Lesson 3

Theory + Computations = Reasoning

3 Types of CFA Exam Questions

In this free workshop, we introduced the concept of *exam-type question analysis*. We showed you what kind of traps to avoid when trying to solve exam-type problems.

We also illustrated how the answers provided for a question can sometimes help you choose the right one in just about 10 seconds and without using any formulas!

Have you already tried to employ the *question analysis* while doing your practice exam-type questions? Paid attention to CFA Institute techniques such as misleading data or tricky wording? Analyzed the questions for both its content and its answers?

Today we propose to add to these exercises also CFA exam questions categorization.

At Soleadea, we like to distinguish 3 types of CFA exam questions based on the competencies they require from you while solving. In this lesson, you can read what skills you need for each question type and find some tips on how to deal with your exam questions more successfully.

3 categories of CFA exam questions we like to distinguish:

theory questions

computing questions

reasoning questions

Your whole level 1 exam consists of such questions. Some can be quite straightforward and some – just the opposite – as complex as it gets.

Before, however, we can consider the more complex ideas behind CFA exam questions and explain the equation that made it to the title of this lesson:

Theory + Computations = Reasoning

we need to start with the basics, i.e. by defining theory and computing questions.

Theory Questions

ca. 20% of all exam questions

Example

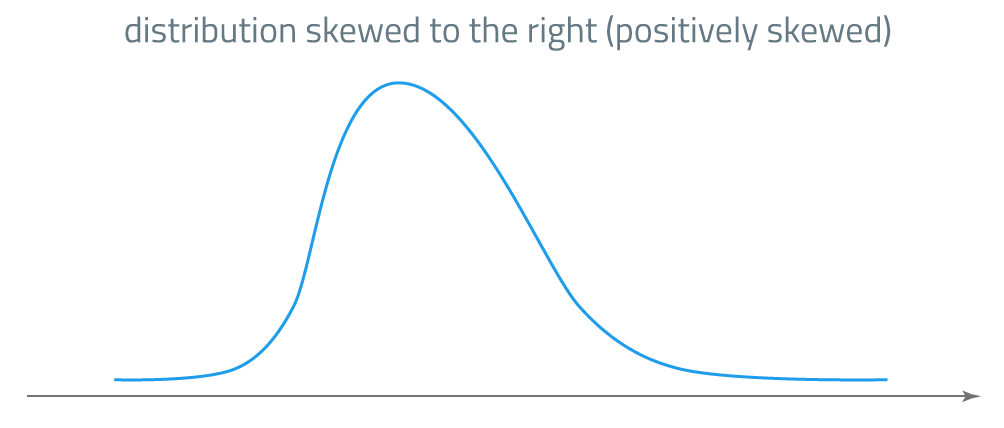

For a unimodal positively skewed distribution:

a. mean is the highest.

b. mode is the highest.

c. median is the highest.

This is a sample theory question.

How we define it: Theory question is a question that strictly tests your knowledge of financial concepts and their definitions. You either know the answer or you don’t – there is little chance you can reason it out.

Competencies you need: thorough knowledge of all financial concepts required in the CFA exam and their understanding

This can help: efficient study techniques (mnemonics), good memory, finance background

But the CFA Program curriculum is huge it’s impossible to remember everything!

Mnemonics can save you here.

Take our example: how to remember which of the 3 values – mean, median, or mode – is the highest for a unimodal positively skewed distribution?

One way is to remember the correct inequality. But which is it:

mode > median > mean ? OR mode < median < mean ?

Perhaps these mnemonic ideas can help:

a) The MEDian (50th percentile) is always the MEDium value: it’s in the MIDDLE between the mode and the mean no matter if the distribution is negatively or positively skewed.

b) You know that the mode is the peak of the distribution (mode=peak, mEAn ≠ pEAk).

c) Now if you are better at visualizing pictures than recalling inequalities, call to your mind the positively skewed distribution graph with its peak on the left that’s when you know that the MEAN is the last from left to right in the equation and so it’s the highest value (mode < median < mean).

Mnemonics you can use: visualization, associations, wordplay, "it’s not how I tend to see it" technique (when you tend to repeat the same mistake over and over again and just can’t get it right), etc.

Always try to think of your own mnemonics for the concepts you believe difficult to remember. Immune your brain against the forget-you-will curse of definitions and theoretical concepts.

Computing Questions

ca. 35% of all exam questions

Example

Below you can find information about Wordees Ltd.:

Net profit margin = 5.5%, ROE = 11%, Total assets turnover = 1.4.

The company’s leverage is closest to:

a. 0.71

b. 1.43

c. 2.13

Above is a sample exam-type computing question.

How we define it: Computing questions are questions mainly based on numbers and calculations.

Competencies you need: good math and calculator skills

This can help: lots of practice, knowing how and when to use formulas, your financial calculator mastery

Sometimes computing questions will be simple in the sense that you will have to use just one formula to get to the right answer. But more often, computations will be embedded in yet more computations, meaning you will need to use the value you arrive at in yet another formula.

The proficient use of your financial calculator is definitely something that can smooth calculating problems out for you.

Reasoning Questions

as many as 45% of all exam questions

Example

If the dividend payout ratio increases then:

a. both the retention ratio AND the sustainable growth rate increase.

b. both the retention ratio AND the sustainable growth rate decrease.

c. the retention ratio decreases AND the sustainable growth rate increases.

This is an example of a reasoning question you can find in your exam.

How we define it: Reasoning questions are when you need to use relevant data, apply different theories, compare concepts, use formulas, connect facts, etc. and often – do all this at the same time.

Competencies you need: multidimensional, ranging from theoretical knowledge through fluent math to comparative/evaluative/analytical skills

Quick look at our example and we see exactly what it takes.

To do such a question in your exam, you’ll need to know:

definitions of:

1. dividend payout ratio

2. retention ratio

3. sustainable growth rate

formula for growth rate:

g=ROE*b where:

g = sustainable growth rate

b = retention ratio

b = (EPS-D)/EPS = 1-D/EPS = 1 - dividend payout ratio

In the end, you’ll have to evaluate the impact of the increase in dividend payout ratio on both retention ratio and sustainable growth rate.

Reasoning questions are more complex than just theory or computing questions. In fact, they often combine theory and computing problems like in our example above (where we need to know some definitions, a formula, and be able to interpret the increase).

That’s what stands behind the equation:

Theory + Computations = Reasoning

So, to be successful in doing reasoning questions, you’ll need all the skills we mentioned for theory and computing questions, and even more…

Competencies you need: thorough knowledge of all financial concepts required in the CFA exam and their understanding, good math and calculator skills, but also knowing and understanding relations between variables, good analytical skills, and logical thinking

This can help:

To develop some of these skills such as thorough concept comprehension, math skills, knowing and understanding relations between variables, and so on > you can also use our handy e-books: