Profitability Index Level 1 CFA® Exam Cheat Sheet

![]() soleadea

soleadea

5 months 2 weeks 2 days

This blog post was created as a part of the CFA exam review series to help you in your level 1 exam revision, whether done regularly or shortly before your CFA exam.

Level 1 CFA Exam: Definition of Profitability Index

The profitability index (PI) is the ratio of the present value of future cash inflows to the initial investment. If a project has a PI greater than 1, you should invest in the project. If the PI is lower than 1, then the project is not profitable.

Profitability Index (PI) Formula

The profitability index is the value we get for each invested unit of money:

\(PI=\frac{\sum_{t=0}^n\frac{CF_t}{(1+r)^t}}{I_0}\)

Where:

- \(t\) – time t,

- \(CF_t\) – cash inflow at time t,

- \(r\) – discount rate,

- \(I_0\) – initial investment.

We can also make the profitability index formula more general so that it applies to more than one cash outflow. The denominator in the generalized formula contains the present value of all cash outflows instead of only the initial investment.

Profitability Index as Investment Decision Criterion

A decision on whether to invest in a project or not should be based on this rule:

- If the profitability index is greater than 1, we should invest in the project.

- If the profitability index is less than 1, we should reject the project.

Profitability Index and NPV

If we assume that there is only one investment outlay at time 0, the formula for the NPV that we discussed here looks as follows:

\(NPV=\sum_{t=0}^n\frac{CF_t}{(1+r)^t}-I_0\)

Where:

- \(t\) – time t,

- \(CF_t\) – cash inflow at time t,

- \(r\) – discount rate,

- \(I_0\) – initial investment.

We can transform the formula:

\(\sum_{t=0}^n\frac{CF_t}{(1+r)^t}=NPV+I_0\)

and substitute the present value of future cash inflows into the formula for the profitability index. This way get the following relation between the PI and the NPV:

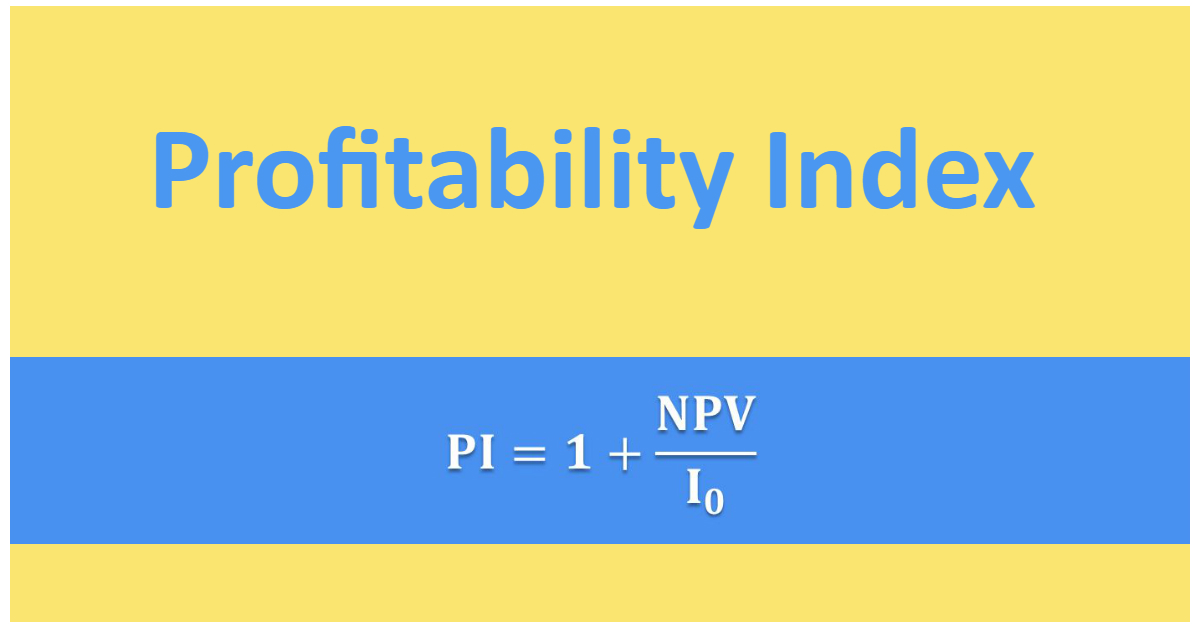

\(PI=1+\frac{NPV}{I_0}\)

As you can see whenever NPV is greater than 0, PI is greater than 1. And if NPV is lower than 0, PI is lower than 1. It’s also true the other way around: if PI is greater than 1, NPV is greater than 0, and if PI is lower than 1, then NPV is lower than 0.

Question 1: PI Question

A company is considering a project that would require an investment of USD 35,000 and that will generate cash flows with a present value of USD 275,000. The profitability index is closest to:

- 6.86.

- 7.86.

- 8.86.

Answer: B

Let’s put the numbers into the formula for the profitability index:

\(PI=\frac{\sum_{t=0}^n\frac{CF_t}{(1+r)^t}}{I_0}\)

\(PI=\frac{275}{35}=7.86\)

A profitability index of 7.86 means that the company will earn USD 7.86 for each invested dollar.

Question 2: PI and NPV

If the profitability index is greater than 0, the NPV is:

- ...

- ...

- ...

Question 2 is available for CFA Program candidates using our study planner to control their prep:

Already using Soleadea? 1. Sign into your account 2. Refresh this page to see Question 2.

Level 1 CFA Exam Takeaways For Profitability Index

- The profitability index (PI) is the ratio of the present value of future cash inflows to the initial investment. If a project has a PI greater than 1, you should invest in the project. If the PI is lower than 1, then the project is not profitable.

- The profitability index is the value we get for each invested unit of money.

- The profitability index can be presented in relation to the NPV, as 1 plus the net present value divided by the investment outlay.

- If PI is greater than 1, then NPV is greater than 0 and, conversely, if NPV is greater than 0, then PI is greater than 1.

- If PI is less than 1, NPV is less than 0 and, conversely, if NPV is less than 0, then PI is less than 1.

LAST UPDATE: 3 Nov 2023

Read Also: