Quantitative Methods

|

6 months 2 weeks ago |

Free CFA® Exam Study Materials for Level 1 and Level 2Check our list of free CFA exam study materials, including level 1 and level 2 videos, level 1 and level 2 questions, and level 1 written content. |

|

2 years 3 months ago |

Level 1 CFA® Exam: IRR vs Cost of Capital |

|

2 years 3 months ago |

Time Value of Money (TVM) CFA® Exam Cheat Sheet |

|

2 years 3 months ago |

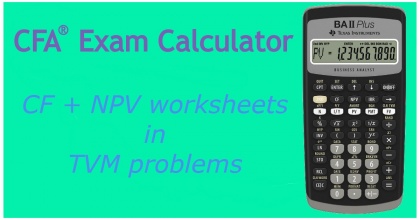

CFA® Exam: Time Value of Money, Annuity |

|

2 years 3 months ago |

CFA® Exam: Time Value of Money Applied |

|

2 years 3 months ago |

Level 1 CFA® Exam Quantitative Methods Summary |

|

2 years 3 months ago |

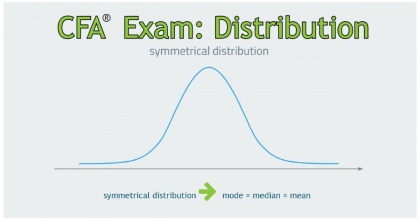

Level 1 CFA® Exam: What Is Skewed Distribution? |

|

2 years 3 months ago |

Money-Weighted vs Time-Weighted Return CFA® Exam Cheat Sheet |

|

2 years 3 months ago |

Level 1 CFA® Exam: Bayes' Formula Explained |

|

2 years 3 months ago |

CFA® Exam: Standard Deviation (Use DATA & STAT Worksheets!) |

|

2 years 3 months ago |

Level 1 CFA® Exam: Geometric Mean Return |

|

2 years 3 months ago |

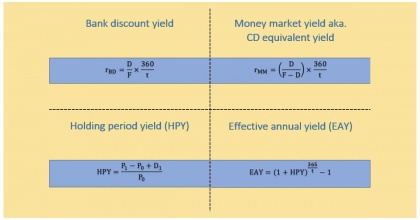

Money Market Yields CFA® Exam Cheat Sheet |

|

2 years 3 months ago |

Level 1 CFA® Exam: Measures of Location (Computing Percentile) |