Level 1 CFA® Exam: Amortizing Bond Discount or Premium

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

The level 1 CFA Exam is approaching, so we have to keep up the pace. Today, let’s discuss the methods of amortizing bond discount or premium.

Effective Interest Rate Method vs Straight-Line Method

If the company uses the amortized cost approach to measure a long-term debt, it can use two methods to amortize the discount and the premium:

- the effective interest rate method, or

- the straight-line method (allowed only under U.S. GAAP).

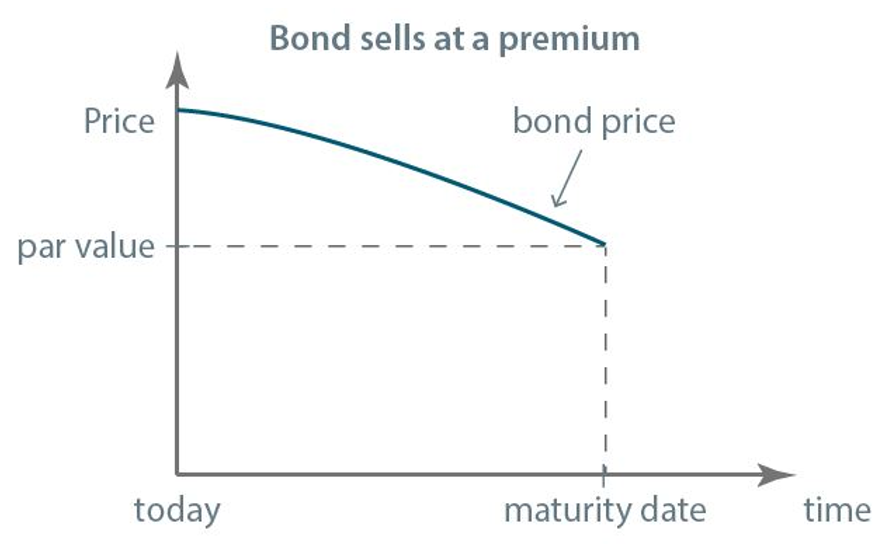

The general rule for both methods is the same. For discount bonds, in consecutive years, we will adjust the historical cost up until we reach the bond’s par value and for premium bonds, we will adjust the historical cost down until we reach the par value. However, the straight-line method assumes that in each period throughout the bond’s life, the value of the adjustment is the same.

According to the effective interest rate method, the adjustment reflects the reality better. In other words, it reflects what the change in the bond price would be if we assumed that the market discount rate doesn’t change.

We will illustrate the problem by the following example related to a premium bond.

Example:

On 1 January 2022, Robots, Inc. issued 4-year bonds with a total par value of USD 100 million and an annual coupon that amounts to 8% of the par value. The effective annual interest rate at issuance was equal to 7%.

What is the interest payment, interest expense, amortization of premium, and bond carrying amount in the first year?

We will solve the problem assuming first the effective interest rate method, and then the straight-line method.

Effective Interest Rate Method

To apply the effective interest rate method, let’s first calculate the bond price at issuance:

Now, we will compute the interest payment. In each year, the interest payment is equal to the coupon payment, i.e., USD 8 million.

Note, however, that the interest expense will be different in each year. The interest expense in a given period is equal to the effective interest rate at the time of issuing bonds multiplied by the carrying amount at the beginning of the period. So, for the first year the interest expense is equal to 7% multiplied by the price of the bond at the time when the bond was issued, that is by USD 103.3872 million. So, for the first year, the interest expense equals USD 7.237105 million.

Note that for premium bonds the interest payment is always greater than the interest expense and the difference between them is the amortization of premium.

So, the amount of the premium amortized in the first year, assuming the effective interest rate method, is equal to USD 0.762895 million.

The carrying amount at the end of a given year is equal to the carrying amount at the beginning of the year less the amortization of premium. So, the carrying amount at the end of the first year is equal to USD 103.3872 million minus USD 0.762895 and amounts to USD 102.6243 million.

Straight-Line Method

According to the straight-line method, the amount of the premium amortized in each year will be the same. To compute it, we have to divide the bond premium by the number of years. The bond premium is equal to the price of the bond at issuance minus the par value of the bond, i.e., USD 103.3872 million minus USD 100 million and amounts to USD 3.3872 million.

So, the premium amortized in each year, assuming the straight-line method, is equal to USD 3.3872 million divided by 4 and amounts to USD 0.846803 million.

To Sum Up

As you can see, according to the straight-line method the amortization of premium is the same for all periods. However, for the effective interest rate method, the amortization of premium is greater as time passes by.

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1/level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join