Discounted Payback Period vs Payback Period: Pros & Cons

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

Level 1 CFA® Exam: Payback Period Formula (PP)

The payback period is the number of years necessary to recover funds invested in a project. The shorter the payback period, the better. Why? Because we cover the negative cash flows related to the project sooner. The payback period shouldn’t be used as a measure of investment project profitability.

A project has the following annual cash flows:

Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

-USD 5,000 | USD 1,000 | USD 1,000 | USD 4,000 | USD 5,000 | USD 2,000 |

A discount rate is equal to 10%. The payback period is closest to:

- 2.75.

- 3.00.

- 3.08.

Answer: A

To compute the payback period, it might be useful to calculate the cumulative cash flows first:

Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

-USD 5,000 | -USD 4,000 | -USD 3,000 | USD 1,000 | USD 6,000 | USD 8,000 |

As we can see, the initial investment is paid back in Year 3 (because the value of the cumulative cash flow is negative at the end of Year 2 and positive at the end of Year 3). The key is to find when exactly.

As we can see, the project pays itself back in 2.75 years, because:

5,000 = 1 x 1,000 + 1 x 1,000 + 0.75 x 4,000

In your Level 1 CFA Exam you can also compute the payback period using your TIBA II PLUS calculator:

We open the Cash Flow worksheet and enter the following:

[2ND] [CE|C] (to clear the worksheet from previous data)

CF0 = 5000 [+/-] [Enter] (initial outlay of -5,000)

C01 = 1000 [Enter]

F01 = 2 [Enter] (there are 2 consecutive inflows of 1000)

C02 = 4000 [Enter]

C02 = 5000 [Enter]

C02 = 2000 [Enter]

Finally, we press the NPV button, then press 3 times, then the CPT button to get the result: PB = 2.75

Discounted Payback Period (DPP)

The discounted payback period is the number of years after which the cumulative discounted cash inflows cover the initial investment. The shorter the discounted payback period, the better. As in the case of the PP, the DPP shouldn’t be used as a measure of investment project profitability.

A project has the following annual cash flows:

Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

-USD 5,000 | USD 1,000 | USD 1,000 | USD 4,000 | USD 5,000 | USD 2,000 |

Discount rate is equal to 10%. The discounted payback period is closest to:

- ...

- ...

- ...

Question 2 is available for CFA Program candidates using our study planner to control their prep:

Already using Soleadea? 1. Sign into your account 2. Refresh this page to see Question 2.

Advantages of

Payback Period (PP) and Discounted Payback Period (DPP):

- Both PP and DPP are easy to compute.

- Both measures are useful for assessing the liquidity of a project.

Disadvantages of

Payback Period (PP) and Discounted Payback Period (DPP):

- The payback period doesn’t take the time value of money into account.

- Both payback period and discounted payback period ignore cash flows occurring after recovering the original investment.

- Since PP and DPP don't account for cash flows after the recovery of the original investment, they can't be used as measures of profitability, in contrast to NPV, IRR, and profitability index which take all cash flows into account.

Level 1 CFA Exam Takeaways

for Payback Period and Discounted Payback Period

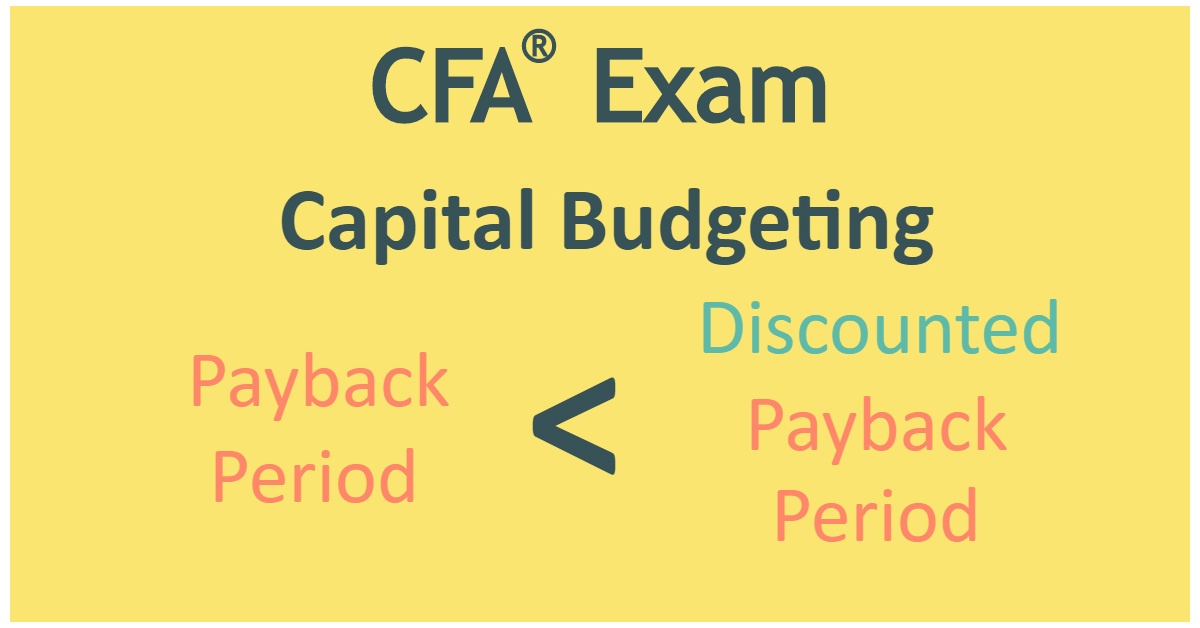

- The payback period is the number of years necessary to recover funds invested in a project. When calculating the payback period, we don’t take the time value of money into account.

- The discounted payback period is the number of years after which the cumulative discounted cash inflows cover the initial investment.

- The payback period and the discounted payback period are measures that allow us to assess in how many years the original investment will pay back.

- Since the payback period and the discounted payback period don't account for cash flows after the recovery of the original investment, they can't be used as measures of profitability. More commonly, we use them to check if we will recover our outlays on a project before an arbitrarily assumed date. We can say that these two measures are useful for assessing the liquidity of a project.

- We prefer investment A to investment B if the (discounted) payback period for investment A is lower than the (discounted) payback period for investment B.

- For a conventional project, the payback period is always lower than the discounted payback period. It’s because the calculation of the discounted payback period takes into account the present value of future cash inflows. So, based on this criterion, it's going to take longer before the original investment is recovered.

LAST UPDATE: 3 Nov 2023

Read Also: