2024 CFA® Exam Study Planner: Study + Review Sessions

![]() soleadea

soleadea

2 months 4 days 19 hours

CFA EXAM STUDY PLANNER available for ALL LEVELS

The Most Successful Level 1 CFA Exam Prep Approach

To be successful, every CFA candidate needs a good study plan. Setting deadlines for the exam topics is the first step. Then, you need to schedule your daily study sessions.

But how about going further and getting some review sessions scheduled alongside your study sessions? That's pretty unconventional for most candidates. Still, such a learning approach is the most successful because you not only get your CFA exam plan but you also take care of your learning curve, which can grow only if there's deliberate knowledge retention!

Seeking a successful exam strategy? Keep on reading.

Conventional CFA Exam Study Planning

3 main assumptions of conventional CFA exam study planning are as follows:

- Study topics one by one according to the CFA Program Curriculum sequence.

- Focus on one topic at a time (go back or forth to other topics sporadically, only if needed).

- Revise the whole study material after dealing with all the topics (usually, it’s the last month before the exam).

PROS & CONS of this conventional CFA exam study planning:

BENEFITS:

As with any organized study rhythm, it enables systematic learning.

It makes you focus on one topic before you move on to the next.

At the end of your exam prep, there's a lot of time planned for revision. In special circumstances, it may act as a buffer against your failure to study all the topics. You may choose to devote less time to revision, which is not ideal but reduces the risk of failing to cover the whole study material.

ONE BIG DRAWBACK:

If for a couple of months, you study topic by topic and you revise the material only in the last month before your exam, you completely ignore one thing which is extremely important from the perspective of a successful learner. This thing is a forgetting curve. Only when you resist its harmful effect can you have good CFA exam prep with all the topics covered on time and properly reviewed.

Impact of Forgetting Curve on Knowledge Retention

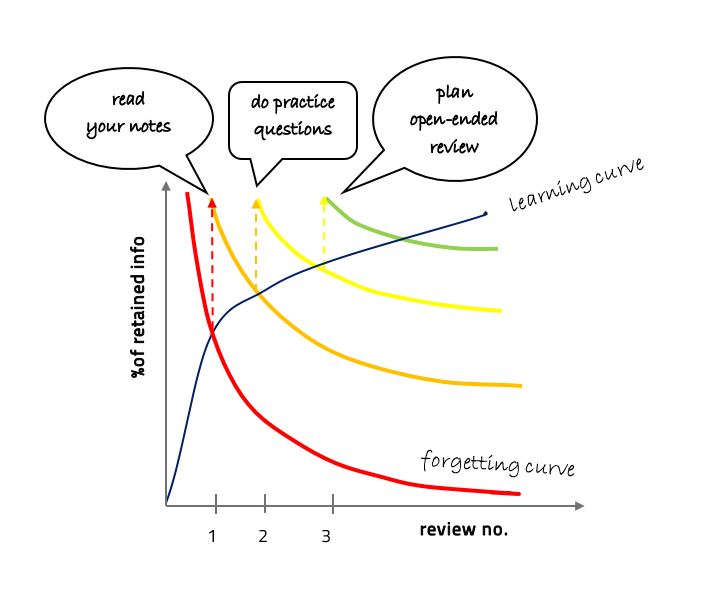

The thick red line, sloping down like crazy, is the forgetting curve. When you look at it, you instantly realize that the retention of information drastically decreases as time passes.

Actually, it is said that over a night we forget even up to 65% of what we study during the day...

That's why regular revision is so important. You want to double down on your study time, not waste it!

And when you know how low level 1 CFA exam pass rates still are, it's safe to say that it's risky not to review during your prep and leave revision just for the last month before the exam.

How to Learn Better?

& Improve Knowledge Retention...

No doubt you need to review regularly to learn successfully and increase your knowledge retention. So, develop ways to actively put yourself in touch with what you’ve already studied. Do tests, watch videos, write index cards & stick them around, use flashcards, read summaries of the study content, take notes.

Whatever works for you, really.

Regular revision helps you retain the most crucial information as it systematically challenges your memory. When you know how the learning curve works, it comes as no surprise that it is better for you to revise more often for shorter time spans than to have one long revision just before the exam.

AVAILABLE FOR ALL LEVELS

We know a bit about the forgetting curve and the learning curve. With this knowledge in mind, we created CFA Exam Study Planner, with both study & review sessions scheduled side by side.

Good CFA Exam Study Plan Should Include Regular Review

Our CFA exam study planning approach is based on 6 principles, whose importance cannot be overstated:

- Reorganize the CFA exam topics into the optimal sequence.

Some CFA exam topics are more important and/or difficult than others. You don't want to neglect the most important and the hardest level 1 topics. As for Ethics, CFA candidates usually study this important topic either first (then, you get to revise it regularly) or last (then, it's fresh before the exam). - Plan plenty of short revision sessions throughout your exam prep.

You best remember what you studied just after you studied it. If you review the material on a daily or weekly basis, you react against the detrimental impact of the forgetting curve. This rule should apply to all 10 topics, regardless of which you study first and which you study last. - When revising topics, accumulate the revised material by going back also to the previous topics (even if just for a while).

Topics are often correlated with each other. By reviewing them in groups, you can see this correlation, which enhances your learning and understanding. Plus, once again, you stay aware of the forgetting curve. - Do many exam-type questions to get familiar with the form of your CFA exam.

Getting used to the form of the CFA exam makes you more confident on the exam day. It's a boost that can often decide about your success. - Secure some time for a proper pre-exam revision.

Even if you revise on a regular basis, a proper pre-exam revision is a must! Why? See no. 6 below. - Do as many mock exams as possible before your exam.

It's too risky to leave mock exams for the last week before your exam. You should do as many mocks as possible over the last couple of weeks before the exam. Worried that you haven't dealt with all of the topics yet? Well, you can still fight against time and do your readings but also make sure you get enough practice.

CFA Exam Study Planner That Meets Your Needs

These 6 principles formed the basis for our CFA Exam Study Planner 4.0 (with the recommended topic sequence):

The topic sequence applied is not random. More challenging topics are coupled with more easy ones allowing you to take a sort of break meanwhile. Also, where possible, topics are coupled based on the similarity of concepts. And if for a reason you don't like this topic sequence, you can easily arrange your own topic order using your Study Plan options available in the PLAN view of your schedule.

You are asked to focus on your weekly tasks, including both CFA exam readings and review sessions (to have a regular review scheduled go for the paid version of your study plan, now available at pay-what-you-can prices). To aid your revision, there are free & paid tools available inside the study planner.

There are 5 topic revision sessions, each accumulating topics into groups. This way the topics covered first are revised most often while the topics covered just before the exam are revised once ('cos they are fresh enough to remember them well). Note that if you change your preferred topic sequence, the topic revision groups & order will adjust accordingly.

Inside your Free Study Plan, you will find some free exam-type questions. And even more of them in the paid version of our CFA Exam Study Planner.

It all wraps up with a proper Final Review! Its length is proportional to your whole CFA exam prep.

During the Final Review, some revision tasks are suggested to you such as mocks or formulas review (use our Test App or Formulas App, respectively).

Below, you will find a sample level 1 CFA exam study plan that follows all the above-mentioned principles. Naturally, you can have your own personalized study plan, with your own deadlines and topic sequence but the same study planning approach.

Sample Level 1 CFA Exam Study + Review Plan

START on 1 APR 2024

1st Study Block: QM + PM + Topic Review

2nd Study Block: FSA + CI + Topic Review

3rd Study Block: FI + EI + Topic Review

4th Study Block: DER + AI + Topic Review

5th Study Block: ECO + ETH + Topic Review

FINAL REVIEW (15 July – 19 Aug)

END on 20-26 AUG 2024

The AUG 2024 level 1 exam window lasts from 20 to 26 August 2024. So, you can have from 4 to 5 weeks of – what we call – Final Review. Basically, that's when you should do as many mock exams as possible!

AUG 2024 Level 1 CFA Exam Deadlines Timetable

| Level 1 CFA Exam Topics | AUG 2024 Exam: Topic Deadlines |

|---|---|

| Quantitative Methods | 13 Apr |

| Portfolio Management | 22 Apr |

| QM+PM Review | 23 Apr |

| Financial Statement Analysis | 9 May |

| Corporate Issuers | 17 May |

| FSA+CI Review | 20 May |

| QM+PM Review | 20 May |

| Fixed Income | 4 June |

| Equity Investments | 14 June |

| FI+EI Review | 18 June |

| QM+PM+FSA+CI Review | 18 June |

| Derivatives | 23 June |

| Alternative Investments | 27 June |

| DER+AI Review | 1 July |

| QM+PM+FSA+CI+FI+EI Review | 1 July |

| Economics | 8 July |

| Ethics | 13 July |

| ECO+ETH Review | 14 July |

| Final Review | 19 Aug |

If you set up your personalized study plan,

the deadlines will get adjusted.

AVAILABLE FOR ALL LEVELS

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

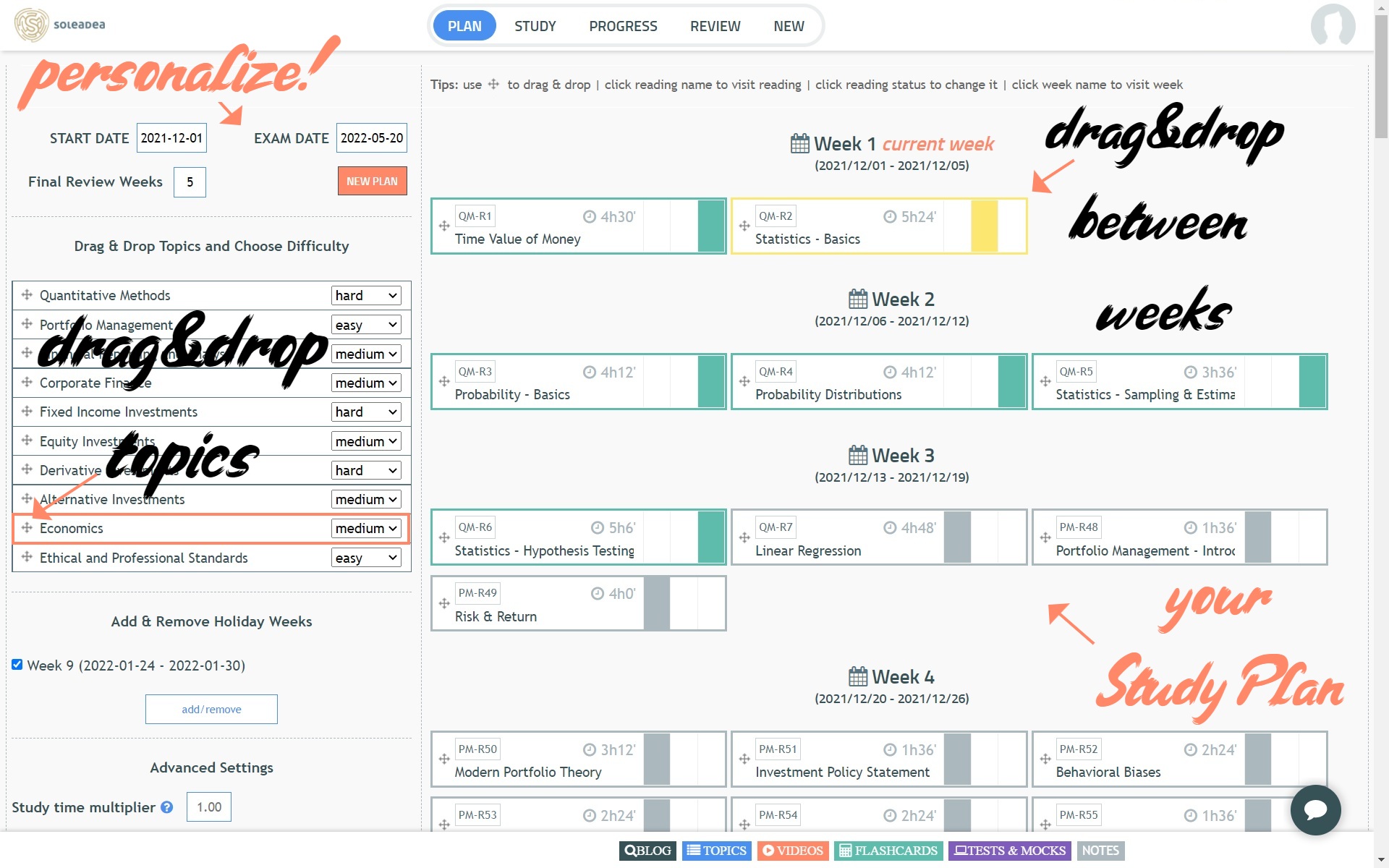

Here’s a sample level 1 CFA exam study schedule as displayed in our Study Planner:

PLAN VIEW of CFA EXAM STUDY PLANNER:

FIND your Study Plan in the PLAN tab View all the weeks of your CFA exam prep, see how much you’ve done and how much is still ahead of you, as well as customize your schedule using your Study Plan personalization options and the DRAG & DROP for both topics and study weeks.

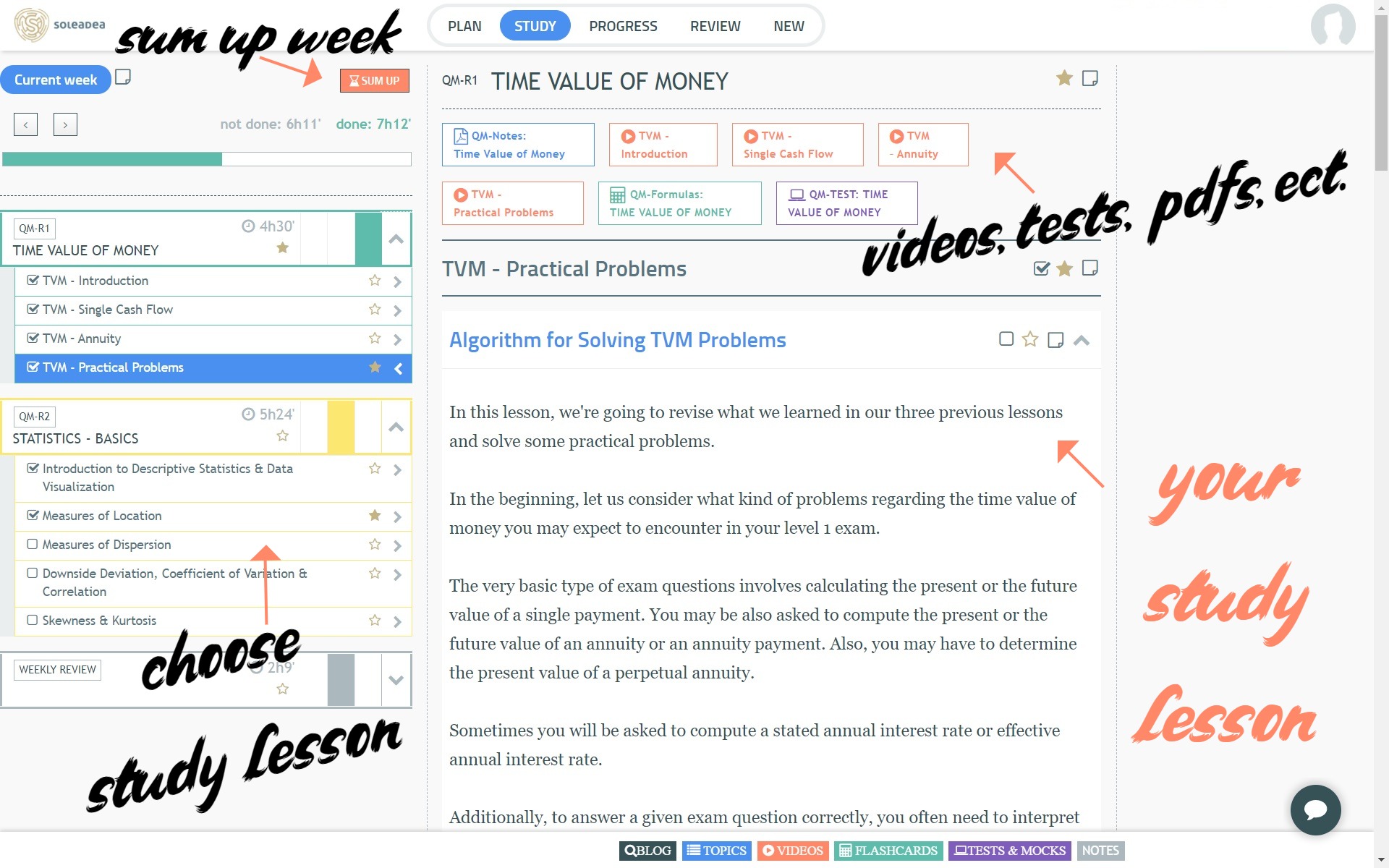

STUDY VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: STUDY View You will be asked to focus on your current week of studying. You will know what to study (left-hand menu) and how much to study (benchmark study times). Here, you'll also find your study lessons, including videos, tests, PDFs, etc. At the end of the week, your hard work will be evaluated (hit the SUM UP button).

PROGRESS VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: PROGRESS View You will be able to see your progress by topics and weeks. Each week your Chance to Pass score will go up or down.

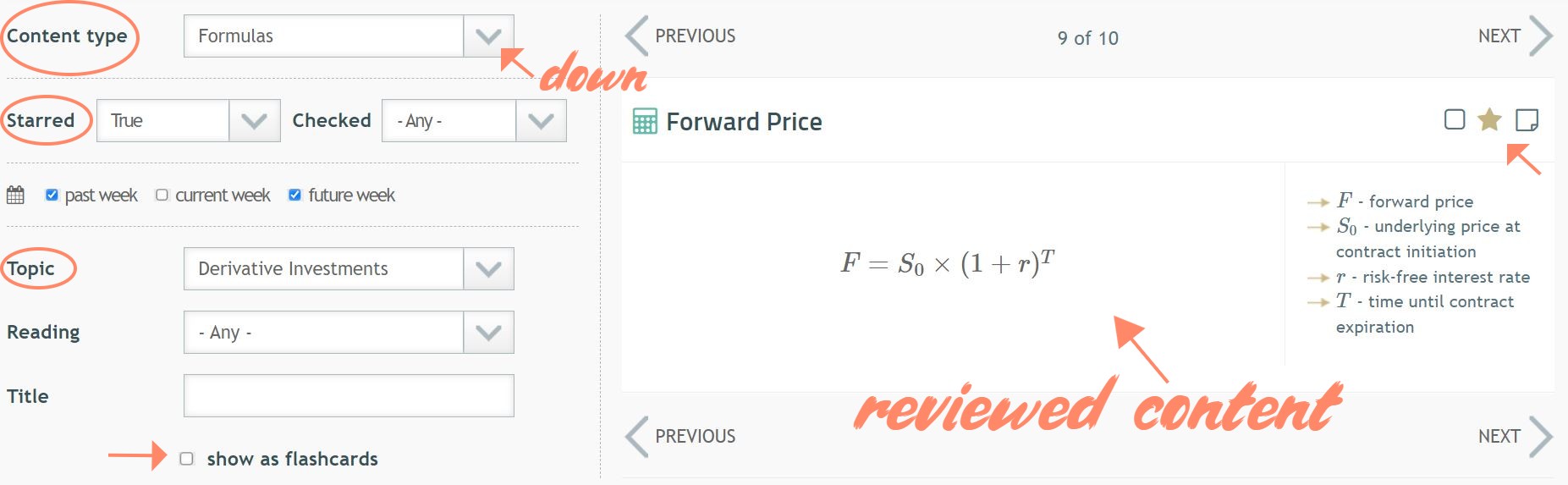

REVIEW VIEW of CFA EXAM STUDY PLANNER:

CFA Exam Study Planner: REVIEW View To learn, you must review. Use the special view of your Study Planner to review your study lessons, rewatch videos, revise formulas, etc.

Read Also:

- Level 1 CFA Exam Study Materials

- When to Start Prep for CFA Exam?

- How to Create Study Plan in 8 Steps

- CFA Exam: Registration to Results

- 3 Reasons Why You May Fail Your Exam

UPDATED: Feb 15, 2024

Comments

You should review at least on 3 levels:

- weekly, when you revise what you studied over the week,

- topics review, where you review the key concepts for given topics (our materials such as videos or notes, i.e. our short printable e-books, are great for that), and

- before the exam, which we call the Final Review. Over this final pre-exam period, you should review formulas, definitions, relations between concepts, etc. Also, do mocks in limitless numbers.

IMPORTANT! Whether it's your weekly, topics, or final revision, you should practice as much as possible doing exam-type questions! You learn the most through practice, not through theory :)