Asset Beta vs Equity Beta: Pure-Play Method in CFA® Exam

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

Difference Between Asset Beta & Equity Beta

In your CFA exam, you should know the difference between:

- the asset beta, and

- the equity beta.

Asset beta is also known as unlevered beta. In contrast, equity beta is also called levered beta (or project beta). A company has only one asset beta. However, depending on its debt-to-equity ratio, it can have many different equity betas.

What Is Asset Beta?

The asset beta is the beta of a company on the assumption that the company uses only equity financing.

What Is Equity Beta?

The equity beta takes into account different levels of the company's debt.

How to Calculate Beta?

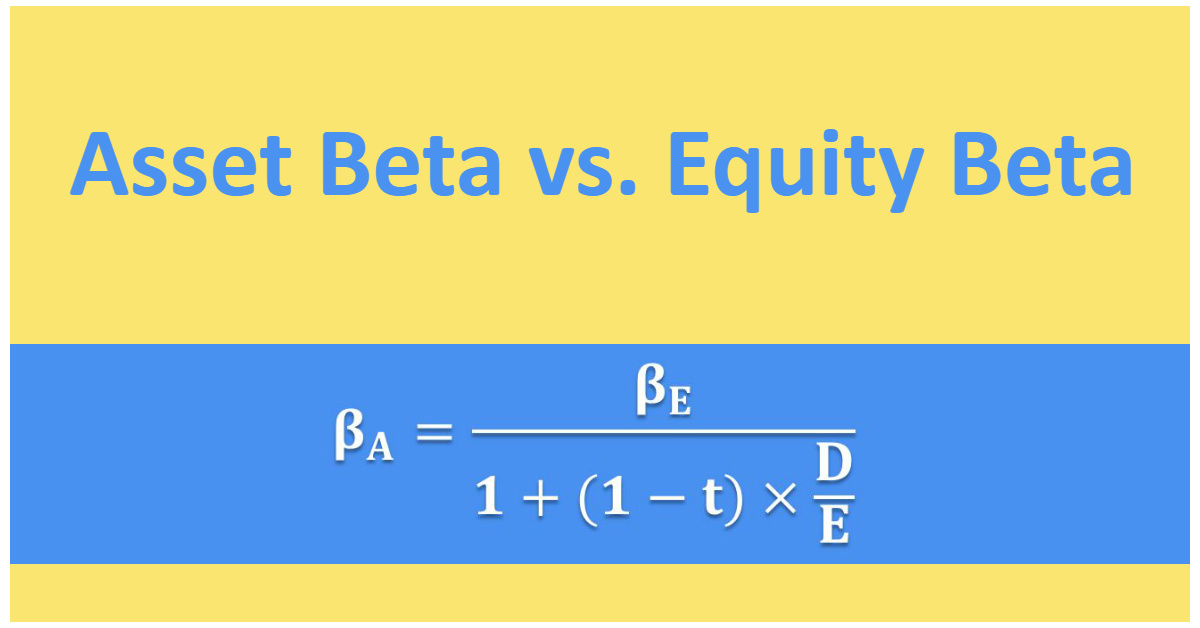

Asset Beta vs Equity Beta: Formula

\(\beta_{A} = \frac{\beta_{E}}{1+(1-t)\times \frac{D}{E}}\)

Where:

- \(\beta_{A}\) – asset beta,

- \(\beta_{E}\) – equity beta,

- \(D\) – market value of debt,

- \(E\) – market value of equity,

- \(t\) – marginal tax rate.

Methods of Beta Estimation for Level 1 CFA Candidates

When you need to estimate beta to compute the cost of capital for a company or project, there are 2 main methods available for you:

- using a market model regression of stock returns, or

- using the pure-play method.

Market Model for Beta Estimation

As we know, beta is necessary when using the CAPM model. Hence, you need to estimate it. One way to do it is to use a market model regression of the company's stock returns. You must know that the beta calculated with this model may vary significantly depending on the assumptions and data used.

Problems that might occur when estimating beta the using market model:

- estimation period length (usually 2-9 years, depending on the company's development stage, restructuring, etc.),

- appropriate stock index,

- small-capitalization companies vs large-capitalization companies: influence on risk and beta,

- public companies vs private companies.

Estimating Beta in Your CFA Exam: Pure-Play Method

Of course, the market model regression is well-suited for estimating the betas of listed companies. The problem arises when you need to estimate the beta for a non-listed company or non-standard project. In the case of non-listed companies, you can use the so-called pure-play method. In short, this method involves using the beta of a comparable publicly traded company and adjusting the beta so that it takes into account the financial risk of a non-listed company. Before we thoroughly explain the pure-play method algorithm and discuss formulas, we’re going to say what kinds of risks affect the beta and why the pure-play method makes sense.

Two main types of risk affect the size of a company’s beta:

- business risk, and

- financial risk.

Business risk is the risk associated with operating earnings which, in turn, depend on revenues. Typically, companies operating in the same industry have a similar level of business risk. In addition to business risk, we can distinguish financial risk, which is associated with the uncertainty of net income and cash flows. The greater the share of debt in the financing of the company, the greater the financial risk. In short, companies with a high financial leverage are characterized by high financial risk.

A comparable company and the company for which you want to calculate the beta operate in the same industry so they both have a similar level of business risk. Hence, the beta of the comparable company is suitable to determine the beta of the company for which you actually want to calculate the beta. At the same time, you must remember that companies can vary in financial leverage, and that is why you need to adjust the beta to financial risk.

How to Estimate Beta Using the Pure-Play Method

Pure-play method algorithm for beta estimation:

- Select comparable companies listed on the stock exchange.

- Estimate beta for comparable companies.

- Unlever the beta from step 2 by removing the effect of financial leverage. The unlevered beta reflects the business risk of the assets and thus is called the asset beta.

- Lever the beta by adjusting the asset beta to the financial risk of the company for which you want to calculate the beta. This beta is called the equity beta.

Unlevered Beta vs Levered Beta: Formula

Now that you know the pure-play method, you understand why the asset beta is called unlevered and the equity beta is called levered. The formula for the unlevered and levered beta is basically the same as above:

\(unlevered \beta = \frac{levered \beta}{1+(1-tax rate)\times \frac{D}{E}}\)

A company has an asset-to-equity ratio of 2. The estimated asset beta for comparable companies is 1.2, and the tax rate is 20%. The company’s beta is closest to:

- 0.67.

- 2.16.

- 3.12.

Answer: B

Before we estimate the equity beta for the company, we have to calculate the debt-to-equity ratio.

First of all, we know that the assets are equal to equity plus debt.

The asset-to-equity ratio is 2, so if we assume that assets are equal to 2 and equity is 1, then debt is equal to 1 (2 – 1 = 1). Then, the debt-to-equity ratio is 1 / 1 = 1.

Now, we put data into the formula:

\(\beta_{A} = \frac{\beta_{E}}{1+(1-t)\times \frac{D}{E}}\)

\(1.2 = \frac{\beta_{E}}{1+(1-20\%)\times 1}\)

\(\beta_{E} = 1.2 \times(1+(1-20\%))=2.16\)

So, the equity beta for the company is equal to 2.16.

Which of the following statements about asset beta and equity beta is least likely correct?

- ...

- ...

- ...

Question 2 is available for CFA exam candidates using our study planner to control their prep:

Already using Soleadea? 1. Sign into your account 2. Refresh this page to see Question 2.

Level 1 CFA Exam Takeaways

for Asset Beta and Equity Beta in the Context of Pure-Play Method

- The asset beta (unlevered beta) is the beta of a company on the assumption that the company uses only equity financing.

- The equity beta (levered beta, project beta) takes into account different levels of the company's debt.

- For beta estimation, you can use either the market model regression of stock returns or the pure-play method.

- Use the pure-play method in the case of non-listed companies or non-standard projects.

- Pure-play method algorithm: (1) select comparable companies listed on the stock exchange, (2) calculate the beta for comparable companies, (3) unlever the beta (remove the effect of financial leverage), (4) lever the beta by adjusting the asset beta to the financial risk of the company for which you want to estimate the beta.

- In the formula showing the relation between the levered beta and unlevered beta, we use the debt-to-equity ratio.

LAST UPDATE: 3 Nov 2023

Read Also: