Level 1 CFA® Exam Study Plan for AUG 2024 Candidates

![]() Bart Mankowski

Bart Mankowski

2 months 1 week 4 days

CFA EXAM STUDY PLANNER available for ALL LEVELS

After reading this post, you’ll learn:

- why the level 1 CFA exam passing rate is so low,

- how much time you need to prepare yourself for the level 1 CFA exam,

- what is strategic vs tactical CFA exam study planning,

- how a good level 1 CFA exam study plan should look like.

How to Prep for Level 1 CFA Exam in 4 Months?

If you want to devote 4 months to studying for your level 1 CFA exam, you need to start your prep in late-April at the latest. AUG 2024 level 1 CFA exam takes place from 20 to 26 August. You can register until 14 May and you should schedule your exam before 21 May 2024.

As soon as you decide you're gonna take your CFA exam in August, you'll probably be looking for some extra study materials to match your exam curriculum and to get ready for the hardships of the study time. Our CFA Exam Study Planner 4.0 with study lessons and various study resources inside can definitely be of great help to you. You can have your own personalized study schedule in seconds, free but limited or unlimited available at pay-what-you-can prices::

AVAILABLE FOR ALL LEVELS

Before you get down to work, however, stop for a while and ask yourself one fundamental question, which is: “How do I beat the low level 1 passing rate?”. It used to be around 43% but now it's below 40% and in 2021 it was even lower, down to ca. 20-25%. To be very specific, we should also add here that this low passing rate is a real value calculated for those who actually took the exam (i.e. it excludes no-shows usually accounting for as much as 20-25% of all registered candidates).

Why Is Level 1 CFA Exam Passing Rate So Low?

Possible causes of the low CFA exam level 1 passing rate can be many. Difficult financial concepts, some complicated or tricky exam questions, limited time you can approximately spend on one exam question, the minimum passing score set at a high level, or even advanced English (often an obstacle to non-natives).

Undoubtedly, all this counts but the real culprit here may be still at large.

Why?

Level 1 CFA Exam Study Plan & Bulky CFA Program Curriculum

Level 1 CFA candidates have voluminous study material to cover.

Just have a look at your CFA Program Curriculum. It's 6 books, hundreds of pages each. You need a lot of time to read it all and understand what you study. That's why, to make good use of your study time, you need a good study plan. And a good study plan means it should both respond to your needs in real-time and keep you on your toes every week!

AVAILABLE FOR ALL LEVELS

But one more word about the study content.

I would call the level 1 CFA exam conceptual ‘cos it verifies your general knowledge and understanding of finance. Best focus on the concepts required in the exam and make sure you get them right. To reach this goal, you may consider taking advantage of numerous study materials available online that will naturally facilitate your uptake of the obligatory dose of knowledge.

How Much Time Do I Need to Study for Level 1 CFA Exam?

It is said that an average candidate needs around 300 hours to get well-prepared for the level 1 CFA exam. Of course, it's a mean value and it need not apply to you. From my own observation, I can tell that some candidates will be fine with only 150 hours of preparation (this is extremely rare, though), but the majority will need to spend 300+ hours before they pass their level 1 exam.

If you work in finance, you studied finance at university and you like to test yourself, you will probably find 300 hours just enough. If, however, you define yourself as a finance greenhorn, you barely fancy poring over the books or you wish to change your field of specialization (of which taking the CFA exam is only a step), you'll surely need more than 300 hours of preparation.

It is very important for you to be able to estimate the number of hours you’re going to need for your exam prep. This estimation would allow you to see what’s the average time per month, week, and day you should spend studying.

This is where our Study Planner comes in handy. If you set up your personalized level 1 study plan, you'll get around 300 study hours divided into roughly 4 months. This time is arranged so as to factor in all 10 topics and a proper revision before your exam. You'll be given the average study time per week plus an estimated time for every reading (module). With this knowledge, it's easier to see how much time you need to study daily, weekly, and even monthly.

My advice is that you treat these estimations as a benchmark to lead you through your exam prep but also allow for some extra hours in excess of your staple preparation time. What I mean is that I haven’t met a person who would say they are fully prepared for the exam or that the exam is just in time for them.

What Is Strategic Study Planning?

How About My Tactics?

When preparing for the CFA exam, you have to tackle the issue both holistically and atomistically. What it means is that, on the one hand, you need to establish how much time overall you’re going to devote to different topics, mock exams, revision, etc. and when. On the other hand, you should be able to systematically adapt your schedule and make plans for shorter periods, usually for the upcoming week. The former, I call general planning strategy and the latter – detailed tactics.

More about NEW 2024 CFA exam topic weights

Below, you will find a hint at how to handle strategic study planning (in the form of a 4-month level 1 study plan). As for tactical planning, you'll be in better control of every study week if you opt for your own personalized study plan using our Study Planner app:

AVAILABLE FOR ALL LEVELS

Before we move on to a sample 4-month level 1 CFA exam study plan, there is one more piece of advice:

Have a look at the concepts of the forgetting curve and learning curve – they may actually give you some idea about what your CFA exam prep should look like to be fully successful.

How Does a Good Level 1 CFA Exam Study Plan Look Like?

This sample 4-month level 1 CFA exam study plan starts on 22 APR 2024. The last 3-4 weeks are devoted to Final Review when you should try to do as many mock exams as possible.

The study plan is divided into topics (5 Study Blocks) and I believe that the sequence is just optimal (though you can easily change it if you wish). More challenging topics are coupled with more easy ones allowing you to take a sort of break meanwhile. Also, where possible, topics are coupled based on the similarity of concepts. The time scheduled for each topic depends on its difficulty, the number of pages in the Curriculum, and the number of questions devoted to the topic on the exam (for the possible number of level 1 questions, go here ):

START on 22 APR 2024

1st Study Block: QM + PM + Topic Review

2nd Study Block: FSA + CI + Topic Review

3rd Study Block: FI + EI + Topic Review

4th Study Block: DER + AI + Topic Review

5th Study Block: ECO + ETH + Topic Review

FINAL REVIEW (29 July – 19 Aug)

END on 20-26 AUG 2024

The AUG 2024 level 1 exam window lasts from 20 to 26 August 2024. So, you can have from 3 to 4 weeks of – what we call – Final Review. Basically, that's when you should do as many mock exams as possible!

4-Month Level 1 CFA Exam Study Schedule

| Level 1 Topics | AUG 2024 Exam Deadlines |

|---|---|

| Quantitative Methods | 2 May |

| Portfolio Management | 10 May |

| QM+PM Review | 11 May |

| Financial Statement Analysis | 26 May |

| Corporate Issuers | 1 June |

| FSA+CI Review | 4 June |

| QM+PM Review | 4 June |

| Fixed Income | 17 June |

| Equity Investments | 24 June |

| FI+EI Review | 29 June |

| QM+PM+FSA+CI Review | 29 June |

| Derivatives | 3 July |

| Alternative Investments | 6 July |

| DER+AI Review | 10 July |

| QM+PM+FSA+CI+FI+EI Review | 10 July |

| Economics | 17 July |

| Ethics | 27 July |

| ECO+ETH Review | 28 July |

| Final Review | 19 Aug |

If you set up your personalized study plan,

the deadlines will get adjusted.

AVAILABLE FOR ALL LEVELS

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Here’s a sample level 1 CFA exam study schedule as displayed in our Study Planner:

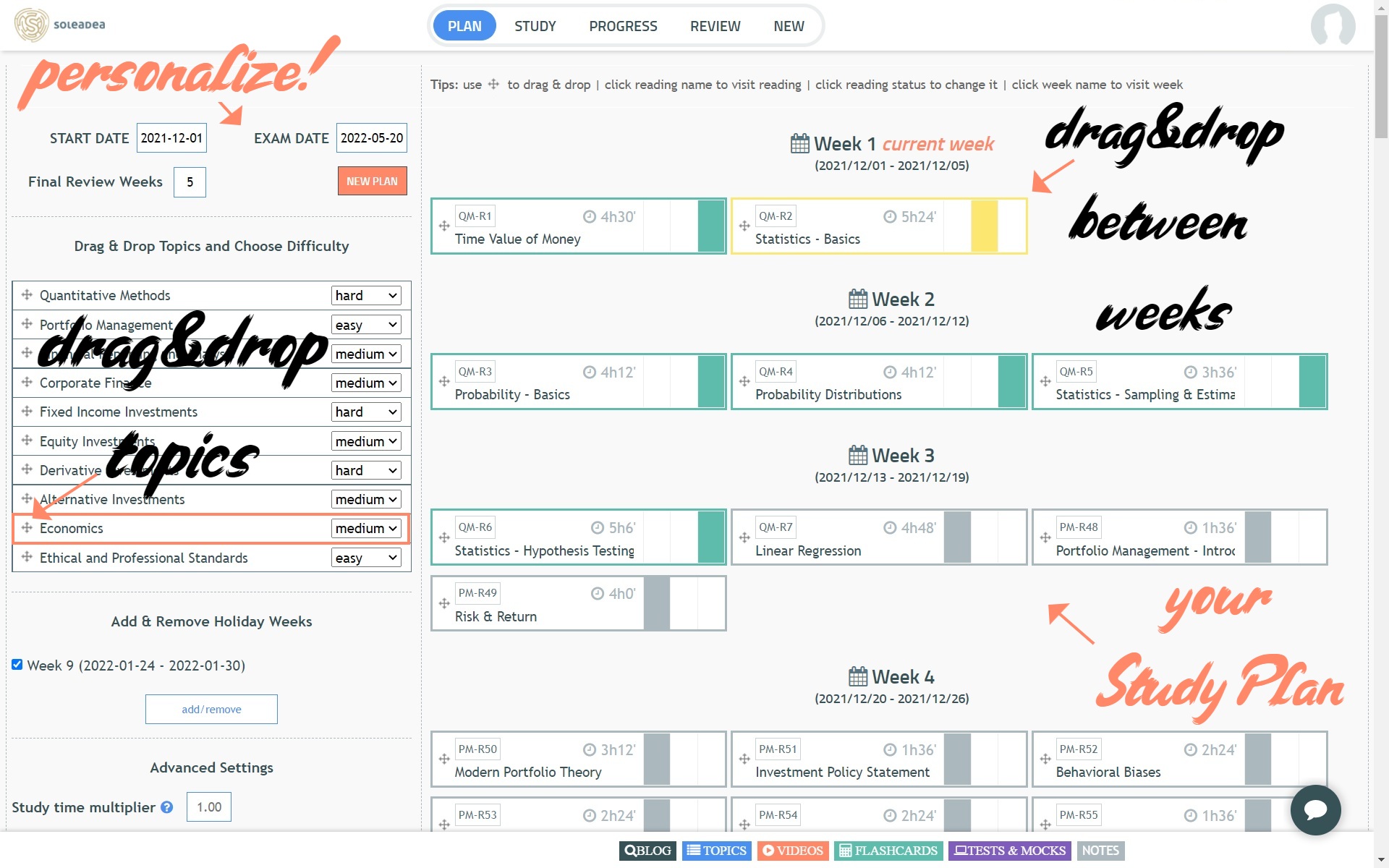

PLAN VIEW of CFA EXAM STUDY PLANNER:

FIND your Study Plan in the PLAN tab View all the weeks of your CFA exam prep, see how much you’ve done and how much is still ahead of you, as well as customize your schedule using your Study Plan personalization options and the DRAG & DROP for both topics and study weeks.

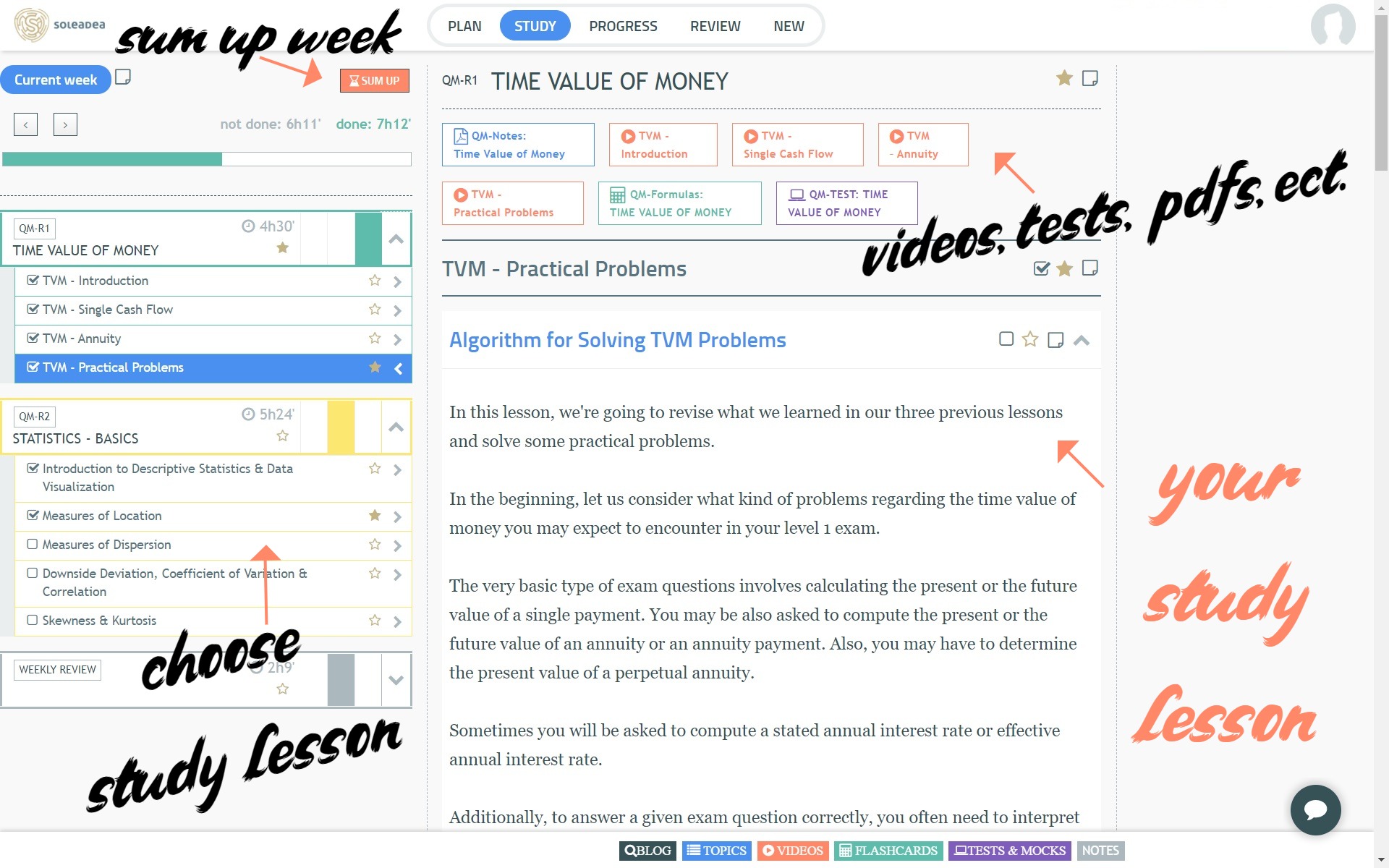

STUDY VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: STUDY View You will be asked to focus on your current week of studying. You will know what to study (left-hand menu) and how much to study (benchmark study times). Here, you'll also find your study lessons, including videos, tests, PDFs, etc. At the end of the week, your hard work will be evaluated (hit the SUM UP button).

PROGRESS VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: PROGRESS View You will be able to see your progress by topics and weeks. Each week your Chance to Pass score will go up or down.

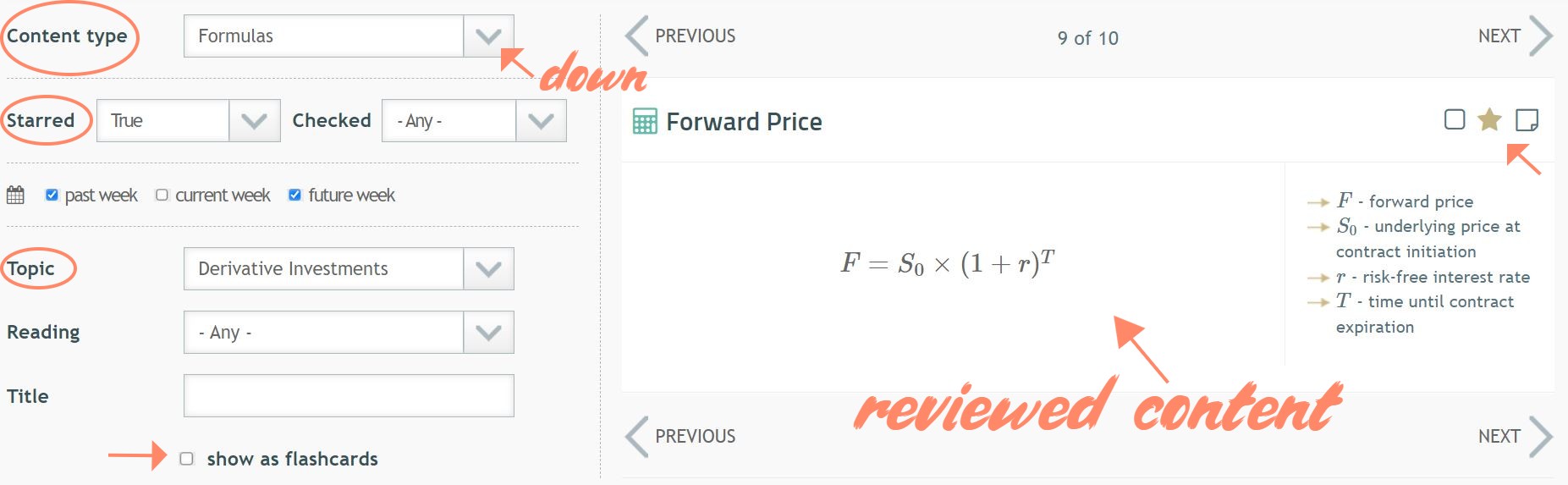

REVIEW VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: REVIEW View To learn, you must review. Use the special view of your Study Planner to review your study lessons, rewatch videos, revise formulas, etc.

About the Author:

Bart Mankowski has been helping candidates from around the world to pass their CFA exams for over 10 years now. He’s the initiator of Soleadea and its CEO. His ideal job is to find solutions to problems and potentials for innovation. That is why Soleadea and its unique CFA Exam Study Planner are being improved all the time ;).

Read Also:

- Level 1 CFA Exam Study Materials

- When to Start Prep for CFA Exam?

- How to Create Study Plan in 8 Steps

- CFA Exam: Registration to Results

- 3 Reasons Why You May Fail Your Exam

UPDATED: Feb 15, 2024

Comments

Hello,

My name is Miguel and I started a couple of months studying for Level 1. The reason is that I work full-time and thus I have to prepare in advance.

Greetings for your blog, I think it is a very good idea worth sharing.

I have taken a look to the study plan and I want to give some opinion about it.

First of all I think it makes sense ordering the topics as you did excepto for one, Ethics. Don´t you think that Ethics should be in another position, not the first one? Take into account this is the first contact you have with CFA and Ethics is the most important part of the exam, at least is the one that makes the difference, plus it is theoretical at all, worth memorizing and maybe a student will forget it sooner than other topics.

In my opinion, one should start with the topic that he/she thinks can at least have some knowledge about, so to start positively thinking that you have some background in CFA. What do you think?

Regards, I will defenitalety follow and try to colaborate as much as possible in the blog.

Hello Miguel, thank you for your opinion. You made a good point concerning the sequence of topics. Surely starting with the most favourite topic is to be encouraged. As for ethics, because it is so important at the Level I exam, we think it should be read early enough to be reviewed now and again between other topics. We are happy that you found our portal useful and we are looking forward to hearing from you again.

Excellent and most simple way to pass CFA.......thanks a lot for making it simple....

THANK YOU VERY MUCH!

What is the "Number of Pages to Cover" referring to? the curriculum or only the Schewsar Notes? E.g for Ethics it says 237 Pages, which pages is this referring to?

"Number of Pages to Cover" is referring to the CFA Curriculum.

Thanks for all the useful information on the Soledea blog. I like this study plan a lot. I am preparing now for Level 1 in Dec. I have already done Quantitative Methods and have started on Corporate F/Portfolio. However, it took me quite awhile to get thru QM due to time constraints. Would a reasonable plan be to just cut all the above in half, in other words, 28 study days and 8-9 pages per day on Ethics, etc? Thanks!!

Good website, will you be posting a Decmber 2013 study plan too?

Thanks

Yes, next week we will post a study plan for December 2013 candidates.

Check this out:

http://www.soleadea.com/december-2013-cfa-exam-study-schedule