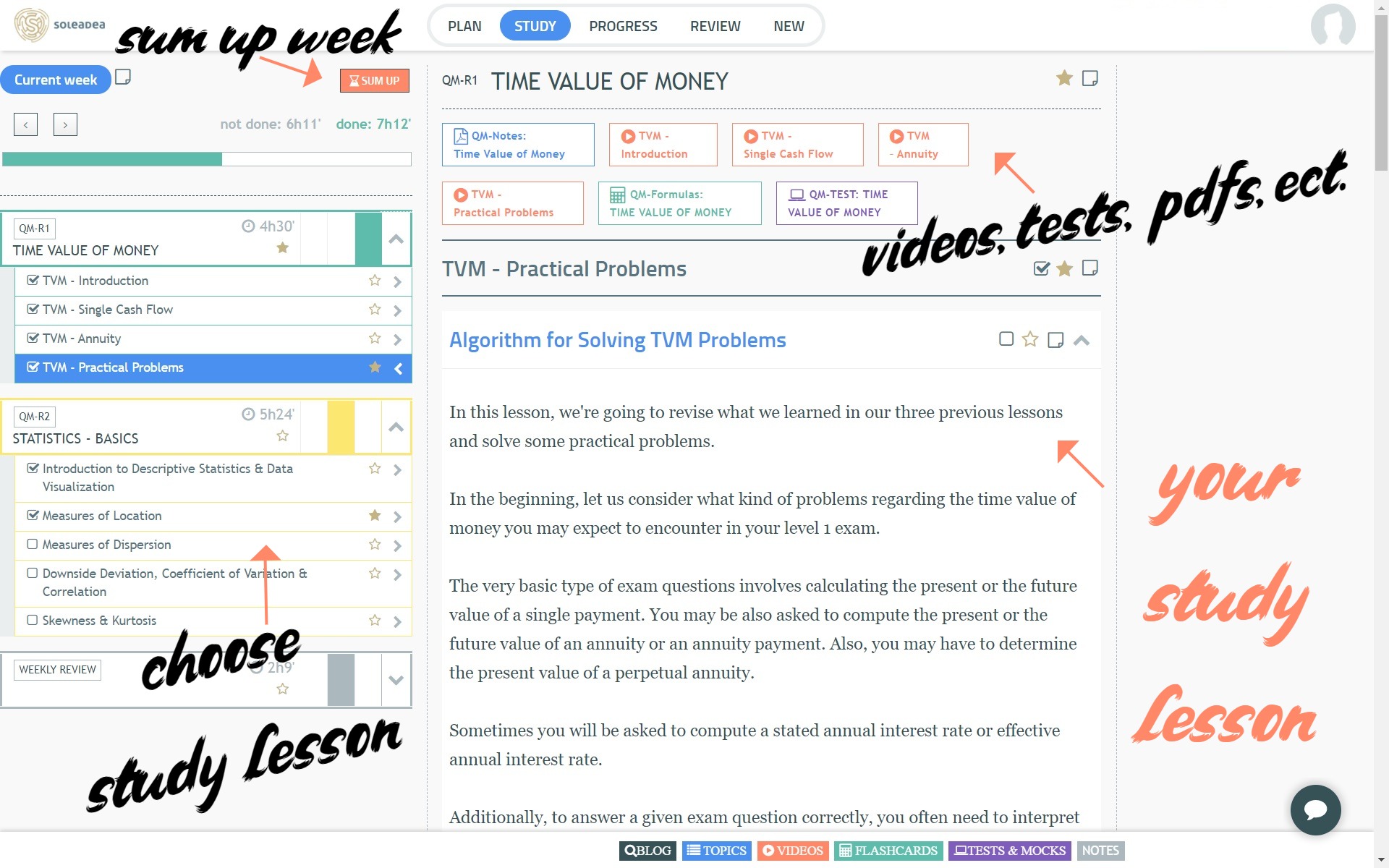

STUDY VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: STUDY View You will be asked to focus on your current week of studying. You will know what to study (left-hand menu) and how much to study (benchmark study times). Here, you'll also find your study lessons, including videos, tests, PDFs, etc. At the end of the week, your hard work will be evaluated (hit the SUM UP button).

PROGRESS VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: PROGRESS View You will be able to see your progress by topics and weeks. Each week your Chance to Pass score will go up or down.

REVIEW VIEW of CFA EXAM STUDY PLANNER:

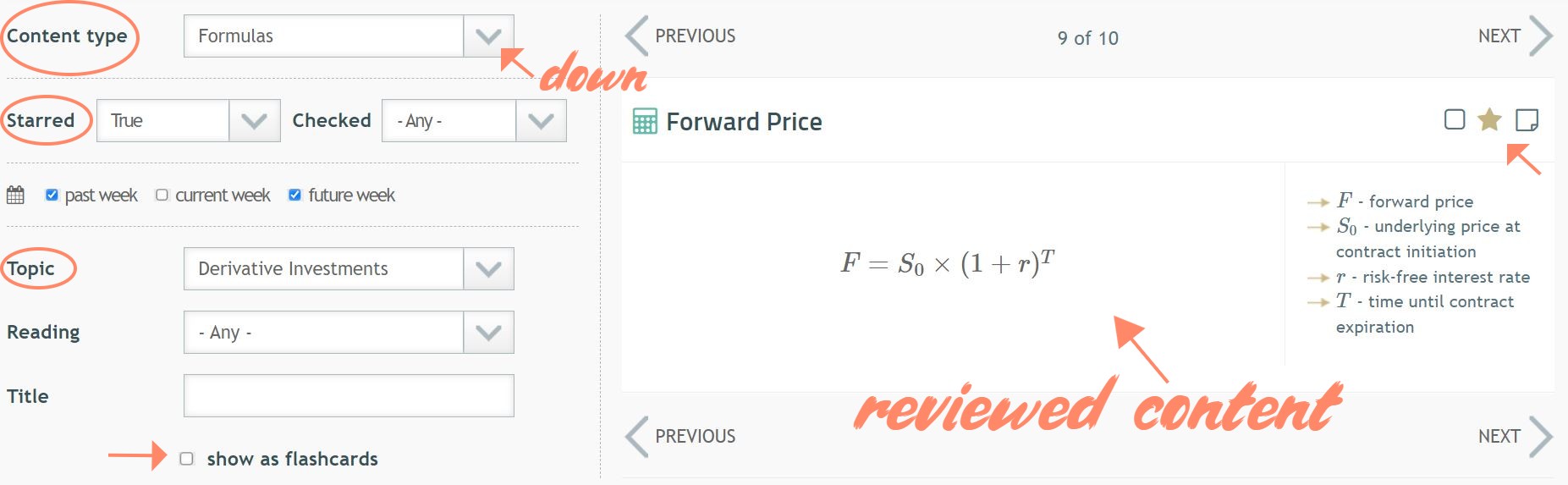

CFA Exam Study Planner: REVIEW View To learn, you must review. Use the special view of your Study Planner to review your study lessons, rewatch videos, revise formulas, etc.

Read Also:

- Level 2 CFA Exam Topics

- Full Level 2 CFA Mock

- Level 2 Sample Questions

- 2026 CFA Program Changes

- 3 Reasons Why You May Fail Your Exam