Cash Conversion Cycle CFA® Exam Cheat Sheet

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

Cash Conversion Cycle Definition

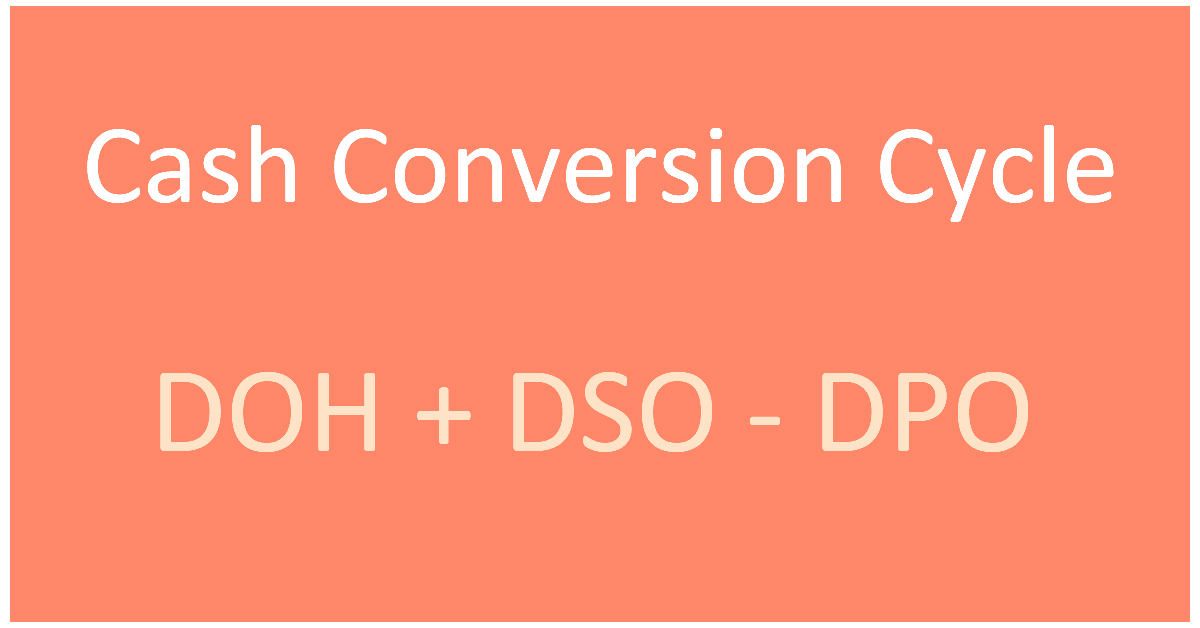

The cash conversion cycle (CCC) measures the time from paying suppliers for materials (or inventory) to collecting the cash from the sale of goods produced from these materials (or inventory).

The CCC is one of the liquidity measures and is also called the net operating cycle.

Cash Conversion Cycle Formula

cash conversion cycle = number of days of inventory (DOH) + number of days of receivables (DSO) - number of days of payables (DPO)

Where:

- Number of days of inventory (days of inventory on hand = DOH) is equal to the ratio of (inventory) and (cost of goods sold per day). This ratio tells us how many days on average inventory remains in the company.

- Number of days of receivables (days sales outstanding = DSO) is equal to the ratio of (accounts receivable) and (sales on credit per day). This ratio shows how much time (how many days) we have to wait for receivables to be paid.

- Number of days of payables (days payable outstanding = DPO) is equal to the ratio of (accounts payable) and (purchases per day). This ratio tells within how many days the company pays its suppliers.

Cash Conversion Cycle Explained

Here is an example showing how the CCC is calculated.

The table presents the information regarding the liquidity of the company:

|

Value |

|

|---|---|

|

Inventory |

USD 100,000 |

|

Cost of goods sold per day |

USD 5,000 |

|

Accounts payable |

USD 108,000 |

|

Average day's purchases |

USD 4,000 |

|

Number of days of receivables |

17 |

The net operating cycle (CCC) is closest to:

- A. 10.

- B. 37.

- C. 64.

Answer A is correct.

Because the CCC is given in days, first we need to compute the DOH and the DPO using the following equations:

The net operating cycle is:

Cash Conversion Cycle Analysis

Generally, the lower the CCC is, the better. A lower cash conversion cycle means that the company needs fewer days to recover money spent on materials.

What does a negative cash conversion cycle mean?

If a company has a negative cash conversion cycle, it means that the company needs less time to sell its inventory (or produce it from raw materials) and receive cash from its customers compared to the time in which it has to pay its suppliers of the inventory (or raw materials).

Related Terms: Operating Cycle

The operating cycle measures the time needed to convert raw materials into cash obtained from the sale of finished products:

\(\text{operating cycle}=\text{DOH}+\text{DSO}\)

Note: The net operating cycle (cash conversion cycle, CCC) is equal to the operating cycle less the number of days of payables.

You can learn more about the cash conversion cycle by visiting our CFA exam lesson on liquidity management .

Get More Study & Review Resources

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1/level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

LAST UPDATE: 3 Nov 2023

Read Also: