How to Prepare for FEB 2026 Level 1 CFA® Exam in 3 Months?

CFA EXAM STUDY PLANNER available for ALL LEVELS

3-Month Level 1 CFA Exam Study Plan: Intro

This post tells you how to efficiently prepare a 3-month CFA exam study plan. Apart from the study schedule, below you will also find 4 level 1 CFA exam topic categorizations together with some relevant exam preparation hints designed to let you make the most of the upcoming 3 months.

What Kind of Learner Are You?

To equip you with the right mindset for the next 3 months preceding your CFA exam, we begin with a BIG question:

ARE YOU A SUPERHERO?

Very Important: Your aim after reading this post is to accept who you are. Possible choices: natural learner vs supernatural learner:

- I am a supernatural learner possessing intellectual skills worth a superhero.

- I am a natural learner, which means I can acquire any kind of knowledge if I have enough time (as for my CFA exam, I would make do with these 3 months).

YES! There are (only) 3 months left before the exam is due. This implies lots of hard work for natural learners. For supernatural ones, it presumably makes no difference ;).

Have you ever heard a story about how someone passed their CFA exam having studied for only [choose the option applicable to the story]:

6 weeks/4 weeks/2 weeks?

We have.

And we know what it is when we hear it. A fairy tale!

It’s surely better to take it that you are not a superhero kind of learner and NEVER BELIEVE SUCH FAIRY TALES! This kind of devil-may-care scenario simply has no happy ending.

If you dream of a happy ending for yourself, take your CFA exam prep (and the exam itself) seriously. Otherwise, you may as well join the 25% of candidates who do not even show up for the exam because they know they did far too little to pass.

AVAILABLE FOR ALL LEVELS

3-MONTH PREP:

Level 1 CFA Exam Topic Categorizations

To prepare for your level 1 CFA exam, you need to study 10 topics. They can be handled using different techniques. Below, you can find 3 possible level 1 topic categorizations we prepared for you (plus 1 you will be guided on how to create on your own).

Level 1 CFA exam topics can be divided using 3 criteria:

- exam weights,

- difficulty,

- efficiency.

When you prepare to take your CFA exam, it's best if you apply a mix of the criteria to rationally plan how long to study each of the topics.

FEB 2026 Level 1 CFA Exam Topic Weights

The graph presents the FEB 2026 level 1 topic weights, given in ranges. The most important CFA exam topics, i.e. given the highest weight, are:

- Ethics, with the exam weight even as high as 20% (note that ethical issues are important in the exam also because of the ethics adjustment), and

- Financial Statement Analysis, with the exam weight ranging from 11% to 14%.

Fixed Income and Equity Investments follow with the same exam weight ranging from 11% to 14%.

Then, comes another couple of topics with a moderate weight range of 8% to 12% for Portfolio Management and 7% to 10% for Alternative Investments (these are the topics whose exam weights have changed visibly).

The last group is made of 4 topics given the lowest weight. These are Quantitative Methods, Economics, and Corporate Issuers, whose weightage drops to 6-9%. Last but not least, there are Derivatives with the unchanged 5-8% topic weight.

#1. CFA EXAM PREP HINT

Spend more time on the topics with higher weights – the higher the weight, the greater the number of topic questions per exam session.

Level 1 Topics & Their Difficulty

Another criterion used to categorize level 1 CFA exam topics is their difficulty. Contrary to the weight criterion, this one is subjective, which means that the classification we propose below may not work for you. Just the opposite, if you easily grasp mathematical concepts but you find it difficult to memorize things and learn them by heart, you may feel that Equity Investments is a greater challenge to you than Fixed Income.

Our division is based on our observations during the courses we provided, as well as the opinions of Soleadea users given mostly through questionnaires.

According to this classification, we distinguish 3 groups of topics: difficult, moderate, and easy. Note that the sequence of topics is very important here: the higher the position, the more difficult the topic.

Difficult CFA exam topics:

- Derivatives (DER) – a positive thing about Derivatives is that although the concepts are difficult, level 1 exam questions often prove easier,

- Fixed Income (FI),

- Financial Statement Analysis (FSA).

Moderate CFA exam topics:

- Quantitative Methods (QM),

- Ethics,

- Alternative Investments (AI).

Easy CFA exam topics:

- Economics (ECO),

- Portfolio Management (PM),

- Corporate Issuers (CI),

- Equity Investments (EI).

How do we define difficulty?

If a topic is said to be difficult, it means that the concepts it covers are considered difficult. It does not have to mean it will take you long to acquire the topic.

Based on this topic difficulty, we proposed what we call Soleadea Topic Sequence, where we mix moderate, difficult, and easy topics plus – when possible – put topics thematically into pairs, namely QM, PM, FSA, CI, FI, EI, DER, AI, ECO, Ethics.

So, first comes moderate QM, then easy PM. FSA being difficult is matched thematically with easy CI, and so is difficult FI and easy EI. Last but not least, there is difficult but short DER followed by moderate, bite-sized AI, and easy ECO. As far as Ethics go – you can do it either at the beginning or at the end of your prep. You can go for the Soleadea Topic Sequence when you set up your CFA exam study plan or you can quickly DRAG&DROP topics in your study plan options to get your desired topic order.

#2. CFA EXAM PREP HINT

If you happen to REALLY struggle with something while studying, be careful not to lose too much time on it. Instead, consider leaving it out (at least for the time being) in favor of other concepts & problems. Go back to it if you still have time before your exam.

AVAILABLE FOR ALL LEVELS

Efficiency of Level 1 CFA Exam Topics

The last classification we are going to present is about the efficiency of the topics.

Efficiency is understood as the average number of exam questions for a given topic per 100 pages of the CFA Program Curriculum and it is calculated using the following equation:

\(\text{E}=\frac{\text{W}\times\text{180 questions}}{\text{N}}\times\text{100 pages}\)

Where:

- E – topic efficiency,

- W – topic weight,

- N – no. of pages on a topic in the CFA Program Curriculum.

For example, if the efficiency for Ethics is 11.7, it means that in the exam you will find from 11 to 12 questions per every 100 pages on Ethics in the Curriculum.

#3. CFA EXAM PREP HINT

If there are two topics similar in difficulty for you and you run out of time, focus more on the topic with higher efficiency. If you feel you need to give up on a topic due to lack of time, we think that Economics may be the topic to drop (it’s often quite intuitive to many CFA candidates with some financial background). Do not give up on other topics too easily even if their efficiency is low! (Always remember to catch up before your level 2 exam...)

Your CFA Exam Topics Classification

The last division is yours to decide.

For example, you should consider your previous knowledge of topics. If you took your finance course at university or you work in finance, you will definitely know some topics better than others.

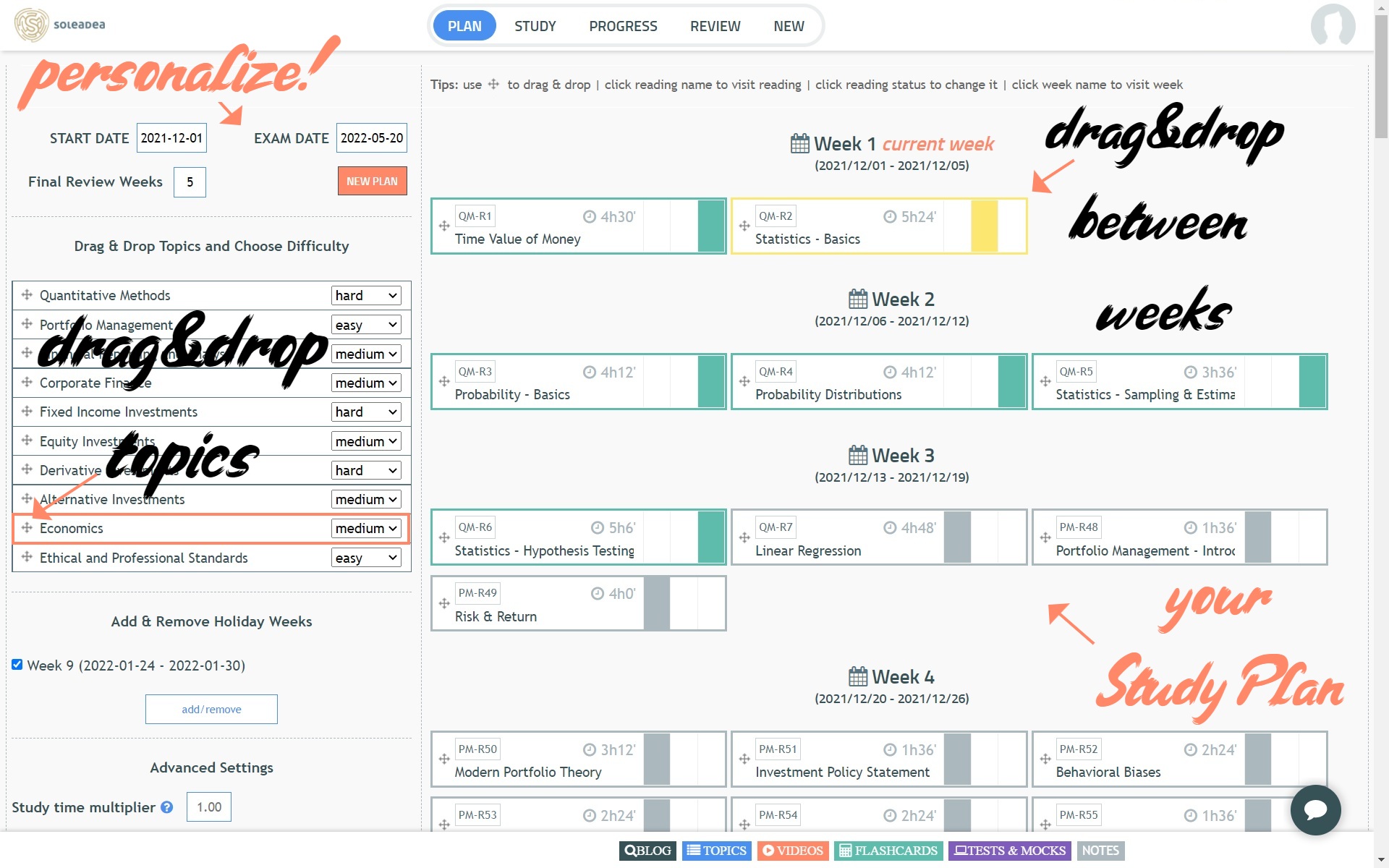

You must take this into account while arranging your 3-month study plan. Because every candidate has different knowledge background and, thus, different study needs. While exam weights or topic efficiency are objective criteria, there is a number of subjective factors such as topic difficulty or fluency that are equally crucial when you plan your CFA exam preparation. We know this and that's why we enable our users to easily customize their study plans by choosing the topic sequence or using the DRAG&DROP feature to quickly move CFA exam readings across study weeks (go to the PLAN view of your study schedule).

#4. CFA EXAM PREP HINT

When planning your CFA exam prep, take into consideration what you already know.

LEVEL 1 CURRICULUM = over 3000 pages

Are You a Superhero?

If NOT get down to work now using our CFA Exam Study Planner.

YES? Quit the CFA exam & save the world like superheroes do .

3-Month Level 1 CFA Exam Study Plan: Details

If you plan to start your CFA exam prep as of 3 Nov, you will get a study schedule exactly like the one below. Of course, unless you choose to personalize it... and personalize you should! By all means, we recommend you choose the topic difficulty or tick off the already-studied readings. 'Cos a personalized study plan is what you need! Let the one below be a sample 3-month schedule then...

START on 3 NOV 2025

1st Study Block: QM + PM + Topic Review

2nd Study Block: FSA + CI + Topic Review

3rd Study Block: FI + EI + Topic Review

4th Study Block: DER + AI + Topic Review

5th Study Block: ECO + ETH + Topic Review

FINAL REVIEW (12 Jan – 1 Feb)

END on 2-8 FEB 2026

The FEB 2026 level 1 exam window lasts from 2 to 8 February 2026. So, you can have from 3 to 4 weeks of – what we call – Final Review. Basically, that's when you should do as many mock exams as possible!

3-Month Level 1 CFA Exam Study Plan: Deadlines

| Level 1 CFA Exam Topics | FEB 2026 Study Deadlines |

|---|---|

| Quantitative Methods | 11 Nov |

| Portfolio Management | 16 Nov |

| QM+PM Review | 17 Nov |

| Financial Statement Analysis | 27 Nov |

| Corporate Issuers | 2 Dec |

| FSA+CI Review | 4 Dec |

| QM+PM Review | 4 Dec |

| Fixed Income | 12 Dec |

| Equity Investments | 19 Dec |

| FI+EI Review | 21 Dec |

| QM+PM+FSA+CI Review | 21 Dec |

| Derivatives | 25 Dec |

| Alternative Investments | 27 Dec |

| DER+AI Review | 29 Dec |

| QM+PM+FSA+CI+FI+EI Review | 29 Dec |

| Economics | 4 Jan |

| Ethics | 10 Jan |

| ECO+ETH Review | 11 Jan |

| Final Review | 1 Feb |

If you set up your personalized study plan,

the deadlines will get adjusted.

AVAILABLE FOR ALL LEVELS

Level 1 CFA Exam in 3 Months: Prep Hints

Let us summarize the key things you need to remember after reading this post:

- There are 3 months left no time to lose before your CFA exam.

- You should spend more time on the topics with higher weights in the exam – the higher the weight, the greater the number of topic questions per exam session.

- If you happen to REALLY struggle with something while studying, be careful not to lose too much time on it. Instead, consider leaving it out (at least for the time being) in favor of other concepts & problems. Go back to it if you still have time before your exam.

- If there are two topics similar in difficulty for you and you run out of time, focus more on the topic with higher efficiency. If you feel you need to give up on a topic due to lack of time, we think that Economics may be the topic to drop (it’s often quite intuitive to many CFA candidates with some financial background). Do not give up on other topics too easily even if their efficiency is low! (Always remember to catch up before your level 2 exam...)

- When planning your CFA exam prep, take into consideration what you already know.

- Soleadea offers a CFA Exam Study Planner that allows you to organize your personalized CFA exam preparation successfully.

- Not everyone can be a superhero ;).

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Here’s a sample level 1 CFA exam study schedule as displayed in our Study Planner:

PLAN VIEW of CFA EXAM STUDY PLANNER:

FIND your Study Plan in the PLAN tab View all the weeks of your CFA exam prep, see how much you’ve done and how much is still ahead of you, as well as customize your schedule using your Study Plan personalization options and the DRAG & DROP for both topics and study weeks.

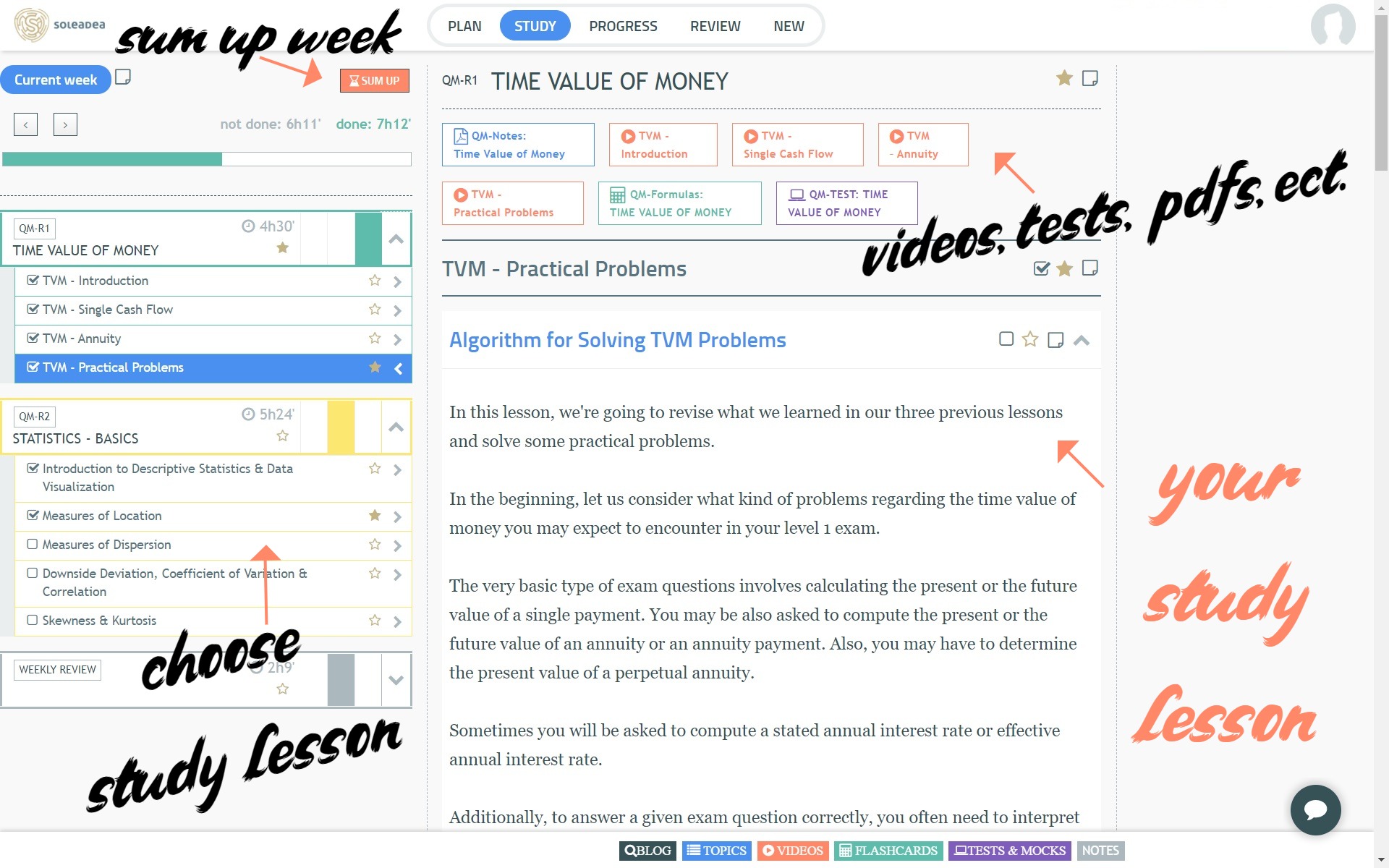

STUDY VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: STUDY View You will be asked to focus on your current week of studying. You will know what to study (left-hand menu) and how much to study (benchmark study times). Here, you'll also find your study lessons, including videos, tests, PDFs, etc. At the end of the week, your hard work will be evaluated (hit the SUM UP button).

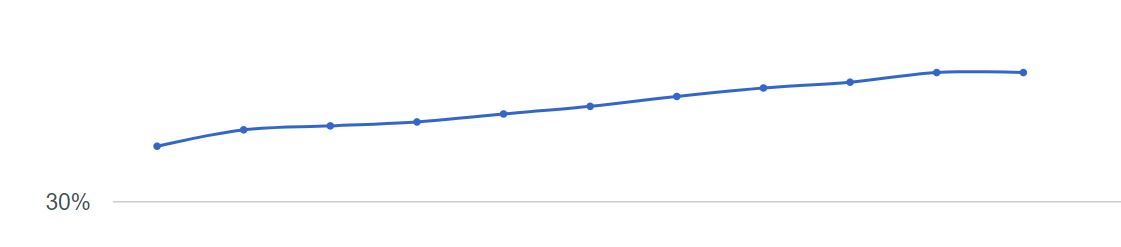

PROGRESS VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: PROGRESS View You will be able to see your progress by topics and weeks. Each week your Chance to Pass score will go up or down.

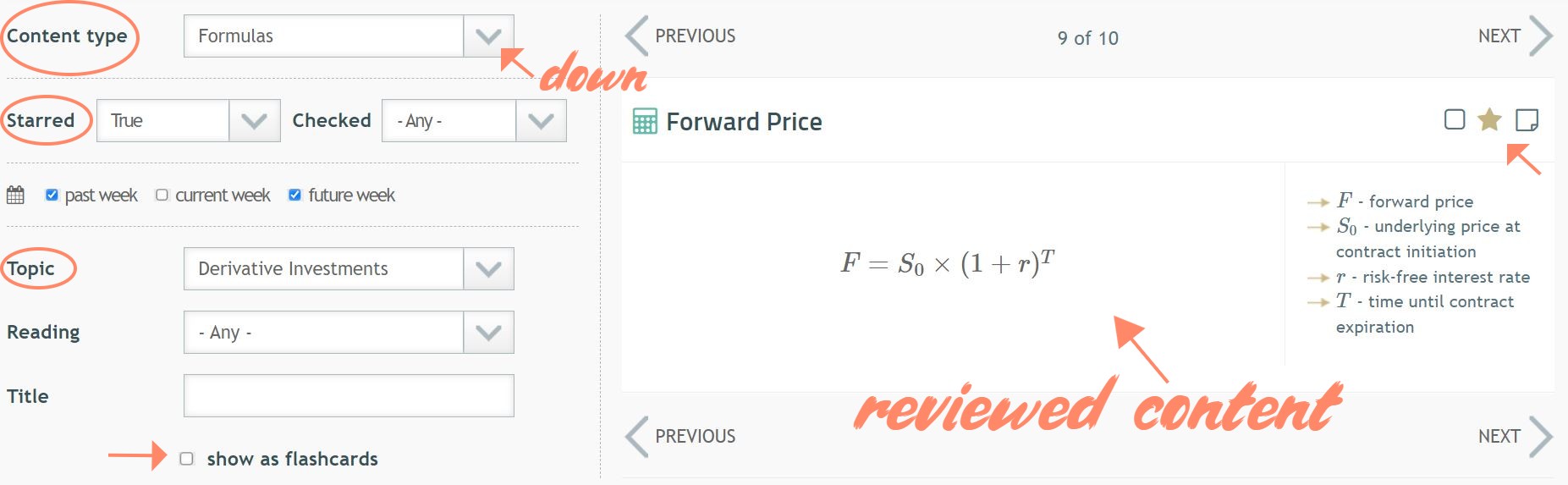

REVIEW VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: REVIEW View To learn, you must review. Use the special view of your Study Planner to review your study lessons, rewatch videos, revise formulas, etc.

AVAILABLE FOR ALL LEVELS

Read Also:

- Level 1 CFA Exam Study Materials

- When to Start Prep for CFA Exam?

- How to Create Study Plan in 8 Steps

- CFA Exam: Registration to Results

- 3 Reasons Why You May Fail Your Exam

Comments

Thank you for this!