5-Month CFA® Exam Study Plan for AUG 2024 Level 1 Candidates

![]() soleadea

soleadea

2 months 1 week 3 days

CFA EXAM STUDY PLANNER available for ALL LEVELS

How to Prepare for Level 1 CFA Exam & How Long to Study?

Most level 1 candidates start their CFA exam preparation around 5 months before the level 1 exam, more or less.

With a 5-month CFA exam study plan, it is calculated that you should study approx. 15 hours a week. Assuming roughly 150 days of studying and review, you'll get a bit over 300 study hours if you follow this study plan (which is the average study time recommended for each CFA exam level).

Creating a Successful Study Plan to Pass CFA Exam

If you want to have a successful level 1 CFA exam prep, there are some universal principles you’ll always need to follow, no matter how long you prepare for your CFA exam. When you start your prep, make sure your learning strategy takes into account:

The 20 Recommendations for Effective Level 1 CFA Exam Prep

Here is a list of 20 universal principles of an effective level 1 study plan & exam prep.

If you want to pass your level 1 CFA exam make sure to:

- 1. Plan your CFA exam study schedule carefully.

- 2. While creating your study plan, take into account your job, friends, and family obligations.

- 3. Analyze your weak points.

- 4. Divide your whole CFA exam prep into: (i) core study schedule and (ii) final review time.

- 5. Divide your core study schedule into: learning, practicing, and testing knowledge.

- 6. Set up deadlines for topics but also your weekly tasks.

- 7. Consider topics difficulty when setting your topics deadlines.

- 8. Count how many study hours you need to spend doing each of the topics.

- 9. Develop your daily study routine.

- 10. Control your study plan every week and hold yourself accountable.

- 11. Stick to your schedule but be flexible when needed.

- 12. Apply passive and active learning techniques.

- 13. Study systematically reading after reading.

- 14. Review regularly for better knowledge retention.

- 15. Monitor your progress regularly and react if needed.

- 16. Practice using exam-type questions.

- 17. Focus on conscious learning – understand, don’t just memorize!

- 18. Reward yourself when you follow your study schedule & be more demanding when you fall behind.

- 19. Take as many mock exams as possible during your final review period.

- 20. Sleep well before your exam day and stay confident – if you have learned effectively, you're bound to pass!

In this blog post, we help you plan your CFA exam study schedule. We also give you a ready 5-month level 1 study plan for the AUG 2024 CFA exam as a reference. It’s just a sample study schedule, which you can easily personalize when you use our CFA Exam Study Planner.

AVAILABLE FOR ALL LEVELS

#1.

Plan Your CFA Exam Study Schedule Carefully

First things first.

When creating your CFA exam study plan, bear in mind that proper planning is more than just a list of topic deadlines. Why? Because when you divide your CFA exam prep into topics (which BTW is the first and most natural step), you create a perfect model that would work in an ideal world. It doesn’t allow for real life, though.

In real life, no two weeks are the same. Sometimes, you won’t be able to study enough to meet your deadline. How are you going to catch up if something goes wrong? With deadlines just for topics, you’re likely to find out too late that you haven’t been studying enough.

Moreover, when you have your topic deadlines – all you know is that you work to a strict deadline a couple of weeks away. If your deadline’s still far away, you are likely to procrastinate. If you postpone studying too often, there’s quite a serious threat you won’t make it.

That’s why – apart from topic deadlines – you need your topic readings (modules) scheduled into consecutive weeks. Weekly schedules allow you to control your prep. When you know what readings to do each week and how much time you’ll need on average to complete them, it’s much easier. You can make it from day to day and react if things do not go as planned.

Weekly schedules also enable you to be flexible, where flexibility means sound management that doesn’t pose a threat to your study plan and exam prep. Using our free study planner, you can easily drag & drop your scheduled CFA exam readings/modules between weeks (go to the PLAN tab).

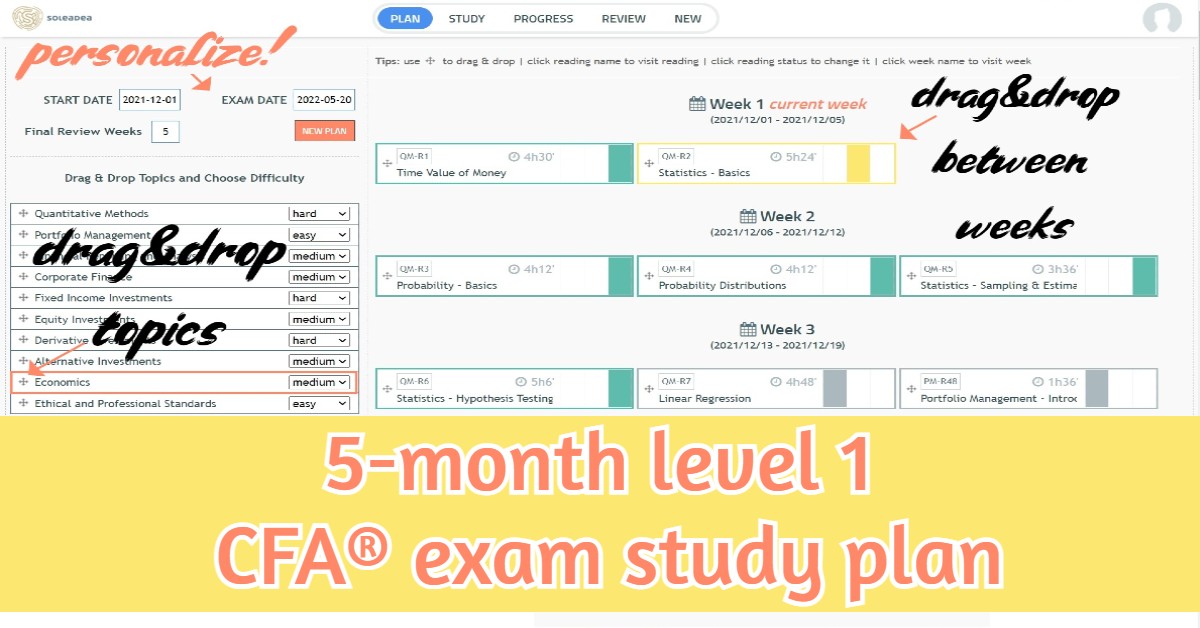

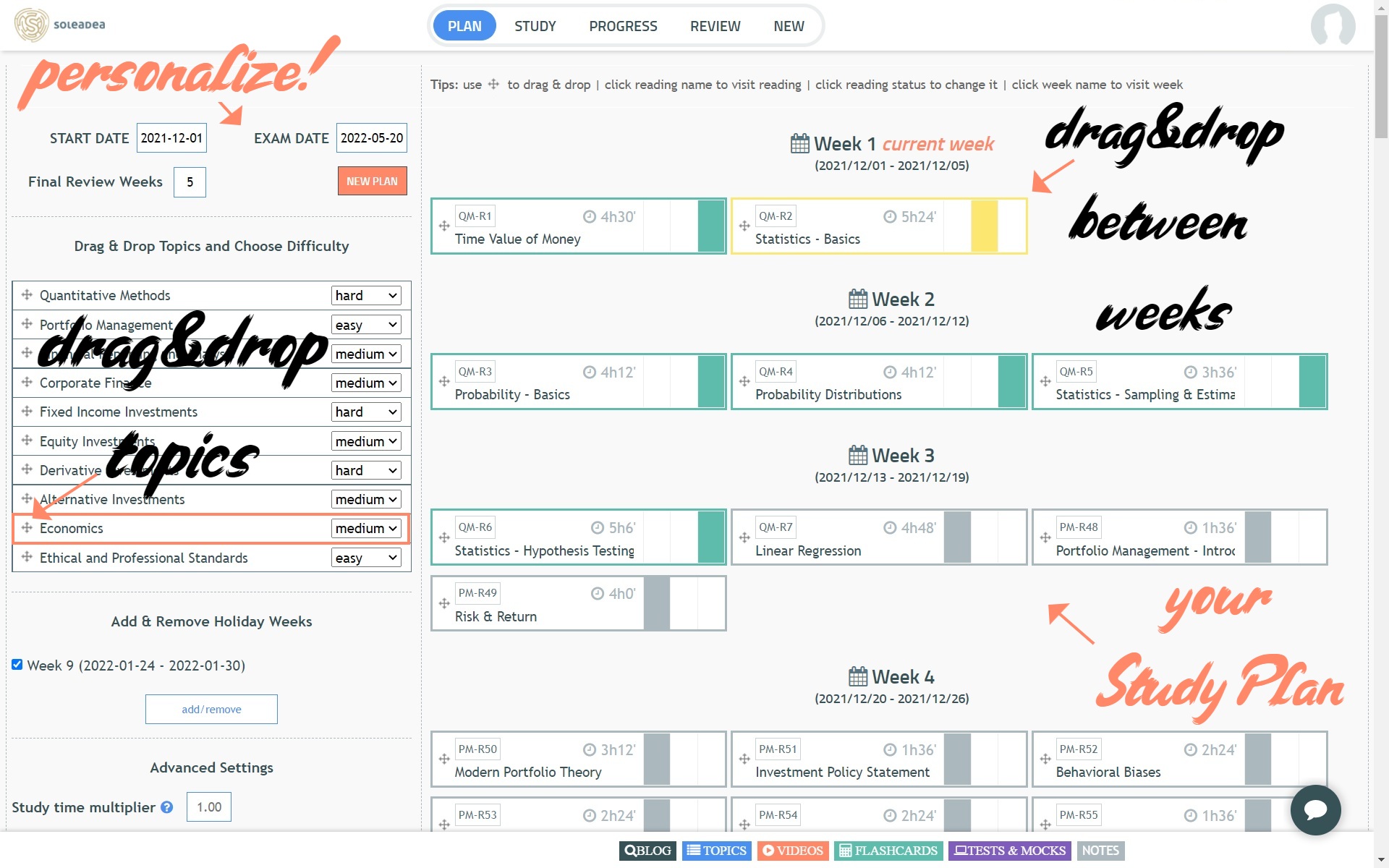

PLAN VIEW of CFA EXAM STUDY PLANNER:

So, when planning your CFA exam prep, you need to have:

- your topic deadlines,

- weekly schedules (exact topic readings/modules included in consecutive weeks),

- estimated amount of time you need to spend studying each week to meet your deadlines.

To execute your CFA exam study plan, it’s best if you have the means to hold yourself accountable and control your prep (with a bit of flexibility, too).

When we devised our CFA Exam Study Planner, we took it all into account. Your CFA exam study plan has 4 views:

- PLAN – where each week has an exact number of readings you should cover and that you can easily drag&drop if need be (apart from drag&dropping readings, you can also personalize your study plan bigtime, e.g., set your START DATE or EXAM DATE or adjust your topic sequence),

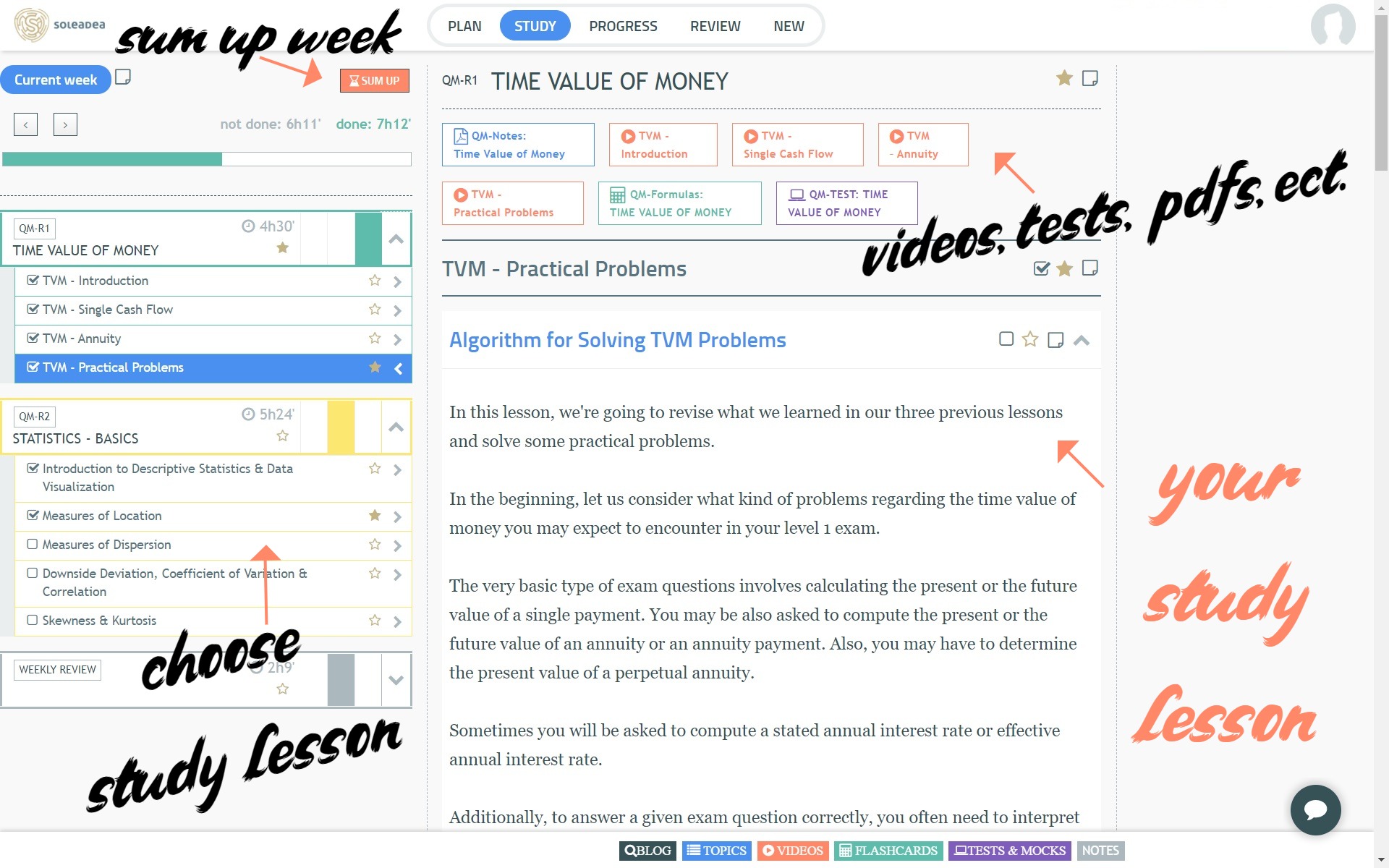

- STUDY – where you can focus on your weekly lessons and watch videos, do questions, check off your lessons as done or star them, as well as see your benchmark study times for both the whole week and separate readings,

- PROGRESS – where you can see your progress in topics and your Chance-to-Pass growing each week,

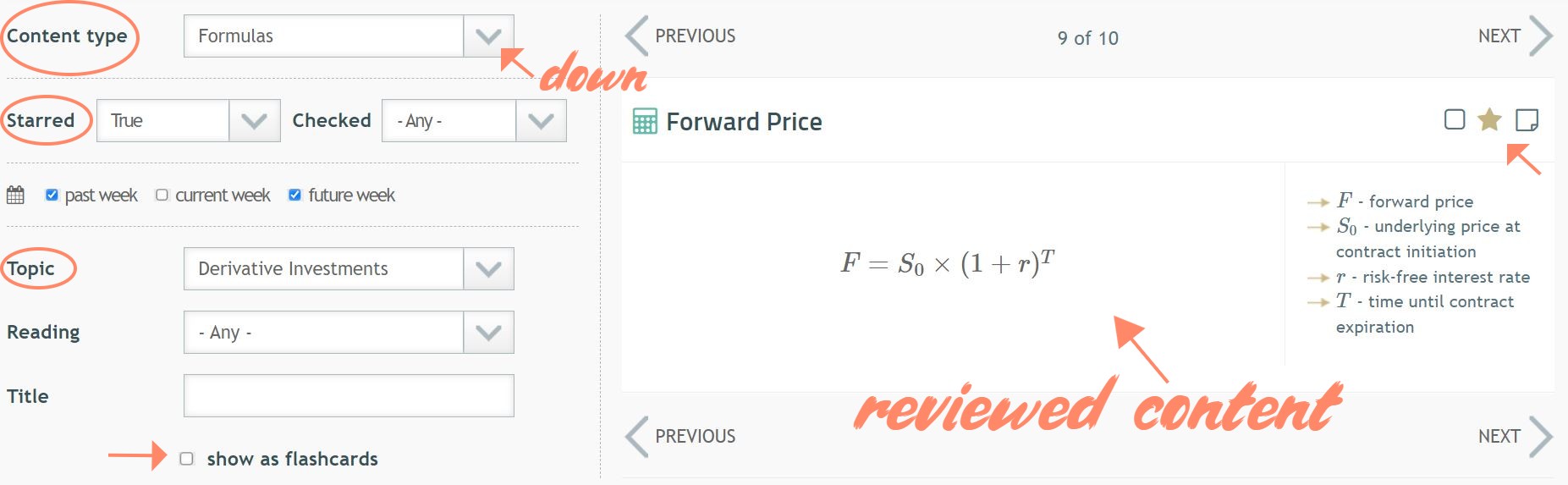

- REVIEW – where you can easily browse for the study content you want to review, e.g., Quantitative Methods videos, Derivative Investments formulas, given sections of Ethics study lessons, or even whole study lessons for your chosen topics.

STUDY VIEW of CFA EXAM STUDY PLANNER:

AVAILABLE FOR ALL LEVELS

How to Prepare for CFA Exam in 5 Months

This sample 5-month AUG 2024 level 1 CFA exam study plan starts on 18 March 2024. The last month should be devoted to revision and mock exams in countless numbers. The first 4 months are divided into 5 Study Blocks with a weekly break meanwhile. The break has 2 functions. On the one hand, it allows you to recharge batteries in the middle of your exam preparation. On the other hand, it motivates you to work hard on the first few topics. It’s like an award for those who follow the plan!

START on 18 MARCH 2024

1st Study Block: QM + PM + Topic Review

2nd Study Block: FSA + CI + Topic Review

*HOLIDAYS*

3rd Study Block: FI + EI + Topic Review

4th Study Block: DER + AI + Topic Review

5th Study Block: ECO + ETH + Topic Review

FINAL REVIEW (22 July – 19 Aug)

END on 20-26 AUG 2024

The AUG 2024 level 1 exam window lasts from 20 to 26 August 2024. So, you can have even 5 weeks of – what we call – Final Review. Basically, that's when you should do as many mock exams as possible!

There’s a special topic sequence applied to help you focus on the more challenging topics such as QM or FSA and facilitate the uptake of related topics (that’s why, for instance, Portfolio Management is coupled with Quantitative Methods). But you can easily personalize your topic sequence using your Study Plan options in the PLAN tab!

The time scheduled for each topic has been estimated by our expert and depends on the topic’s difficulty understood as the number of pages in the CFA Program Curriculum, topic weight in the exam (AUG 2024 CFA exam weights applied), and the share of math and calculations in the topic (but you can further customize topics difficulty using our study planner).

New 2024 Level 1 CFA Exam Topis Weights!

In 2024, level 1 CFA exam topic weights change. The chart shows the new 2024 topic weights for the level 1 CFA exam, given in ranges (MIN-MAX topic weight expressed as a percentage). See how level 1 topic weights changed in 2024 compared to the previous years.

The chart also gives you the estimated number of days you will most likely spend studying (and reviewing) each topic. Note that the period of Final Review just before your exam is excluded from the estimation. Also, we left out the week of holidays proposed in this schedule.

It is estimated that you will study approx. 15 hours per week if you follow this 5-month CFA exam study plan. This means that you can prepare for your level 1 exam over weekends. So, this is a great solution for those who have too much on their plate on work days!

Regular Revision = Effective Execution

What’s quite exceptional for our Study Planner is spaced revision. Review sessions are scheduled all throughout your exam prep:

- Topic Review and Final Review are spaced out as presented above & in the table below,

- since the topic and final review are not enough – a regular weekly review is also scheduled as part of Proper Review-ON SystemTM if you opt for our PAID PLAN.

All the revision sessions arranged inside your study plan give you plenty of space to practice and review what you’ve learned. Bear in mind regular review is an important prerequisite to successful and productive learning 'cos it helps you fully overcome your forgetting curve.

REVIEW VIEW of CFA EXAM STUDY PLANNER:

5-Month AUG 2024 Level 1 CFA Exam Study Plan

Topic Deadlines Timetabled

| Level 1 CFA Exam Topics | AUG 2024 Exam: Topic Deadlines |

|---|---|

| Quantitative Methods | 31 March |

| Portfolio Management | 12 Apr |

| QM+PM Review | 14 Apr |

| Financial Statement Analysis | 28 Apr |

| Corporate Issuers | 8 May |

| FSA+CI Review | 12 May |

| QM+PM Review | 12 May |

| *HOLIDAYS* | 19 May |

| Fixed Income | 2 June |

| Equity Investments | 10 June |

| FI+EI Review | 15 June |

| QM+PM+FSA+CI Review | 15 June |

| Derivatives | 20 June |

| Alternative Investments | 24 June |

| DER+AI Review | 30 June |

| QM+PM+FSA+CI+FI+EI Review | 30 June |

| Economics | 8 July |

| Ethics | 19 July |

| ECO+ETH Review | 21 July |

| Final Review | 19 Aug |

If you set up your personalized study plan,

the deadlines will get adjusted and you'll be able to decide if and when you need

*HOLIDAYS*, i.e., time without studying.

Why Use Excel

if You Can Have CFA Exam Study Plan in a Sec!

Some CFA candidates use Excel to create their CFA exam study plan and outline their topic deadlines.

The table above shows the level 1 CFA exam topic deadlines for a 5-month study schedule like an Excel study plan would. The deadlines take AUG 2024 topic weights into account. There's also a weekly break in between Study Blocks to show you that you can schedule your own time without studying if you want.

Don't use Excel to create your CFA exam study plan. As soon as you create your personalized study plan using our Study Planner, topic deadlines will get adjusted to your preferences (e.g. start date, topic sequence, topic difficulty, number of weeks without studying, etc.). Also, you’ll get concrete topic readings (modules) assigned to consecutive study weeks to ensure better control and successful execution of your study plan. Plus, you'll get benchmark study times both for readings and study weeks to keep you on track during your level 1 CFA exam prep.

All this within seconds!

AVAILABLE FOR ALL LEVELS

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Read Also:

- Level 1 CFA Exam Study Materials

- When to Start Prep for CFA Exam?

- How to Create Study Plan in 8 Steps

- CFA Exam: Registration to Results

- 3 Reasons Why You May Fail Your Exam

UPDATED: Feb 15, 2024