Level 1 CFA® Exam: Bayes' Formula Explained

![]() soleadea

soleadea

5 months 2 weeks 4 days

Bayes' Theorem: No Formulas – Just Logical Thinking!

If you have trouble doing questions with Bayes' formula, here is an alternative way of solving this kind of problems in your level 1 CFA Exam. Using this solution, you need no formulas – just logical thinking.

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

Level 1 CFA Exam-Type Question: Bayes' Theorem

PROBLEM:

You have two classes of bonds in your portfolio. 90% of the portfolio consists of bonds with an A rating. The rest are junk bonds. The probability of default for bonds with an A rating is 3% and for junk bonds it is 20%. What is the probability that a randomly selected bond is a junk bond if it is in default?

SOLUTION:

If I ask you a question:

What is the probability that a randomly selected bond is a junk bond?

you will say:

It is 10% because in the portfolio there are only two types of bonds: A rating and junk bonds, and A rating bonds constitute 90% of the whole portfolio. Thus, the rest are junk bonds.

However:

The probability that a randomly selected bond is a junk bond IF it is in default is conditional probability. Why? Because we have a condition here:

We know that a bond is in default.

Intuitively we can see that: The probability that a randomly selected bond is a junk bond IF it is in default is higher than the probability that a randomly selected bond is a junk bond. How should we tackle this problem, though?

Formula for Bayes' Theorem

Bayes' formula comes in handy:

\(P(A│B)=\frac{P(B│A)}{P(B)}\times P(A)\)

Where:

\(P(A│B)\) – probability of event given the new information,

\(P(B│A)\) – probability of the new information given event,

\(P(B)\) – unconditional probability of the new information,

\(P(A)\) – prior probability of event.

What if we do not remember the formula or we don't know how to use it? What do we do then?

You can learn more about Bayes' Theorem by visiting our CFA exam lesson on Bayes' formula .

Bayes' Theorem Explained Without Formulas

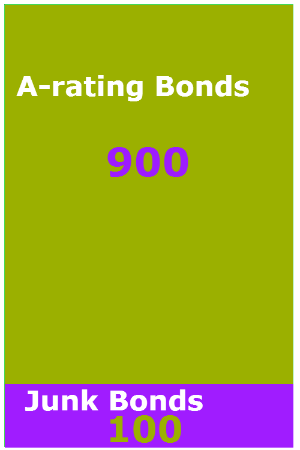

Assume that we have 1000 bonds in our portfolio.

Because 90% of bonds are A rating bonds, it means that we have 900 A rating bonds in the portfolio.

So, the number of junk bonds is 1000 minus 900, i.e. 100 bonds.

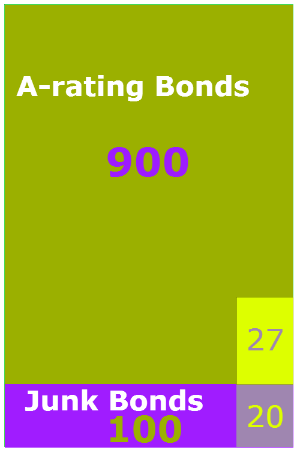

The probability of default for bonds with an A rating is 3%, so the number of bonds with an A rating that will be in default is 3% times 900 bonds, which gives us 27 bonds.

The probability of default for junk bonds is higher and amounts to 20%. Therefore, the number of junk bonds that will be in default is 20% times 100 bonds, i.e. 20 bonds.

So, in the portfolio we have 27 plus 20 bonds, i.e. 47 bonds that will be in default.

So, the probability that a randomly selected bond is a junk bond IF it is in default is 20 junk bonds in default divided by 47 bonds in default total, i.e. 42.55%.

Summary and Interpretation

The probability that a randomly selected bond is a junk bond is unconditional probability, and the probability that a randomly selected bond is a junk bond IF it is in default is conditional probability.

If you are a math lover, you will probably say: “But hey! Using Bayes' formula, I do quite the same calculations...”. That's definitely true – but lots of people prefer the alternative solution.

Struggling with CFA Exam Formulas?

Check out our e-book with Must-Know CFA Exam Formulas

Check out our e-book with

Must-Know Formulas

LAST UPDATE: 2 Nov 2023

Read Also: