Level 1 CFA® Exam: NPV vs IRR. Which is Better?

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

NPV vs IRR, Meaning

NPV stands for net present value.

IRR stands for internal rate of return.

Level 1 CFA Exam: Net Present Value (NPV)

The net present value (NPV) is the fundamental measure of the profitability of investment projects. NPV equals the sum of present values of all cash flows (inflows and outflows) in a project. If the NPV is greater than zero, the project is profitable. If the NPV is less than zero, you shouldn't invest in the project.

NPV Formula

An investment's net present value is the sum of the discounted cash flows of this investment project:

\(NPV= \sum_{t=0}^n\frac{CF_t}{(1+r)^t}\)

Where:

- \(t\) – time t,

- \(CF_t\) – positive or negative after-tax cash flow at time t,

- \(r\) – discount rate equal to the cost of the capital used to finance the project or the required rate of return for the investment.

[Negative cash flows (investment outlays) must be substituted into the formula as negative values.]

NPV Interpretation

If a project's NPV is greater than zero, the project will be profitable for the company owners. If NPV is less than zero, the company's value will decrease. So, we make the decision based on the following rule:

- If the \(\text{NPV > 0}\), we should invest in the project.

- If the \(\text{NPV < 0}\), we should reject the project.

Effect of NPV on the Value of a Company and the Price of the Stock

If a company invests in a profitable project, it will increase the owners' equity and the value of the company by an amount equal to the NPV. If a company invests in an unprofitable project, it will decrease the owners' equity and the value of the company by an amount equal to the NPV.

NPV has also a similar effect on stock prices. Projects with a positive NPV increase the price of a stock by an amount equal to the NPV per stock, whereas projects with a negative NPV decrease the price by an amount of the NPV per stock.

Question 1: NPV Question

A company is considering whether or not to proceed with an investment project that requires an initial outlay of USD 100,000. The after-tax cash inflows are estimated to amount to USD 20,000 at the end of the first and second year and to USD 30,000 at the end of the third, fourth, and fifth year. The required rate of return for the project is 4.4%. The net present value for the project is closest to:

- USD -53,318.

- USD 13,314.

- USD 30,000.

Answer: B

Using a calculator we can compute the NPV. We're going to use the Cash Flow and NPV worksheets.

We open the Cash Flow worksheet and enter the following:

[2ND] [CE|C] (to clear the worksheet from previous data)

CF0 = 100 [+/-] [Enter] (initial outlay of -100)

C01 = 20 [Enter]

F01 = 2 [Enter] (there are 2 consecutive inflows of 20)

C02 = 30 [Enter]

F02 = 3 [Enter] (there are 3 consecutive inflows of 30)

Finally, we press the NPV button, set the discount rate equal to 10, then press and CPT to get the result: NPV = 13,313.7

Let’s summarize the problem. The net present value tells us about the amount by which a company's value will increase or decrease if the company decides to make an investment. If the project's net present value amounts to USD 13,313.7, the company's value will increase by this amount (of course if the company decides to proceed with the investment).

Level 1 CFA Exam: NPV Profile

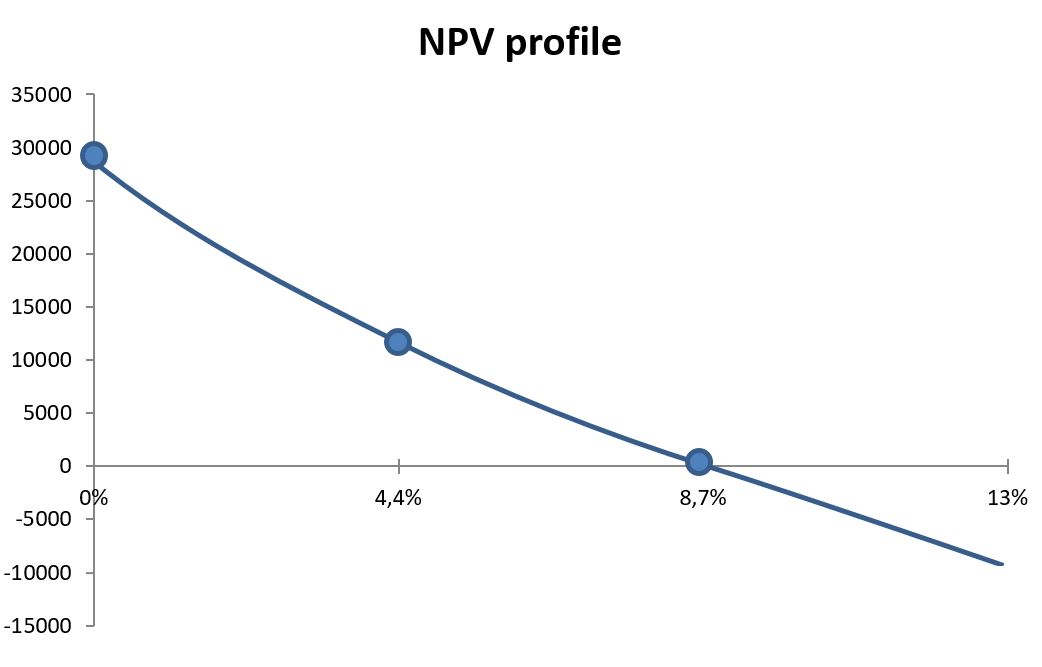

An NPV profile is a graphic representation of the relationship between NPV (y-axis) and the interest rate (x-axis). Unsurprisingly, usually the greater the discount rate, the lower the NPV.

If the discount rate was 0%, the NPV would equal the sum of undiscounted cash flows in the project.

The point at which the NPV profile crosses the horizontal axis is the discount rate which we call the internal rate of return (IRR).

You can learn more about NPV and IRR by visiting our CFA exam lesson on NPV and IRR .

Level 1 CFA Exam: Internal Rate of Return (IRR)

IRR is a discount rate at which NPV equals 0. So, IRR is a discount rate at which the present value of cash inflows equals the present value of cash outflows. If the IRR is higher than the required return, we should invest in the project. If the IRR is lower, we shouldn't.

IRR Formula

\(0=NPV= \sum_{t=0}^n\frac{CF_t}{(1+IRR)^t}\)

Where:

- \(t\) – time t,

- \(CF_t\) – positive or negative after-tax cash flow at time t.

IRR Interpretation

According to the IRR criterion, a decision on whether or not to invest in a project depends on the relation between the IRR and the required rate of return:

- If the IRR is greater than the required rate of return, the company should invest in the project.

- If the IRR is lower than the required rate of return, the company should reject the project.

Question 2: IRR Question

As the required rate of return goes up, the IRR:

- ...

- ...

- ...

Question 2 is available for CFA Program candidates using our study planner to control their prep:

Already using Soleadea? 1. Sign into your account 2. Refresh this page to see Question 2.

Multiple IRR Problem & No IRR Problem

When working with IRR, we can encounter the "multiple IRR problem" and the "no IRR problem". They occur when a project has nonconventional cash flows. Nonconventional projects involve outlays (cash outflows) not only at the beginning but also later. In other words, for nonconventional projects cash flows change signs more than once.

Ranking Conflicts Between NPV and IRR

One very important thing to learn for the exam is the comparison of NPV and IRR.

Generally, when we are dealing with independent projects, there will be no conflict over whether to accept a project or not regardless of the criterion you use. A conflict over which project to choose may, however, occur for mutually exclusive projects. You might encounter a situation when the NPV and the IRR suggest two different investment projects, and you need to choose either of the two. If there is such a conflict, you should always choose the project with a higher positive NPV.

Level 1 CFA Exam Takeaways for NPV and IRR

- NPV equals the sum of the present values of all cash flows in a project (both inflows and outflows). If the NPV is greater than zero, the project is profitable. If the NPV is less than zero, you shouldn't invest in the project.

- The point at which the NPV profile crosses the horizontal axis is the discount rate which we call the internal rate of return (IRR).

- IRR is a discount rate at which NPV equals 0. So, IRR is a discount rate at which the present value of cash inflows equals the present value of cash outflows. If the IRR is higher than the required return, you should invest in the project. If the IRR is lower, you shouldn't.

- In the case of mutually exclusive projects, if the NPV and the IRR suggest two different investment projects, we should choose the project with a higher positive NPV.

- Nonconventional projects involve outlays (cash outflows) not only at the beginning but also later.

- In the case of nonconventional projects, we might encounter the "multiple IRR problem" and the "no IRR problem".

- The maximum number of possible IRRs is equal to the number of sign changes between cash flows.

LAST UPDATE: 4 Nov 2023

Read Also: