MAY 2026 Level 2 CFA® Exam Study Schedule in 5 Months

CFA EXAM STUDY PLANNER available for ALL LEVELS

Perfect Preparation Time for Level 2 CFA Exam

Most of the level 2 CFA candidates start their exam preparation approx. 5 months before the exam. Some will think that 6 months is a safer prep time and some will wait just a bit longer only to get down to intensive work when it's 4 months to the exam.

5 months of prepping for the level 2 CFA exam sounds like a perfect choice if you don't like it too intensive.

So, if you’re about to take your level 2 CFA exam in MAY 2026, it’s a perfect time to take up your preparation. Tempted to wait just a little bit longer, a week or a month perhaps? Naaah... Better pull up your sleeves and start right away. Especially since the level 2 exam can be a tough one.

How to Prepare for Level 2 CFA Exam?

Below, you will find how to prepare for the level 2 exam using a reliable 5-month level 2 CFA exam study plan. This preparation plan is divided into 5 Study Blocks, each ending with some topic revision. Spaced revision sessions allow for overcoming the forgetting curve, which can be quite steep for such a voluminous study content.

Before you go to the details of this study plan, however, take your time to learn a few key issues about the level 2 CFA exam format and prep characteristics.

What Should I Know About Level 2 CFA Exam?

CBT for Level 2 CFA Exam

First of all – as of 2021 – the level 2 CFA exam is transitioned to computer-based testing. It means that the exam will be delivered on computers in proctored test centers around the world.

Importantly, in some aspects, the level 2 exam is more difficult compared to the level 1 exam. The level 2 CFA exam pays great attention to detail and requires analytical skills.

Level 2 CFA Exam Item Sets

The format of the exam changes. For level 2, traditional multiple-choice questions are composed into the so-called item sets.

An item set consists of a vignette (approximately one-page long description) + 4 multiple-choice questions (related to the vignette). Every exam session includes 44 multiple-choice questions grouped into item sets (read about our prediction about the number of item sets in the level 2 exam). You'll have around 12 minutes per one item set. It’s not much when you think of quite lengthy vignettes you must read in order to answer the questions. The vignettes will include tons of data, some of which may prove totally irrelevant.

Topics Tested in Level 2 CFA Exam

Another unique thing about level 2 CFA exam prep is the topics. There are 10 topics for level 2, like for level 1. Level 2 CFA exam topic weights are given in ranges but the topic weight ranges change compared to level 1 topics.

The most important topics in the level 2 CFA exam are:

- Equity,

- Financial Statement Analysis,

- Fixed Income,

- Portfolio Management,

- and Ethics.

The table below presents the most crucial information on level 2 CFA exam topics:

| Number of pages in curriculum | Minimum topic weight | Maximum topic weight | No. of questions per topic* | Topic efficiency | |

|---|---|---|---|---|---|

| Quantitative Methods | 365 | 5% | 10% | 4-8 | 1.6 |

| Economics | 195 | 5% | 10% | 4-8 | 3.0 |

| Financial Statement Analysis | 547 | 10% | 15% | 8-12 | 1.8 |

| Corporate Issuers | 216 | 5% | 10% | 4-8 | 2.7 |

| Equity Investments | 445 | 10% | 15% | 8-12 | 2.2 |

| Fixed Income | 309 | 10% | 15% | 8-12 | 3.2 |

| Derivatives | 153 | 5% | 10% | 4-8 | 3.9 |

| Alternative Investments | 202 | 5% | 10% | 4-8 | 2.9 |

| Portfolio Management | 384 | 10% | 15% | 8-12 | 2.6 |

| Ethics | 262 | 10% | 15% | 8-12 | 3.8 |

* estimated based on the minimum and maximum level 2 CFA exam topic weights and knowledge of exam format

The first four columns need no explanation. The last column concerns topic efficiency, which is defined as the number of questions in the exam per 100 pages of the CFA Program Curriculum:

\(\text{E}=\frac{\text{Q}}{\text{N}}\times\text{100 pages}\)

Where:

- E – topic efficiency,

- Q – estimated average number of questions for a topic,

- N – number of pages on a topic in the CFA Program Curriculum.

For example, if the efficiency for Economics is 3, it means that in the exam you will find about 3 questions per every 100 pages on ECO in the curriculum.

Taking this criterion into consideration, we can divide the topics into 3 groups:

- High topic efficiency: DER, ETH, FI

- Moderate topic efficiency: ECO, AI, CI, PM

- Low topic efficiency: EI, FSA, QM

The topic efficiency criterion may come in handy if you run out of time and need to reconsider how much you’re going to spend on each topic. Of course, some other variables, like e.g. topic weights, need to be accounted for then as well.

What Level 2 Study Materials Should I Use?

Because of the detailed nature of the level 2 exam, it is believed that the CFA Program Curriculum is the best source of knowledge for level 2 candidates.

We also believe so, and this is why we encourage you to use your level 2 CFA exam curriculum as much as possible, especially since you’re a 5-month study plan user and still have much preparation time at your disposal.

HOWEVER: Though the curriculum is the best source of knowledge, it doesn’t mean it’s best for knowledge retention. Particularly during the revision sessions, you should also depend on reliable complementary materials. Choose those presenting the curriculum in the most digestive and user-friendly way.

Will I Find Any Interesting

Level 2 Study Materials at Soleadea?

Sure you will, both free and paid.

First, check our CFA Exam Study Planner. Inside you will find some free level 2 videos and item sets.

If you like them, you’ll be able to purchase as many as 40+ hours of to-the-point L2 videos and 50 item sets.

Our videos are short but exhaustive and let the knowledge sink in. The item sets, which are constructed like exam-type questions (vignette + multiple-choice questions), make a perfect practice tool. We strongly believe that doing exam-type questions is the key to success. That’s why it’s important for the tests you do to have the right format.

How To Use Level 2 CFA Exam Curriculum?

CFA Program Curriculum presents the study material in diversified ways. Apart from the plain subject-related text, after most of the readings, you will also find the so-called end-of-reading questions. Moreover, you can find numerous examples throughout the readings. These are perfect for practice and they should be duly analyzed.

Pay attention particularly to those questions that are constructed into item sets to get used to the exam format from the very beginning.

L1 vs L2: Exam Prep Hints

You had your way of preparing for the level 1 CFA exam. If you feel it worked, follow the route.

First, however, apply some constructive criticism to your level 1 preparation. If after thorough analysis you find things you could do better, improve your studying strategy.

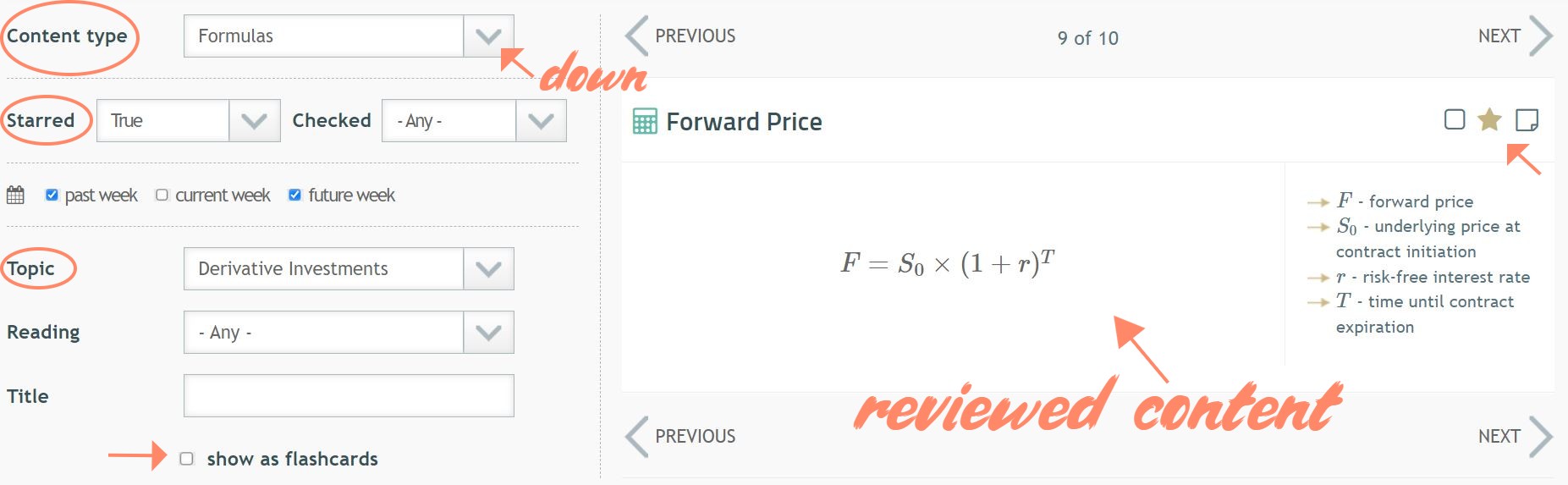

Learn formulas systematically. You can write down the CFA Program Curriculum formulas and repeat them often. You can also use the shortcut way and get the ready-made level 2 formulas e-book. Also inside our CFA Exam Study Planner, you will find a special Formulas App to practice the formulas on an everyday basis.

Like for level 1, follow the LOS (Learning Outcomes) enumerated before every chapter. Also, make use of the bolded terms and concepts that indicate what you should know after each reading.

Detailed 5-Month Level 2 CFA Exam Study Schedule

This sample 5-month level 2 CFA exam plan starts on 22 Dec 2025. Meanwhile, there's a weekly pause in studying. You can personalize your holiday dates if you indeed opt for some time off. The whole preparation period is divided into 5 Study Blocks, each ending with Topic Review:

START on 22 DEC 2025

1st Study Block: EI + CI + Topic Review

2nd Study Block: FI + DER + Topic Review

3rd Study Block: FSA + ECO + Topic Review

*HOLIDAYS*

4th Study Block: QM + PM + Topic Review

5th Study Block: AI + ETH + Topic Review

FINAL REVIEW (20 Apr – 18 May)

END on 19-23 MAY 2026

The MAY 2026 level 2 exam window lasts from 19 to 23 May 2026. So, you can have from 4 to 5 weeks of – what we call – Final Review. Basically, that's when you should do as many mock exams as possible!

Note that while using our CFA Exam Study Planner you can easily choose your own topics sequence – there's drag&drop for topics in your study plan options when you go to the PLAN view of your study schedule.

With 5 months to your exam, we think you can surely afford 1 week off studying (when exactly is your choice!). Such a break has 2 functions. On the one hand, it allows you to recharge batteries in the middle of your exam preparation. On the other hand, it motivates you to work hard on the first few topics. It’s like an award for those who follow the plan!

5-Month Level 2 CFA Exam Study Schedule: Topic Deadlines

Your level 2 CFA exam study schedule + 1 week off studying has been timetabled below. Deadlines are given for all 10 level 2 topics and your topic review sessions:

| Level 2 Topics | MAY 2026 Exam Deadlines |

|---|---|

| Equity Investments | 4 Jan |

| Corporate Issuers | 11 Jan |

| EI+CI Review | 13 Jan |

| Fixed Income | 25 Jan |

| Derivatives | 31 Jan |

| FI+DER Review | 3 Feb |

| EI+CI Review | 3 Feb |

| Financial Statement Analysis | 16 Feb |

| Economics | 22 Feb |

| FSA+ECO Review | 1 March |

| EI+CI+FI+DER Review | 1 March |

| *HOLIDAYS* | 8 March |

| Quantitative Methods | 16 March |

| Portfolio Management | 28 March |

| QM+PM Review | 4 Apr |

| EI+CI+FI+DER+FSA+ECO Review | 4 Apr |

| Alternative Investments | 9 Apr |

| Ethics | 17 Apr |

| AI+ETH Review | 19 Apr |

| Final Review | 18 May |

If you set up your personalized study plan,

the deadlines will get adjusted and you'll be able to decide if and when you need *HOLIDAYS*, i.e., time without studying.

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with named study lessons inside, various level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

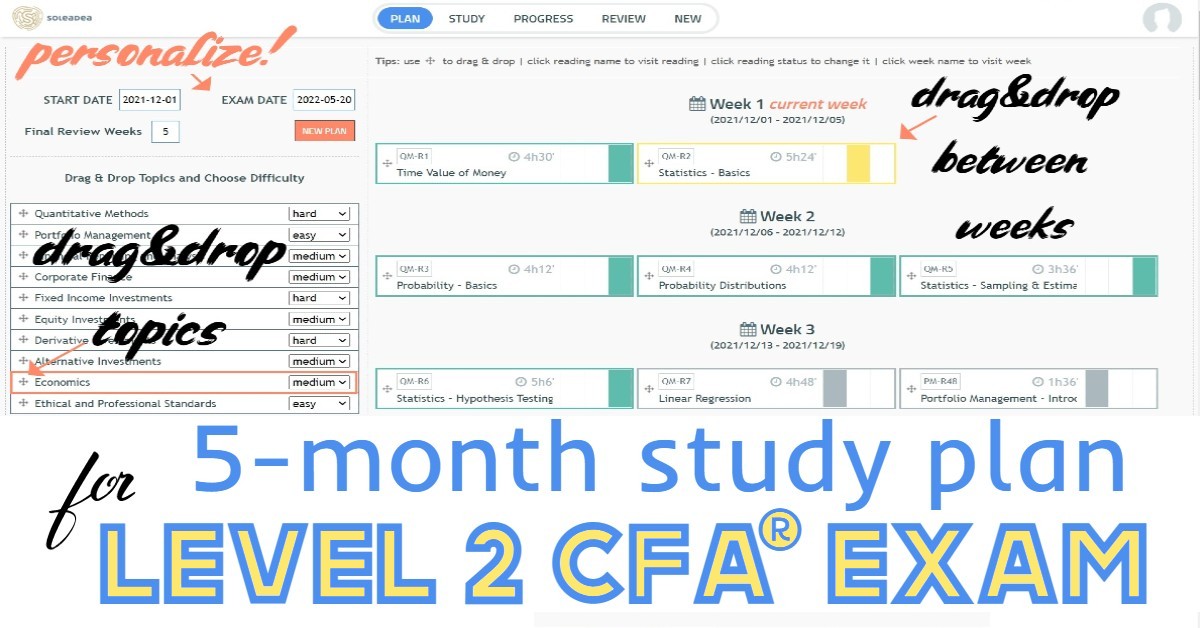

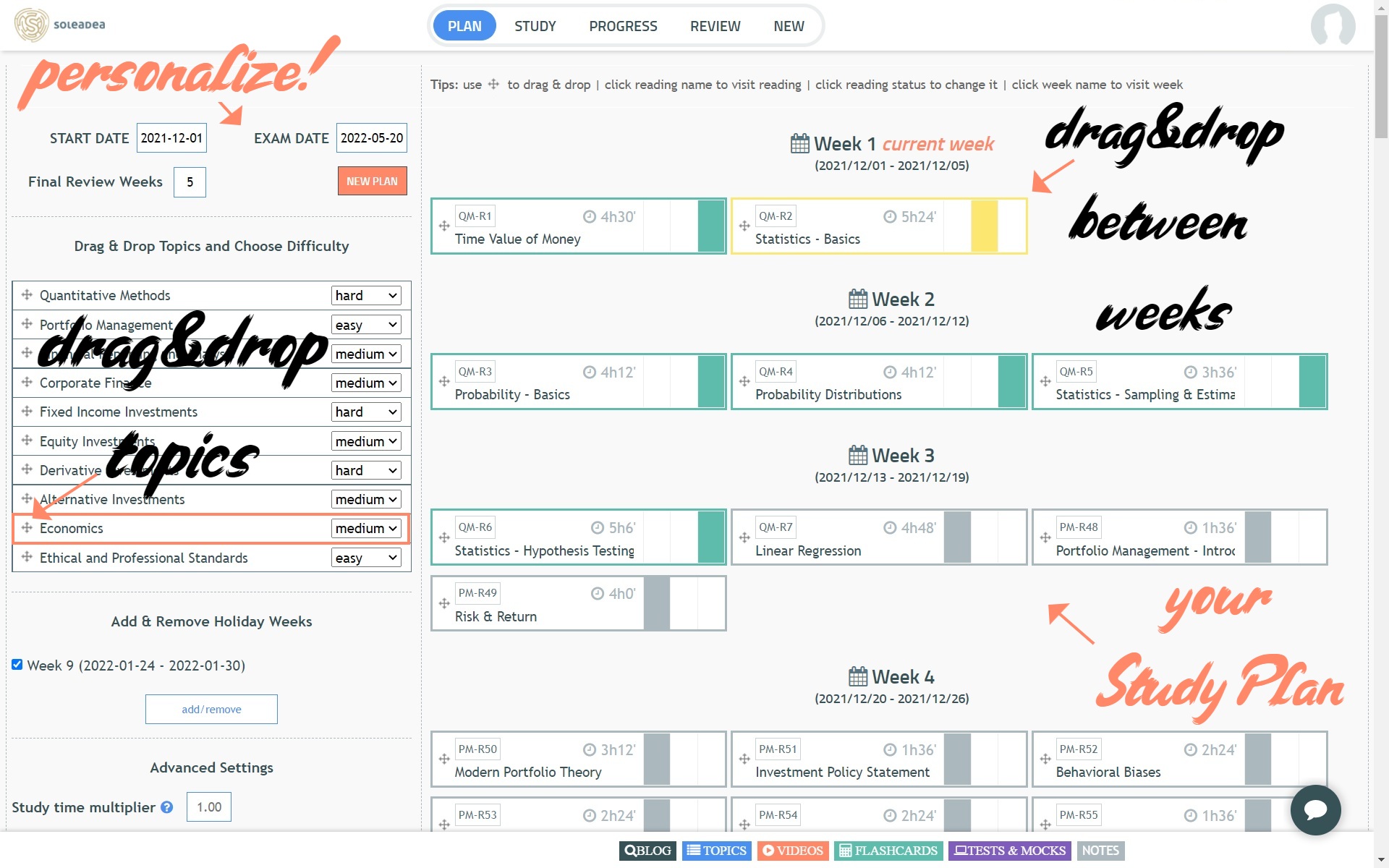

Here’s a sample CFA exam study schedule as displayed in our Study Planner:

PLAN VIEW of CFA EXAM STUDY PLANNER:

FIND your Study Plan in the PLAN tab View all the weeks of your CFA exam prep, see how much you’ve done and how much is still ahead of you, as well as customize your schedule using your Study Plan personalization options and the DRAG & DROP for both topics and study weeks.

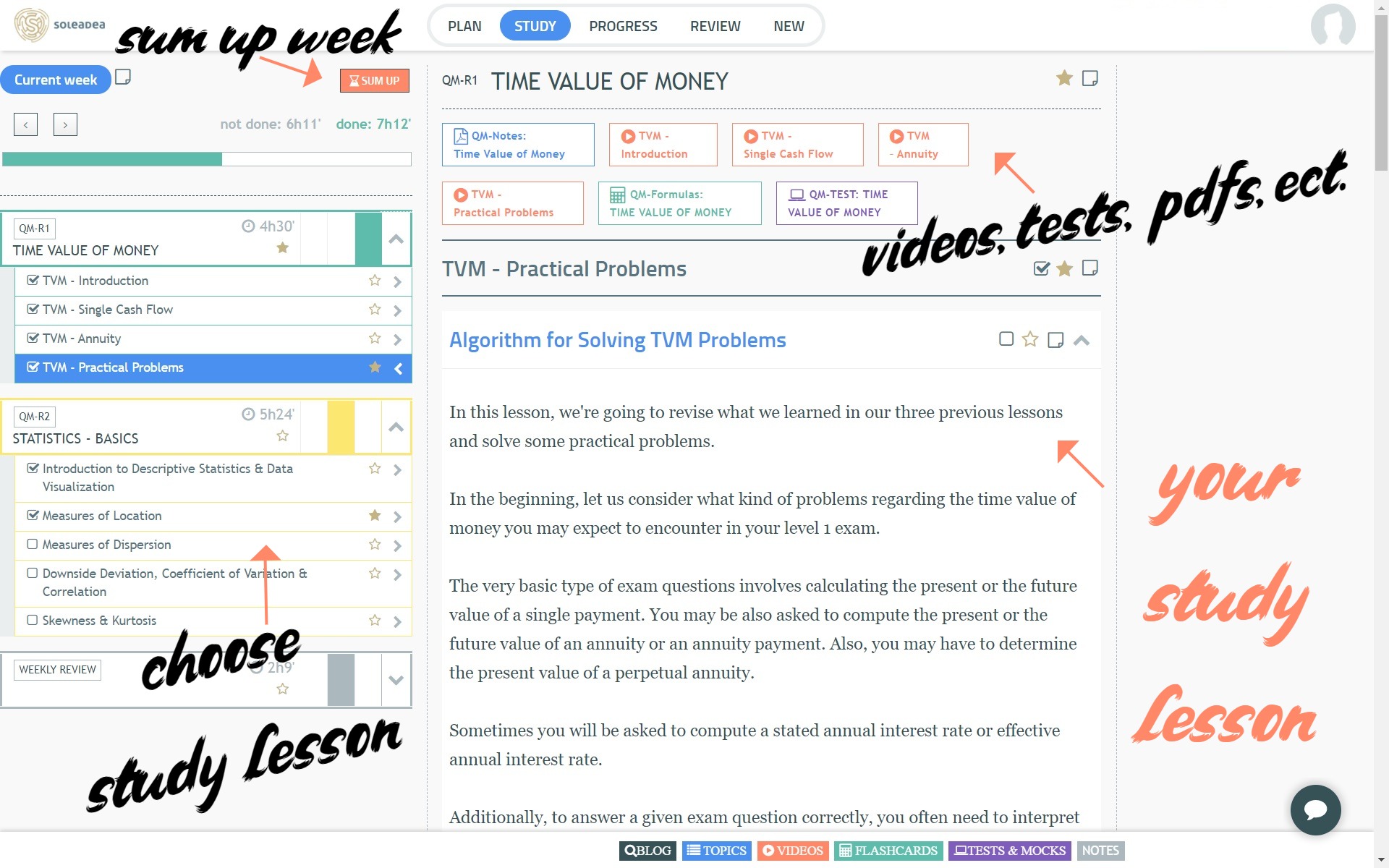

STUDY VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: STUDY View You will be asked to focus on your current week of studying. You will know what to study (left-hand menu) and how much to study (benchmark study times). Here, you'll also find your study lessons, including videos, tests, PDFs, etc. At the end of the week, your hard work will be evaluated (hit the SUM UP button).

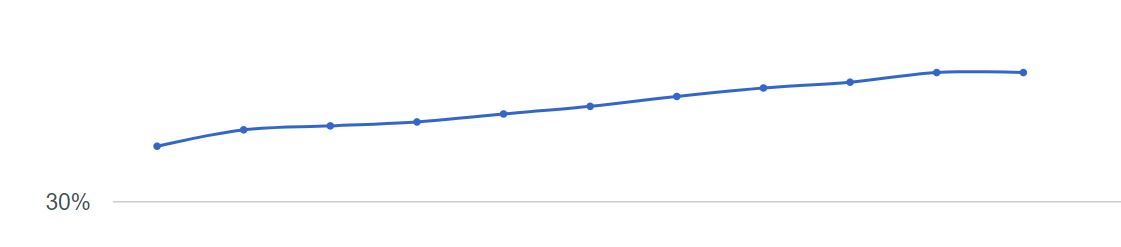

PROGRESS VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: PROGRESS View You will be able to see your progress by topics and weeks. Each week your Chance to Pass score will go up or down.

REVIEW VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: REVIEW View To learn, you must review. Use the special view of your Study Planner to review your study lessons, rewatch videos, revise formulas, etc.

Read Also:

- Level 2 CFA Exam Topics

- Full Level 2 CFA Mock

- Level 2 Sample Questions

- 2026 CFA Program Changes

- 3 Reasons Why You May Fail Your Exam