CFA® Exam: Time Value of Money Applied

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

Level 1 CFA Exam TVM Problem Solved

In the previous post, we presented an algorithm to be used for time value of money (TVM) problems. Let’s recall it here.

After reading a TVM question:

- determine what you need to calculate,

- establish whether you are dealing with a single payment or an annuity,

- check if it is an ordinary annuity or annuity due,

- put the cash flows on a timeline,

- apply relevant formulas and – using your calculator – solve the problem,

- interpret the results when necessary.

In this blog post, we take an exam-type question and show how to solve time value of money problems using the CF and NPV worksheets in the TIBA II Plus Professional calculator. So read on, especially if so far you've been using only the TVM worksheet for this kind of Level 1 CFA Exam questions.

Level 1 CFA-Exam-Type Question

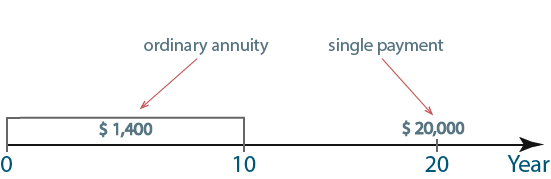

What is the present value of a series of 10 payments, USD 1,400 each, paid at the end of each year starting at the end of the first year and a single payment of USD 20,000 which is to be paid in 20 years from now if we assume that the discount rate does not change over time and equals 6%?

We need to compute the present value.

This problem can be divided into two parts. We have to calculate the present value of:

- the ordinary annuity (10 payments of USD 1,400 from Year 1 to Year 10), and

- a single cash flow (1 payment of USD 20,000 at the end of Year 20).

Solution

We use the CF and NPV worksheets in the TIBA II Plus Professional calculator.

Press CF to enter the Cash Flow worksheet:

Press 2ND CLR WORK to delete the data.

Enter the appropriate values, that is:

- CF0 is 0 because today there is no payment,

- C01 is 1,400,

- F01 is 10 because in the first 10 years, we have payments of USD 1,400,

- C02 is 0,

- F02 is 9 because there are 9 payments of 0 from Year 11 to Year 19,

- C03 is 20,000,

- F03 is 1 because there is 1 payment of USD 20,000 at the end of Year 20.

Now, we open the NPV worksheet. We enter the interest rate of 6, find the NPV, press compute, and get the value of USD 16,540.22.

Note that when you use the CF worksheet, you can skip zeros, namely take 14 instead of 1,400 and 200 instead of 20,000 (mind we skipped the same amount of zeros for both values). This way you'll get your calculations more quickly.

Calculator Keystroke Sequence

\(CF0=0\)

\(C01=1400\)

\(F01=10\)

\(F01=10\)

\(C02=0\)

\(F02=9\)

\(F02=9\)

\(C03=20000\)

\(F03=1\)

\(F03=1\)

\(I=6\)

\(I=6\)

\(NPV=16,540.2164\)

\(NPV=16,540.2164\)

Get More Study & Review Resources

LAST UPDATE: 5 Nov 2023

Read Also: