Damn Low 2021 Level 1 CFA® Exam Pass Rates!

The May & July 2021 level 1 CFA exam pass rates were 25% and 22%, respectively. That was exceptionally low! Now, the NOV 2021 level 1 CFA exam pass rate of 27% is no better! Who would believe that the average pass rate for the level 1 CFA exam used to be 43%?

Was the MPS set too high for the 2021 CFA exams?

Yes, probably the MPS exceeded 70% (which should never happen!).

Too High MPS for 2021 Level 1 CFA Exams?

The May 2021 level 1 CFA exam pass rate was indeed exceptionally low.

When we first saw it we thought it must be a misprint. Unfortunately, CFA Institute confirmed that the pass rate was 25% and that there was no mistake. CFA Institute said that it might be due to the stop-start nature of studying that many candidates had experienced because of their exam postponements.

But the July 2021 level 1 CFA exam pass rate of 22% was even lower. In fact, it was the lowest in history! Now, the November 2021 level 1 CFA exam pass rate of 27% is no better...

We think that a possible explanation is that there were much fewer no-shows to the May, July, Aug, and Nov exams than usual, which affected the 2021 pass rates. Why fewer no-shows? First of all, because of the pandemic and many postponed exams back in 2020 and early 2021. Candidates had waited too long for their CFA exams to stay at home when the exam day finally came. Secondly, owing to the new CBT format that CFA Institute introduced starting in 2021. Candidates simply went to their first CBT CFA exams to find out what the new CFA exam experience looks like after the transfer to computers.

According to the information previously made available by CFA Institute, in the past even 25% of registered candidates decided to stay at home rather than go to the exam because they felt not ready to take it. This means that the “real” pass rate used to be more like 30% than 43%, which for long was the official average pass rate for level 1. However, we believe it is highly possible that due to many postponements and changes introduced to the CFA exam, now more candidates decide to take their chances even though they know it is a tough call for them.

Still, the most recent 2021 CFA exam level 1 pass rates are surprisingly low and we feel that our theory cannot fully account for the situation.

For long, CFA Institute failed to provide us with some sort of analysis of what happened that the pass rates are so low. Recently, it stated that the low pass rates are a result of the artificially prolonged prep due to the CFA exam postponements that took place in the wake of the pandemic outbreak.

On the contrary, some people say that the bar was set too high for the 2021 CFA exams.

What do you think?

Don’t hesitate to share your opinion in the comments below .

After what we've heard from CFA candidates, we must admit that the MPS for the last four 2021 level 1 CFA exams must have probably exceeded 70%. That is why many of you passed by the skin of your teeth or failed by a hair's breadth. Of course, CFA Institute never releases the MPS, which is set separately for each exam. So, we’re just guessing here, but we’ve seen some recent results that might as well confirm this educated guess.

In our most popular blog post about CFA exam results, we explain why the MPS should never get higher than 70%. If you read it, you’ll surely get on board with us on this. However, everything we know about the recent results seems to convince us that this highly irrational decision has been made for the 2021 CFA exams.

Why do we think so?

For starters, there surely were many postponements to the November 2021 CFA exam window but certainly not that many! Still, the NOV level 1 pass rate is too similar to what we saw in May, July, or August 2021 when there were by far more postponed candidates. Secondly, we’ve always encouraged candidates to have longer-than-average CFA exam prep. It helps you prepare better, enhances your learning curve, and immunizes you against the harmful effect of the forgetting curve (which frankly speaking is natural to every learner, without an exception). Now, CFA Institute seems to suggest otherwise by giving the prolonged stop-start nature of studying as a reason for the lower pass rates. As far as we are concerned, the more you review, the better.

So – yes – we cannot accept CFA Institute’s explanation as convincing.

Actually, having heard what CFA Institute says about exam grading, we think that the new CBT format of the exam, with fewer questions and shorter testing time, might have proven easier to many test-takers than expected. This would account for a bit higher MPS (for paper-based exams, it surely was a bit below 70%), which must have been raised to ensure consistency across examinations. But how to explain the so much lower pass rates compared to the average 43% of the last decade or so? Perhaps when you combine all the explanations together – namely the fewer no-shows, the lower “real” pass rate for paper-based exams, and the difficulties related to postponements – you will arrive at the 20-something pass rates of 2021?

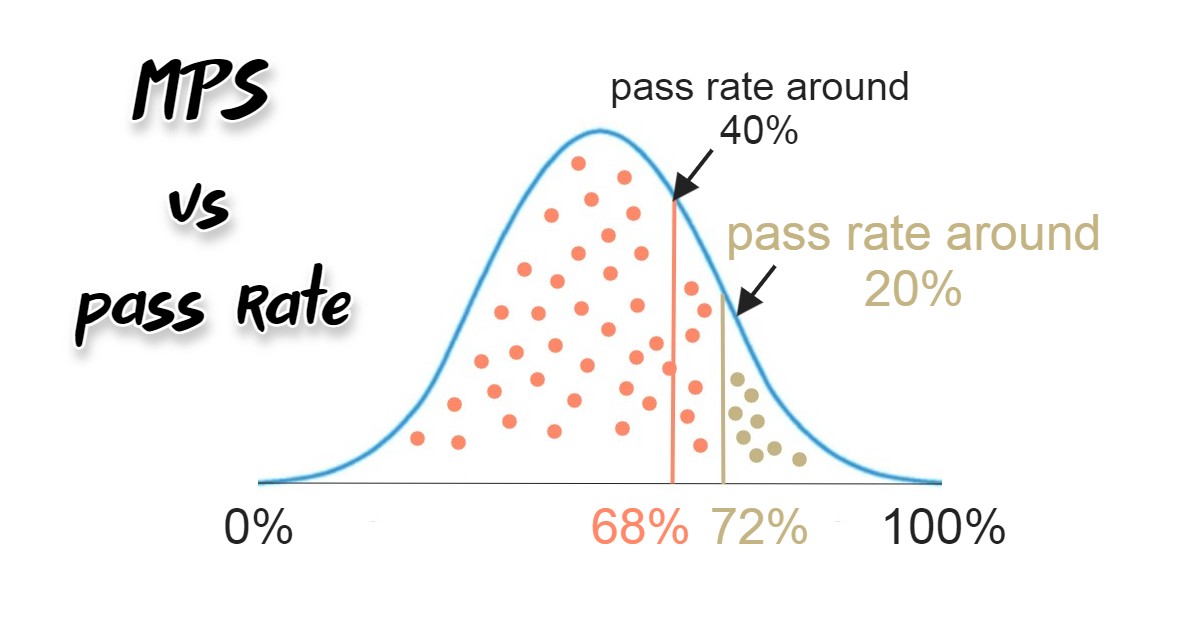

We also illustrate how it is indeed possible that the pass rates have gone so much down even though the MPS was raised only by a few percentage points:

The graph presents the normal distribution of CFA exam results and a hypothetical MPS of 68% used for paper-based exams together with a hypothetical MPS of 72% used for computer-based exams. You can see that as we move just a bit to the right, we leave quite a lot behind. This lot can be even as high as 20%.

2022 Level 1 CFA Exam Pass Rate Will Be Higher?

Hopefully, this thing that CFA Institute is doing with 2021 level 1 CFA exams (whatever it is that they will never admit and for whatever reason) will change as soon as the first 2022 CFA exams happen. The vast majority of 2022 CFA candidates didn’t need to postpone their exams. If the stop-start nature of studying is to get the blame for the low 2021 pass rates, we should soon see the new 2022 CFA exam pass rates soar!

We keep our fingers crossed for this hopeful wish to come true.

Read Also:

Published: July 28, 2021