|

Post date: Wednesday, February 28, 2024 - 10:02

*UPDATED* Level 1 CFA exam in 2 months: With only 60 days to your MAY 2024 level 1 exam, you need a good 2-month CFA exam study plan. START: mid-March 2024.

|

|

Post date: Tuesday, December 5, 2023 - 11:19

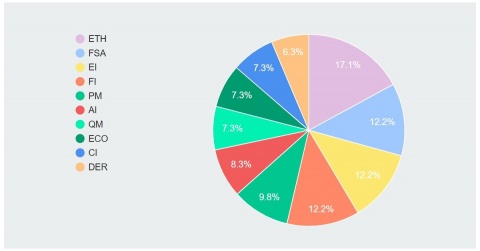

Learn about the level 1 CFA® exam: its CBT structure, topic weights (new as of 2024!), passing score, and approved calculators.

|

|

Post date: Tuesday, November 7, 2023 - 11:00

In level 1 CFA exam questions related to the IRR, when only the IRR needs to be computed, often the cost of capital is given to mislead the candidate.

|

|

Post date: Tuesday, November 7, 2023 - 10:01

As a level 1 CFA exam candidate, you must know Ethics well. Each ethical standard talks about a separate area of the investment profession. See summary.

|

|

Post date: Tuesday, November 7, 2023 - 09:55

CFA EXAM, LEVEL 1/2/3: See the summary of Standard I of the CFA Institute Code of Ethics and Standards of Professional Conduct.

|

|

Post date: Tuesday, November 7, 2023 - 09:50

CFA EXAM, LEVEL 1/2/3: See the summary of Standard II of the CFA Institute Code of Ethics and Standards of Professional Conduct.

|

|

Post date: Tuesday, November 7, 2023 - 09:45

CFA EXAM, LEVEL 1/2/3: See the summary of Standard III of the CFA Institute Code of Ethics and Standards of Professional Conduct.

|

|

Post date: Tuesday, November 7, 2023 - 09:40

CFA EXAM, LEVEL 1: Find all 9 sections of the Global Investment Performance Standards (part of lvl 1 Ethics) and do our CFA GIPS questions (2 examples included).

|

|

Post date: Sunday, November 5, 2023 - 09:00

Intro to level 1 CFA exam time value of money (TVM): USD 100 is worth more today than in a year + formulas for present value (PV) and future value (FV).

|

|

Post date: Sunday, November 5, 2023 - 08:55

TVM problems in the level 1 CFA exam: ordinary annuity, annuity due, perpetuity? Annuity = a series of cash flows of the same value at equal intervals.

|

|

Post date: Sunday, November 5, 2023 - 08:50

Time value of money (TVM) applied: how to use the approved CFA exam calculator and its CF and NPV worksheets to do TVM questions in your level 1 CFA exam.

|

|

Post date: Sunday, November 5, 2023 - 08:45

Approved CFA exam calculators: TI BA II Plus Professional vs HP 12C Platinum. Which of the calculators is the best choice for your CFA exam?

|

|

Post date: Sunday, November 5, 2023 - 07:40

CFA Exam Quantitative Methods Summary: Watch our presentation on Quantitative Methods (TVM and stats) if you study or review for your level 1 CFA exam.

|

|

Post date: Sunday, November 5, 2023 - 07:37

CFA Exam Portfolio Management Summary: Watch our presentation on the level 1 Portfolio Management topic if you study or review for your level 1 CFA exam.

|

|

Post date: Saturday, November 4, 2023 - 09:05

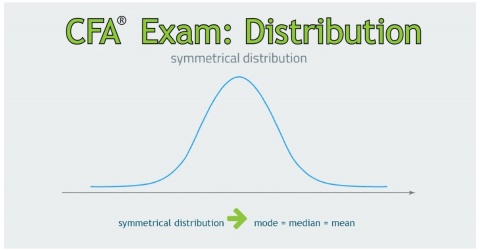

Level 1 CFA Exam Revision: Skewness is a measure of the asymmetry of a distribution. It tells us how observations are distributed around the mean.

|

- 1 of 3

- ››