Lesson 2

CFA Exam Day:

Reaching the Right Answer in 10 Seconds

Just as I promised last time, today we’re looking at exam-type questions from the perspective of provided answers.

As you know, each question both in the level 1 and level 2 CFA exam, has 3 answers to choose from.

Out of these 3 answers, only 1 is correct.

The 2 wrong answers reflect the most common mistakes candidates tend to make. It particularly holds true for computing questions.

That the CFA Institute makes the wrong answers reflect common mistakes is obviously bad news for you. However, as soon as you know about it – you can sometimes use it to your advantage and find the correct answer in no time.

Take a look at our example:

An option-free bond has the modified duration of 7.2 and convexity equal to 134.2. If interest rates decrease by 1.2 percentage point, the percentage change in the bond’s price will be closest to:

a. 7.67%

b. 8.64%

c. 9.61%

You can do this question correctly in 10 seconds and you’re about to learn how .

But first I need to make sure we share some common ground on the bond price change.

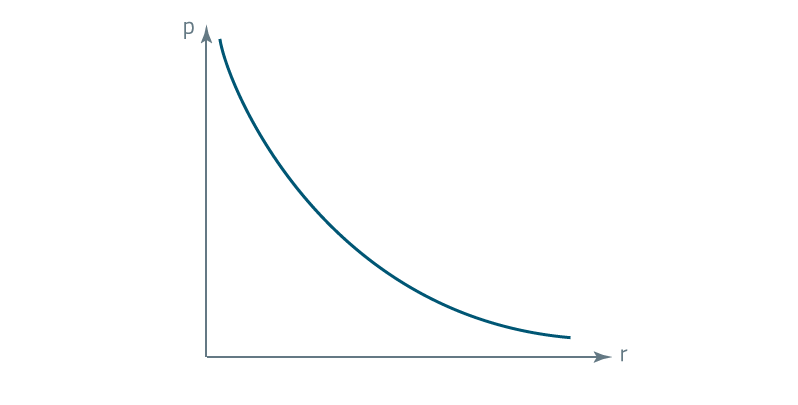

Please take a look at the graph presenting the relationship between price and interest rate.

As you can see:

1) the bond price and the yield-to-maturity are inversely related, and

2) the relationship is not linear (the curve is convex).

To measure the interest rate risk (i.e. how much the price of the bond will change when the yield-to-maturity changes) we have to use two measures: duration and convexity. Duration is the main measure of interest risk, and we use convexity to adjust our calculations for the convexity of the curve.

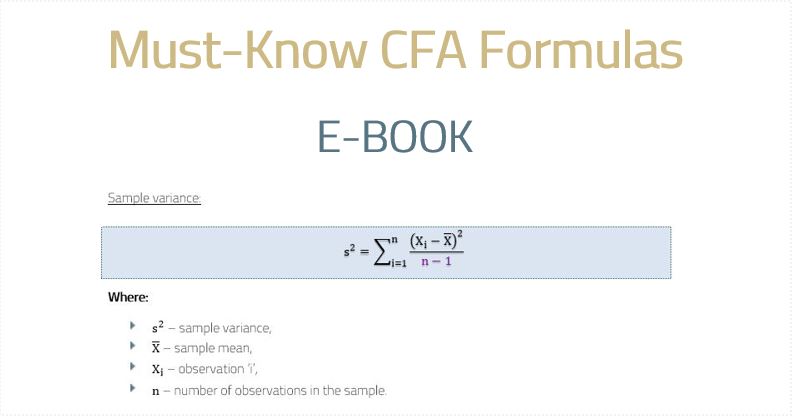

Take a look at the formula:

Note 1: Because the bond price and the yield-to-maturity are inversely related, there is a minus sign before duration. So when the interest rate increases – the price of the bond decreases, and when the interest rate decreases – the price of the bond increases.

Note 2: We always add the convexity adjustment (because we square the change in yield-to-maturity) as long as convexity is positive. For bonds without embedded options, convexity is always positive so the impact of the convexity adjustments on this type of bonds is always positive. However, for bonds with embedded call options the convexity can take a negative value if the yield is low enough. When this is the case, the effect of convexity adjustment on this type of debt instruments will be negative – we will add a value lower than 0.

We’re back to our question:

An option-free bond has the modified duration of 7.2 and convexity equal to 134.2. If interest rates decrease by 1.2 percentage point, the percentage change in the bond’s price will be closest to:

a. 7.67%

b. 8.64%

c. 9.61%

It features a straight bond (with no embedded options) and with modified duration and convexity given.

Now imagine that you don’t remember the formula for the price change or you have no time to do the necessary calculations. Is it all lost for you? Nope. You can make an educated guess based on the assumption that the wrong answers tend to reflect the most common mistakes.

In questions about bond price change, CFA exam candidates usually make 2 mistakes:

1) They calculate only the price change resulting from duration (so they apply just the first part of the formula and forget about the convexity).

2) They don’t know whether to add or subtract the convexity adjustment (which is silly because if there’s anything you need to remember about bond prices and interest rates is that (a) their relation is always inverse and (b) the curve for option-free bonds is always convex – this means we add).

So, if we assume that our question reflects these 2 common mistakes, we expect that:

i. one answer allows only for duration,

ii. one answer subtracts the convexity adjustment from the change resulting from duration,

iii. one answer adds the convexity adjustment to the change resulting from duration (the CORRECT answer).

There is one more thing, you should pay attention to – the difference between the given A-B-C values.

Some of you might have already noticed that in our example the difference between the answers B and A is the same as the difference between the answers C and B and it amounts to 0.97.

What it tells us is that:

the middle value (answer B) allows only for duration,

the lowest value (answer A) assumes subtracting the convexity adjustment,

the highest value (answer C) assumes adding the convexity adjustment so, it’s the correct one.

So – if you need to speed things up in your exam & if there’s a question about the bond price change resulting from a change in interest rates (with both modified duration and convexity given), you can go for this simple trick and choose the highest value (10 seconds should suffice ;)).

Important 1: Not always are answers for interest rate risk questions constructed to reflect the 2 common mistakes we’ve just talked about. But if you have the gut feeling about a question – check the difference between the given A-B-C values. If it is the same (like in our example, where B is higher than A by 0.97 and C is higher from B by 0.97), you can trust your intuition and go for the highest value (especially if you run against the time in your exam).

Important 2: If the yield increased by 1.2 percentage point, the price of the bond would decrease. Then, the answers would be negative values, namely -7.67%, -8.64%, -9.61%. Of course, with negative values the highest value means -7.67%.

Indeed, a sheer look at the provided answers can give us sometimes a hint about the correct one.

You’ve just learned a trick to use for questions with the bond price change resulting from a change in interest rates when both modified duration and convexity are given.

For other types of questions, not always will you be able to identify 2 wrong answers. Sometimes, only one can be rejected. Either way, *question answers analysis* may help you decide on the correct answer and even speed up your choice as we’ve just seen. It is a strategy worth using because it can substantially increase your chance of passing the exam.

Today, we’ve had just one example where *question answers analysis* saved us some time and helped us choose the right answer but there are numerous examples to prove this strategy useful.

Hence a piece of advice to apply over this last month before your CFA exam:

When you do revision questions, always take a moment to think: What kind of mistakes can I make here? Because wrong answers come from common mistakes!

Lesson 2: Key Takeaways

1) Wrong answers tend to reflect the most common errors.

2) Because the wrong answers will reflect the most common errors, you need to analyze questions in your exam very carefully.

3) Always ask yourself: What kind of mistakes can I make doing this question?

4) After you solve a computing question, take a moment to check if the answer you reached makes sense.

5) Your goal when doing exam-type questions during this review month: try to think like those who write exam questions and what they want to test you on.

Short Exercise

Go back to Lesson 1 and analyze the WACC question in the context of its answers. What kind of mistakes do these answers reflect? Do you think you could make such mistakes and fall into the trap the author of the question set up for you?

I encourage you to share your opinion using the chat box in the right-hand bottom corner .

Our last lesson in this series is about 3 types of of CFA exam questions.