Level 1 CFA® Exam:

Features of Debt Securities

A bond is a financial instrument for which the issuer, called also the borrower, agrees to pay certain amounts of money at specified dates in the future. These amounts of money are:

- the par value a bond, also called principal value and

- interest, commonly known as coupons.

In exchange for the obligation to pay coupons and the par value in the future, the issuer receives some amount of money today. This amount of money is called the price of a bond and the entity that pays this amount and purchases the bond is called the bondholder or creditor. The value of coupons and the price of the bond depend on the rate of return required by investors. And the rate of return required by investors largely depends on the risks associated with investing in the bond.

It is 1 January 2014. Stark, Inc. is today issuing an 8-year bond with a par value of USD 1,000 and coupons paid on an annual basis that amount to 6% of the par value. The price of the bond is equal to USD 912.40.

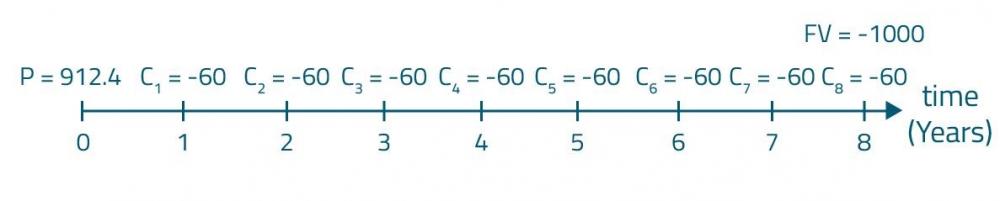

Let us examine the situation from the perspective of the issuer, namely Stark, Inc.

The above information means that the company will get USD 912.40 today, and in return it agrees to make regular payments to the investor that purchased the bond. The issuer is obliged to pay coupons of: 6% times USD 1000, which gives us USD 60, at the end of each of the next 7 years and to pay the nominal value of USD 1000 and the last coupon in the amount of USD 60 at the end of year eight.

Stark, Inc. will make 7 payments of USD 60 each, and one payment of USD 1060.

We should also add here that USD 912.40 will not be transferred to the issuer in total, but will be reduced by the costs of the issuance, which may even constitute a few percent of the nominal value of the issued bond.

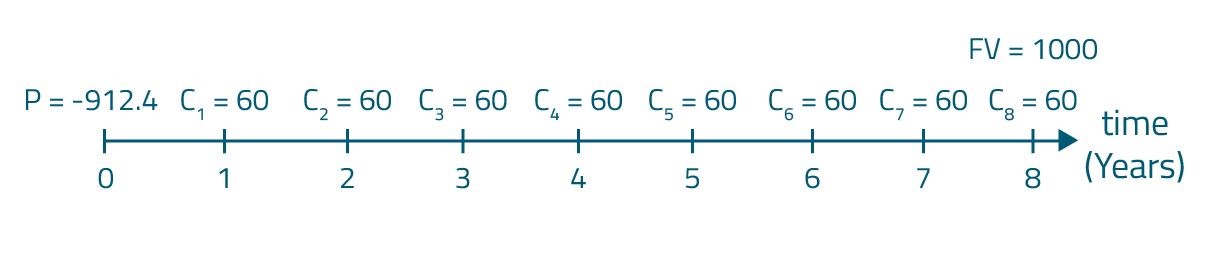

Now let’s analyze the situation from the investor's perspective.

The investor buying the bond lends the issuer USD 912.40 today in exchange for the promise and obligation of the issuer to pay coupons and par value at specified moments in the future. Note that the price of the bond results from the value of the coupons, the principle (par value) and the rate of return required by bondholders.

If we have the data given in the example, we can calculate the rate of return required by the investor. The required rate of return will be equal to 7.5% annually. This required rate of return in the case of the bond market is called the yield to maturity.

Quotation of Bonds

A bond is often quoted as:

- a percentage of its par value (e.g. 102.5%),

- a price per 1 USD of par value (e.g. USD 1.025),

- using fractions – the decimal value in the decimal fraction is represented as a vulgar fraction whose denominator is 2 raised to a certain power (e.g. USD 102 1/2).

For the prices of bonds tabulated below, decide what the price per USD 1 of par value is. Assume that the par value of all bonds is USD 100.

| Bond | Price (USD) |

|---|---|

| A | 105 1/16 |

| B | 103 1/4 |

| C | 92 1/8 |

Price of bonds A is USD 105 and 1/16, or 105 plus 1 divided by 16 , which gives us USD 105.0625. Therefore the price per USD 1 of par value is USD 1.050625.

Price of bonds B is USD 103 and a fourth, which is 103 plus 1 divided by 4, which gives us USD 103.25. Therefore, the price per USD 1 of par value is USD 1.0325.

Price of bonds C is USD 92 and 1/8 , or 92 plus 1 divided by 8 , which gives us USD 92,125. Therefore, the price per USD 1 of par value is USD 0.92125.

5 basic features of debt instruments to remember in your level 1 CFA exam:

- principal value (par value),

- term to maturity (tenor),

- coupons and their frequency,

- type of the issuer, and

- currency denomination.

Bond Principal Value

Principal value is the value which should be repaid at maturity of the bond. It is also the value used to calculate coupons when we know the coupon rate (given in %).

Term to Maturity of a Bond

Term to maturity, sometimes also called the tenor, is the number of years to maturity date. At the maturity date, the issuer should fulfill all his remaining obligations towards bondholders. In the case of a common coupon bond it means that the issuer should repay the principal and the last coupon at the maturity date.

Generally, if we take under consideration the time to maturity, we can classify bonds as:

- short-term bonds with a term to maturity of 1 to 5 years,

- medium-term bonds with a term to maturity of over 5 to 12 years, and

- long-term bonds with a term to maturity of over 12 years.

Coupons are the interest paid by the issuer at some strictly specified points in time. Typically, coupon payments are made semi-annually. However we may encounter a situation in which coupons will be paid annually or quarterly or – as is the case with financial instruments called MBS or ABS – even monthly.

Taking coupons under consideration, we distinguish 3 basic types of bonds:

- conventional bonds, also called plain vanilla bonds, which pay fixed coupons,

- floaters, also called floating-rate notes (FRN), for which coupon changes from period to period, and

- zero-coupon bonds, also called pure discount bonds, which pay no coupons.

For a conventional bond, coupon payment is equal to some fixed coupon rate multiplied by the bond’s par value. Note, that the coupon rate is given annually.

If coupon rate is equal to 8% and par value amounts to USD 3,000, then on the assumption that coupons are paid annually, the single coupon payment will be equal to:

\(\text{coupon}=8\%\times3,000=\text{USD }240\)

(...)

Let’s assume that the coupon is paid annually and is defined as LIBOR plus 3%. The par value amounts to USD 100. If at the beginning of the year LIBOR equals 2.2% and at the end of the year it is equal to 2.4%, then the coupon payment at the end of the year will be closest to:

- USD 2.7.

- USD 5.2.

- USD 5.4.

In the case of floaters, LIBOR at the beginning of the year is the reference rate for the coupon payment at the end of the year.

Therefore, if at the beginning of the year LIBOR equals 2.2%, then the coupon payment at the end of the year (assuming the coupon is paid annually) will be:

\(\text{coupon}=(\text{LIBOR}+\text{margin})\times\text{par value}=\\=(2.2\%+3\%)\times100=\text{USD }5.2\)

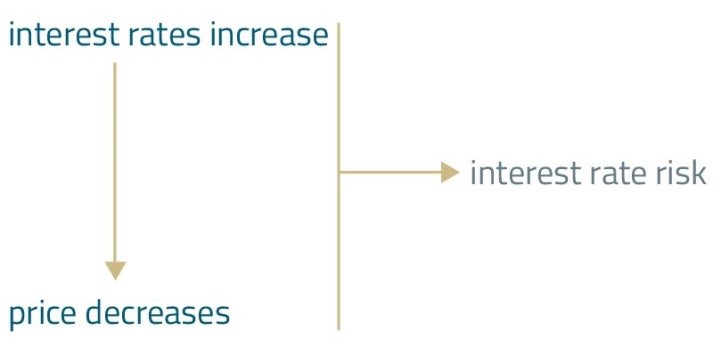

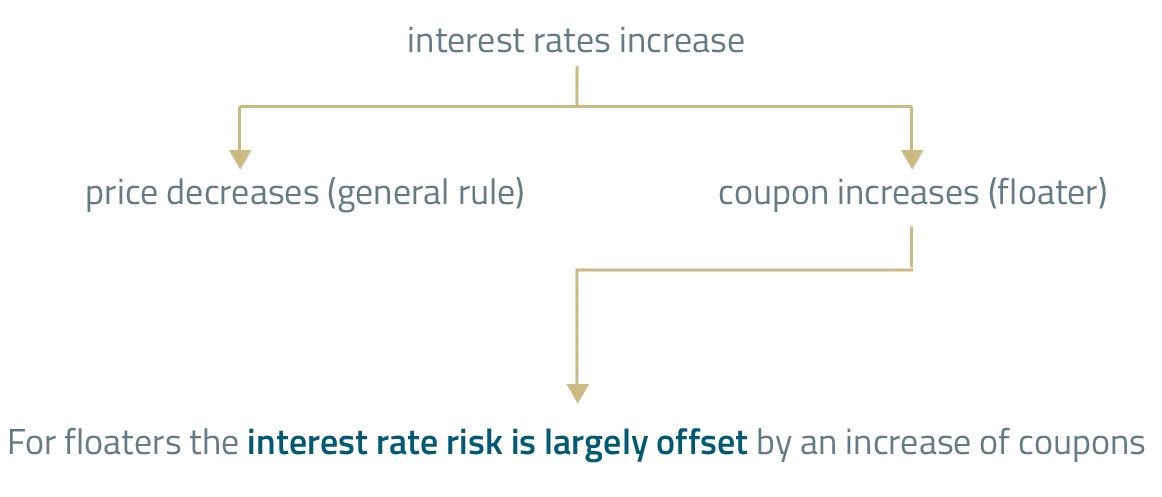

It is worth mentioning that in the case of floaters the so-called interest rate risk is usually lower than in the case of conventional bonds. You should know that there is inverse relationship between interest rates and the price of a bond. If interest rates go up, the price of a bond goes down. On the other hand, if interest rates go down, the price of the bond goes up. If we are bondholders, we don’t like situations when interest rates go up. And here comes the interest rate risk. This is the risk that if interest rates increase, the price will decrease.

Let’s analyze the interest rate risk for floaters. On the one hand, if interest rates increase, the price will decrease because generally if interest rates go up prices go down. On the other hand, if interest rates increase, the coupon also increases. So, in the case of floaters the interest rate risk is largely offset by an increase of coupon payments.

(...)

Type of Issuer

Another feature of a bond is the type of the issuer. We distinguish the following types of issuers:

- supranational organizations,

- national governments,

- local governments,

- quasi-government entities, and

- companies.

Currency Denomination of Bonds

Of course bonds can pay its coupons and the par value in any currency, but the majority of bonds throughout the world are denominated in US dollars or euros. There are also bonds that we call dual-currency bonds, which pay its coupons in one currency and the par value in another.

Bond Price

The price of a bond is the amount of money for which you can buy the bond. As it was mentioned earlier, the price depends, on the one hand, on the par value and coupons and, on the other hand, the required rate of return. What is more, the price of the bond is affected by the term to maturity.

The price of bonds may be:

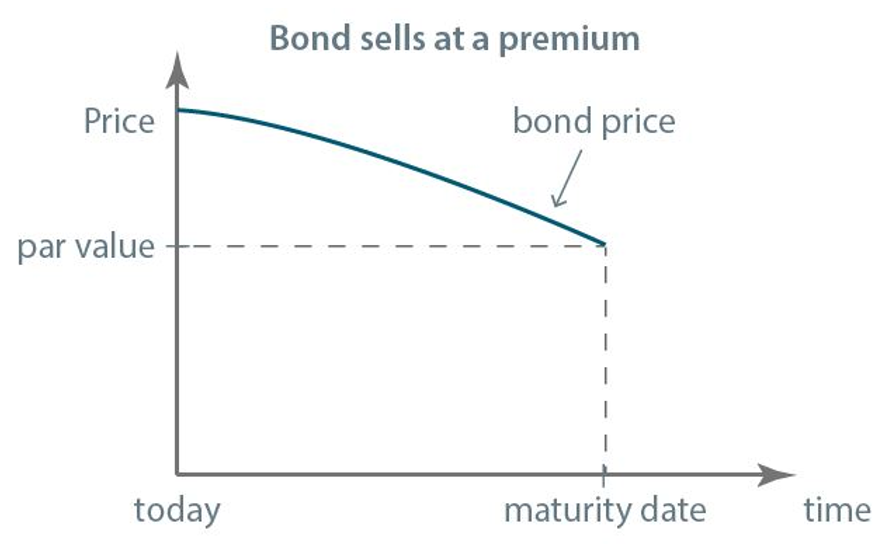

- higher than the par value. In this case we say that the bond sells at premium.

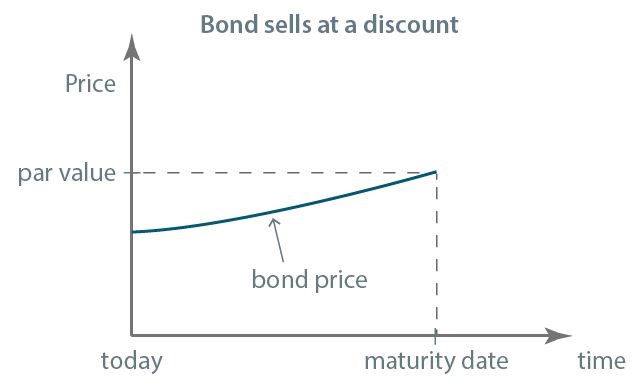

- lower than the par value. In this case we say that the bond sells at a discount.

- equal to the par value. In this case we said say the bond sells at par.

Prices of bonds that are at a premium or at a discount approach the par value as the maturity date gets closer. [Assumption: The required rate of return doesn’t change over time (‘constant-yield’).]

Note that if the market is efficient and if there is a bond with a short term to maturity for which we have reasonable assurance that all commitments will be met, it is unlikely that its price will largely differ from the principal value. So, the price of a bond whose maturity date is close is close to the par value.

Bond Yields

In case of bonds, we can talk about different types of yields (rates of return). The most popular yield is the so-called yield to maturity. However, there are also other types of yields, for example:

- yield to worst,

- yield to call, or

- option-adjusted yield.

Embedded Options

Bonds often have options embedded in them, such as put options, call options or conversion privileges. A put option is the right of the bondholder to sell back the bond to the issuer and the call option is the right of the issuer to buy back the bond from the bondholder. A conversion privilege gives a right to convert the bonds into a company’s equity. Embedded options are either profitable to the bondholder or to the issuer and they affect the bond price.

- A bond is a financial instrument for which the issuer, in exchange for some amount of money received today, agrees to pay coupons and the par value at specified dates in the future to the bondholder.

- A bond is often quoted as a percentage of its par value, a price per 1 USD of par value or using fractions.

- 5 basic features of debt instruments to remember in your level 1 CFA exam: principal value (par value), term to maturity (tenor), coupons and their frequency, type of issuer, and currency denomination.

- Accrued interest is the interest earned but not yet paid and the full price is equal to the clean price plus accrued interest.